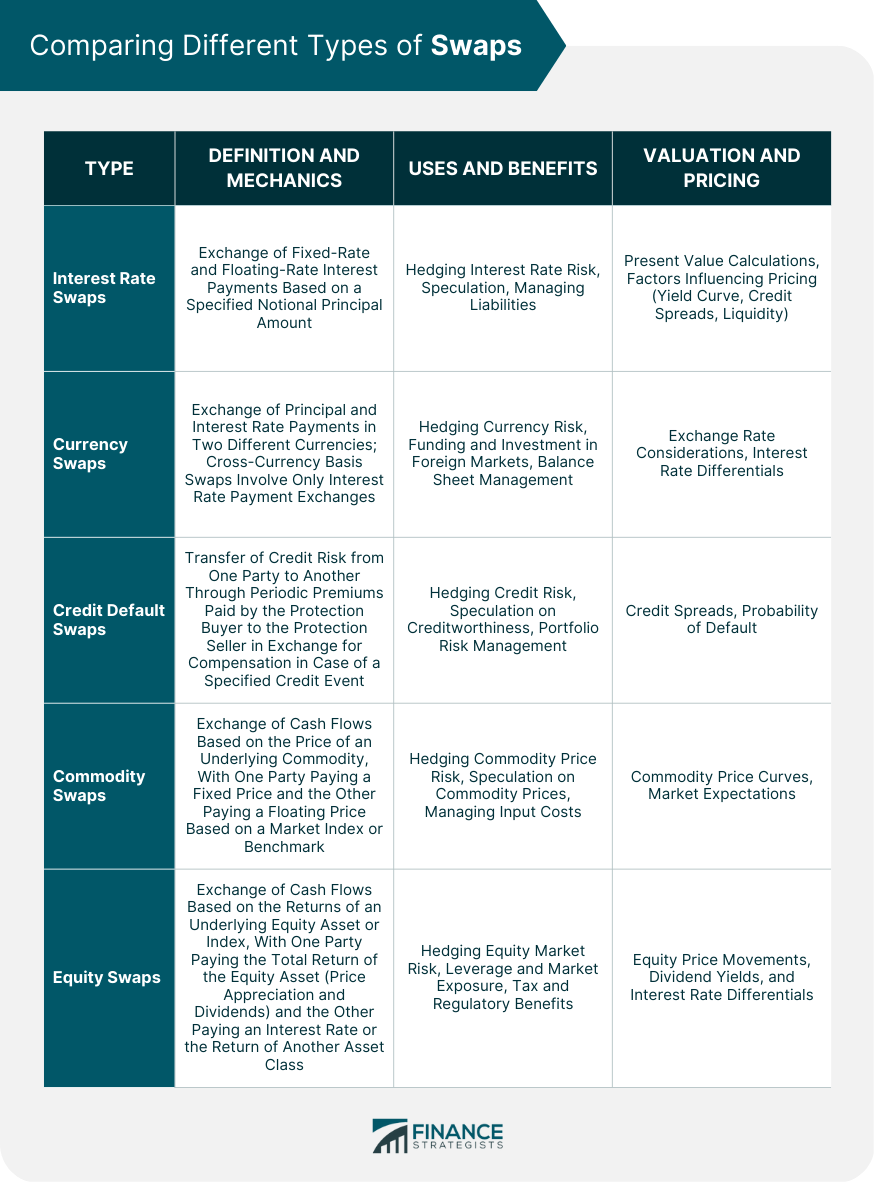

A swap is a financial derivative contract that involves the exchange of cash flows between two parties, based on a specified notional principal amount. Swaps allow parties to manage risks, such as interest rate, currency, and credit risks, or to speculate on market movements. Swaps play a significant role in modern financial markets, providing a versatile tool for risk management, speculation, and optimizing investment strategies. They also facilitate the flow of capital and help maintain market efficiency. There are several types of swaps, including interest rate swaps, currency swaps, credit default swaps, commodity swaps, and equity swaps. Each type serves a unique purpose and caters to different market participants. An interest rate swap is a financial derivative contract between two parties that agree to exchange interest payments based on a specified notional principal amount. The fixed-rate payer is the party that pays a fixed interest rate on the notional principal amount. The floating-rate payer is the counterparty that pays a floating interest rate based on a benchmark, such as the London Interbank Offered Rate (LIBOR) or the Secure Overnight Financing Rate (SOFR), on the same notional principal amount. Interest rate swaps are used to hedge interest rate risk, as they allow parties to lock in a fixed interest rate or obtain exposure to a floating interest rate, depending on their needs. Market participants can use interest rate swaps to speculate on future interest rate movements, with the expectation of profiting from changes in interest rates. Companies and financial institutions can use interest rate swaps to manage their liabilities, such as converting fixed-rate debt to floating-rate debt or vice versa. Valuation and Pricing The valuation of interest rate swaps is based on the present value of the expected cash flows exchanged between the parties. This involves discounting future cash flows using the appropriate discount rates. Factors that influence the pricing of interest rate swaps include the yield curve, credit spreads, and liquidity conditions in the market. A currency swap involves the exchange of principal and interest rate payments in two different currencies between counterparties. The principal amounts are exchanged at the inception and termination of the swap at predetermined exchange rates. Cross-currency basis swaps are a type of currency swap where only the interest rate payments are exchanged, and the principal amounts remain unchanged. Currency swaps are used to hedge currency risk by allowing parties to manage their exposure to foreign exchange rate fluctuations. Companies and financial institutions can use currency swaps to obtain funding or invest in foreign markets while mitigating the risk of currency fluctuations. Currency swaps can help organizations manage their balance sheets by matching assets and liabilities in different currencies. The valuation of currency swaps considers exchange rate fluctuations, which affect the present value of future cash flows in different currencies. Currency swap pricing also takes into account interest rate differentials between the two currencies involved, as these affect the relative value of the cash flows being exchanged. A credit default swap (CDS) is a financial derivative contract that transfers credit risk from one party to another. The protection buyer pays periodic premiums to the protection seller in exchange for compensation if a specified credit event, such as default or restructuring, occurs. Upon the occurrence of a credit event, the protection seller compensates the protection buyer, either by paying the difference between the bond's face value and the post-default market value or by taking possession of the defaulted bond in exchange for the face value. CDSs are used to hedge credit risk by allowing parties to transfer the risk of default or credit deterioration to another counterparty. Market participants can use CDSs to speculate on the creditworthiness of an issuer, profiting from the changes in credit spreads. Institutional investors can use CDSs to manage the credit risk of their bond portfolios, diversifying credit exposure and reducing the impact of defaults. CDS pricing is primarily based on credit spreads, which reflect the market's perception of an issuer's credit risk. Wider spreads indicate a higher risk of default, while narrower spreads suggest a lower risk. The pricing of CDSs also considers the probability of default, which is derived from factors such as the issuer's financial health, industry trends, and economic conditions. A commodity swap is a financial derivative contract in which two parties agree to exchange cash flows based on the price of an underlying commodity. The fixed-price payer agrees to pay a fixed price for the commodity, while the floating-price payer pays a floating price based on a market index or benchmark. The floating-price payer benefits from price fluctuations in the commodity market, while the fixed-price payer seeks to hedge against such fluctuations. Commodity swaps are used to hedge commodity price risk by allowing producers and consumers to lock in prices for future transactions, reducing their exposure to price volatility. Market participants can use commodity swaps to speculate on commodity price movements, profiting from changes in market prices. Companies can use commodity swaps to manage input costs by securing a fixed price for the raw materials required for their production processes. The valuation of commodity swaps is based on the commodity price curve, which represents the market's expectations of future prices for a specific commodity. Commodity swap pricing considers factors such as supply and demand, inventory levels, geopolitical events, and macroeconomic trends that influence market expectations of future commodity prices. An equity swap is a financial derivative contract in which two parties agree to exchange cash flows based on the returns of an underlying equity asset or index. The equity return payer agrees to pay the total return of the underlying equity asset, including price appreciation and dividends. The interest rate or other asset return payer agrees to pay a floating or fixed interest rate, or the return of another asset class, such as a bond index or commodity index, on the same notional principal amount. Equity swaps are used to hedge equity market risk by allowing parties to reduce or increase their exposure to specific equity assets or market indices without buying or selling the underlying securities. Investors can use equity swaps to obtain leveraged exposure to equity markets, enabling them to benefit from market movements with a smaller upfront capital commitment. Equity swaps can offer tax and regulatory benefits by allowing parties to manage their equity exposure without triggering taxable events or regulatory restrictions associated with direct ownership of the underlying assets. The valuation of equity swaps is influenced by the underlying equity asset's price movements, which determine the cash flows exchanged between the parties. Equity swap pricing also considers factors such as dividend yields and interest rate differentials, which affect the relative value of the cash flows being exchanged. Banks and financial institutions are key players in the swap market, acting as market makers and intermediaries to facilitate transactions between counterparties. Corporations use swaps to manage their financial risks, such as interest rate, currency, and commodity price risks, as well as to optimize their balance sheets and capital structures. Institutional investors, such as pension funds and asset managers, use swaps to manage portfolio risk, diversify their investments, and gain exposure to specific asset classes. Hedge funds utilize swaps as part of their trading strategies to hedge risks, speculate on market movements, and exploit arbitrage opportunities. Although swaps are primarily used by institutional market participants, some retail investors also use swaps to gain exposure to specific asset classes or hedge their investment risks. Counterparty risk refers to the risk that one party in a swap agreement will default on its obligations, resulting in a loss for the other party. Market risk arises from changes in market variables, such as interest rates, exchange rates, and asset prices, which can affect the value of a swap contract. Liquidity risk is the risk that a party may not be able to unwind or exit a swap position at a reasonable price due to insufficient market liquidity. Operational risk includes risks related to errors, fraud, system failures, and other operational issues that can disrupt the execution and settlement of swap transactions. Regulatory bodies, such as the U.S. Commodity Futures Trading Commission (CFTC) and the European Securities and Markets Authority (ESMA), oversee and regulate the swap market to ensure transparency, financial stability, and investor protection. Swap Execution Facilities (SEFs) Central counterparties (CCPs) act as intermediaries in swap transactions, reducing counterparty risk by standing between the buyer and seller and guaranteeing the performance of the swap contract. Swaps are an integral part of modern finance, providing a versatile tool for risk management, speculation, and the optimization of investment strategies. They facilitate the flow of capital, support market efficiency, and enable market participants to better manage their financial risks and exposures. The swap market is constantly evolving, driven by changing market dynamics, regulatory reforms, and the introduction of new financial instruments and trading technologies. As the global economy becomes more interconnected and complex, the importance of swaps in managing risks and enhancing market efficiency is likely to grow, making them an essential component of the financial landscape. Consult a qualified financial advisor or wealth management professional for additional information and guidance on swaps. These experts can help investors understand swaps and how these derivative contracts can help them achieve their financial goals.What Are Swaps?

Interest Rate Swaps

Definition and Mechanics

Fixed-Rate Payer

Floating-Rate Payer

Uses and Benefits

Hedging Interest Rate Risk

Speculation

Managing Liabilities

Present Value Calculations

Factors Influencing Pricing

Currency Swaps

Definition and Mechanics

Principal and Interest Rate Exchanges

Cross-Currency Basis Swaps

Uses and Benefits

Hedging Currency Risk

Funding and Investment in Foreign Markets

Balance Sheet Management

Valuation and Pricing

Exchange Rate Considerations

Interest Rate Differentials

Credit Default Swaps (CDS)

Definition and Mechanics

Protection Buyer and Protection Seller

Credit Events and Settlements

Uses and Benefits

Hedging Credit Risk

Speculation on Creditworthiness

Portfolio Risk Management

Valuation and Pricing

Credit Spreads

Probability of Default

Commodity Swaps

Definition and Mechanics

Fixed-Price Payer

Floating-Price Payer

Uses and Benefits

Hedging Commodity Price Risk

Speculation on Commodity Prices

Managing Input Costs

Valuation and Pricing

Commodity Price Curves

Market Expectations

Equity Swaps

Definition and Mechanics

Equity Return Payer

Interest Rate or Other Asset Return Payer

Uses and Benefits

Hedging Equity Market Risk

Leverage and Market Exposure

Tax and Regulatory Benefits

Valuation and Pricing

Equity Price Movements

Dividend Yields and Interest Rate Differentials

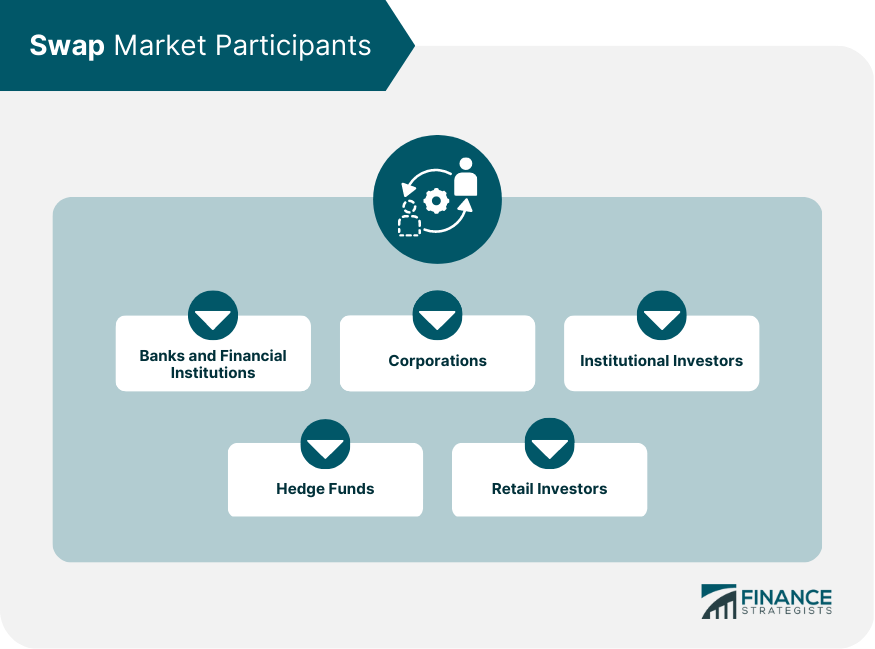

Swap Market Participants

Banks and Financial Institutions

Corporations

Institutional Investors

Hedge Funds

Retail Investors

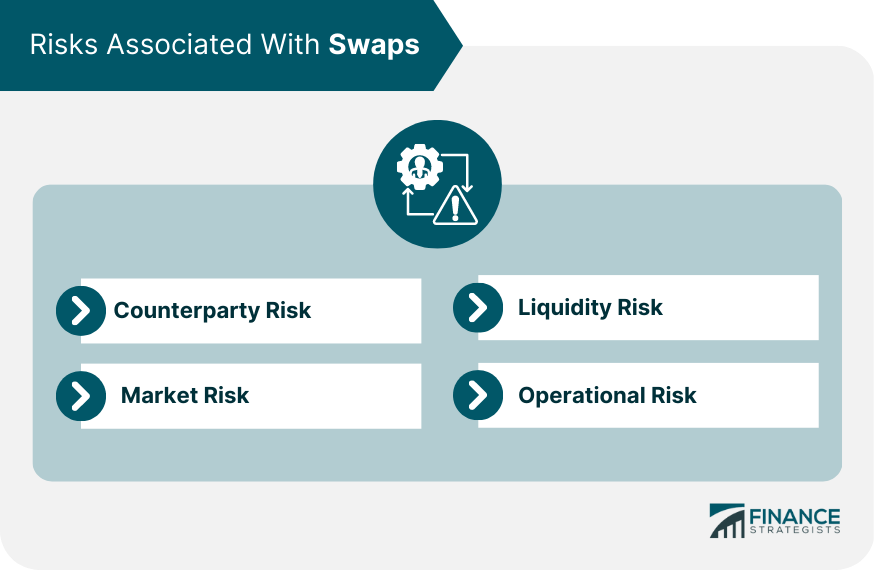

Risks Associated with Swaps

Counterparty Risk

Market Risk

Liquidity Risk

Operational Risk

Regulation and Oversight

Regulatory Bodies

Swap execution facilities (SEFs) are trading platforms that facilitate the execution and negotiation of swap transactions, providing greater transparency and price discovery for market participants.Central Counterparties (CCPs)

Final Thoughts

Swaps FAQs

The primary types of swaps include interest rate swaps, currency swaps, credit default swaps, commodity swaps, and equity swaps. Each type serves a unique purpose and caters to different market participants, allowing them to manage risks or speculate on market movements.

Swaps help manage risk by allowing parties to transfer or hedge various risks, such as interest rate, currency, credit, commodity price, or equity market risks. By exchanging cash flows based on specified notional principal amounts, swaps enable market participants to reduce their exposure to unfavorable market movements and better manage their financial risks.

Swap pricing is influenced by various factors, depending on the type of swap. Some common factors include yield curves, credit spreads, liquidity conditions, exchange rates, interest rate differentials, market expectations of future asset prices, and the probability of default. These factors determine the present value of the expected cash flows exchanged between the parties.

The main participants in the swaps market include banks and financial institutions, corporations, institutional investors, hedge funds, and, to a lesser extent, retail investors. These market participants use swaps to manage their financial risks, optimize their investment strategies, and exploit arbitrage opportunities.

The key risks associated with swaps include counterparty risk, market risk, liquidity risk, and operational risk. Regulatory bodies, such as the U.S. Commodity Futures Trading Commission (CFTC) and the European Securities and Markets Authority (ESMA), oversee and regulate the swaps market to ensure transparency, financial stability, and investor protection. Swap execution facilities (SEFs) and central counterparties (CCPs) also play critical roles in mitigating risks and enhancing market efficiency.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.