Hedge funds are an essential component of the financial market, offering investors unique strategies and potential rewards. Hedge funds are a diverse class of investment vehicles, with each fund pursuing its unique strategy. The most common types include: This strategy involves taking long positions in undervalued stocks and short positions in overvalued stocks. By doing so, hedge funds aim to profit from both the appreciation and depreciation of assets. Event-driven hedge funds capitalize on corporate events, such as mergers, acquisitions, spin-offs, and bankruptcies. These funds seek to exploit inefficiencies and mispricing that may occur before or after such events. Global macro hedge funds invest in a variety of asset classes, including equities, bonds, currencies, and commodities. They attempt to profit from macroeconomic trends and geopolitical events on a global scale. Relative value funds focus on identifying and exploiting price discrepancies between related securities. They often employ complex mathematical models to identify and exploit arbitrage opportunities. Multi-strategy hedge funds utilize multiple investment strategies to diversify their portfolios and mitigate risk. These funds typically allocate capital across various strategies, aiming to generate consistent returns regardless of market conditions. Hedge funds typically operate as limited partnerships or limited liability companies, with the following key components: In a limited partnership (LP), the general partner (GP) manages the fund and assumes unlimited liability, while limited partners (LPs) provide capital and enjoy limited liability. Limited liability companies (LLCs) are hybrid structures, combining aspects of corporations and partnerships. The general partner is responsible for managing the hedge fund's investments and day-to-day operations. In contrast, limited partners serve as passive investors, supplying capital without participating in the fund's management. Prime brokers provide essential services to hedge funds, such as trade execution, securities lending, and risk management. Other service providers, including administrators, auditors, and legal counsel, play crucial roles in ensuring the fund's operational efficiency and compliance with regulations. Hedge funds typically charge two types of fees: management fees and performance fees. Management fees are a percentage of assets under management (AUM) and cover operational costs. Performance fees are based on the fund's profits and align the interests of the fund manager and investors. Hedge funds employ various strategies and techniques to generate returns for their investors, such as: Short selling involves borrowing and selling a security with the expectation of repurchasing it at a lower price. Hedge funds use short selling to profit from declining asset prices or hedge long positions in their portfolios. Leverage refers to the use of borrowed funds to amplify potential returns. While leverage can increase gains, it also exposes hedge funds to greater risks, including the potential for significant losses. Derivatives are financial instruments whose values are derived from underlying assets, such as stocks, bonds, or commodities. Hedge funds use derivatives to hedge risk, gain exposure to specific asset classes, or implement complex trading strategies. Hedge funds employ various risk management techniques and diversification strategies to mitigate potential losses and enhance portfolio performance. This includes allocating assets across different investment styles, regions, and asset classes, as well as using advanced mathematical models to monitor and manage risk exposure. Activist investing involves acquiring significant stakes in publicly traded companies and using that influence to push for operational or strategic changes. Hedge funds may engage in activist investing to unlock value for shareholders and generate profits. Measuring and evaluating hedge fund performance is essential for investors and managers alike. Key aspects include: KPIs are metrics used to evaluate a hedge fund's success, such as return on investment (ROI), volatility, and drawdowns. These indicators help investors assess the fund's performance relative to their risk tolerance and investment objectives. Risk-adjusted performance measures, such as the Sharpe ratio and Sortino ratio, evaluate a fund's returns relative to its risk exposure. These metrics help investors compare funds with different risk profiles and determine which offers the best risk-reward tradeoff. Benchmarking involves comparing a hedge fund's performance to relevant market indices and peer groups. This process helps investors gauge the fund's success relative to its competitors and broader market trends. Attribution analysis examines the sources of a hedge fund's returns, attributing performance to specific investment strategies, asset classes, or market factors. This analysis helps investors and managers understand the drivers of a fund's success and identify areas for improvement. Hedge funds operate within a complex regulatory environment, with requirements varying across jurisdictions. Key aspects include: In the United States, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) oversee hedge funds. Regulations include registration, disclosure, and reporting requirements, as well as restrictions on leverage and marketing practices. In Europe, the Alternative Investment Fund Managers Directive (AIFMD) and the Markets in Financial Instruments Directive II (MiFID II) govern hedge funds. These regulations aim to enhance transparency, investor protection, and financial stability. Hedge funds must adhere to various compliance requirements and reporting obligations, including periodic financial reporting, risk management policies, and disclosure of material information to investors and regulators. Regulatory trends impacting hedge funds include the harmonization of global standards, increased scrutiny of systemic risk, and the implementation of environmental, social, and governance (ESG) criteria. Hedge funds face numerous risks and criticisms, such as: Market risk refers to the potential for losses due to fluctuations in asset prices, interest rates, or exchange rates. Hedge funds, particularly those employing aggressive strategies or high leverage, may experience significant volatility and losses during market downturns. Liquidity risk arises when a fund cannot easily convert its assets into cash or meet redemption requests without impacting asset prices. This risk is particularly relevant for hedge funds investing in illiquid assets or experiencing large investor withdrawals. High leverage can amplify both gains and losses for hedge funds, potentially leading to substantial losses during market downturns. Counterparty risk, which arises when a trading partner fails to meet its obligations, may also threaten a fund's financial stability. Operational risk encompasses the potential for losses resulting from internal failures, such as inadequate controls, systems, or personnel. Hedge funds may face operational risks due to complex investment strategies, reliance on key personnel, or external factors such as regulatory changes or technological disruptions. Critics argue that hedge funds may contribute to financial instability through aggressive short selling, excessive leverage, or market manipulation. Additionally, some funds have faced ethical concerns regarding their activist investing tactics, tax avoidance strategies, and lack of transparency. The hedge fund industry continues to evolve, driven by technological advancements, competition, and emerging markets. Key trends include: Advancements in technology, such as big data, machine learning, and artificial intelligence, are transforming the hedge fund industry. Funds are increasingly leveraging these technologies to enhance trading strategies, risk management, and operational efficiency. Artificial intelligence (AI) and machine learning (ML) enable hedge funds to analyze vast amounts of data, identify patterns, and generate trading signals more efficiently than traditional methods. These technologies are driving the development of new investment strategies and enabling funds to adapt to changing market conditions. Hedge funds face increasing competition from other alternative investment vehicles, such as private equity, venture capital, and real estate. Investors seeking diversification and potentially higher returns may allocate a portion of their portfolios to these alternative assets. Emerging markets offer hedge funds new investment opportunities and potential for higher returns, albeit with increased risk. As these markets develop and become more accessible to foreign investors, hedge funds may increase their allocations to tap into their growth potential. Hedge funds play a significant role in the global financial landscape, offering investors unique strategies and potential rewards. Understanding their structures, strategies, risks, and regulations is essential for both investors and industry professionals. As the industry continues to evolve and adapt to new challenges, hedge funds will remain a key component of the financial market, shaping its future development and growth. In conclusion, hedge funds play a significant role in the global financial landscape, offering investors unique strategies and potential rewards, and serving as an important component of wealth management for high-net-worth individuals and institutional investors.What Are Hedge Funds?

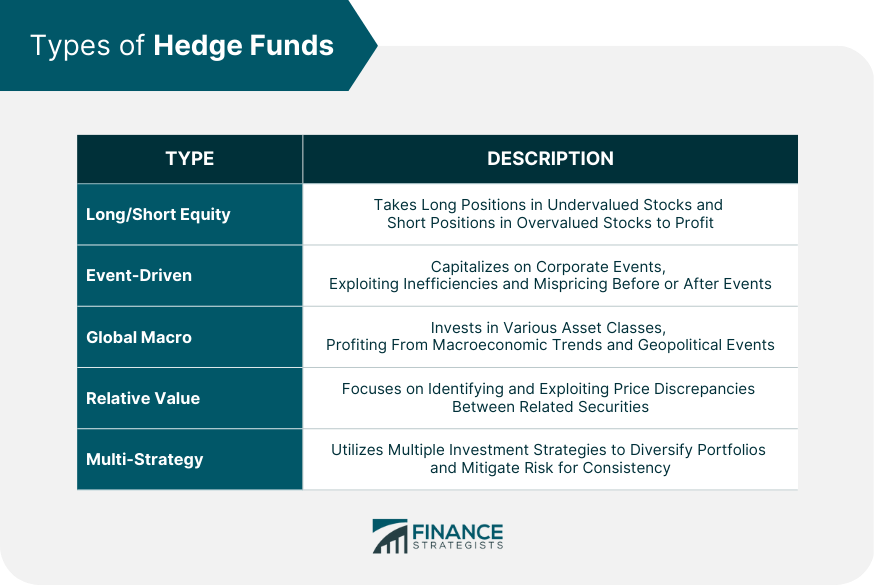

Types of Hedge Funds

Long/Short Equity

Event-Driven

Global Macro

Relative Value

Multi-Strategy

Structure of Hedge Funds

Limited Partnership or Limited Liability Company

Roles of General Partner and Limited Partners

Role of the Prime Broker and Other Service Providers

Role of the Prime Broker and Other Service Providers

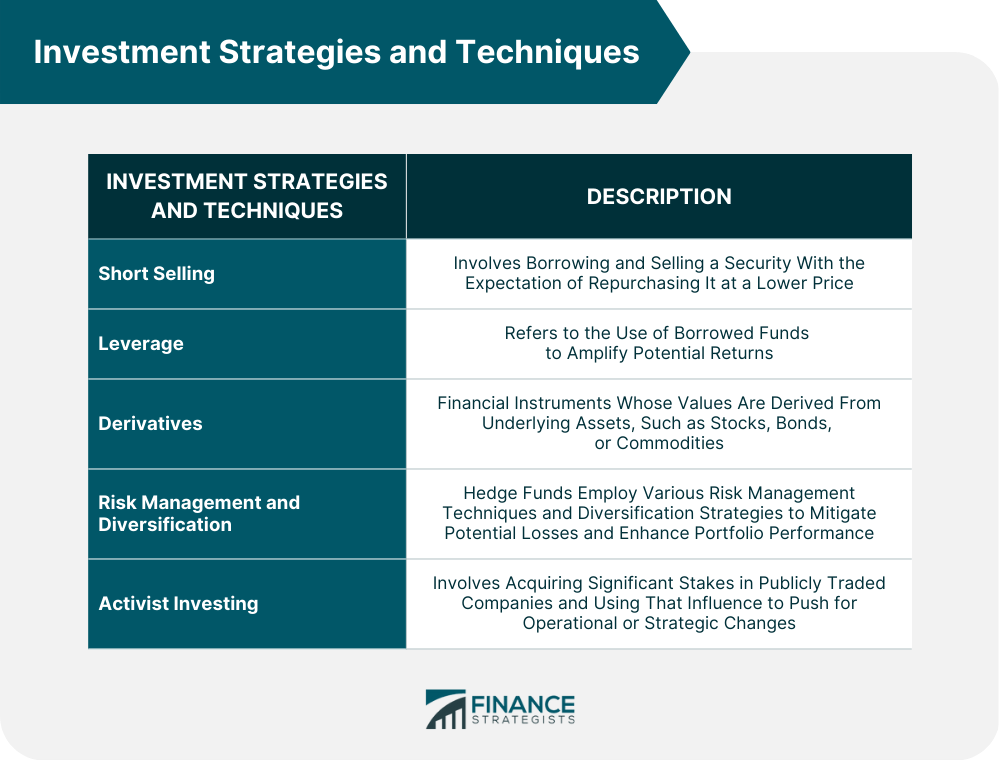

Investment Strategies and Techniques of Hedge Funds

Short Selling

Leverage

Derivatives

Risk Management and Diversification

Activist Investing

Hedge Fund Performance and Evaluation

Key Performance Indicators (KPIs)

Risk-Adjusted Performance Measures

Benchmarking Against Indices and Peers

Attribution Analysis

Regulatory Environment of Hedge Funds

U.S. Regulations (SEC, CFTC)

European Regulations (AIFMD, MiFID II)

Compliance Requirements and Reporting Obligations

Trends and Developments in Global Hedge Fund Regulation

Risks and Criticisms of Hedge Funds

Market Risk and Volatility

Liquidity Risk

Leverage and Counterparty Risk

Operational Risk

Ethical Concerns and Impact on Financial Stability

Future of Hedge Funds

Technological Advancements and Their Impact on Hedge Funds

Role of Artificial Intelligence and Machine Learning in Hedge Fund Strategies

Competition From Other Alternative Investment Vehicles

Emerging Markets and New Opportunities

Conclusion

Hedge Funds FAQs

Hedge funds are specialized investment vehicles that use a wide range of strategies and techniques to generate returns. Unlike mutual funds, hedge funds typically cater to high-net-worth individuals and institutional investors, employ aggressive strategies, and are subject to different regulations.

Hedge funds manage risk through various techniques, such as diversification across asset classes, investment styles, and regions, employing advanced mathematical models for risk assessment, and using derivatives to hedge against potential losses.

The main types of hedge funds include long/short equity, event-driven, global macro, relative value, and multi-strategy. Each type employs a unique investment approach, targeting opportunities in equity markets, corporate events, macroeconomic trends, price discrepancies, or a combination of strategies.

Yes, hedge funds are subject to regulatory oversight. In the United States, the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) oversee hedge funds. In Europe, the Alternative Investment Fund Managers Directive (AIFMD) and the Markets in Financial Instruments Directive II (MiFID II) govern hedge fund activities.

Hedge funds face several risks, including market risk, liquidity risk, leverage and counterparty risk, and operational risk. Criticisms of hedge funds involve their potential contribution to financial instability, aggressive short selling, excessive leverage, market manipulation, and ethical concerns related to activist investing and transparency.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.