Real Estate Asset Management is a specialized field of asset management, focusing primarily on maximizing the owner's wealth through careful management of real estate assets. It entails both strategic and daily decision-making to ensure the property's best performance, thus leading to value enhancement and reliable income generation. The role requires a deep understanding of real estate markets, financial analysis, property maintenance, and tenant relationships. A competent Real Estate Asset Manager can significantly increase the profitability and value of a property portfolio. In this capacity, they also liaise with various stakeholders such as property managers, leasing agents, contractors, and lawyers to achieve the property's strategic objectives. By evaluating market trends, forecasting property values, and devising innovative investment strategies, a Real Estate Asset Manager plays a pivotal role in shaping the financial future of real estate portfolios. Asset managers regularly assess properties to understand their current performance and potential. This involves careful analysis of market trends, property conditions, tenant mix, and financial metrics. This evaluation can identify opportunities for improvement, be it physical upgrades, rent adjustments, or tenant mix changes, leading to higher returns on the property. A vital part of asset management is fostering strong relationships with tenants. This can involve resolving disputes, negotiating lease renewals, and even finding new tenants. By doing so, asset managers ensure consistent revenue for the property. They also work towards tenant satisfaction, which reduces turnover and contributes to a positive reputation for the property. Real Estate Asset Managers are also tasked with the financial well-being of the properties they manage. They establish budgets, control expenses, and optimize income from the property. They also perform detailed financial analysis to inform strategic decisions. This could include refinancing decisions, capital expenditure plans, or potential property acquisitions and disposals. In the multifaceted world of real estate, legal compliance is a critical aspect. Asset managers ensure that properties adhere to all relevant laws and regulations, which can range from health and safety to environmental and zoning laws. Regular audits and legal consultations are often employed to ensure that all properties remain compliant and avoid costly penalties. Identifying potential risks and planning for mitigation is another essential task. These could be market risks, physical property risks, or even risks associated with tenants. By creating and implementing robust risk management strategies, Real Estate Asset Managers can prevent issues before they become problematic and ensure the longevity of the investment. Real Estate Asset Managers require strong financial skills. They need to understand and interpret financial statements, conduct investment property analysis, and make strategic decisions based on their assessments. This knowledge allows them to maximize returns, minimize costs, and identify lucrative investment opportunities. Given the legal complexities involved in managing real estate, asset managers need a good understanding of the relevant laws. This can help them ensure compliance and manage legal issues when they arise. A solid grasp of the legal landscape can prevent costly disputes and ensure smooth operations. These managers frequently liaise with diverse stakeholders - tenants, maintenance staff, government agencies, and the owners themselves. Thus, they need to communicate effectively and maintain positive relations with all parties. Effective communication facilitates smoother operations, prevents misunderstandings, and helps in the successful resolution of issues. The dynamic nature of the real estate industry means asset managers often face unexpected issues. Problem-solving abilities are crucial in such situations, along with the capacity to make informed, sound decisions. This is important for managing crises, negotiating beneficial deals, and generally maintaining the profitability of the property. A deep understanding of the real estate market, including trends, pricing, and the competitive landscape, is essential. This knowledge aids in decision-making processes and contributes to the successful management of properties. Keeping up with market trends can help in making timely decisions, whether it's adjusting rents, renovating properties, or even buying or selling properties. Real Estate Asset Managers are instrumental in maximizing returns on property investments. They optimize rental income, reduce vacancies, manage operational costs, and make strategic decisions that can enhance the property's value. They also consider market trends to time property transactions effectively. The goal is to ensure a steady stream of income while also realizing the full potential of the property's appreciation. One of the most important roles of a Real Estate Asset Manager is the mitigation of risks associated with property ownership. By constantly monitoring market conditions, inspecting the physical condition of properties, and ensuring tenant satisfaction, they can preemptively identify and mitigate potential risks. This proactive approach can help avoid costly mistakes and losses. In essence, a good asset manager not only seeks to maximize returns but also to minimize risks, thus ensuring a stable and sustainable investment. While immediate income is important, a significant part of real estate investing is the long-term appreciation of property value. Asset managers contribute to this by ensuring that the properties are well-maintained, have good tenant relations, and are positioned favorably in the market. Strategic renovations and improvements can also enhance the property's appeal, leading to an increase in its long-term value. Thus, a competent asset manager can significantly contribute to the wealth of the property owner by enhancing the long-term value of the properties. Real estate markets are known for their volatility. Market conditions can change rapidly due to various factors, including economic trends, changes in interest rates, and shifts in supply and demand. These changes can impact property values and rental income, posing significant challenges for asset managers. A successful asset manager, however, can navigate these market changes, adapting strategies to capitalize on opportunities and mitigate threats. The legal landscape of real estate is complex and constantly evolving. Keeping up with regulatory changes and ensuring compliance can be a challenging task. Non-compliance can lead to legal issues, fines, and damage to the property's reputation. Asset managers, therefore, must stay updated on legal developments and implement necessary changes to remain compliant. Managing tenants can be a tricky aspect of real estate asset management. Issues can arise around lease agreements, property maintenance, or rent payments. These can lead to disputes or even legal issues, presenting a significant challenge. However, with good tenant relations and effective dispute resolution strategies, these issues can be managed effectively, ensuring smooth operations and consistent income. The role of a Real Estate Asset Manager is a dynamic one, encompassing several key responsibilities that determine the financial health of a property portfolio. By understanding market trends, maintaining strong tenant relationships, managing finances prudently, ensuring legal compliance, and mitigating risks, they contribute significantly to both immediate and long-term property investment success. Their skill set not only allows for steady income generation but also long-term wealth maximization through strategic decision-making and diligent oversight. Despite market volatility, regulatory challenges, and tenant issues, adept Real Estate Asset Managers successfully navigate these obstacles, turning them into opportunities for growth and enhancement of the property's value. Whether you're a seasoned investor or new to the real estate game, the value of a knowledgeable and experienced Real Estate Asset Manager cannot be overstated. Understanding the Role of a Real Estate Asset Manager

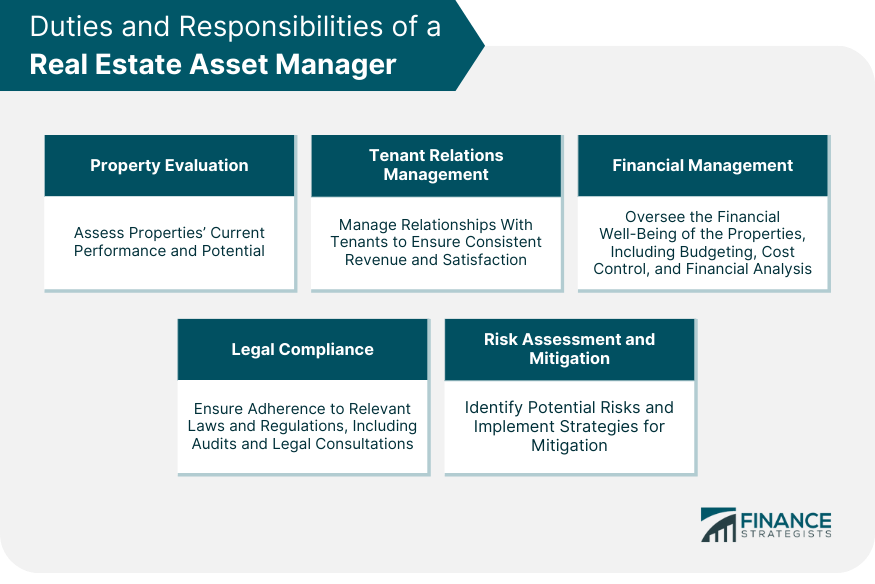

Duties and Responsibilities of a Real Estate Asset Manager

Property Evaluation

Tenant Relations Management

Financial Management

Legal Compliance

Risk Assessment and Mitigation

Essential Skills and Requirements for a Real Estate Asset Manager

Financial Acumen

Legal Knowledge

Interpersonal and Communication Skills

Problem-Solving and Decision-Making Abilities

Deep Understanding of the Real Estate Market

Real Estate Asset Manager's Impact on Investment Success

Returns Optimization

Risk Mitigation

Long-Term Property Value Enhancement

Potential Challenges in Real Estate Asset Management

Market Volatility

Regulatory Compliance

Tenant Issues

Final Thoughts

Real Estate Asset Manager FAQs

A Real Estate Asset Manager is responsible for property evaluation, tenant relations management, financial management, legal compliance, and risk assessment and mitigation.

Key skills include financial acumen, legal knowledge, interpersonal and communication skills, problem-solving and decision-making abilities, and an understanding of the real estate market.

The manager maximizes returns, mitigates risks, and enhances the long-term property value, thus ensuring investment success.

They often contend with market volatility, regulatory compliance, and tenant issues, among other challenges.

They ensure properties are well-maintained, foster good tenant relations, and undertake strategic renovations, all contributing to long-term value enhancement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.