Put-call parity is a principle of derivatives pricing that says the premium an investor receives for a call option should equal a similar put option. It focuses on European options, which can only be exercised at expiry. Put-call parity states that the price of a put and a call with the same strike and expiration must have the same implied volatility. Put-call parity is a useful formula for pricing options because it allows you to price an option by looking at the prices of other related options. Understanding this principle can help you make better investment decisions and makes practicing sound risk management a little easier. Put-call parity is the most basic option pricing model because it allows you to calculate the value of a call or put by computing the value of a related option. It says that a stock option should be worth at least as much as its corresponding position in the underlying security. Put-call parity is also a method to assess the market for pricing discrepancies. Put-call parity explains that traders aren't willing to risk their capital unless there is sufficient compensation, making it much easier to manage your portfolio. Put-call parity says that if you buy a call option on a stock then sell a put option on that same stock, the premium received from buying the call must be equal to the premium paid for the shot put. Put-call parity says that there should also be equality between premiums and strikes when you write an option in your portfolio and buy its related option. The figure below shows how to calculate P/C parity. The equation that expresses put-call parity is: Put-call parity is the most important tool in your derivatives pricing toolbox because it allows you to compare options across strikes, tenors, and issuers. The greatest advantage of put-call parity is that it's a great tool for risk management. It also makes it easier to compare the prices of different options written on the same security because you can calculate them in terms of their intrinsic value, which is simply the difference between the strike and the current price. However, Put-Call parity does have some drawbacks. Put-call parity typically only works near the money and when trading options on individual stocks. Put-call parity also doesn't work as well without money options. Put-Call Parity is a major tool in derivatives pricing because it tells you the combined premium of Put and Call options for a security trading at or around strike price. In addition to its uses as a risk management tool, Put-Call parity can help you better diversify your portfolio by limiting which companies or sectors you invest in. It also aids you in identifying opportunities when Put-Call parity shows Put option prices are too expensive and helps identify overpriced securities. Importance of Put-Call Parity

How Put-Call Parity Works

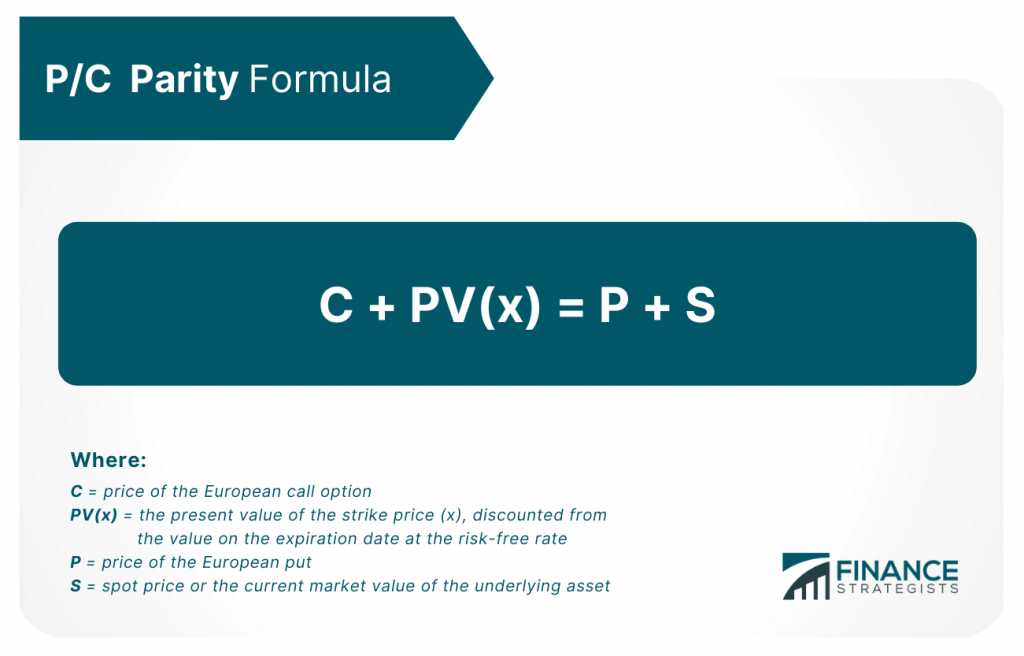

The Formula for P/C Parity

Benefits and Drawbacks of P/C Parity

Why It’s Important to Understand Put-Call Parity

The Bottom Line

Put-Call Parity FAQs

Put Call Parity is defined as the equality between Put and Call prices, or equivalently, Put/Call=Stock price. Put-call parity allows investors to calculate the intrinsic value of their option based on the intrinsic value of its related security.

Put-Call Parity is a major tool in derivatives pricing because it tells you the combined premium of Put and Call options for a security trading at or around strike price.

The formula for P/C parity is: C + PV(x) = S + PN(x)

Put-Call Parity relates to the principle that in rational and efficient markets, the price of a put option should always be equal to the price of a call option plus the present value of the strike price. This means that if an investor has a call option and a puts option with identical underlying assets, strike prices and expiration dates, it is impossible for one to be more valuable than the other.

While Put-Call Parity is a useful tool for hedging and arbitrage trading, there is always a possibility of mispricing and losses if the market moves in an unexpected direction. Investors should be aware of these risks before trading with Put-Call Parity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.