A zero coupon swap is a type of interest rate swap where the future interest payments are exchanged for a single net payment at maturity. It is simpler than a traditional swap because it only has one net payment, and it differs from a zero coupon bond because it involves interest rate swaps rather than direct bond investments. The key terms of a zero coupon swap are the fixed rate, floating rate, notional principal, maturity date, and net payment. The fixed rate is the agreed-upon rate of interest, the floating rate is tied to an index, and the notional principal sets the amount of the interest payments. The net payment is the difference between the fixed rate payments and the floating rate payments, and it is made at maturity. Zero coupon swaps can be used to hedge against interest rate risk, to speculate on future interest rates, or to obtain funding. They are a relatively new financial instrument, but they have become increasingly popular in recent years. The term 'zero coupon' in zero coupon swap refers to the absence of periodic interest payments during the life of the swap. Instead, the interest that would have been paid periodically is accrued and paid as a single net payment at the end of the swap term. This concept is similar to that of a zero coupon bond, where the bondholder receives a single payment at maturity rather than periodic coupon payments. The mechanics of a zero coupon swap involve two parties agreeing to swap interest rates on a notional principal amount. One party agrees to pay a fixed rate, while the other pays a floating rate. The net payment at maturity is calculated based on the difference between the present value of the fixed and floating interest rate payments. If the present value of the fixed payments is higher than the floating payments, the fixed rate payer will make the net payment to the floating rate payer, and vice versa. In zero coupon swaps, there are no cash flows until the maturity date. At maturity, the net payment is made by one party to the other. The net payment is calculated as the difference between the present value of the fixed and floating interest rate payments over the swap term. This means that the party who agreed to pay the rate that results in a higher present value will make the net payment at maturity. The fixed-rate payer in a zero coupon swap agrees to pay a predetermined fixed rate on a notional principal amount. They take on the risk of interest rate increases, as they will have to make a larger net payment at maturity if the floating rate (tied to market interest rates) is lower than the fixed rate. The floating rate payer agrees to pay a floating rate, typically tied to a benchmark index, on the notional principal amount. They take on the risk of interest rate decreases, as they will have to make a larger net payment at maturity if the fixed rate is higher than the floating rate. The swap dealer, typically a financial institution, facilitates the zero coupon swap by bringing together the fixed and floating rate payers. They provide the infrastructure for the transaction and may also take on the counterparty risk, ensuring that the swap agreement is fulfilled even if one party defaults. The pricing of zero coupon swaps is determined by several factors. These include the fixed and floating rates agreed upon by the parties, the term of the swap, the notional principal amount, and the current and expected future interest rates in the market. The price of a zero coupon swap is calculated by determining the net present value of the fixed and floating interest rate payments over the swap term. This involves discounting the future interest payments to their present value using a discount rate, which is typically the current market interest rate. The difference between the present value of the fixed and floating payments represents the net payment that will be made at maturity. Interest rates play a crucial role in zero coupon swap pricing. If interest rates rise, the present value of the fixed payments (discounted at the higher interest rate) will decrease, leading to a lower net payment for the fixed-rate payer. Conversely, if interest rates fall, the present value of the fixed payments will increase, leading to a higher net payment for the fixed-rate payer. Therefore, changes in interest rates can significantly impact the profitability of a zero coupon swap for both parties. Zero coupon swaps can be used as a hedging instrument to manage interest rate risk. For example, a company with a floating rate loan could enter into a zero coupon swap as the fixed rate payer, effectively converting its floating rate liability into a fixed rate liability. This allows the company to hedge against the risk of rising interest rates. Speculators can use zero coupon swaps to profit from their views on future interest rate movements. If a speculator believes that interest rates will fall, they can enter into a zero coupon swap as the fixed rate payer, hoping to make a net payment that's less than the current market value of the swap at maturity. Financial institutions and other corporations can use zero coupon swaps in their asset and liability management strategies. By swapping fixed interest payments for floating ones (or vice versa), these institutions can align the interest rate profiles of their assets and liabilities, thereby managing their interest rate risk. One of the key advantages of zero coupon swaps is their simplified cash flow structure. Unlike traditional interest rate swaps, which involve multiple periodic payments, zero coupon swaps streamline these payments into a single net payment made at maturity. This feature allows parties to manage their cash flows efficiently, reducing the administrative burden of tracking and making several payments over the term of the swap. Zero coupon swaps serve as an effective hedging tool, particularly against interest rate risk. For instance, an entity with a floating rate liability could enter a zero coupon swap as the fixed rate payer. This action effectively transforms their floating rate exposure to a fixed one, thereby insulating them from potential interest rate hikes. Similarly, an entity with a fixed-rate asset could swap its fixed interest receipts for floating ones if they anticipate a rise in interest rates. Zero coupon swaps also present a significant return potential, especially for speculators. If a speculator accurately predicts the direction of future interest rates, they can position themselves in the swap to profit from this movement. For instance, if they foresee a drop in interest rates, they can enter the swap as the fixed-rate payer. If their prediction holds, they will make a net payment at maturity that's lower than the market value of the swap, thereby realizing a gain. Lastly, zero coupon swaps offer flexibility in asset and liability management. By swapping the interest rate profiles of their assets or liabilities, financial institutions can align their interest income and expense streams. This alignment can help maintain the institution's net interest margin, which is a critical determinant of its profitability. While zero coupon swaps can be used to hedge against interest rate risk, they can also expose parties to this risk. If market interest rates move in a direction unfavorable to a party's position in the swap, the net payment at maturity may be significantly higher than expected. For instance, a fixed-rate payer will incur a larger net payment if interest rates decrease, as the present value of their fixed payments will exceed that of the floating payments. Credit risk is another disadvantage inherent in zero coupon swaps. This risk refers to the possibility that one party may default on their obligations under the swap agreement. While the swap dealer usually assumes the counterparty risk, parties to the swap are still exposed to the credit risk of the swap dealer itself. If the swap dealer defaults, parties might not receive their anticipated net payment at maturity. Liquidity risk is a concern with zero coupon swaps. Due to their unique structure, these swaps might not be as easily traded in the market as regular interest rate swaps. This illiquidity can make it difficult for a party to exit the swap before maturity without incurring significant costs, especially in volatile market conditions. Finally, zero coupon swaps can pose pricing challenges due to their unique structure and relative lack of liquidity. Accurately determining the present value of future fixed and floating payments requires complex mathematical models and a thorough understanding of current and expected future interest rates. Mispricing the swap could lead to unexpected losses, particularly for speculators seeking to profit from predicted interest rate movements. Zero Coupon Swaps are unique interest rate swaps that simplify the traditional swap structure into a single net payment at maturity. These swaps offer an effective tool for hedging interest rate risk, speculating on future interest rate movements, and aligning interest rate profiles of assets and liabilities. However, they also come with potential risks, including exposure to interest rate movements, credit risk, and liquidity risk. Furthermore, the pricing of these instruments can pose challenges due to their complexity and relative illiquidity. Despite these challenges, Zero Coupon Swaps, with their simplified cash flow structure and significant return potential, present a flexible and potent financial instrument for risk management and speculative purposes. As with any financial instrument, understanding their structure uses, and associated risks is critical before engaging in a Zero Coupon Swap transaction.What Are Zero Coupon Swaps?

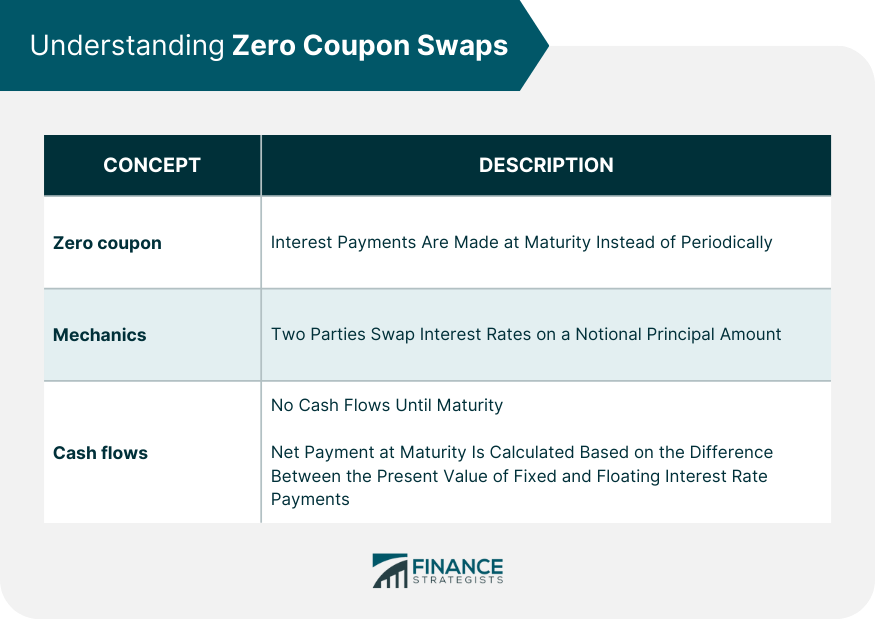

Understanding Zero Coupon Swaps

Concept of 'Zero Coupon'

Mechanics

Cash Flows

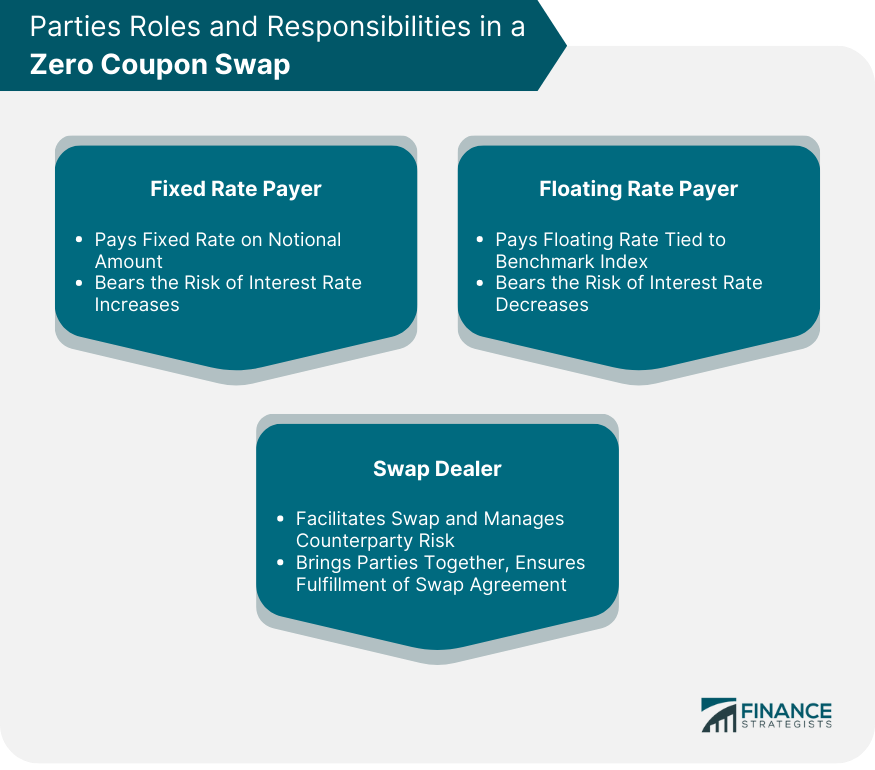

Parties Involved in a Zero Coupon Swap

Role of the Fixed Rate Payer

Role of the Floating Rate Payer

Role of the Swap Dealer

Pricing of Zero Coupon Swaps

Determinants of Zero Coupon Swap Pricing

Calculation of Zero Coupon Swap Price

Impact of Interest Rates on Zero Coupon Swap Pricing

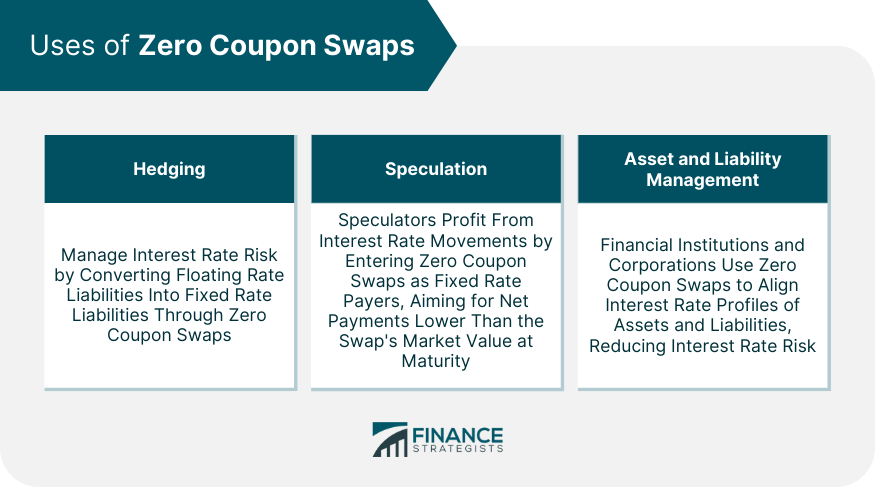

Uses of Zero Coupon Swaps

Hedging

Speculation

Asset and Liability Management

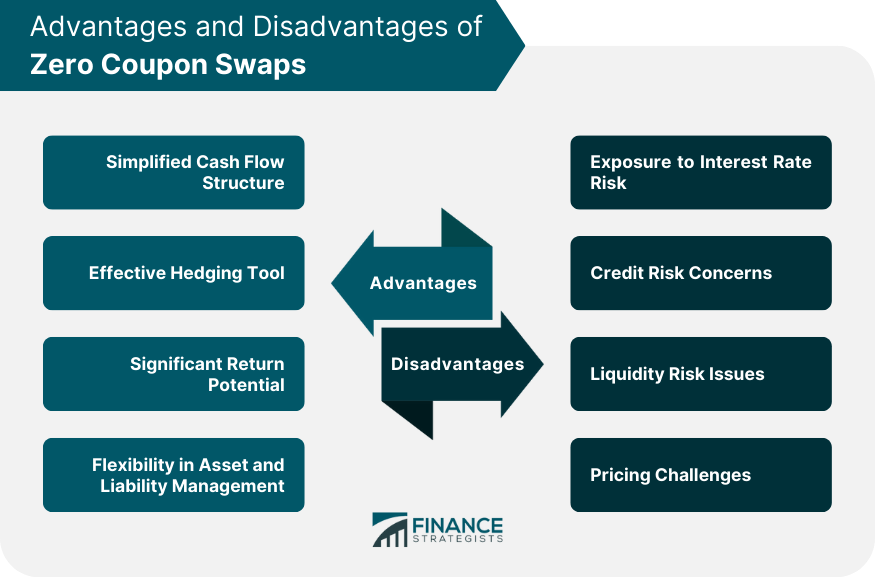

Advantages of Zero Coupon Swaps

Simplified Cash Flow Structure

Effective Hedging Tool

Significant Return Potential

Flexibility in Asset and Liability Management

Disadvantages of Zero Coupon Swaps

Exposure to Interest Rate Risk

Credit Risk Concerns

Liquidity Risk Issues

Pricing Challenges

Final Thoughts

Zero Coupon Swaps FAQs

A Zero Coupon Swap is a type of interest rate swap where there are no periodic interest payments. Instead, a single net payment is made at the end of the swap period.

The net payment in a Zero Coupon Swap is calculated as the difference between the present value of the fixed and floating interest rate payments over the swap term.

Zero Coupon Swaps can be used for hedging interest rate risk, speculating on future interest rate movements, and managing the interest rate profiles of assets and liabilities.

The main risks associated with Zero Coupon Swaps are interest rate risk, credit risk, and liquidity risk.

The advantages of Zero Coupon Swaps include simplicity and the potential for significant returns. Disadvantages include exposure to interest rate, credit, and liquidity risk, as well as potential difficulties in pricing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.