A Venture Capital Trust (VCT) is a type of publicly listed, closed-end investment vehicle in the United Kingdom, created to encourage individual investors to invest in early-stage, high-growth companies. VCTs are structured as companies that pool investors' funds and deploy the capital into a diversified portfolio of private, unlisted businesses with strong growth potential. By investing in VCTs, individual investors can access the high return potential of venture capital while benefiting from tax incentives offered by the UK government. VCTs play a crucial role in the financial industry by providing much-needed funding to early-stage businesses that may struggle to access traditional financing options. Through VCTs, these companies can secure the capital necessary to develop and expand their operations, driving innovation and economic growth. Additionally, VCTs offer investors a means to participate in the high-risk, high-reward world of venture capital, which is often limited to institutional investors and high net worth individuals. Venture Capital Trusts can be broadly classified into different categories based on their investment focus, strategy, and stage of the investee companies. Generalist VCTs invest in a diversified portfolio of early-stage companies across various sectors and industries. These VCTs do not limit their investments to a specific industry or sector, providing investors with a broad exposure to multiple areas of the market. This diversification can help mitigate risks associated with investing in a single sector, as the VCT's portfolio performance is less dependent on the success of any particular industry. Specialist VCTs focus on investments in specific sectors or industries, such as technology, healthcare, or renewable energy. By concentrating their investments in a particular area, specialist VCTs aim to capitalize on their expertise and knowledge in that sector. This focused approach can potentially lead to higher returns if the chosen sector experiences significant growth. However, it also increases the risk associated with the VCT, as its performance is more closely tied to the success or failure of a single industry. Early-stage VCTs primarily invest in companies at the seed or start-up phase, offering investors exposure to businesses with high growth potential. These VCTs often focus on innovative companies with disruptive products or services that have the potential to transform their respective markets. While early-stage VCTs can offer higher return potential due to the rapid growth of investee companies, they also carry a higher level of risk, as many early-stage businesses may fail to achieve their growth objectives or become profitable. Later-stage VCTs invest in companies that are more established and further along in their growth trajectory. These VCTs target businesses with a proven track record, existing revenue streams, and a more stable financial position. While later-stage VCTs may offer lower return potential compared to early-stage VCTs, they typically involve lower risks, as the investee companies have a more established business model and are less likely to fail. Investing in VCTs offers the potential for high returns, as early-stage companies can experience rapid growth and significant increases in valuation. By investing in a diversified portfolio of such companies, VCTs can provide investors with exposure to the upside potential of the venture capital asset class. VCTs provide investors with a means of diversifying their investment portfolios by offering exposure to a different asset class and a range of companies at various stages of development. This diversification can help to spread risk and potentially enhance overall portfolio performance. VCTs are managed by experienced investment professionals who possess the skills and expertise necessary to identify promising early-stage companies and provide ongoing support and guidance. This professional management can be a significant advantage for individual investors who may lack the time or knowledge to evaluate and manage such investments themselves. Despite being invested in private, unlisted companies, VCT shares are listed and traded on public stock exchanges, offering a degree of liquidity to investors. This allows investors to buy and sell VCT shares more easily than if they were to invest directly in private companies. However, it is important to note that liquidity can still be limited compared to more traditional investment vehicles, and the market for VCT shares may not always be as active. Although VCT shares are publicly listed, the market for these shares can be less liquid than for other types of publicly traded securities. This illiquidity can make it more difficult for investors to sell their VCT shares at a desired price or in a timely manner, particularly during periods of market volatility. Many early-stage companies in which VCTs invest have a limited operating history and may lack a proven track record of success. This makes it more challenging for investors to evaluate the potential performance of these companies and increases the risk of investing in a business that may not achieve its growth objectives. VCT investments are subject to general market risks, including fluctuations in stock prices, interest rates, and economic conditions. As a result, the value of a VCT's investments may decline, and investors could lose a portion or all of their invested capital. VCTs are subject to changes in tax laws and regulations, which could impact the tax benefits available to investors and the attractiveness of VCTs as an investment vehicle. Additionally, changes in regulations governing the eligibility of companies for VCT investment could impact the availability of suitable investment opportunities and the performance of a VCT's portfolio. VCTs differ from mutual funds in that they invest primarily in early-stage, private companies rather than publicly traded securities. While both investment vehicles provide diversification and professional management, VCTs offer significant tax advantages for UK investors, but also carry a higher level of risk due to the nature of the underlying investments. Similar to mutual funds, ETFs typically invest in publicly traded securities, whereas VCTs focus on private, early-stage companies. ETFs are known for their liquidity, low-cost structure, and ease of trading, while VCTs offer tax benefits and the potential for higher returns. However, VCTs also involve higher risks and may be less liquid than ETFs. Investing in VCTs provides exposure to a diversified portfolio of early-stage companies, whereas investing in individual stocks involves selecting and managing specific securities. While investing in individual stocks can offer higher potential returns if a particular company performs well, VCTs offer the benefits of professional management, diversification, and tax incentives. Venture Capital Trusts (VCTs) are publicly listed, closed-end investment vehicles in the United Kingdom, designed to encourage individual investors to invest in early-stage, high-growth companies. Structured as companies, VCTs pool investors' funds and invest the capital into a diversified portfolio of private, unlisted businesses with strong growth potential, offering investors access to the high return potential of venture capital and tax incentives from the UK government. Key characteristics of VCTs include significant tax benefits, a focus on early-stage companies across various sectors, investments in different financial instruments like equity shares and convertible debt securities, and eligibility requirements for companies they invest in. VCTs are managed by experienced professionals who identify suitable investment opportunities, often targeting innovative businesses with strong market potential. Investing in VCTs offers potential advantages such as high returns, diversification, professional management, and liquidity. However, VCT investments also involve risks, including illiquidity, limited track records of investee companies, market risk, and regulatory risk. Compared to other investment vehicles like mutual funds, ETFs, and individual stocks, VCTs provide unique opportunities to invest in early-stage companies and tax benefits, but also come with higher risks. Investors must carefully consider their risk tolerance and investment objectives before venturing into VCTs.What Is a Venture Capital Trust (VCT)?

Importance of VCT in the Financial Industry

Types of Venture Capital Trusts (VCTs)

Generalist VCTs

Specialist VCTs

Early-Stage VCTs

Later-Stage VCTs

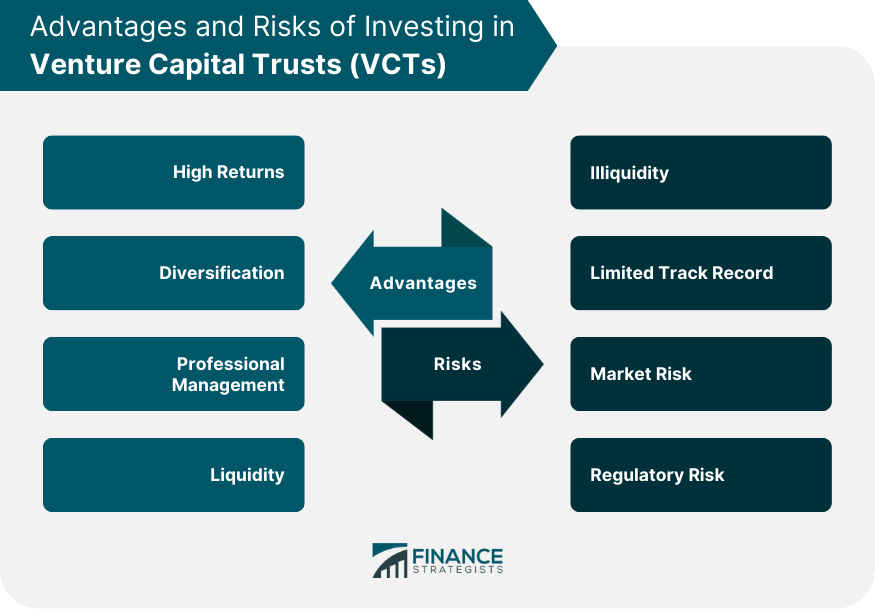

Advantages of Investing in VCTs

High Returns

Diversification

Professional Management

Liquidity

Risks Associated With VCTs

Illiquidity

Limited Track Record

Market Risk

Regulatory Risk

Comparison of VCTs With Other Investment Vehicles

Mutual Funds

Exchange-Traded Funds (ETFs)

Individual Stocks

Bottom Line

Venture Capital Trust (VCT) FAQs

VCT is a tax-efficient investment vehicle that invests in small and growing companies in the UK, providing capital in exchange for equity.

Investors can claim up to 30% income tax relief on their investment and any dividends received are tax-free.

VCTs typically invest in early-stage or growth-stage businesses, particularly those in technology or innovation sectors.

VCTs are considered high-risk investments, with risks such as market volatility, illiquidity, and regulatory changes affecting their performance.

VCTs offer potential higher returns and tax benefits but come with higher risks compared to traditional investment vehicles such as mutual funds or individual stocks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.