Liquid alternative investments refer to a broad category of investment strategies that offer daily liquidity while seeking to generate returns that are uncorrelated with traditional investments such as stocks and bonds. They often employ sophisticated techniques to capitalize on market inefficiencies and provide an additional layer of diversification for investors. Liquid alternative investments play a critical role in modern portfolio management as they offer investors a means to diversify their investments beyond traditional asset classes. This diversification can help to reduce portfolio risk and enhance long-term performance. Compared to traditional investments, liquid alternative investments often have lower correlations with standard asset classes, providing investors with additional diversification opportunities. They also tend to utilize more complex strategies and investment vehicles, which can result in unique risk and return profiles. There are several types of liquid alternative investments, each with its own set of characteristics, strategies, and potential benefits. This section will discuss some of the most popular types of liquid alternative investments. Long-short equity funds involve taking both long and short positions in stocks, seeking to generate returns through stock selection and market timing. By holding both long and short positions, these funds aim to provide returns that are less correlated with the overall market. Market neutral funds strive to achieve a low or zero correlation with market movements by taking simultaneous long and short positions in various asset classes. There are two main types of market neutral funds. Equity market neutral funds focus on achieving returns that are uncorrelated with equity markets by taking long and short positions in individual stocks, sectors, or indexes. Fixed-income market neutral funds employ similar strategies but focus on fixed income securities such as government bonds, corporate bonds, and other debt instruments. Managed futures involve investing in futures contracts across various asset classes, including commodities, currencies, and interest rates. They often use quantitative models and technical analysis to identify trends and capitalize on market inefficiencies. Global macro strategies invest in a wide range of global asset classes, including equities, fixed income, currencies, and commodities. These funds typically use macroeconomic analysis to identify investment opportunities arising from economic or political events. Multi-strategy funds combine several alternative investment strategies within a single fund, providing exposure to a diverse set of investment opportunities and risk factors. Event-driven strategies focus on corporate events such as mergers, acquisitions, and restructurings, seeking to capitalize on the potential mispricing of securities associated with these events. Credit strategies involve investing in fixed income securities, such as corporate bonds, distressed debt, or mortgage-backed securities, with the aim of generating income and capital appreciation. Real assets include investments in tangible assets, such as real estate, infrastructure, and commodities, which can provide diversification benefits and protection against inflation. Liquid alternative investments offer several advantages for investors, including risk management, access to unique opportunities, and increased liquidity and flexibility. Liquid alternative investments can help investors manage risk and diversify their portfolios by providing exposure to unique sources of return and low correlations with traditional investments. Liquid alternatives provide investors with access to a wide array of unique investment opportunities and strategies that are not typically available in traditional asset classes. These strategies can help investors capitalize on market inefficiencies and potentially enhance portfolio performance. Liquid alternative investments offer daily liquidity, allowing investors to easily enter and exit positions as needed. This increased liquidity and flexibility can be advantageous during periods of market stress or when investors need to rebalance their portfolios. By incorporating liquid alternative investments into a diversified portfolio, investors may benefit from improved risk-adjusted returns and reduced volatility, contributing to overall enhanced portfolio performance. While liquid alternative investments offer numerous benefits, they also come with their own set of risks and challenges, including complexity, fees, regulatory issues, and the potential for underperformance. Liquid alternative investments often involve complex strategies and investment vehicles that can be difficult for investors to understand. It is essential for investors to conduct thorough research and due diligence before investing in these types of assets. Liquid alternative investments may have higher fees and expenses than traditional investments due to the complexity of their strategies and the specialized expertise required to manage them. Investors should carefully evaluate fee structures and understand the potential impact on investment returns. Regulation and compliance requirements for liquid alternative investments can vary depending on the jurisdiction and the specific type of investment. Investors should be aware of the regulatory environment and ensure that they comply with any applicable rules and regulations. Despite their potential benefits, liquid alternative investments are not immune to periods of underperformance. As with any investment, there is no guarantee that these strategies will always generate positive returns or outperform traditional investments. Each liquid alternative investment strategy carries its own unique set of risks. Investors should carefully evaluate the risks associated with each strategy and consider how they fit within their overall investment objectives and risk tolerance Selecting the right liquid alternative investments for a portfolio requires a thorough understanding of each investment's objectives, strategy, and risks. This section outlines the key steps in the selection and due diligence process. When considering a liquid alternative investment, it is crucial to understand the investment's objective and strategy, ensuring that it aligns with an investor's overall portfolio goals and risk tolerance. The experience and track record of the investment manager are essential factors to consider when evaluating a liquid alternative investment. Investors should look for managers with a demonstrated history of success in managing similar strategies and a strong understanding of the specific risks involved. Evaluating a liquid alternative investment's historical performance and comparing it to relevant benchmarks can help investors assess the potential risks and returns associated with the strategy. While past performance is not indicative of future results, it can provide insight into the investment's potential risk/return profile. Effective risk management and control processes are critical for the success of a liquid alternative investment. Investors should evaluate a manager's risk management practices and ensure that they have the necessary tools and procedures in place to manage the unique risks associated with the strategy. Understanding the fee structure and level of transparency provided by a liquid alternative investment is essential for investors. High fees can significantly impact investment returns, so it is crucial to ensure that fees are reasonable and transparent. Incorporating liquid alternative investments into a portfolio requires careful consideration of the appropriate allocation and the integration of these investments with traditional assets. The allocation to liquid alternative investments will depend on an investor's risk tolerance, investment objectives, and overall portfolio composition. Investors should carefully assess their individual needs and determine the appropriate allocation that meets their specific goals while maintaining a well-diversified portfolio. Successfully incorporating liquid alternative investments into a portfolio requires a thoughtful approach to blending them with traditional assets. Investors should consider the correlations between liquid alternatives and traditional investments to maximize diversification benefits and achieve an optimal risk/return profile. Regular monitoring and rebalancing of a portfolio are essential to maintaining an appropriate allocation to liquid alternative investments. Investors should periodically review the performance of their liquid alternatives and assess whether any adjustments are necessary to maintain the desired level of risk and diversification. Liquid alternative investments offer investors a means to diversify their investments beyond traditional asset classes, providing exposure to unique sources of return and low correlations with traditional investments. To navigate the complexities of incorporating liquid alternatives into your portfolio, it is highly recommended to consult with a wealth management professional who can provide expert guidance and tailored solutions.Definition of Liquid Alternative Investments

Types of Liquid Alternative Investments

Long-Short Equity Funds

Market Neutral Funds

Managed Futures

Global Macro Strategies

Multi-Strategy Funds

Event-Driven Strategies

Credit Strategies

Real Assets

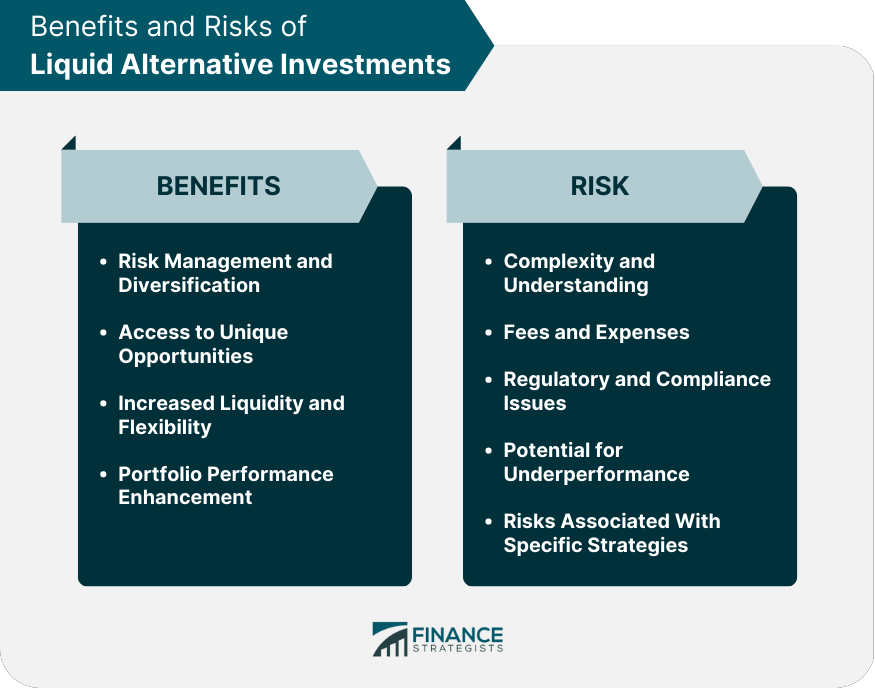

Benefits of Liquid Alternative Investments

Risk Management and Diversification

Access to Unique Opportunities

Increased Liquidity and Flexibility

Portfolio Performance Enhancement

Risks and Challenges of Liquid Alternative Investments

Complexity and Understanding

Fees and Expenses

Regulatory and Compliance Issues

Potential for Underperformance

Risks Associated With Specific Strategies

Selection of the Right Liquid Alternative Investments

Investment Objective and Strategy

Manager Experience and Track Record

Performance History and Benchmarking

Risk Management and Controls

Fee Structure and Transparency

Portfolio Construction & Allocation for Liquid Alternative Investments

Determining the Appropriate Allocation

Integrating Liquid Alternatives With Traditional Investments

Monitoring and Rebalancing

Bottom Line

The different types of liquid alternative investments offer a wide array of unique investment opportunities and strategies that are not typically available in traditional asset classes.

Liquid alternative investments offer several advantages for investors, including risk management, access to unique opportunities, and increased liquidity and flexibility.

However, liquid alternative investments come with their own set of risks and challenges, including complexity, fees, regulatory issues, and the potential for underperformance.

Selecting the right liquid alternative investments for a portfolio requires a thorough understanding of each investment's objectives, strategy, and risks.

Liquid Alternative Investments FAQs

Liquid alternative investments are a category of investment strategies that offer daily liquidity and seek to generate returns uncorrelated with traditional investments like stocks and bonds.

Investors should consider liquid alternative investments for their potential to diversify portfolios, provide access to unique opportunities, and enhance risk-adjusted returns.

The main types of liquid alternative investments include long-short equity funds, market neutral funds, managed futures, global macro strategies, multi-strategy funds, event-driven strategies, credit strategies, and real assets.

The risks associated with liquid alternative investments include complexity and understanding, fees and expenses, regulatory and compliance issues, potential for underperformance, and risks specific to each strategy.

Investors can incorporate liquid alternative investments into their portfolios by determining the appropriate allocation, integrating them with traditional investments, and regularly monitoring and rebalancing the portfolio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.