Rare coins are unique or scarce monetary units, often with historical or cultural significance, that have been issued by governments or other official institutions throughout human history. Investing in rare coins involves acquiring these valuable pieces as a long-term investment strategy, with the hope that their value will appreciate over time due to factors such as rarity, historical significance, and the intrinsic value of the metals they are made from. Rare coins have been collected and traded for centuries, often serving as a store of wealth and a symbol of power. These coins offer a glimpse into the past, providing insights into the economic, social, and political conditions of the time. Ancient Greek coins are known for their intricate designs and artistic craftsmanship. They often feature images of gods, goddesses, and mythological creatures, making them highly sought after by collectors and investors. Roman coins provide a window into the vast and powerful Roman Empire. They are often made from gold, silver, or bronze and feature portraits of emperors, military conquests, and other symbols of the empire's might. Ancient Chinese coins are known for their unique shapes and characters. They are often made of bronze or iron and can be identified by the square hole in the center of the coin. Medieval coins are minted during the Middle Ages and offer a unique insight into the economic and political landscape of the period. These coins often feature kings, queens, and religious symbols, reflecting the importance of religion and monarchy during this time. Gold coins have been a popular form of investment for centuries due to their intrinsic value and stability. They are often issued by governments and central banks and can be a solid addition to an investment portfolio. Silver coins are another popular investment option, with many investors considering them a more affordable alternative to gold coins. They often feature beautiful designs and are issued by various governments around the world. Commemorative coins are minted to celebrate significant events, anniversaries, or milestones. These coins are often made from precious metals and can have both numismatic and intrinsic value. Error coins are coins that have been minted with mistakes, such as misaligned images, double strikes, or incorrect inscriptions. These coins can be highly sought after by collectors and can sometimes fetch high prices. Rarity is a significant factor when determining the value of a rare coin. The fewer coins minted or the fewer coins remaining in existence, the more valuable the coin is likely to be. The condition of a coin is assessed using a grading scale, which ranges from "Poor" to "Mint State." The higher the grade, the more valuable the coin is likely to be. Proper preservation and storage of coins are essential to maintain their condition and value. Investors should handle coins carefully and store them in appropriate holders or cases to prevent damage. The value of a rare coin is also influenced by the level of demand among collectors and investors. Coins with high demand are likely to fetch higher prices. Coins with historical significance or those connected to important events, people, or places often hold a higher value due to their unique appeal to collectors and investors. The intrinsic value of the metals in a coin, such as gold or silver, also contributes to its overall value. Coins with higher precious metal content are often more valuable, especially during times of economic uncertainty or rising metal prices. Rare coins are a tangible asset that investors can hold and physically possess. This provides a sense of security and stability compared to intangible investments, such as stocks or bonds. Investing in rare coins can help protect against inflation, as the value of precious metals often increases during times of economic uncertainty. This can make rare coins a suitable investment option for those looking to preserve their wealth. Adding rare coins to an investment portfolio can provide diversification and reduce overall risk. Rare coins often have a low correlation with traditional assets, such as stocks and bonds, which can help balance a portfolio during market fluctuations. Rare coin investments offer a level of privacy and confidentiality that may not be available with other types of investments. Transactions can often be conducted without revealing the investor's identity or financial information. Some rare coins have the potential to yield high returns on investment, particularly if they are acquired at a low price and their value appreciates significantly over time. The rare coin market can be volatile, with prices subject to fluctuations based on factors such as demand, economic conditions, and market sentiment. The risk of counterfeit coins is a significant concern for rare coin investors. It is crucial to work with reputable dealers and ensure that coins are authenticated and certified by trusted grading services. Rare coins can be less liquid than other types of investments, meaning it may be more challenging to sell or exchange them quickly if needed. Investors must consider the costs of securely storing and insuring their rare coin collection, which can be an ongoing expense. Investing in rare coins requires specialized knowledge and expertise. Investors must be prepared to dedicate time to research and educate themselves about the rare coin market. A well-balanced portfolio should include a mix of rare coins, such as ancient, medieval, and modern coins, to minimize risk and maximize potential returns. Investors should conduct thorough research and educate themselves about the rare coin market, including the factors affecting coin values and the history of the coins they are interested in. Working with reputable and knowledgeable dealers can help investors avoid counterfeit coins and make informed decisions about their investments. Investors should ensure their coins are graded and certified by trusted grading services, such as the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC), to verify their authenticity and condition. Rare coins are best suited for long-term investment strategies, as their value often appreciates over time. Investors should be prepared to hold onto their coins for an extended period to maximize potential returns. Rare coin investments may be subject to capital gains taxes, depending on the jurisdiction and the specific circumstances of the investor. It is essential for investors to consult with a tax professional to understand their tax obligations. Certain countries and jurisdictions may have regulations and restrictions related to the purchase, sale, and transport of rare coins. Investors should familiarize themselves with these regulations to ensure compliance. Maintaining accurate records and documentation of rare coin investments is critical for tax reporting and insurance purposes. Investors should keep detailed records of their transactions, including purchase and sale prices, dates, coin descriptions, and any relevant certifications or appraisals. Investing in rare coins offers numerous benefits, such as portfolio diversification, the potential for high returns, a hedge against inflation, tangible assets, and privacy and confidentiality. However, investors must also be aware of the risks and challenges associated with rare coin investments, including market volatility, counterfeit coins, and limited liquidity. To maximize the potential of rare coin investments, it is essential to build a balanced portfolio, educate oneself about the market, work with reputable dealers, ensure proper grading and certification, and adopt a long-term investment approach. Legal and tax considerations, such as understanding capital gains tax implications, complying with regulations, and maintaining accurate records, are also crucial aspects of rare coin investments. The complexities and nuances of rare coin investments require specialized knowledge and expertise to navigate successfully. A wealth management with experience in this niche market can provide valuable guidance and support, helping you build a robust portfolio, minimize risks, and maximize the potential for long-term growth and wealth preservation.What Are Rare Coins Investments?

They can be made from various metals, such as gold, silver, copper, or other precious materials.Types of Rare Coins for Investments

Ancient Coins

Greek Coins

Roman Coins

Chinese Coins

Medieval Coins

Modern Coins

Gold Coins

Silver Coins

Commemorative Coins

Error Coins

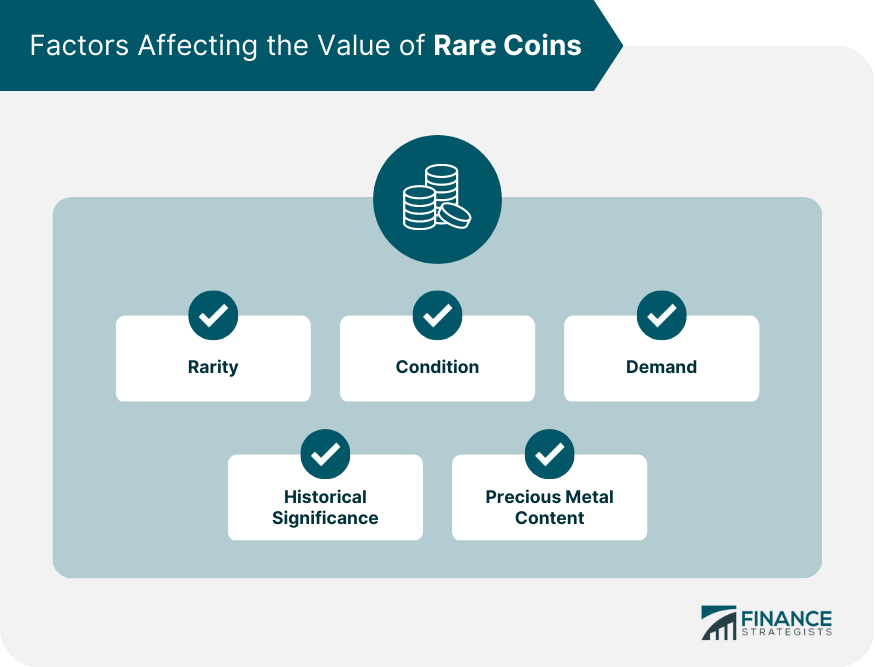

Factors Affecting the Value of Rare Coins

Rarity

Condition

Grading Standards

Coin Preservation

Demand

Historical Significance

Precious Metal Content

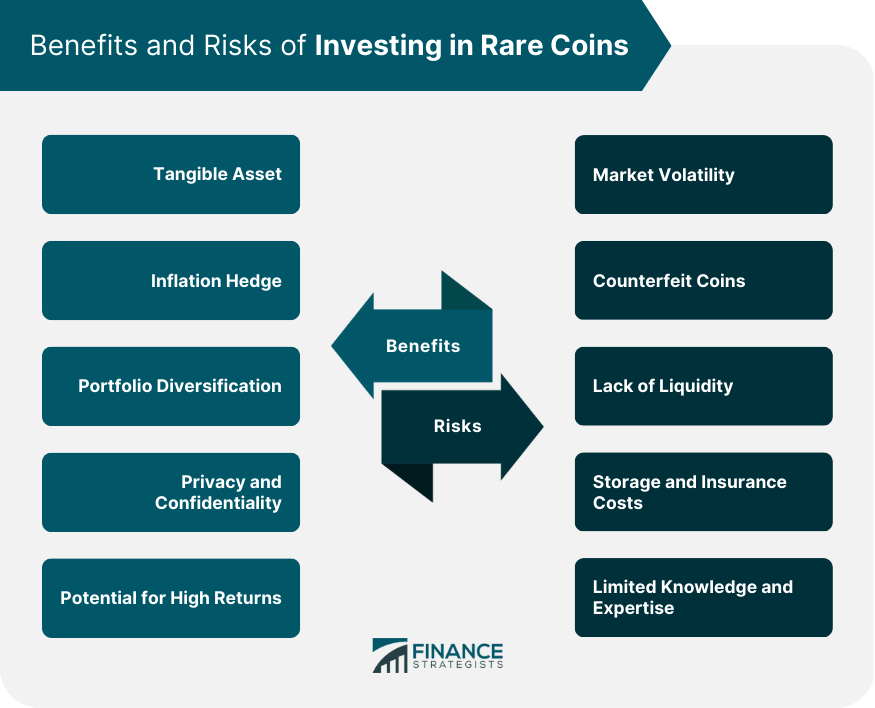

Benefits of Rare Coin Investments

Tangible Asset

Inflation Hedge

Portfolio Diversification

Privacy and Confidentiality

Potential for High Returns

Risks of Rare Coin Investments

Market Volatility

Counterfeit Coins

Lack of Liquidity

Storage and Insurance Costs

Limited Knowledge and Expertise

Strategies for Investing in Rare Coins

Building a Balanced Portfolio

Research and Education

Establishing a Relationship With Reputable Dealers

Coin Grading and Certification

Long-Term Investment Approach

Legal and Tax Considerations of Rare Coin Investments

Tax Implications of Rare Coin Investments

Regulations and Restrictions

Record Keeping and Documentation

Conclusion

Rare Coins Investments FAQs

The main benefits of rare coins investments include portfolio diversification, the potential for high returns, a hedge against inflation, tangible assets, and privacy and confidentiality.

The risks associated with rare coin investments include market volatility, counterfeit coins, lack of liquidity, storage and insurance costs, and limited knowledge and expertise.

To ensure the authenticity of their rare coin investments, investors should work with reputable dealers, and have their coins graded and certified by trusted grading services such as the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC).

Investors should consider including a mix of ancient, medieval, and modern coins, such as Greek, Roman, Chinese, gold, silver, commemorative, and error coins, in their rare coins investments portfolio for diversification.

Legal and tax considerations for rare coins investments include understanding the tax implications of capital gains, complying with regulations and restrictions related to the purchase, sale, and transport of rare coins, and maintaining accurate records and documentation for tax reporting and insurance purposes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.