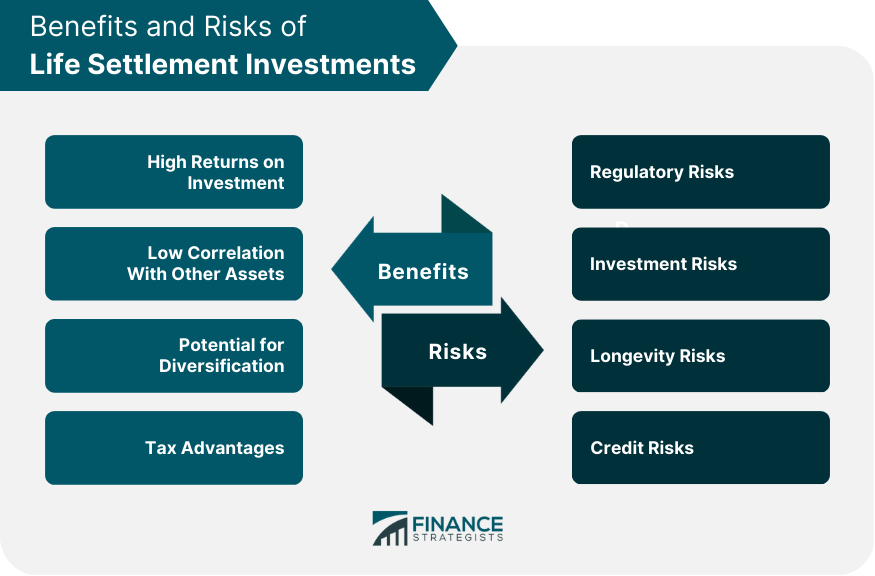

Life settlement investments involve purchasing life insurance policies from policyholders at a discount and receiving the benefits upon the insured's death. This allows investors to potentially earn high returns and diversify their portfolio. Life settlements emerged in the early 20th century as a way for seniors to sell their life insurance policies to pay for retirement or medical expenses. The industry grew in the 1980s, and today, it is a multi-billion-dollar market. The purpose of life settlement investments is to provide investors with an opportunity to purchase life insurance policies from policyholders at a discount and receive the benefits upon the insured's death. Life settlement investments offer potential high returns, diversification benefits, and tax advantages. They can also provide seniors with an alternative to surrendering their life insurance policies for cash value or allowing them to lapse. There are several benefits for those who purchase life settlement investments. Life settlement investments offer investors a high rate of return. These investments can provide returns which are significantly higher than other asset classes such as stocks and bonds. Life settlement investments are not correlated with other traditional asset classes such as stocks, bonds, or real estate. This means that investing in life settlements can help diversify an investor's portfolio and reduce risk. Investing in life settlements can provide investors with diversification benefits. Life settlements can be uncorrelated with other asset classes, such as equities, and offer a way to diversify one's portfolio. Investing in life settlements can provide tax advantages to investors. For example, the death benefits paid to investors are generally tax-free, making them an attractive investment for high-net-worth individuals who are seeking to minimize their tax liability. Life Settlement Investments also comes with several drawbacks. One of the significant risks associated with life settlement investments is regulatory risk. Regulations surrounding life settlements are constantly evolving and can change quickly, potentially leaving investors exposed to risks they did not anticipate. Investing in life settlements can also carry investment risks. For example, the underlying life insurance policies may not perform as anticipated, or the insured may live longer than expected, reducing the returns on the investment. Another risk associated with life settlement investments is longevity risk. Longevity risk refers to the risk that the insured will live longer than expected, potentially reducing the returns on the investment. There is also credit risk associated with life settlement investments. The life insurance policies that are sold to investors are often bundled into a pool, and the creditworthiness of the pool will depend on the creditworthiness of the underlying policies. There are several factors that must be considered before one decides to invest in life settlements. Before investing in life settlements, investors should carefully consider market conditions. For example, life expectancy tables and the cost of insurance can impact the potential returns of life settlement investments. The legal and regulatory environment surrounding life settlements can significantly impact an investor's ability to invest in this asset class. It is important to consider the regulatory environment before making an investment decision. Investors should consider their investment goals and risk tolerance before investing in life settlements. These investments may not be suitable for all investors, and investors should be aware of the risks involved. Investors should perform due diligence on life settlement investment opportunities before investing. Due diligence may include reviewing the underlying insurance policies, assessing the creditworthiness of the pool, and evaluating the reputation and track record of the investment manager. There are several types of life settlement investments, including: Direct investments in life settlements involve purchasing an individual policy or a group of policies directly from a policyholder or their representative. These investments are typically made by institutional investors or high-net-worth individuals. Indirect investments in life settlements involve investing in a fund that invests in life settlements. These funds pool investor capital to purchase a large number of policies, reducing the credit risk associated with investing in a single policy. Fractionalized investments in life settlements involve investing in a portion of a life settlement policy rather than the entire policy. This can provide investors with the opportunity to invest in life settlements at a lower cost and potentially diversify their portfolio further. Secondary market investments in life settlements involve purchasing an existing life settlement policy from a third party. These investments can provide investors with access to existing policies that have already been underwritten, potentially reducing investment risks. These are the steps involved when individuals wish to invest in life settlements. Investors should carefully consider the investment manager they choose to work with when investing in life settlements. Investors should look for investment managers with a proven track record in life settlement investments and a reputation for transparency. Investors should review investment documents carefully before making an investment in life settlements. These documents should include detailed information on the underlying policies, the investment strategy, and the risks associated with the investment. Investors should ensure they have sufficient capital available to fund their investment in life settlements. Investing in life settlements often requires a significant capital investment, and investors should be prepared to commit these funds for an extended period. Investors should monitor their investment in life settlements carefully. This may involve monitoring the underlying policies, tracking the performance of the investment, and remaining vigilant for changes in the regulatory environment that may impact the investment. Life settlement investments involve purchasing life insurance policies from policyholders at a discount and receiving the benefits upon the insured's death. The types of life settlement investments include direct, indirect, fractionalized, and secondary market investments. Working with a qualified wealth management professional can help investors navigate the complexities of life settlement investments and ensure that their investment strategy aligns with their overall financial goals.What Are Life Settlement Investments?

Benefits of Life Settlement Investments

High Returns on Investment

Low Correlation With Other Asset Classes

Potential for Diversification

Tax Advantages

Risks of Life Settlement Investments

Regulatory Risks

Investment Risks

Longevity Risks

Credit Risks

Factors to Consider Before Investing in Life Settlements

Market Conditions

Legal and Regulatory Environment

Investment Goals and Risk Tolerance

Due Diligence Process

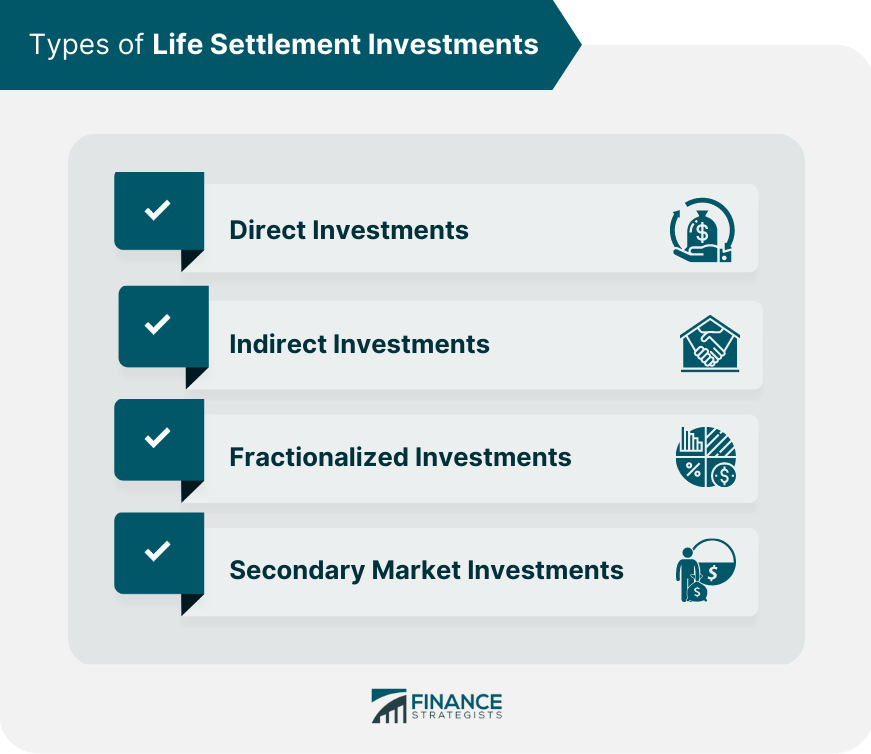

Types of Life Settlement Investments

Direct Investments

Indirect Investments

Fractionalized Investments

Secondary Market Investments

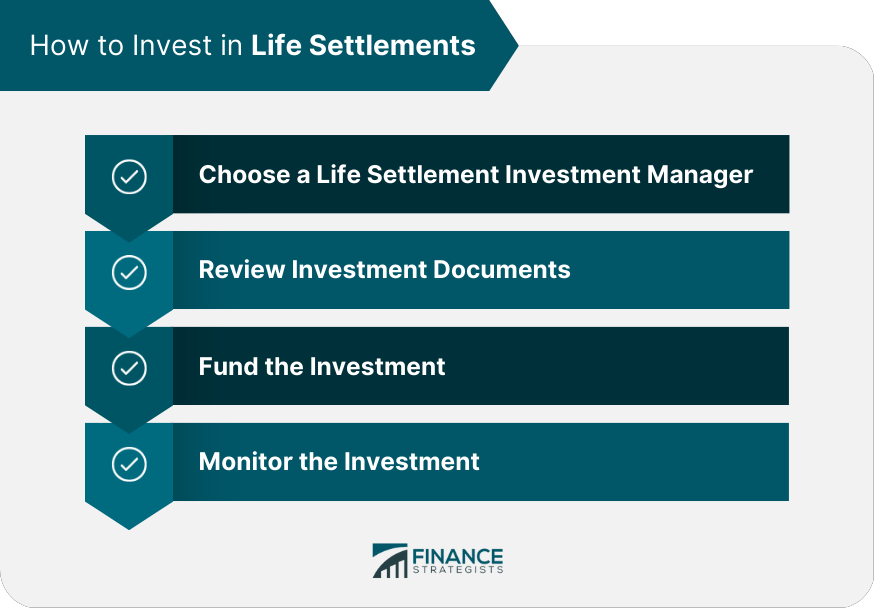

How to Invest in Life Settlements

Choose a Life Settlement Investment Manager

Review Investment Documents

Fund the Investment

Monitor the Investment

Bottom Line

They offer the potential for high returns, diversification benefits, and tax advantages. However, they also come with risks such as regulatory, investment, longevity, and credit risks.

Before investing in life settlements, investors must consider market conditions, legal and regulatory environment, investment goals, and risk tolerance. They must also perform due diligence.

Overall, life settlement investments can be a viable asset class for investors seeking high returns and diversification, but investors should carefully consider their investment goals and risk tolerance before making an investment decision.

Life Settlement Investments FAQs

Life settlement investments involve purchasing life insurance policies from policyholders at a discount and receiving the benefits upon the insured's death.

Life settlement investments offer high returns, potential diversification, tax advantages, and low correlation with other asset classes.

Risks include regulatory risks, investment risks, longevity risks, and credit risks.

Factors to consider include market conditions, legal and regulatory environment, investment goals, risk tolerance, and due diligence process.

Investors can invest in life settlements directly, indirectly, fractionally, or through the secondary market. It's important to work with a qualified wealth management professional and perform due diligence on investment opportunities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.