Asset Management Company (AMC) Fees Overview

Asset Management Company (AMC) fees are the costs associated with professional asset management services.

These fees serve as the company's main revenue stream, and their structure varies depending on the volume of assets managed performance and services provided.

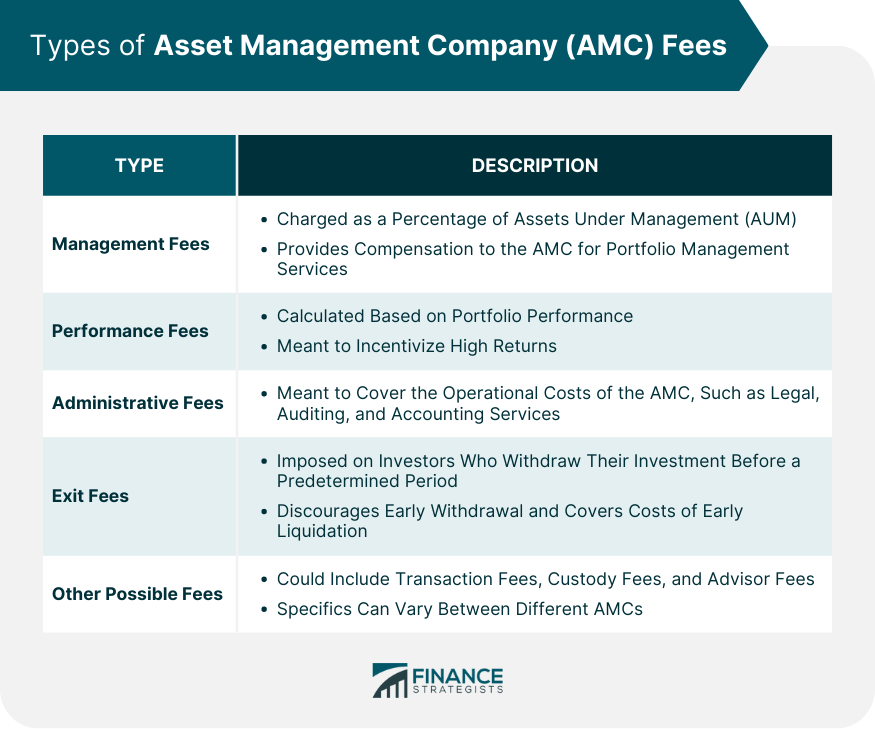

The most common types of AMC fees include management fees (a percentage of the assets under management), performance fees (based on portfolio performance), administrative fees (covering operational costs), and exit fees (charged for early withdrawal of investment).

The calculation methods for AMC fees often include a percentage of AUM, performance-based fees, or a combination of both.

AMC fees significantly impact investment returns; therefore, their consideration is crucial in formulating an investment strategy.

Regulatory bodies oversee AMC fees to ensure transparency and fairness, while various strategies exist to minimize these fees.

Types of Asset Management Company (AMC) Fees

Management Fees

Management fees are the most common type of fees charged by AMCs. These fees are usually a percentage of the assets under management (AUM) and are meant to compensate the AMC for the service of managing the client's investment portfolio.

Performance Fees

Performance fees are another type of fee that some AMCs charge. These fees are based on the portfolio's performance over a specified period and are intended to incentivize the portfolio manager to deliver high returns.

However, this type of fee can also drive higher risk-taking.

Administrative Fees

Administrative fees cover the operational costs of the AMC, such as legal, auditing, and accounting services. These fees are usually quite low and are often built into the overall management fee.

Exit Fees

Some AMCs may charge an exit fee if an investor decides to withdraw their investment before a predetermined period. The purpose of this fee is to discourage short-term investment and to cover the costs associated with the early liquidation of assets.

Other Possible Fees

Other fees may include transaction fees, custody fees, and advisor fees. The specifics can vary widely between different AMCs and even between different types of funds within the same AMC.

Impacts of Asset Management Company (AMC) Fees on Investments

Effects on Investment Returns

Fees can have a significant impact on the net returns that investors receive. High fees can erode investment returns over time, especially in cases where the fund's performance is mediocre or poor.

Importance of Fee Consideration in Investment Strategy

When formulating an investment strategy, it's crucial to consider the fees associated with different investment options. Lower fees can often lead to better net returns over the long term, even if the gross returns are similar.

Transparency and Regulation of Asset Management Company (AMC) Fees

Role of Regulatory Bodies in Overseeing AMC Fees

Regulatory bodies like the Securities and Exchange Commission (SEC) in the U.S. or the Financial Conduct Authority (FCA) in the U.K. have rules and regulations in place to ensure transparency and fairness in the way AMCs charge their fees.

Importance of Disclosure and Transparency of Fees

Transparency in fee structures is vital for investors. AMCs are required to disclose all fees upfront, which allows investors to make informed decisions about their investments.

Comparing Asset Management Company (AMC) Fees

Tools for Comparing AMC Fees

There are many online tools and resources available that allow investors to compare the fees of different AMCs. These can be a useful starting point when deciding where to invest.

Factors to Consider When Comparing Fees

While comparing fees, it's crucial to look beyond just the headline numbers. Investors should also consider the performance history of the fund, the expertise of the fund managers, the level of service provided, and the fund's risk profile.

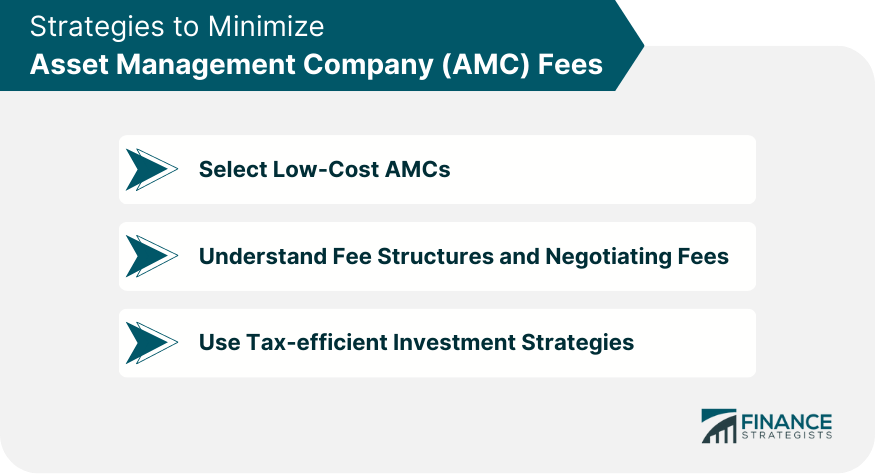

Strategies to Minimize Asset Management Company (AMC) Fees

Select Low-Cost AMCs

One straightforward strategy to minimize AMC fees is to invest in low-cost AMCs or funds. These are usually passively managed funds like index funds or ETFs that aim to replicate the performance of a specific index.

Understand Fee Structures and Negotiating Fees

By understanding the various fee structures, investors can negotiate a better deal with their AMC, especially if they are high-net-worth individuals or institutions with significant investments.

Use Tax-efficient Investment Strategies

Utilizing tax-efficient investment strategies can also help to offset the impact of fees. This might involve taking advantage of tax-deferred investment accounts, strategically realizing capital gains and losses, or investing in tax-efficient funds.

Conclusion

AMC fees are critical considerations for investors as they significantly impact overall returns. They come in various forms, including management, performance, administrative, and exit fees.

The calculation is often based on a percentage of AUM or performance, sometimes combining both. Investors must understand these fees when crafting investment strategies, given their potential to erode returns.

Regulatory bodies oversee the transparency of these fees, mandating AMCs to disclose them upfront. Tools are available to compare fees across AMCs, but factors such as fund performance, risk profile, and provided services should also be considered.

Lastly, investors can minimize fees through strategies like choosing low-cost AMCs, negotiating fees, and applying tax-efficient strategies. Understanding AMC fees' impacts on investments is a vital part of making informed decisions and optimizing returns.

Asset Management Company (AMC) Fees FAQs

AMCs typically charge management fees, performance fees, administrative fees, and sometimes exit fees. Management fees are based on the total assets under management, while performance fees are tied to the portfolio's success. Administrative fees cover operational costs, and exit fees apply for the early withdrawal of investments.

AMC fees are usually calculated based on a percentage of the assets under management (AUM). For performance fees, they are usually calculated as a percentage of the profit generated by the portfolio. Some AMCs use a combination of AUM and performance-based fees.

AMC fees can significantly impact your investment returns. Higher fees reduce the net return on your investment. Therefore, understanding and considering the fee structure is an essential part of choosing an AMC and formulating your investment strategy.

Yes, there are regulations in place to govern AMC fees. These regulations ensure that AMCs disclose all relevant information, including their fee structure, to investors. This promotes transparency and fair practices in the industry.

Yes, several strategies can help minimize AMC fees. These include negotiating lower fees, investing in low-cost funds, and monitoring your account for any unnecessary charges. It is important to actively manage and review your investments and fees to ensure they align with your financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.