Unconventional retirement investments are non-traditional investment vehicles that investors use to grow their retirement savings. These can include real estate investments, precious metals and commodities, and business ownership. While these investments may offer the potential for higher returns, they also come with greater risks and less regulation than traditional retirement accounts. Diversifying retirement investments is an important strategy for managing risk and maximizing returns. By investing in a mix of assets, investors can reduce their exposure to any one asset class and potentially benefit from the strengths of others. Unconventional retirement investments can provide a way to diversify beyond traditional stocks and bonds. Real estate investments are a popular choice for unconventional retirement investments. They can offer the potential for passive income and long-term capital appreciation. Some ways to invest in real estate for retirement include: Investors can purchase a property and earn income from rent payments, which can provide a stable source of passive income over time. However, managing rental properties requires significant capital and time, including finding tenants, collecting rent, and maintaining the property. Investors should also be prepared to handle potential legal and financial issues that may arise with tenants. Real Estate Investment Trusts (REITs) are companies that own and operate real estate properties, such as office buildings, shopping malls, and apartment complexes. Investors can buy shares in these companies and earn dividends from the rental income. This option allows investors to invest in real estate without the hassle of managing properties, and it can be a more liquid investment than owning rental properties directly. Crowdfunding platforms allow investors to pool their money to invest in real estate properties. This can be a way to invest in real estate with less capital and without the hassle of managing properties. Investors should, however, do their due diligence when considering crowdfunding platforms, as there is often less regulation and oversight than traditional investments. Investing in precious metals and commodities can be another way to diversify retirement investments. Gold and silver have a long history of being considered safe investments during times of economic turmoil, political unrest, and currency devaluation. Investors can choose to invest in physical metals such as coins or bullion, or they can invest in exchange-traded funds (ETFs) that track the prices of these metals. Investing in ETFs can be a convenient and cost-effective way to gain exposure to precious metals without the hassle of storing and insuring physical metals. Cryptocurrencies like Bitcoin and Ethereum have gained popularity as an investment vehicle in recent years. While cryptocurrencies are highly volatile and risky, they can offer the potential for significant returns. Investors can purchase cryptocurrencies on exchanges, hold them in digital wallets, and trade them like traditional stocks or currencies. Cryptocurrencies are not regulated like traditional investments and can be subject to significant market fluctuations and fraud. Investors should be aware of the risks associated with cryptocurrencies and carefully assess their investment goals and risk tolerance before investing in this asset class. Investing in private businesses can be a way to earn higher returns than traditional stocks and bonds potentially. Private equity investments involve buying shares in private companies that are not publicly traded. These investments can offer high returns but are typically only available to accredited investors with significant capital. Angel investing involves investing in early-stage startups that are not yet publicly traded. This can be a way to potentially earn high returns by identifying promising companies early on. While unconventional retirement investments can offer the potential for higher returns, they also come with greater risks than traditional retirement accounts. Some risks to consider include: Many unconventional investments are not easily sold or traded, which can make it difficult for investors to access their funds in an emergency. For example, investments in rental properties may take time to sell and may not be in high demand during a down market. Investing in assets such as real estate, commodities, and private businesses can be highly volatile and may result in significant losses. For example, investing in a startup company that ultimately fails can result in a complete loss of the invested capital. Unconventional retirement investments are often subject to less regulation and oversight than traditional retirement accounts. This can make it easier for scams and fraudulent schemes to flourish, putting investors at risk. For example, investing in a crowdfunding platform without proper due diligence can result in a scam that leaves investors with no recourse. Despite the risks, there are also potential benefits to investing in unconventional retirement vehicles. Unconventional retirement investments can offer the potential for higher returns than traditional investments such as stocks and bonds. For example, investing in a rental property can provide investors with passive income through rent payments and the potential for long-term capital appreciation. By investing in assets beyond traditional stocks and bonds, investors can spread their risk across a broader range of asset classes. This can potentially reduce the portfolio's overall risk and improve long-term returns. For example, investing in real estate can provide a diversification benefit to a heavily invested portfolio in stocks and bonds. Investing in some unconventional assets, such as precious metals and commodities, can also serve as a hedge against inflation and a safe haven during economic uncertainty. When the value of traditional investments such as stocks and bonds decline during times of economic uncertainty, precious metals and commodities can often maintain or even increase their value. For example, investing in gold and silver can provide a safe haven investment that can help protect investors' portfolios during economic volatility. When considering unconventional retirement investments, there are several factors to keep in mind. When choosing unconventional retirement investments, investors should consider their investment goals and time horizon. Some assets, such as rental properties, may be better suited for long-term investment horizons, while others, such as cryptocurrencies, may be better suited for shorter-term speculation. Investors should also consider their risk tolerance when choosing unconventional retirement investments. Some assets, such as private equity and angel investing, can be highly volatile and may only be suitable for some investors. Many unconventional retirement investments require significant capital to invest. Investors should consider their available funds and whether they can afford the risks associated with these investments. Investors should also consider their level of knowledge and expertise in the asset class they are considering investing in. Investing in real estate, for example, requires a deep understanding of the local market and the ability to manage properties effectively. Unconventional retirement investments are non-traditional investment vehicles that investors use to grow their retirement savings. To navigate the world of unconventional investments and create a comprehensive retirement plan, it is highly recommended that you seek the guidance of a wealth management professional. A financial advisor can also provide you with valuable insights and help you make informed decisions to secure your financial future. What Are Unconventional Retirement Investments?

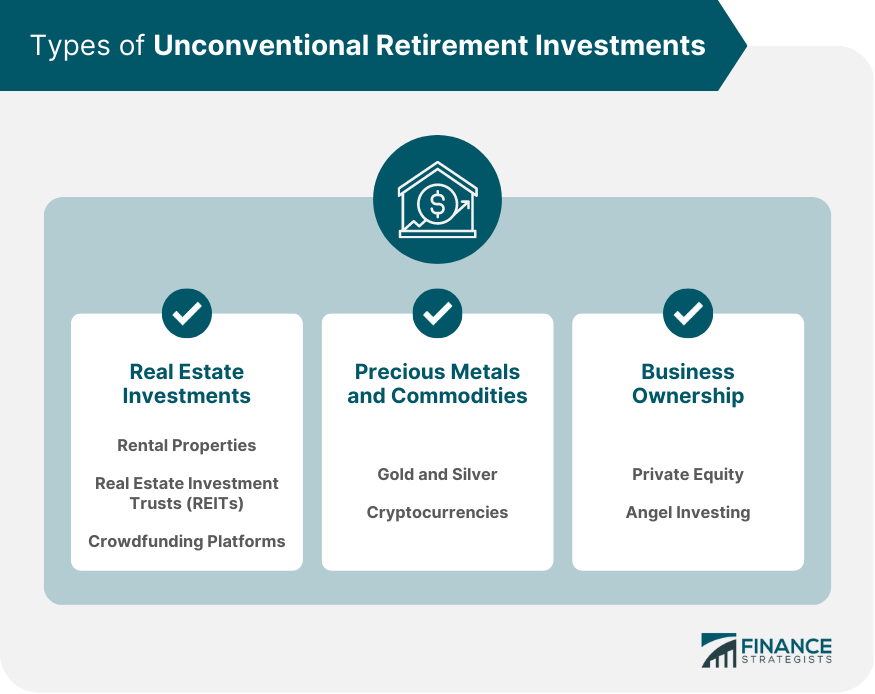

Types of Unconventional Retirement Investments

Real Estate Investments

Rental Properties

Real Estate Investment Trusts (REITs)

Crowdfunding Platforms

Precious Metals and Commodities

Gold and Silver

Cryptocurrencies

Business Ownership

Private Equity

Angel Investing

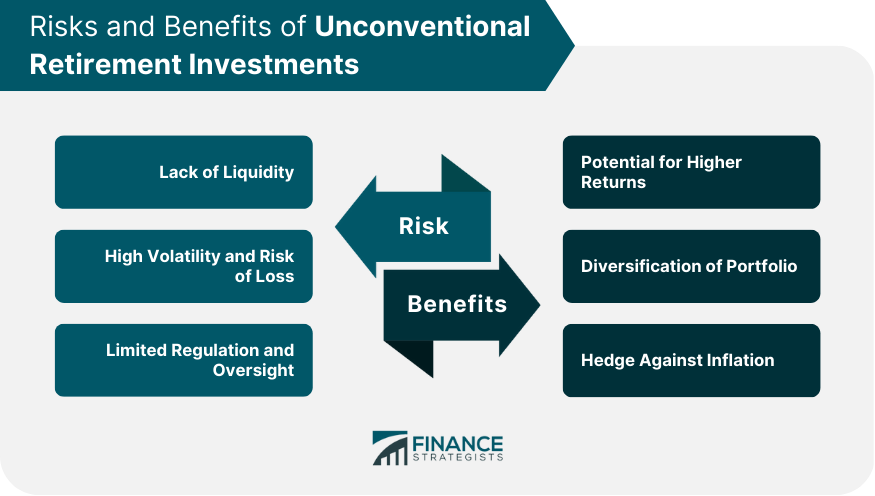

Risks and Benefits of Unconventional Retirement Investments

Risks

Lack of Liquidity

High Volatility and Risk of Loss

Limited Regulation and Oversight

Benefits

Potential for Higher Returns

Diversification of Portfolio

Hedge Against Inflation

Factors to Consider When Choosing Unconventional Retirement Investments

Investment Goals and Time Horizon

Risk Tolerance

Investment Amount

Investment Knowledge and Expertise

The Bottom Line

Real estate investments, precious metals and commodities, and business ownership are popular choices for unconventional retirement investments, but they come with greater risks and less regulation than traditional retirement accounts.

Diversifying retirement investments is an important strategy for managing risk and maximizing returns.

Unconventional retirement investments can provide a way to diversify beyond traditional stocks and bonds, potentially offering higher returns, diversification benefits, and a hedge against inflation.

Unconventional retirement investments can be a great way to diversify your portfolio, potentially earn higher returns, and hedge against inflation. However, these investments also come with greater risks and require careful consideration and expertise.

Unconventional Retirement Investments FAQs

Unconventional retirement investments are non-traditional investment vehicles that investors use to grow their retirement savings. These can include real estate investments, precious metals and commodities, and business ownership.

Unconventional retirement investments come with greater risks than traditional retirement accounts, including lack of liquidity, high volatility, and limited regulation and oversight.

Unconventional retirement investments can offer the potential for higher returns, diversification of portfolios, and a hedge against inflation.

When choosing unconventional retirement investments, consider your investment goals, risk tolerance, investment amount, and level of knowledge and expertise in the asset class you are considering.

While having a financial advisor to invest in unconventional retirement assets is not required, it is highly recommended. A financial advisor can provide valuable guidance in navigating the world of unconventional investments and creating a comprehensive retirement plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.