Insurance-Linked Securities (ILS) are financial instruments that transfer insurance risks from insurers to capital market investors. They allow insurance and reinsurance companies to offload some of their risks, especially those associated with catastrophic events, to a broader range of investors. The ILS market has its roots in the 1990s, following the increased frequency and severity of natural disasters and the need for new risk transfer mechanisms. The primary purpose of ILS is to provide insurers and reinsurers with an alternative form of risk transfer, as well as a source of capital. This helps companies to manage their risk exposure more effectively and to maintain capital adequacy. For investors, ILS offers a unique investment opportunity that provides diversification, attractive risk-adjusted returns, and low correlation with other asset classes. The ILS market has grown significantly over the past two decades, driven by the increasing demand for alternative risk transfer solutions and the attractive investment opportunities that ILS presents. Market trends include the emergence of new types of ILS, expansion into new regions, and the application of technology to improve risk modeling and streamline the issuance process. Catastrophe bonds, or CAT bonds, are the most common form of ILS. They are issued by insurers and reinsurers to transfer the risk of specified catastrophic events, such as hurricanes or earthquakes, to investors. CAT bonds have different triggers, which can be based on indemnity, industry loss, or parametric indexes. Investors benefit from the attractive risk-adjusted returns and diversification that CAT bonds offer, while insurers and reinsurers obtain additional capital and risk transfer. In the event of a catastrophe, the bond principal may be reduced or forgiven, allowing the issuer to cover its losses. Notable examples of CAT bonds include Residential Reinsurance, a series of bonds issued by USAA to cover hurricane and earthquake risks, and MetroCat Re, a bond issued by the Metropolitan Transportation Authority to cover storm surge risks in New York City. Industry Loss Warranties are a type of ILS that provide coverage based on the total industry loss resulting from a specified catastrophic event. They are triggered when the industry loss reaches a predetermined threshold, regardless of the individual losses incurred by the protection buyer. ILWs offer investors an opportunity to invest in insurance risks without having to underwrite individual policies, while insurers and reinsurers can transfer a portion of their risk exposure to the capital markets. ILWs are often used as a complement to other risk transfer mechanisms, such as CAT bonds and traditional reinsurance. ILWs have been used to cover various catastrophic events, including hurricanes, earthquakes, and wildfires. They are often structured as private transactions between protection buyers and sellers, with brokers playing a key role in arranging and pricing the deals. Collateralized reinsurance is a form of ILS where investors provide collateral to cover the reinsurance obligations of an insurer or reinsurer. This collateral is typically held in a trust or other segregated account and can be used to pay claims in the event of a catastrophe. Investors benefit from the diversification and risk-adjusted returns that collateralized reinsurance provides, while insurers and reinsurers benefit from additional capacity and risk transfer. Collateralized reinsurance allows insurers to access the capital markets more directly and efficiently than through other ILS structures, such as CAT bonds. Collateralized reinsurance has been used to cover a wide range of risks, including natural catastrophes, aviation, and marine insurance. The market has grown rapidly in recent years, with many new entrants and specialized ILS funds participating in the collateralized reinsurance space. Sidecars are special purpose vehicles (SPVs) that allow investors to participate in the underwriting profits and losses of an insurer or reinsurer. They are typically structured as quota share arrangements, with the sidecar providing a portion of the capital needed to underwrite a specified book of business. Life Insurance-Linked Securities (LILS) are ILS that transfer life insurance risks, such as mortality or longevity risks, to the capital markets. LILS have gained traction in recent years as insurers seek to manage their exposure to these risks more effectively. ILS sponsors include insurance and reinsurance companies, as well as public entities seeking to transfer risks. Investors in ILS typically include institutional investors, such as pension funds, hedge funds, and asset managers, who are attracted by the diversification and return potential of ILS. Risk modeling and pricing are essential components of the ILS issuance and investment process. Catastrophe models are used to estimate the potential losses from specified events and to price the ILS accordingly. Improvements in modeling technology and the availability of more granular data have contributed to the growth of the ILS market. Legal and regulatory considerations play a key role in the issuance and investment process for ILS. Jurisdictions such as Bermuda, the Cayman Islands, and Ireland have established favorable regulatory frameworks for ILS, while other jurisdictions are actively working to develop their ILS markets. Rating agencies and brokers play important roles in the ILS market. Rating agencies assess the credit quality of ILS, providing investors with valuable information about the risk profile of the securities. Brokers facilitate the placement of ILS, connecting issuers with investors and advising on the structuring and pricing of transactions. The investment process for ILS begins with the identification of a suitable risk transfer opportunity and the selection of an appropriate ILS structure. The issuer, often with the assistance of a broker, will develop the offering documentation and engage with potential investors. Once the ILS is issued, investors receive periodic coupon payments and may be required to provide additional capital in the event of a triggering event. At maturity, the ILS principal is returned to investors, provided no triggering events have occurred. ILS provides investors with a unique opportunity to diversify their portfolios by investing in insurance risks that are largely uncorrelated with traditional financial markets. ILS offers attractive risk-adjusted returns relative to other fixed-income investments, reflecting the premium that investors receive for bearing insurance risks. ILS have limited correlation with other asset classes, such as equities and bonds, making them an attractive addition to investment portfolios seeking to reduce overall volatility and enhance risk-adjusted performance. ILS provides insurers and reinsurers with an alternative mechanism for transferring risk, reducing their exposure to catastrophic events and allowing them to manage their capital more effectively. By transferring risks to the capital markets, insurers and reinsurers can free up capital that would otherwise be required to support their underwriting activities, potentially leading to more efficient capital deployment and growth opportunities. ILS increases the overall capacity of the insurance and reinsurance markets, enabling insurers and reinsurers to underwrite more risks and maintain their competitiveness in the face of growing demand for insurance coverage. Basis risk refers to the potential mismatch between the losses experienced by an insurer and the payouts triggered by an ILS. This risk can arise due to differences in the triggers used in the ILS and the actual losses experienced by the issuer. The accuracy and reliability of catastrophe models and the data used to inform them are critical factors in the pricing and performance of ILS. Model and data limitations can lead to mispricing of risks and unexpected losses for investors. Regulatory and legal risks, such as changes in the tax treatment or regulatory requirements for ILS, can impact the attractiveness of the market for both issuers and investors. ILS are relatively illiquid investments, which may make it difficult for investors to sell their positions or adjust their exposures in response to changing market conditions. Insurance-Linked Securities provide a unique and valuable risk transfer mechanism for insurers and reinsurers while offering attractive investment opportunities for institutional investors. The market has evolved significantly since its inception, with new types of ILS, expanding geographical reach, and the application of innovative technologies driving growth and development. As the global risk landscape continues to evolve, ILS are likely to play an increasingly important role in helping insurers and reinsurers manage their risk exposure and maintain capital adequacy. The growing demand for insurance coverage, particularly in emerging markets and for emerging risks, is expected to create new opportunities for ILS issuers and investors alike. Insurance-Linked Securities provide a unique investment opportunity that can help diversify portfolios, enhance risk-adjusted returns, and provide exposure to a growing and innovative segment of the capital markets, making them an attractive addition to wealth management strategies. The International Association of Insurance Supervisors (IAIS) is a global standard-setting organization for insurance supervision that provides guidance on various topics related to insurance.What Are Insurance-Linked Securities?

Definition and Background

Purpose and Benefits

Market Growth and Trends

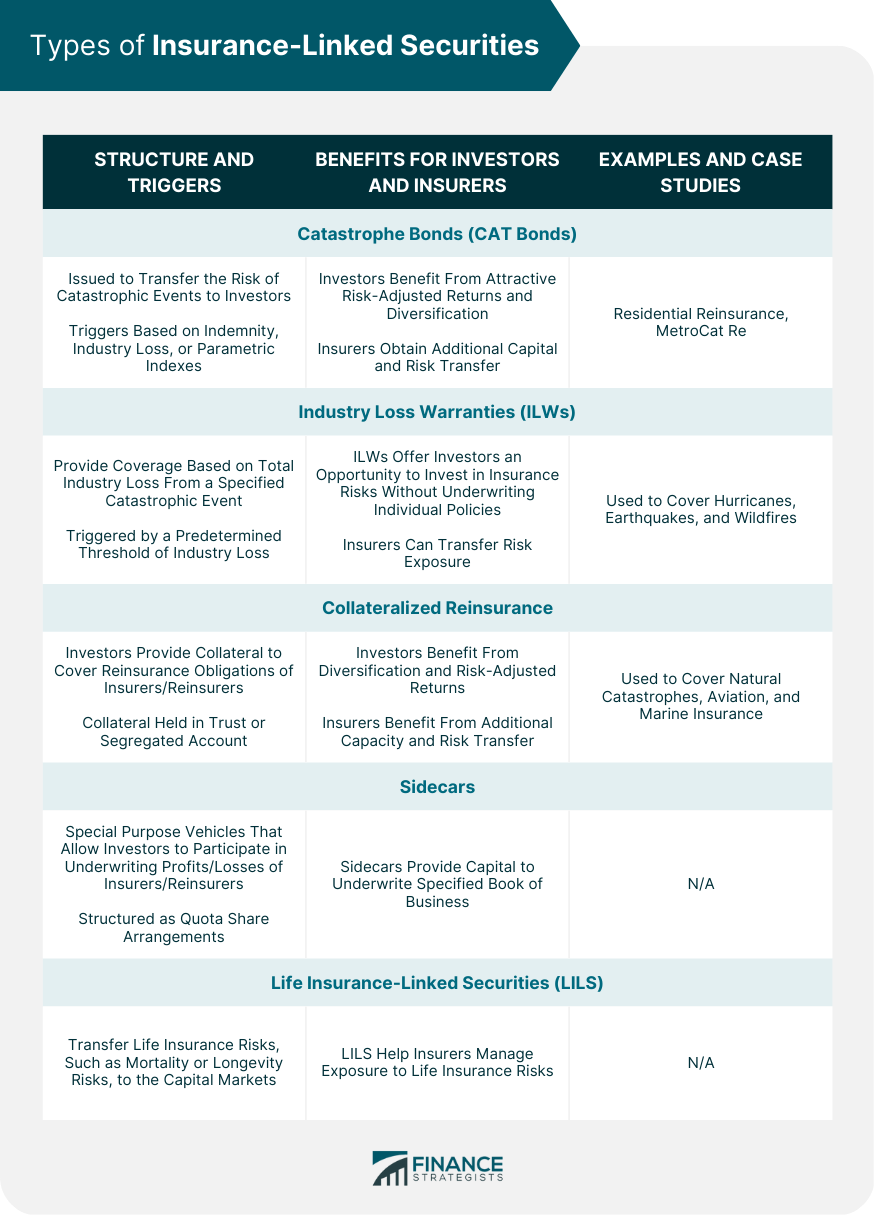

Catastrophe Bonds (CAT Bonds)

Structure and Triggers

Benefits for Investors and Insurers

Examples and Case Studies

Industry Loss Warranties (ILWs)

Structure and Triggers

Benefits for Investors and Insurers

Examples and Case Studies

Collateralized Reinsurance

Structure and Characteristics

Benefits for Investors and Insurers

Examples and Case Studies

Other Types of ILS

Sidecars

Life Insurance-Linked Securities

Issuance and Investment Process

ILS Sponsors and Investors

Risk Modeling and Pricing

Legal and Regulatory Considerations

Role of Rating Agencies and Brokers

Investment Process – From Issuance to Maturity

Benefits and Risks of Insurance-Linked Securities

Benefits for Investors

Diversification

Attractive Risk-Adjusted Returns

Limited Correlation with Other Asset Classes

Benefits for Insurers and Reinsurers

Risk Transfer

Capital Relief

Increased Capacity

Risks and Challenges

Basis Risk

Model and Data Limitations

Regulatory and Legal Risks

Liquidity Concerns

Final Thoughts

Insurance-Linked Securities FAQs

ILS are financial instruments that transfer insurance risks from insurers to capital market investors, allowing insurers to offload some of their risks to a broader range of investors.

Investing in ILS can provide diversification, attractive risk-adjusted returns, and low correlation with other asset classes, making them an attractive addition to investment portfolios seeking to enhance risk-adjusted performance.

ILS can cover a wide range of risks, including natural catastrophes, aviation, marine, life insurance risks, and others.

Rating agencies assess the credit quality of ILS, providing investors with valuable information about the risk profile of the securities. Brokers facilitate the placement of ILS, connecting issuers with investors and advising on the structuring and pricing of transactions.

The ILS market is expected to continue expanding into new regions and covering a broader range of risks, driven by technological advancements and increasing demand for insurance coverage. The growing demand for ILS is likely to attract a broader range of investors and offer a wider range of risk transfer solutions for insurers and reinsurers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.