An asset manager is a financial professional or firm that makes investment decisions on behalf of clients. They do this by using their expertise to strategically buy and sell assets like stocks, bonds, and real estate, with the aim of helping their clients achieve their financial goals. This service is usually provided to institutional clients and high-net-worth individuals who have significant assets that require special handling. These individuals or entities often lack the time or expertise needed to manage their assets effectively on their own. The role of asset managers is vital in the finance industry. They not only offer their expertise in managing a diverse portfolio of assets, but they also provide an essential service to clients who need help navigating the complex world of finance. Their main purpose is to help their clients achieve specific investment goals, whether it's capital growth, income generation, or capital preservation. They do this by implementing a strategy tailored to the client's risk tolerance, time horizon, and investment objectives, all while constantly keeping an eye on market trends and changes. One of the primary responsibilities of an asset manager is portfolio construction and management. This involves selecting the right mix of assets that align with the client's investment objectives and risk tolerance. It's a delicate process that requires a deep understanding of each asset's characteristics and how they interact with each other in the broader portfolio. The asset manager adjusts the portfolio composition as market conditions change to maintain its alignment with the client's goals, which requires vigilance and swift action when needed. Asset managers play a crucial role in identifying potential risks and implementing strategies to mitigate them. This can involve analyzing market trends, assessing geopolitical events, or considering economic indicators. By doing so, they can position the client's portfolio in a way that manages risk while still striving for optimal returns. They do this while ensuring that the chosen risk strategy aligns with the client's comfort level and investment objectives. Asset managers also have a responsibility to maintain open lines of communication with their clients. They regularly provide updates on the portfolio's performance, discuss strategy adjustments, and address any concerns the clients might have. This fosters transparency and trust between the client and the manager, leading to a more productive relationship. Regular communication also ensures that the manager understands any changes in the client's circumstances or objectives, enabling them to adjust strategies accordingly. Adherence to regulatory standards is a critical part of an asset manager's role. They must ensure all investment activities comply with the relevant financial laws and regulations. This requires staying up to date with any changes in legislation and implementing these changes within their operations promptly. Moreover, they are responsible for accurate and timely reporting of the portfolio's performance and any relevant activities. This helps to maintain trust with clients and regulators, as well as ensure transparency in their operations. Staying updated on market trends and developments is an essential duty of an asset manager. This continual analysis helps inform investment decisions and strategies, ensuring they are timely and relevant in the current market environment. It also allows them to anticipate potential shifts in the market, enabling proactive adjustments to portfolio strategies. Institutional asset managers handle the investments of institutional investors such as pension funds, endowments, and insurance companies. These investors typically have large amounts of money to invest, necessitating specialized management and strategies. These managers need to navigate complex financial regulations and execute large-scale investment strategies effectively. Private wealth managers cater to high-net-worth individuals and families, providing comprehensive financial solutions. They offer more than just investment advice; they provide holistic financial planning that takes into account the client's entire financial situation. In addition to asset management, these professionals often offer services like estate planning, tax strategies, and succession planning, ensuring their clients' wealth is protected and grows over time. Mutual fund managers oversee a pool of funds collected from numerous investors to purchase securities like stocks and bonds. These managers make buying and selling decisions based on the fund's investment objective. It's a big responsibility, as their decisions directly impact the financial wellbeing of numerous investors. Hedge fund managers operate similarly to mutual fund managers but typically take on more risk in the pursuit of higher returns. They employ complex strategies, often involving derivatives and leverage, and cater primarily to accredited or institutional investors. Despite the increased risk, successful hedge fund managers can deliver impressive returns, making this a lucrative area of asset management for those with a high-risk tolerance. Asset managers bring a level of expertise and professionalism that can be hard to match for individual investors. They have the knowledge and tools to analyze market trends, assess investment risks, and make informed decisions. Their years of experience and constant immersion in the financial markets allow them to navigate complex investment landscapes effectively. Asset managers can help investors diversify their portfolios across various asset classes, sectors, and regions, thereby spreading risk. They have the expertise to identify suitable investment opportunities across a wide range of assets, which can be difficult for individual investors to do on their own. This is especially beneficial for investors with substantial assets or those unfamiliar with the intricacies of different markets. Asset managers often have access to investment opportunities that individual investors may not. This includes institutional-level products, private deals, and newly issued securities. Their connections in the finance industry and their status as large-scale investors can provide them with opportunities that can enhance the performance of their client's portfolios. Investing requires time for research, execution, and management. By delegating these responsibilities to an asset manager, investors can free up their time and reduce the stress associated with managing their own investments. This allows investors to focus on other areas of their lives, knowing that their investments are being professionally managed. A proven track record is one of the most critical factors when choosing an asset manager. Potential clients should consider the manager's performance over different market cycles and against relevant benchmarks. The manager's past performance can provide insight into their investment strategy's effectiveness and how they manage risk during volatile periods. Asset managers usually charge a fee based on a percentage of the assets under management. However, the exact fee structure can vary. Potential clients should understand how these fees are calculated and what services they cover. It's important to compare fees among different managers to ensure you're getting good value for the cost. Before engaging an asset manager, it is important to verify their credentials and reputation. This can involve checking for relevant licenses, looking at reviews or ratings, and considering any regulatory actions against them. A well-reputed asset manager with a clean regulatory record can provide clients with the peace of mind that they are in good hands. Understanding the asset manager's investment philosophy is crucial. This philosophy, which guides their investment decisions, should align with the client's own investment goals, risk tolerance, and time horizon. A misalignment here can lead to dissatisfaction with the investment strategy and potential conflicts down the line. One of the most common fee structures is a percentage of the assets under management (AUM). The asset manager charges a certain percentage, typically between 0.10% and 2% per annum, of the total assets they manage for the client. This fee is usually deducted quarterly. It creates an incentive for the manager to grow the portfolio, as their income directly relates to the size of the assets they manage. Some asset managers, particularly hedge fund managers, charge a performance-based fee. This is typically a certain percentage of the investment profits over a certain hurdle rate. This fee structure aligns the interests of the manager and the client, as the manager only profits when the client's investments perform well. However, it can also encourage riskier investment strategies as the manager aims to achieve high returns. In some cases, asset managers may charge a fixed fee for their services. This fee is agreed upon in advance and does not change based on the performance or size of the client's portfolio. It's typically utilized for specific services such as financial planning or investment advisory. This type of fee provides certainty for the client, but it might not reflect the level of work required by the manager if the portfolio's size or complexity changes. Many asset managers use a combination of the above fee structures. For instance, they may charge a lower percentage of AUM and include a performance-based fee to incentivize better results. This combined approach can offer a balance between steady revenue for the manager and performance-aligned incentives. Asset managers play an integral role in the financial landscape by offering expert portfolio management, risk mitigation, client communication, regulatory compliance, and continual market analysis. They cater to different types of clients, including institutional investors, high-net-worth individuals, and mutual fund and hedge fund investors. The advantages of engaging an asset manager include their specialized expertise, opportunities for portfolio diversification, access to exclusive investment deals, and the convenience of time and stress reduction. Prospective clients should consider an asset manager's track record, fee structures, credentials, and investment philosophy before deciding on their services. Moreover, an understanding of the fee structures, like the percentage of AUM, performance-based fees, fixed fees, or a combination thereof, can help clients choose the most suitable option for their needs. Seek expert asset management services today to secure your financial future.What Is an Asset Manager?

Roles and Responsibilities of an Asset Manager

Portfolio Construction and Management

Risk Assessment and Mitigation

Client Relationship and Communication

Regulatory Compliance and Reporting

Continual Market Analysis

Types of Asset Managers

Institutional Asset Managers

Private Wealth Managers

Mutual Fund Managers

Hedge Fund Managers

Benefits of Using an Asset Manager

Expertise and Professional Management

Diversification and Risk Management

Better Investment Opportunities

Time and Stress Reduction

How to Choose an Asset Manager

Evaluate Track Record

Understand Fee Structures

Verify Credentials and Reputation

Assess Investment Philosophy

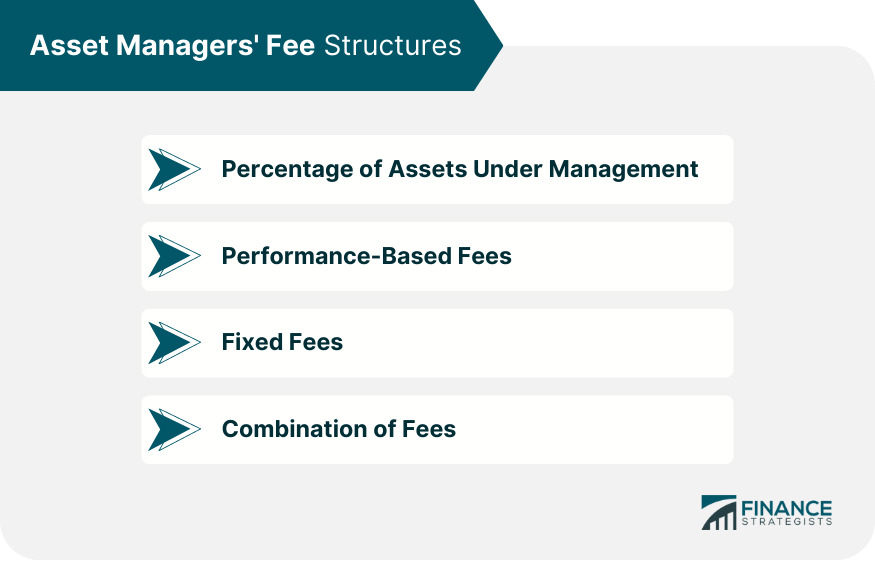

Asset Managers' Fee Structures

Percentage of Assets Under Management

Performance-Based Fees

Fixed Fees

Combination of Fees

Final Thoughts

Asset Manager FAQs

An asset manager makes investment decisions on behalf of clients to help achieve their financial goals. They handle portfolio construction, risk mitigation, client communication, regulatory compliance, and market analysis.

Main roles include portfolio construction and management, risk assessment and mitigation, client relationship management, regulatory compliance and reporting, and continual market analysis.

Asset managers can specialize in different areas, such as institutional asset management, private wealth management, mutual fund management, and hedge fund management.

Benefits include professional expertise, a diversified portfolio, access to better investment opportunities, and time and stress reduction for clients.

Asset managers commonly use fee structures like a percentage of assets under management, performance-based fees, fixed fees, or a combination of these.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.