What Is Crypto?

Cryptocurrency, often referred to as 'crypto,' embodies a digital or virtual form of currency that leverages cryptography for security.

Essentially, these are decentralized mediums of exchange, which operate on a technology called blockchain.

This technology aids in the distribution of information across various computers, ensuring data protection, decentralization, and transparency.

Cryptocurrencies such as Bitcoin, Ethereum, and Ripple have gained global recognition and acceptance for their potential to offer a faster, more secure, and more private method of transferring funds.

These cryptos exist purely in digital form, with no physical counterparts like coins or notes.

Is Crypto a Commodity?

The classification of cryptocurrencies has been a source of intense debate among economists, legal professionals, and regulatory bodies.

The heart of the controversy lies in determining whether cryptocurrencies, like Bitcoin, can be classified as commodities.

Different jurisdictions and regulatory bodies worldwide have various viewpoints on this matter, leading to a somewhat fragmented global approach to cryptocurrency regulation.

In the United States, the Commodity Futures Trading Commission (CFTC) views Bitcoin and other cryptocurrencies as commodities, likening them to gold.

However, in other regions, they are seen as securities, currencies, or even completely novel assets.

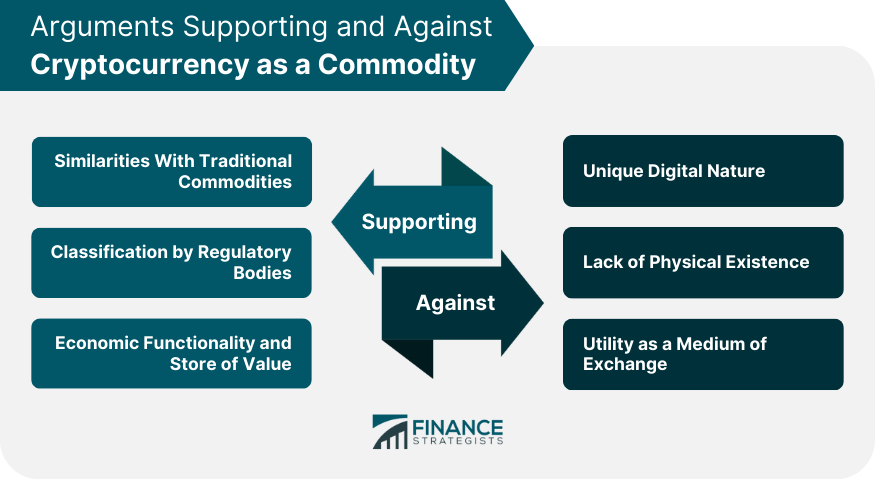

Arguments Supporting Cryptocurrency as a Commodity

Similarities With Traditional Commodities

Cryptocurrencies share several similarities with traditional commodities, a fact that bolsters the argument for their classification as commodities.

Both commodities and cryptocurrencies are finite resources, traded in open markets, and their value is determined by supply and demand forces.

Moreover, like commodities, cryptocurrencies can be used as a hedge against inflation or market volatility.

Bitcoin, for instance, has often been termed as 'digital gold,' highlighting its commodity-like nature.

Classification by Regulatory Bodies

The way regulatory bodies classify cryptocurrencies also plays a part in cementing the view that cryptos are commodities.

In the United States, the Commodity Futures Trading Commission (CFTC) has declared Bitcoin and other cryptocurrencies as commodities under the Commodity Exchange Act (CEA).

This classification implies that cryptocurrency derivatives such as futures and options can be legally traded in a similar manner to commodity derivatives.

Economic Functionality and Store of Value

Cryptocurrencies often serve a similar economic function to that of commodities, acting as a store of value. Bitcoin, for example, is sometimes used as a value preservation tool, similar to precious metals like gold.

Furthermore, similar to commodities, cryptocurrencies can also be seen as speculative assets. Traders often buy cryptocurrencies, not for their use-value, but in anticipation of a future price increase.

Arguments Against Cryptocurrency as a Commodity

Unique Digital Nature

On the other side of the debate, the unique digital nature of cryptocurrencies challenges their classification as commodities.

Unlike traditional commodities, which are tangible and physical, cryptocurrencies are intangible and exist solely in digital form.

This difference can impact several key aspects, including how they are stored, transferred, and used, setting them apart from conventional commodities.

Lack of Physical Existence

The lack of physical existence of cryptocurrencies adds to the arguments against their commodity classification.

Traditional commodities, such as gold, oil, or wheat, have physical form and intrinsic value. They can be utilized in producing goods and services.

Cryptocurrencies, in contrast, cannot be used in a physical sense and don't have an inherent value outside their exchange medium, pushing them outside the standard definition of commodities.

Utility as a Medium of Exchange

Cryptocurrencies, by design, serve as a medium of exchange—a characteristic that aligns more with the definition of currency rather than a commodity.

Some cryptocurrencies like Bitcoin were initially envisioned as a decentralized form of digital money.

The utility of cryptocurrencies as a medium of exchange, especially in an increasing number of transactions and services, challenges their categorization purely as commodities.

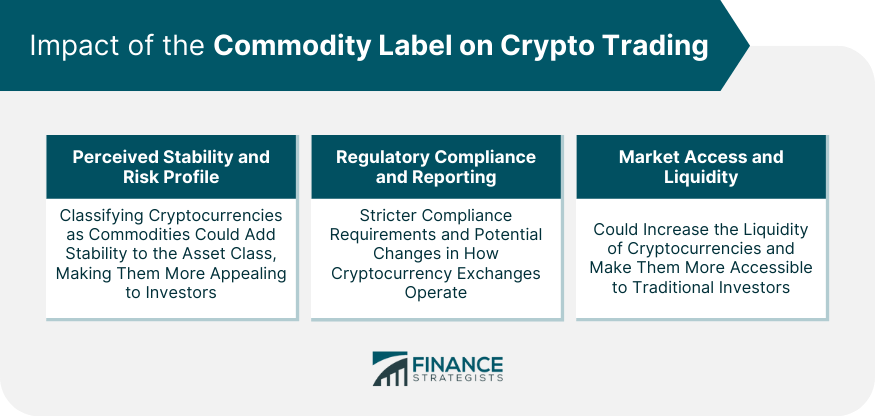

Impact of the Commodity Label on Crypto Trading

Perceived Stability and Risk Profile

The classification of cryptocurrencies as commodities can impact their perceived stability and risk profile.

Commodities are often viewed as relatively stable investments—especially when compared to the volatility experienced in the crypto market.

Classifying cryptocurrencies as commodities could therefore potentially add an air of stability to the asset class and make them more appealing to risk-averse investors.

Regulatory Compliance and Reporting

If cryptocurrencies are treated as commodities, this would necessitate certain regulatory compliances and reporting requirements, similar to other commodities.

Traders and investors would need to consider tax implications, reporting requirements, and other regulatory obligations associated with commodity trading.

For cryptocurrency exchanges, it could mean stricter compliance requirements and potential changes in how these platforms operate.

Market Access and Liquidity

The 'commodity' label can also influence market access and liquidity for cryptocurrencies. Recognized commodities have access to established global markets, which could potentially be extended to cryptocurrencies.

This could increase the liquidity of cryptocurrencies and make them more accessible to traditional investors, further integrating them into the mainstream financial system.

Conclusion

The classification of cryptocurrencies as commodities remains a subject of debate and varies across jurisdictions and regulatory bodies.

The debate on whether cryptocurrencies are commodities hinges on their perceived similarities with traditional commodities and regulatory classifications like the CFTC.

While others emphasize their unique digital nature and utility as a medium of exchange, resembling currencies.

Despite these arguments, the commodity label can impact the perception and behavior of crypto traders and investors.

It can lend a sense of stability, subject cryptocurrencies to regulatory compliance and reporting requirements, and potentially improve market access and liquidity.

Ultimately, the debate on whether crypto is a commodity continues to shape the regulatory landscape and market dynamics, influencing the future trajectory of these digital assets.

Is Crypto a Commodity? FAQs

Cryptocurrency, often referred to as 'crypto,' is a digital or virtual form of currency that uses cryptography for security. It operates on a technology called blockchain, which aids in data protection, decentralization, and transparency.

The classification of cryptocurrency as a commodity is a subject of intense debate. Some regulatory bodies, like the U.S. Commodity Futures Trading Commission (CFTC), consider cryptocurrencies as commodities. However, other jurisdictions view them as securities or currencies.

Cryptocurrencies could be considered commodities because they share several characteristics with traditional commodities. They are finite, their value is determined by supply and demand, and they can act as a store of value or a hedge against inflation.

Cryptocurrencies' unique digital nature and lack of physical existence challenge their classification as commodities. Also, their utility as a medium of exchange aligns them more with the definition of currency than a commodity.

Classifying cryptocurrency as a commodity could impact their perceived stability and risk profile, regulatory compliance and reporting requirements, and market access and liquidity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.