The United States Natural Gas Fund is an exchange-traded fund (ETF) that tracks the price movements of natural gas. The fund aims to expose investors to the daily changes in the price of natural gas futures contracts. This allows investors to participate in the natural gas market without needing a futures account. UNG is managed by United States Commodity Funds LLC (USCF), a commodity pool operator registered with the Commodity Futures Trading Commission (CFTC). USCF employs a team of professionals with extensive experience in managing commodity-focused investment products. Investing in UNG offers several benefits, including exposure to natural gas price movements, the convenience of an ETF structure, and the potential for portfolio diversification. Unlike investing directly in natural gas futures, UNG does not require a futures trading account, making it accessible to a broader range of investors. As an ETF, UNG trades on a stock exchange like individual stocks. It allows investors to buy and sell shares during normal trading hours. The fund's net asset value (NAV) is calculated at the end of each trading day based on the closing prices of its futures contracts. Investors can trade UNG shares through any brokerage account. The shares are bought and sold at market prices, which can differ from the fund's NAV. The fund issues and redeems shares in large blocks known as "creation units" to and from authorized participants, usually large financial institutions. The price of UNG shares is determined by supply and demand dynamics in the market. However, it's closely tied to the value of its underlying assets – natural gas futures contracts. The fund's NAV represents its total assets minus liabilities per share value. Futures contracts are agreements to buy or sell a specific amount of a commodity, in this case, natural gas, at a predetermined price on a set date in the future. Producers and consumers of the commodity use them to hedge against price changes and by speculators for potential profit. UNG primarily invests in near-month natural gas futures contracts traded on the New York Mercantile Exchange (NYMEX). The fund's performance aims to reflect the changes in the price of these contracts. While investing in futures contracts offers the potential for significant returns if natural gas prices rise, it also carries high risks. The prices of futures contracts can be highly volatile, and investors can lose a substantial amount if prices move against their position. The key performance indicators for UNG include its total return, the performance of its underlying index, and the changes in the price of natural gas futures contracts. Since its inception, UNG's performance has varied widely due to the volatility of natural gas prices. Investors should review the fund's historical returns when considering an investment in UNG. UNG's performance is often compared to the Bloomberg Natural Gas Subindex, a benchmark that reflects the potential return of natural gas futures contracts. This comparison can provide insight into the fund's relative performance. Commodities, including natural gas, are considered a distinct asset class that can provide diversification benefits. They have unique performance characteristics and can offer a hedge against inflation. As represented by UNG, natural gas often exhibits a low correlation with traditional asset classes such as stocks and bonds. This means that natural gas can perform well when other investments are struggling, providing potential portfolio diversification benefits. An investor can improve the portfolio's risk-return trade-off by adding UNG to a portfolio. However, given the volatility of natural gas prices, UNG should be used as part of a balanced and diversified portfolio. UNG is exposed to the risk that the price of natural gas will fall. This could be due to factors such as changes in supply and demand, weather conditions, and geopolitical events. There is also a risk that UNG shares could become difficult to trade. This could happen if the market for the shares becomes illiquid or if the underlying futures contracts are disrupted. UNG operates under various regulatory frameworks, including those of the U.S. Securities and Exchange Commission (SEC) and the CFTC. Changes in these regulations could impact the fund's operations and performance. The price of natural gas, and therefore the performance of UNG, is heavily influenced by supply and demand dynamics. Factors such as the level of natural gas production, the availability of storage capacity, and the demand for natural gas for heating and electricity generation can all impact prices. Weather conditions can significantly impact the demand for natural gas, particularly in the U.S. Winters that are colder than average can increase the demand for natural gas for heating. In contrast, hotter-than-average summers can increase the demand for natural gas for electricity generation. Geopolitical events can also affect the natural gas market. For example, conflicts or political instability in regions that are major natural gas producers can disrupt supply and cause prices to fluctuate. As an ETF, UNG is subject to the regulations of the SEC. This includes rules related to the disclosure of information, the management of the fund, and the trading of the fund's shares. As a fund that invests in futures contracts, UNG is also subject to the regulations of the CFTC. These regulations cover areas such as trading futures contracts, managing the fund's assets, and reporting requirements. UNG must also comply with other laws and regulations, including those related to anti-money laundering and tax. Compliance with these rules is critical for the fund's continued operation. UNG is an ETF that provides exposure to natural gas prices through investment in futures contracts. It offers potential benefits such as portfolio diversification and the possibility of high returns. However, it also carries significant risks, including market, liquidity, and regulatory risks. It allows investors to gain exposure to the natural gas market without the need to trade futures contracts directly. The fund's performance is closely tied to the price of natural gas, making it a potentially profitable investment when natural gas prices rise. However, it also carries risks, including the volatility of natural gas prices and potential regulatory changes. Investing in commodities like natural gas can be a part of a balanced investment strategy. If you're considering adding UNG to your portfolio, it's essential to understand your risk tolerance and investment objectives. A professional wealth manager can provide personalized advice based on your individual circumstances.What Is the United States Natural Gas Fund (UNG)?

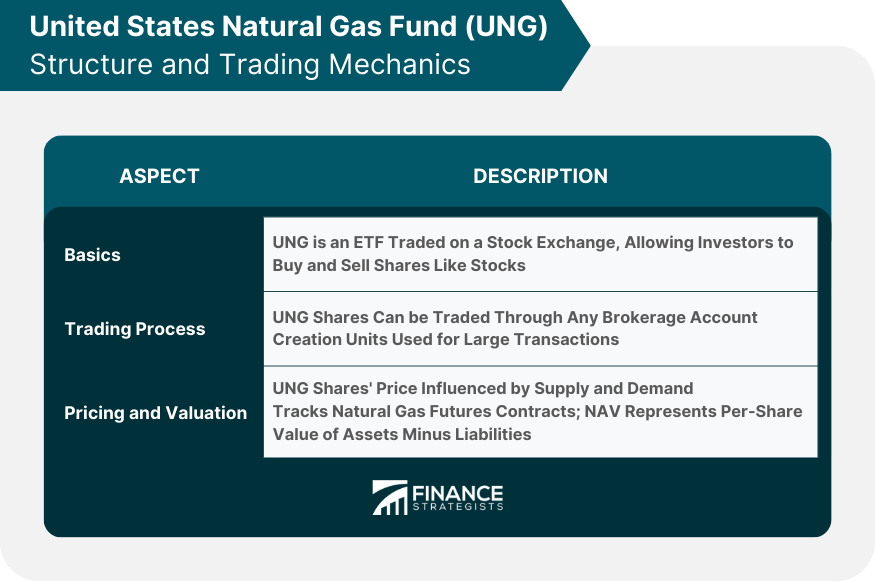

UNG Structure and Trading Mechanics

Basics

Trading Process

Pricing and Valuation

UNG's Investment in Natural Gas Futures Contracts

Concept of Futures Contracts

Role in the Fund's Portfolio

Risks and Benefits

Performance History of UNG

Key Performance Indicators

Historical Returns

Benchmark Comparison

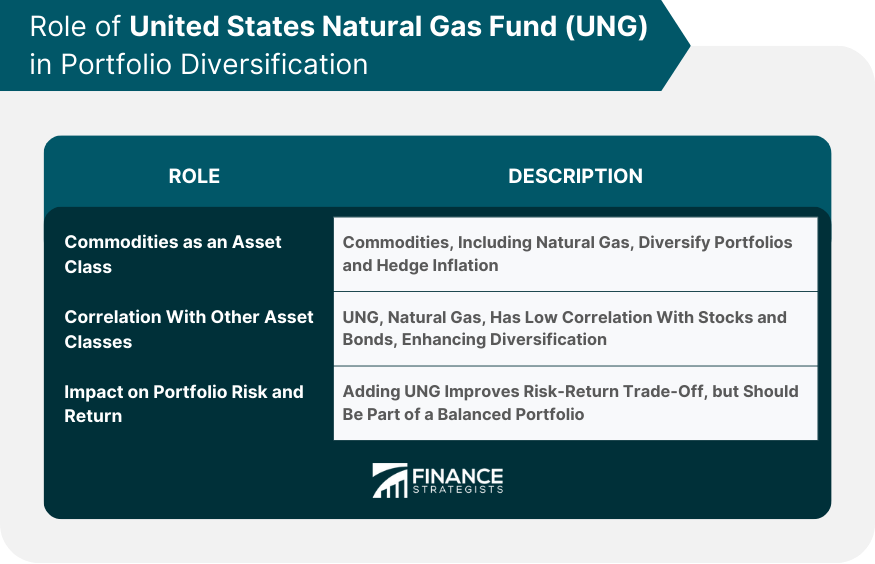

Role of UNG in Portfolio Diversification

Commodities as an Asset Class

Correlation With Other Asset Classes

Impact on Portfolio Risk and Return

Risks Associated With Investing in UNG

Market Risk

Liquidity Risk

Regulatory Risk

UNG and the Natural Gas Market

Influence of Supply and Demand

Impact of Weather Conditions

Geopolitical Factors

Regulatory Framework for UNG

US Securities and Exchange Commission (SEC) Oversight

Commodity Futures Trading Commission (CFTC) Regulations

Other Relevant Laws and Regulations

Conclusion

United States Natural Gas Fund (UNG) FAQs

UNG is an exchange-traded fund (ETF) that seeks to track natural gas price movements. It does this by investing in natural gas futures contracts.

UNG invests primarily in near-month natural gas futures contracts traded on the New York Mercantile Exchange (NYMEX). The fund's performance aims to reflect the changes in the price of these contracts.

Investing in UNG provides exposure to the natural gas market without the need for a futures account. It also offers potential portfolio diversification benefits.

Investing in UNG carries several risks, including the volatility of natural gas prices, potential liquidity issues, and regulatory changes that could impact the fund's operations.

UNG can be used as part of a diversified portfolio to provide exposure to the commodities sector. However, given the volatility of natural gas prices, it should be used in a balanced portfolio context and based on an investor's risk tolerance and investment objectives.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.