Open interest is a concept that underpins the dynamics of the derivatives market, particularly futures and options contracts. It denotes the total number of outstanding derivative contracts that have not yet been settled or closed. More specifically, it represents the aggregate of all open positions, both long and short, held by market participants at the end of a trading day. These contracts are either held by buyers who are yet to offset their position, or by sellers who are yet to cover their position. Open interest provides key insights into the market sentiment and potential reversals, acting as a proxy for the flow of money into futures and options markets. Rising open interest indicates new money entering the market, suggesting a continuing trend, while declining open interest implies market liquidation, signaling a potential end to the current price trend. Open interest is computed by adding all open contracts at the end of the trading day. It is important to note that for each trade, there are two sides: the buyer (holder of a long position) and the seller (holder of a short position). Although two parties are involved in a transaction, only one new contract is created. To illustrate, consider the following example: Trader A buys one futures contract from Trader B who is selling one futures contract. Assuming that both Trader A and Trader B have initiated a new position, the open interest would increase by one contract. If Trader C, who already holds a contract, sells it to Trader D who is entering the market for the first time, the open interest would remain unchanged. This is because the existing contract was merely transferred, not newly created. However, if Trader A who already holds a contract decides to close his position by selling to Trader B who is also closing her position, the open interest would decrease by one contract. One common misconception in calculating open interest is that it accounts for both the buyer's and the seller's contracts separately. However, as we have explained, for every transaction, only one new contract is created or removed, irrespective of the number of parties involved. In futures markets, open interest can be used as a gauge of market sentiment. Rising open interest, especially when coupled with rising prices, can suggest a strong trend, indicating that money is flowing into the futures market. On the other hand, declining open interest may signal that the market is weakening. Open interest is particularly valuable in futures markets because it can help traders understand the dynamics of supply and demand. For instance, in commodity markets, significant changes in open interest may suggest potential movements in commodity prices. Open interest also plays an important role in options trading. Each option contract represents the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specific price before a certain date. Analyzing open interest in options can provide insights into investor behavior. For instance, a high level of open interest in call options can suggest that a large number of investors are betting on the price of the underlying asset to increase. Conversely, a high open interest in put options may suggest a bearish sentiment. Moreover, open interest can help options traders assess the liquidity of an options contract. Contracts with higher open interest tend to have tighter bid-ask spreads, making it easier for traders to enter or exit positions at favorable prices. Open interest serves as a critical tool in revealing market sentiment. By comparing the changes in price, volume, and open interest, traders can glean valuable insights about the market’s underlying strength or weakness. A rising price, volume, and open interest can indicate a strong bullish trend. Conversely, falling price, volume, and open interest may suggest a strong bearish trend. However, discrepancies among these indicators can hint at potential reversals. For example, if the price is rising but volume and open interest are declining, it might suggest that the bullish trend is losing momentum and a bearish reversal could be on the horizon. Open interest is influenced by various factors, ranging from the actions of individual traders to larger market trends. As previously mentioned, open interest is significantly influenced by the creation of new trades and the closing of existing ones. When a buyer and a seller each open a new position, they create a new contract and open interest increases. Conversely, if both parties are closing an existing position, open interest decreases. If one party is opening a new position while the other is closing an old one, the contract is simply transferred, and open interest remains unchanged. Institutional investors can also significantly influence open interest due to the large size of their trades. Large blocks of new contracts being opened can result in a sharp increase in open interest, indicating a strong level of interest in a particular asset or market. This activity can signal the potential for a strong price trend. Expiration and delivery dates can also impact open interest. As the expiration date of a futures or options contract approaches, open interest typically declines as traders close out their positions to avoid physical delivery of the asset (in the case of futures) or to avoid the expiration of the contract's value (in the case of options). Open interest analysis can yield important insights into market behavior and potential future trends. Changes in open interest can be used to predict market trends. Rising open interest indicates new money entering the market, suggesting that the current trend is likely to continue. Conversely, falling open interest can suggest that the market is weakening, which can be a bearish signal. Analyzing the relationship between price, volume, and open interest can provide a deeper understanding of market sentiment. For instance, rising prices accompanied by rising volume and open interest can signal a strong uptrend. Conversely, falling prices, volume, and open interest can suggest a downtrend. However, divergences between these three factors can also suggest potential price reversals. Open interest can also serve as a measure of a market's liquidity. Contracts with high open interest are typically more liquid, with tighter bid-ask spreads. This liquidity can make it easier for traders to enter or exit positions. Open interest analysis can be incorporated into various trading strategies, particularly in the options and futures markets. Options traders often use open interest to identify potential trading opportunities. High open interest in certain strike prices can indicate areas where large numbers of traders have positions, which could act as potential support or resistance levels. Changes in open interest can also suggest whether money is flowing into call options or put options, providing clues about market sentiment. In the futures markets, traders often use open interest in combination with volume and price to confirm trends and anticipate reversals. For example, a rise in price accompanied by increasing volume and open interest can confirm a bullish trend. On the other hand, a rise in price with declining volume and open interest might suggest a potential bearish reversal. Open interest can also be used as a tool for risk management. By providing insights into market liquidity, open interest can help traders assess the ease with which they can enter or exit positions. Moreover, sudden changes in open interest can signal increased volatility, allowing traders to adjust their risk management strategies accordingly. Open interest serves as a key indicator of market sentiment. An increase in open interest signals that new money is entering the market, which may suggest a strengthening trend, be it bullish or bearish. Open interest can provide insights into a contract's liquidity. High levels of open interest indicate a greater number of market participants, which often translates into better liquidity and tighter bid-ask spreads, thus facilitating easier trade execution. Open interest can help identify the strength of a trend. For instance, rising prices along with rising open interest suggest a strong upward trend, while falling prices coupled with increasing open interest may indicate a strong downward trend. Changes in open interest can also provide potential reversal signals. If prices are rising but open interest is falling, it could suggest that the upward trend is losing strength and a bearish reversal might be imminent. Similarly, if prices are falling but open interest is increasing, it may hint at a potential bullish reversal. While open interest provides a wealth of information to market participants, it does come with certain limitations. While open interest can provide information about the strength or weakness of a trend, it does not indicate the direction of the market. An increase in open interest simply signifies new money coming into the market, but it does not reveal whether the new money is bullish or bearish. Unlike price and volume data, which is available in real-time, open interest data is often updated only once a day after the close of trading. This delay can sometimes limit the effectiveness of using open interest as a real-time trading tool. Open interest is a nuanced indicator that can sometimes be misinterpreted. An increase or decrease in open interest can have various implications depending on the broader market context, and misinterpreting these signals can potentially lead to costly trading mistakes. The value of open interest as an indicator is less pronounced in illiquid markets. In these markets, changes in open interest may be driven by the actions of just a few traders, making it a less reliable gauge of market sentiment. Open interest and trading volume are two key metrics in the world of derivatives trading, but they offer different perspectives. Trading volume refers to the total number of contracts traded during a specific period, usually a day. It counts all contracts, regardless of whether they are opening new positions or closing existing ones. On the other hand, open interest counts only the number of open contracts at the end of the trading day. Trading volume shows the level of activity or the number of transactions in a market on a given day. It can help identify periods of high activity, which often coincide with significant market events or announcements. Conversely, open interest represents the number of contracts that remain open and have not yet been offset or fulfilled. It provides a snapshot of the ongoing activity or interest in a specific market. Trading volume is useful for assessing the momentum of the current price movement. High volume on up-days and low volume on down-days are typically bullish signs, and vice versa. Meanwhile, open interest can confirm whether the money is flowing into or out of the market, offering insights into the strength of the prevailing trend. Changes in open interest can signal potential reversals, providing valuable clues to traders and investors. Open interest, an essential concept in derivatives trading, represents the total number of outstanding contracts that have not been settled in a market. Calculating open interest involves tracking the flow of contracts, with the number increasing or decreasing based on the entrance of new traders or the exit of existing ones. Numerous factors, such as new trades, institutional activity, and contract expiration dates, can impact open interest. However, like all market indicators, open interest has its limitations. It doesn't specify market direction, the data can be delayed, it can be misinterpreted, and its usefulness is diminished in illiquid markets. Nevertheless, when used judiciously, open interest can provide valuable insights into market sentiment, trend strength, and potential reversals. Seek the guidance of professional wealth management services to help you interpret this and other complex market indicators to align with your investment goals.What Is Open Interest?

Calculating Open Interest

Formula for Calculating Open Interest

Examples of Open Interest Calculation

Misconceptions in Calculating Open Interest

Understanding Open Interest in Derivative Markets

Open Interest in Futures Contracts

Open Interest in Options Contracts

Role of Open Interest in Indicating Market Sentiment

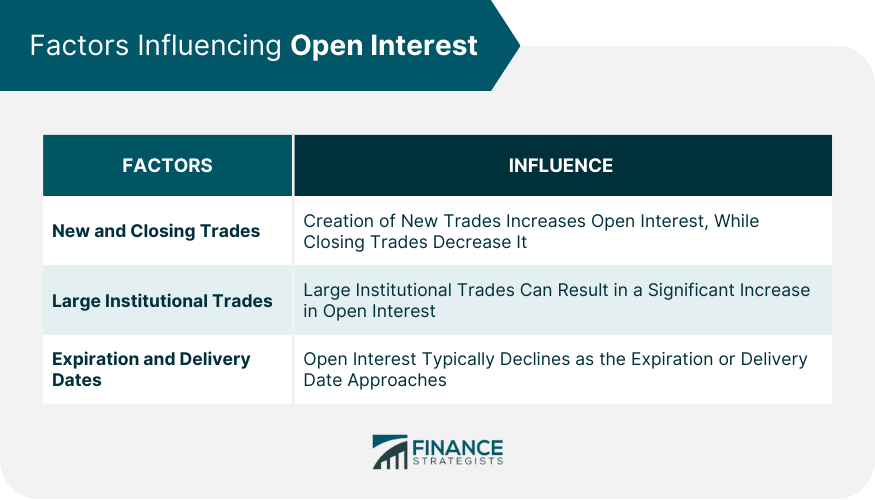

Factors Impacting Open Interest

New and Closing Trades on Open Interest

Large Institutional Trades

Expiration and Delivery Dates on Open Interest

Analyzing Open Interest

Using Open Interest to Predict Market Trends

Correlation Between Price, Volume, and Open Interest

Open Interest as a Liquidity Indicator

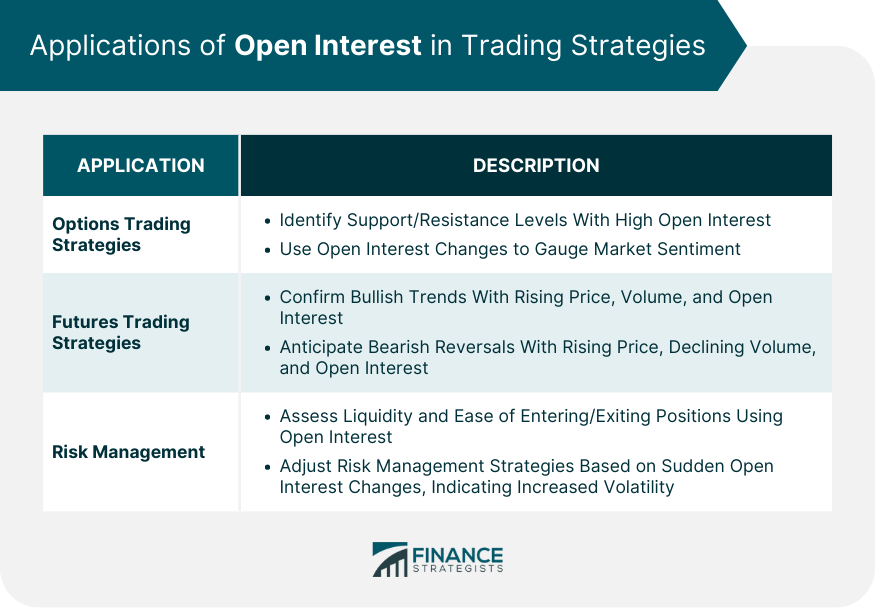

Applications of Open Interest in Trading Strategies

Application in Options Trading Strategies

Application in Futures Trading Strategies

Use of Open Interest in Risk Management

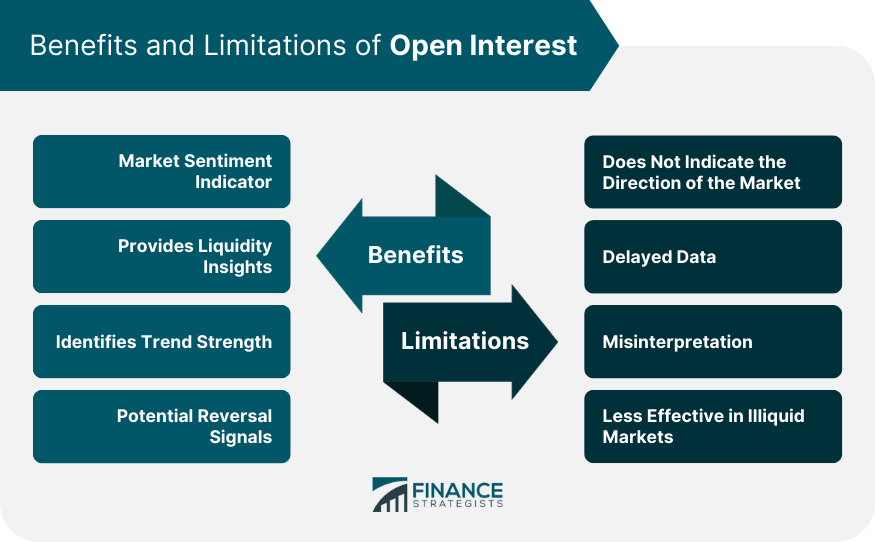

Benefits of Open Interest

Market Sentiment Indicator

Provides Liquidity Insights

Identifies Trend Strength

Potential Reversal Signals

Limitations of Open Interest

Does Not Indicate the Direction of the Market

Delayed Data

Misinterpretation

Less Effective in Illiquid Markets

Open Interest vs Trading Volume

Definition

What They Represent

Utility

Final Thoughts

Open Interest FAQs

Open interest is a measure that shows the number of derivatives contracts, such as futures and options, that are active or "open" in the market at a given time. It can provide insights into market liquidity and sentiment.

Open interest is calculated by counting the total number of open contracts at the end of each trading day. It increases when a new buyer and seller enter the market, remains the same when a new participant trades with an existing participant, and decreases when an existing buyer and seller close their positions.

While both open interest and trading volume provide valuable information about market activity, they represent different things. Trading volume counts the total number of contracts traded in a single day, while open interest shows the total number of contracts that remain open and unsettled at the end of the trading day.

While open interest can provide valuable insights, it has some limitations. It does not indicate market direction, the data can be delayed, it can be prone to misinterpretation, and it is less effective in illiquid markets.

Open interest can provide indications of the strength or weakness of a market trend. If prices and open interest are increasing, the current trend is likely strong. However, if prices are rising and open interest is falling, it could be a signal that the trend is weakening and a price reversal might be on the horizon.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.