Interest rate swaps are financial instruments that allow parties to exchange interest rate cash flows. They are an important tool for managing interest rate risk and can be used to lower borrowing costs or increase investment returns. Interest rate swaps allow parties to manage their interest rate risk and can be used to lower borrowing costs or increase investment returns. The primary purpose of interest rate swaps is to manage interest rate risk. Interest rates can have a significant impact on the value of investments or debts, and by exchanging cash flows with a counterparty, parties can lock in a fixed rate or convert a floating rate to a fixed rate, reducing their exposure to interest rate fluctuations. It can also be used to reduce borrowing costs or increase investment returns by taking advantage of lower floating rates or higher fixed rates. Interest rate swaps involve two parties: the fixed-rate payer and the floating-rate payer. The fixed-rate payer agrees to pay a fixed rate of interest to the floating-rate payer. The floating-rate payer agrees to pay a variable rate of interest based on a benchmark such as LIBOR (London Interbank Offered Rate) to the fixed-rate payer. The terms and conditions of interest rate swaps include the notional amount, the fixed and floating rates, the frequency of payments, and the maturity date. The notional amount is the hypothetical amount of the underlying debt or investment that the swap is based on. The fixed and floating rates are agreed upon by the parties and can be changed over time. The frequency of payments can be monthly, quarterly, semi-annually, or annually. The maturity date is the date on which the swap expires. The calculation of interest rate swap payments involves determining the net cash flow due to each party based on the notional amount, fixed and floating rates, and the actual interest rate. For example, if the fixed rate is 3% and the floating rate is LIBOR plus 1%, and the actual interest rate is 4%, then the floating-rate payer would pay the fixed-rate payer 2% (4% - 3%) of the notional amount. The settlement of interest rate swaps can be done through cash payments or by offsetting the swap with a similar swap in the opposite direction. Cash settlements involve the payment of the net cash flow to the party owed, while offsetting involves terminating the original swap and entering into a new swap with different terms. Below are types of interest rates swaps: Fixed-for-fixed interest rate swaps involve the exchange of fixed-rate cash flows between parties. They are used to adjust the cash flows of existing fixed-rate investments or debts, such as bonds. Fixed-for-floating interest rate swaps involve the exchange of fixed-rate cash flows for floating-rate cash flows based on a benchmark such as LIBOR. They are used to manage interest rate risk by converting fixed-rate investments or debts to floating-rate investments or debts. Interest rate swaps offer the following benefits: Interest rate swaps are an effective tool for managing interest rate risk, which is the risk that interest rates will rise or fall and affect the value of investments or debts. By exchanging cash flows with a counterparty, parties can lock in a fixed rate or convert a floating rate to a fixed rate, reducing their exposure to interest rate fluctuations. Interest rate swaps can be used to reduce borrowing costs or increase investment returns. By entering into a fixed-for-floating swap, borrowers can take advantage of lower floating rates, while investors can earn a higher return by receiving a fixed rate. Interest rate swaps are a flexible instrument that can be customized to meet the specific needs of parties. They can be structured with different terms and conditions and can be used for a variety of purposes, including hedging, speculation, or to generate cash flows. Risks of interest rate swaps include: While interest rate swaps can be used to manage interest rate risk, they also expose parties to interest rate risk. If interest rates move against a party, they may be required to make payments that exceed their expectations, resulting in a financial loss. Interest rate swaps also expose parties to counterparty risk, which is the risk that the other party will default on their payment obligations. This risk can be mitigated by using credit limits or collateral requirements, but there is always a risk that the counterparty will not meet their obligations. Basis risk is the risk that the relationship between different interest rates will change over time, causing the cash flows of the swap to be misaligned with the underlying investment or debt. This risk can be managed by using floating-for-floating swaps with similar benchmarks or by adjusting the terms of the swap. Corporate entities use interest rate swaps to manage their interest rate risk and to reduce borrowing costs. By entering into swaps with financial institutions, they can reduce the cost of debt by converting floating-rate debt to fixed-rate debt or by taking advantage of lower floating rates. Financial institutions use interest rate swaps to manage their balance sheets and to generate income. They can use swaps to manage the interest rate risk of their assets and liabilities, or to generate income by earning a spread between the fixed and floating rates. Governments and public sector entities use interest rate swaps to manage their debt portfolios and to reduce borrowing costs. By entering into swaps with financial institutions, they can convert variable-rate debt to fixed-rate debt or take advantage of lower floating rates. Interest rate swaps are an important financial instrument for managing interest rate risk and reducing borrowing costs. They are a flexible tool that can be customized to meet the specific needs of parties and can be used for a variety of purposes. While they offer many benefits, they also expose parties to risks such as interest rate risk, counterparty risk, and basis risk. As such, it is important for parties to carefully consider the terms and conditions of the swap and to manage their risks appropriately. It is highly recommended to seek the guidance of a professional wealth management service that can provide expert advice tailored to your individual needs and goals.Definition of Interest Rate Swaps

The swap typically involves one party making fixed payments and receiving variable payments based on a benchmark interest rate, while the other party makes variable payments and receives fixed payments. Parties Involved in Interest Rate Swaps

Terms and Conditions of Interest Rate Swaps

Calculation of Interest Rate Swap Payments

Settlement of Interest Rate Swaps

Types of Interest Rate Swaps

Fixed-For-Fixed Interest Rate Swaps

Fixed-For-Floating Interest Rate Swaps

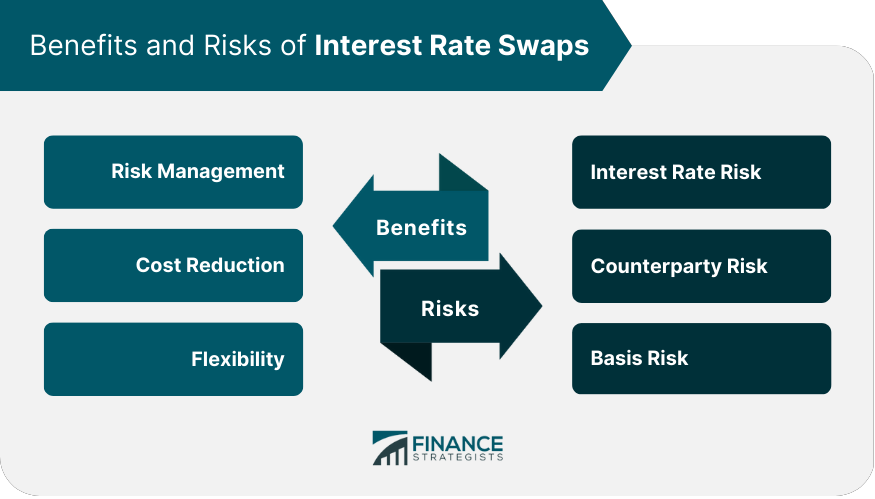

Benefits of Interest Rate Swaps

Risk Management

Cost Reduction

Flexibility

Risks of Interest Rate Swaps

Interest Rate Risk

Counterparty Risk

Basis Risk

Applications of Interest Rate Swaps

Corporate Uses

Financial Institution Uses

Government and Public Sector Uses

Final Thoughts

Interest Rate Swaps FAQs

Interest rate swaps are financial instruments that allow parties to exchange interest rate cash flows, primarily used for managing interest rate risk, reducing borrowing costs, and increasing investment returns.

Interest rate swaps involve two parties: the fixed-rate payer and the floating-rate payer. The fixed-rate payer agrees to pay a fixed rate of interest to the floating-rate payer.

The calculation of interest rate swap payments involves determining the net cash flow due to each party based on the notional amount, fixed and floating rates, and the actual interest rate.

The three types of interest rate swaps are Fixed-for-Fixed Interest Rate Swaps, Fixed-for-Floating Interest Rate Swaps, and Floating-for-Floating Interest Rate Swaps.

Interest rate swaps offer benefits such as risk management, cost reduction, and flexibility. However, they also expose parties to risks such as interest rate risk, counterparty risk, and basis risk. It is important for parties to carefully consider the terms and conditions of the swap and to manage their risks appropriately.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.