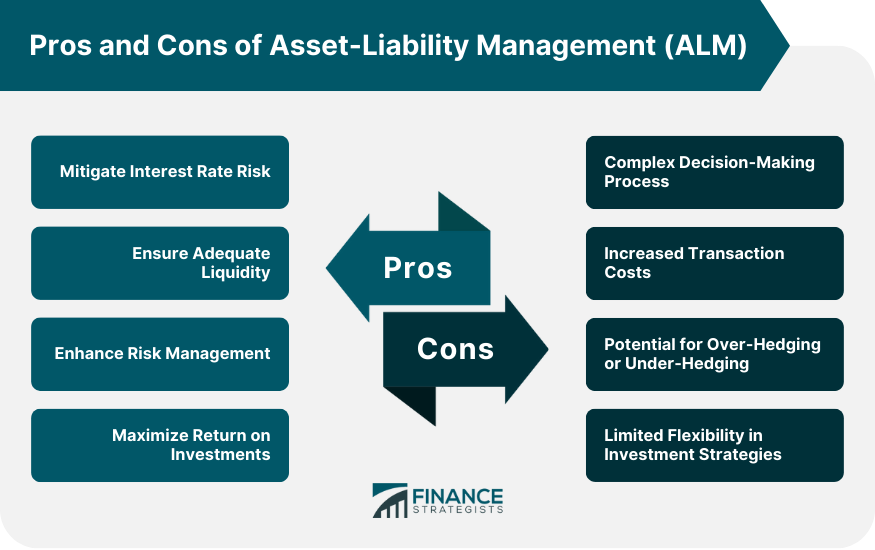

Asset-liability management (ALM) is a strategic financial practice employed by businesses, especially financial institutions, to balance their assets and liabilities in order to achieve specific goals. The primary advantage of ALM lies in its capacity to minimize risk exposure by ensuring that a company's liabilities and assets are well-matched in terms of maturity, interest rates, and liquidity. This can enhance stability, optimize funding costs, and align business strategies with market conditions. However, ALM also comes with challenges, such as the complexity of predicting interest rate movements accurately, the potential for liquidity mismatches during market fluctuations, and the costs associated with implementing sophisticated ALM strategies. ALM empowers financial institutions to shield themselves from the volatile tides of interest rates. Through instruments like interest rate swaps, institutions can craft strategic hedges that act as financial safeguards, minimizing potential losses when interest rates take unexpected turns. This proactive approach is akin to an umbrella in a rainstorm, offering protection against sudden downpours of adverse rate movements. ALM functions as a skilled tightrope walker, deftly managing the interplay between assets and liabilities of varying maturities. By aligning the durations of these financial components, institutions reduce vulnerability to abrupt interest rate shifts. Like a seasoned navigator, ALM ensures that both the short-term waves and the long-term currents of interest rates are navigated with poise, minimizing risks and maintaining financial stability. ALM serves as a financial conductor orchestrating the flow of cash within institutions. By meticulously aligning assets and liabilities, ALM ensures that there's a steady stream of funds available precisely when needed. This proactive cash flow optimization reduces reliance on last-minute scrambles for funds and expensive emergency financing. Just as a well-choreographed dance captivates an audience, ALM's optimization of cash flow captivates financial stability. ALM is a safeguard against the peril of illiquidity, akin to a safety net that prevents financial institutions from falling into a liquidity abyss. By judiciously managing assets and liabilities, institutions can avoid situations where they're unable to quickly convert assets into cash to meet obligations. This readiness to convert assets into liquid funds at a moment's notice shields institutions from potential crises and secures their ability to navigate through uncertain financial waters. ALM's role in mitigating the risk of illiquidity is akin to a lifeboat, ensuring that financial institutions stay afloat even when the tides of liquidity are challenging. ALM operates as a vigilant sentry, continuously monitoring the credit quality of assets held by financial institutions. This practice ensures that institutions are not overexposed to high-risk assets, mitigating the potential fallout from credit defaults. Similar to a safety harness for climbers, ALM's credit risk management prevents institutions from venturing too far into risky terrain, safeguarding their financial health and stability. ALM encourages financial institutions to adopt a diversified investment strategy, akin to a skilled gardener cultivating a variety of plants to protect against diseases. By spreading investments across a spectrum of assets, institutions reduce their vulnerability to the downfall of a single asset class. This diversification cushions against unforeseen shocks, creating a balanced and resilient portfolio. ALM's emphasis on diversification is like an armor that shields institutions from the arrows of financial uncertainties, enabling them to weather storms and maintain a robust financial posture. ALM functions as a financial architect, intricately designing the alignment of assets and liabilities to create a solid foundation for profitability. By ensuring that assets generate returns that match or surpass liabilities' costs, ALM enhances the institution's overall financial performance. This alignment is akin to a puzzle where every piece fits perfectly, optimizing the institution's ability to earn and thrive. ALM transforms financial institutions into agile market players, ready to pounce on lucrative opportunities. Like a skilled angler casting a line at the right moment, ALM enables institutions to swiftly adapt their asset and liability positions to seize advantageous market conditions. This dynamic approach empowers institutions to pivot quickly and capitalize on emerging trends, ensuring they don't miss out on potentially high-yield prospects. ALM's role in capturing market opportunities is akin to a windfall, allowing institutions to harness the winds of financial change and steer toward greater profitability. ALM involves intricate decision-making akin to solving a complex puzzle. Financial institutions must meticulously juggle a range of factors – from interest rates and market dynamics to economic indicators. This intricate balancing act demands a deep understanding of the financial landscape and an ability to harmonize divergent elements into a cohesive strategy. ALM's effectiveness hinges on the ability to anticipate future economic shifts, an endeavor reminiscent of gazing into a crystal ball. Accurate forecasts of interest rates and economic conditions are inherently uncertain, introducing an element of unpredictability into the decision-making process. Miscalculations in predicting these pivotal variables can lead to misalignments and unintended consequences. The perpetual need to recalibrate asset and liability positions, while vital, can escalate operational costs. Frequent adjustments akin to fine-tuning an instrument can accumulate transaction fees and administrative expenses, impacting the institution's bottom line. While hedging instruments like swaps offer protection, they come with associated costs. Moreover, ensuring liquidity to meet obligations necessitates a financial cushion, incurring additional expenses. These costs can erode potential gains and impede overall profitability. Overzealous risk mitigation can inadvertently stifle potential returns. By excessively hedging against perceived risks, institutions may miss out on profitable opportunities, similar to taking unnecessary detours on a journey. Conversely, inadequate hedging may expose institutions to unforeseen risks, like sailing into uncharted waters without proper navigation. Insufficient safeguards may leave the institution vulnerable to economic turbulence or sudden market shifts. ALM's emphasis on alignment with liabilities may limit investment freedom. Institutions might pass up potentially lucrative opportunities simply because they don't perfectly match their existing liabilities, curbing the scope for diversification. While ALM ensures prudence, an overly conservative approach could mean institutions miss out on ventures with higher returns. This restraint is akin to holding back when one could potentially achieve more, sacrificing higher yields for the sake of meticulous alignment. Asset-Liability Management (ALM) is a linchpin for financial stability, risk mitigation, and returns optimization. Skillfully managing interest rate risks, balancing short- and long-term assets, ensuring liquidity, and enhancing risk management, ALM fortifies institutions. It orchestrates returns through alignment and market savvy. Still, ALM poses challenges. Navigating intricate decisions, predicting economic shifts, and managing costs demand finesse. The tightrope between over- and under-hedging, coupled with limited investment flexibility, unveils ALM's subtlety. ALM emerges as a crucial tool, guiding institutions through the financial landscape. Its potential for stability, growth, and risk mitigation must counterbalance complexities. Striving for a harmonious asset-liability equilibrium, institutions pursue financial excellence.Asset-Liability Management Overview

Pros of Asset-Liability Management

Mitigating Interest Rate Risk

Hedging Against Fluctuations in Interest Rates

Balancing Long-Term and Short-Term Assets and Liabilities

Ensuring Adequate Liquidity

Optimizing Cash Flow to Meet Obligations

Reducing the Risk of Illiquidity

Enhancing Risk Management

Minimizing Credit Risk Exposure

Improving Portfolio Diversification

Maximizing Return on Investments

Aligning Assets and Liabilities to Increase Profitability

Capturing Opportunities in the Market

Cons of Asset-Liability Management

Complex Decision-making Process

Balancing Multiple Factors and Variables

Challenge of Predicting Future Interest Rates and Economic Conditions

Increased Transaction Costs

Frequent Adjustments to Maintain Alignment

Costs Associated With Hedging Instruments and Liquidity Management

Potential for Over-Hedging or Under-Hedging

Risk of Overreacting to Market Changes

Exposing the Organization to Unanticipated Risks

Limited Flexibility in Investment Strategies

Constraints on Investment Choices Due to Matching Liabilities

Missing Out on High-Return Opportunities

Conclusion

Pros and Cons of Asset-Liability Management FAQs

Pros of ALM include effective risk management, profit maximization, liquidity management, and strategic planning. However, it can be complex, resource-intensive, susceptible to unforeseen market changes, and challenging to comply with evolving regulations.

ALM mitigates risks like interest rate, credit, and liquidity risk by aligning the maturity profiles of assets and liabilities, reducing exposure to fluctuations and protecting against potential losses.

ALM optimizes resource allocation, ensuring efficient use of assets and generating optimal returns. It aligns the duration and yield of assets with liabilities, leading to increased profitability through improved net interest margin.

ALM ensures that financial institutions maintain sufficient liquid assets to meet short-term cash flow needs and withstand unexpected demands. It strikes a balance between short-term and long-term assets and liabilities, safeguarding against liquidity crises.

Implementing ALM can be complex due to market volatility, changing interest rates, and evolving regulatory requirements. It requires dedicated resources, skilled professionals, and continuous monitoring to effectively manage its complexities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.