Asset management pertains to the systematic approach of developing, operating, maintaining, and selling assets in a cost-effective manner. At its core, it's about maximizing a company's portfolio value, ensuring optimal use and return on assets, and aligning them with the broader organizational goals and objectives. Asset management can encompass a wide variety of assets, from tangible assets like real estate and machinery to intangible assets like intellectual property and financial investments. The process involves decision-making, long-term planning, and continuous monitoring and adjustment, with the goal of deriving the greatest value, minimizing risks, and ensuring that an organization’s resources are used efficiently. Modern asset management often employs sophisticated software tools and analytical techniques to manage assets, predict their lifecycle, and calculate return on investment. Whether for an individual, a corporation, or a government entity, asset management plays a pivotal role in financial and strategic planning. Management fees, also known as advisory fees, are typically a percentage of the assets under management (AUM). These fees are paid to investment advisors or managers for their expertise and services in managing and overseeing the portfolio. They cover the time, effort, and resources that these professionals dedicate to managing your assets. Transaction fees are charged for the purchase and sale of investments within a portfolio. These costs are essential to consider because they apply every time a trade is made. They can vary depending on the platform used for trading, the type of security traded, and the size of the transaction. The frequency of trading also directly affects the amount of transaction fees incurred. Performance fees are an additional charge by the fund manager when the fund's return exceeds a predetermined benchmark or target. These fees act as an incentive for fund managers to perform well. They ensure that managers are rewarded for successful investment strategies, but they can add up if not carefully considered in your overall cost calculation. Operating expenses are the costs incurred by the fund for its day-to-day operations. They can include legal fees, audit fees, administrative costs, and other expenses related to running the fund. While these costs may seem inconsequential in isolation, when aggregated, they can significantly impact the fund's performance. Taxes can also be considered as indirect costs in asset management. The type of investments and the timing of buying and selling can have significant tax implications for the investor. They can affect your net returns and should be considered when developing your investment strategy. These direct and indirect costs, when taken together, can significantly impact the net return of your investment portfolio. Each fee, no matter how small, can influence the outcome of your investments. The cost of managing assets is, therefore, a crucial factor to consider in wealth management. Simply put, the higher your asset management costs, the lower your net return. For example, if your portfolio earns a gross return of 7% in a year, but your total costs amount to 2%, your net return would be only 5%. Over time, even a seemingly small difference in costs can add up due to compounding, significantly impacting your wealth growth. Therefore, having a clear understanding of these costs can help you make informed investment decisions. In evaluating any investment strategy, one should always consider its cost relative to the potential benefits. This type of analysis will provide a more holistic view of your investments. An investment with high costs may still be worthwhile if it offers superior returns, diversification, or risk management. Conversely, an investment with low costs but poor returns or high risks may not be the best choice. Understanding the cost-benefit dynamic is a fundamental aspect of effective wealth management. A cost-efficient wealth management strategy aims to maximize returns for a given level of risk while minimizing costs. It is about striking the right balance between performance and cost. This often involves selecting low-cost investment vehicles, diversifying the portfolio to reduce risk, and managing taxes effectively. These strategies should work together to create an efficient wealth management plan. One of the easiest ways to lower asset management costs is by negotiating fees with your asset manager. While some fees are set in stone, others, especially performance and management fees, may be negotiable, especially for larger investment amounts. It's worth having a discussion with your asset manager about the potential for fee negotiation. Investment vehicles like index funds and exchange-traded funds (ETFs) often have lower management and transaction fees than actively managed funds. This is because they simply aim to replicate the performance of a particular index, such as the S&P 500, rather than attempting to beat the market. By using these low-cost investment vehicles, you can potentially increase your net returns without needing to outperform the market. Another way to minimize asset management costs is through tax-efficient investing. This involves making investment decisions that take into account the tax implications, with the goal of minimizing your tax liability. Strategies may include holding investments longer to qualify for long-term capital gains rates, strategically placing investments in tax-advantaged accounts, or investing in tax-efficient funds. By being mindful of taxes, you can avoid unnecessary costs and keep more of your investment returns. Transaction costs can quickly add up, especially for investors who trade frequently. One way to keep these costs under control is to limit the number of trades. Some investors may also benefit from using a low-cost brokerage or trading platform. Remember, each transaction brings with it a cost, and multiple transactions can significantly impact your net returns. Asset management seeks to optimize portfolio value by effectively managing tangible and intangible assets, a process that is underpinned by strategic decision-making, meticulous planning, and ongoing adjustments. Within this framework, both direct and indirect costs play significant roles. While management, transaction, and performance fees form the direct costs, operating expenses and taxes make up the indirect ones. Their collective impact on a portfolio's net return can be considerable. For instance, a mere 2% cost on a 7% gross return diminishes the net gain to 5%, a difference that compounds over time. To navigate these waters, investors should conduct a rigorous cost-benefit analysis, ensuring they strike the right balance between performance and expenditure. Leveraging strategies like fee negotiation, tax-efficient investing, and using low-cost investment vehicles can also aid in maximizing returns. Ultimately, prudent wealth management demands a comprehensive grasp of these costs and strategies for their mitigation.Overview of Asset Management

Understanding Asset Management Costs

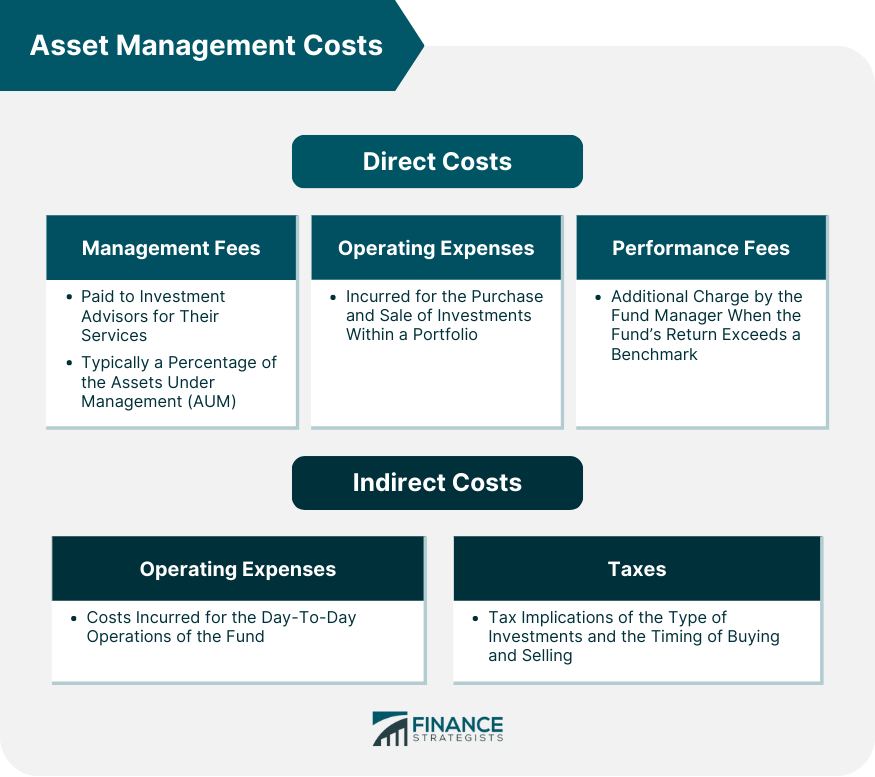

Direct Costs

Management Fees

Transaction Fees

Performance Fees

Indirect Costs

Operating Expenses

Taxes

Role of Asset Management Costs in Wealth Management

How Asset Management Costs Affect Wealth Growth

Cost-Benefit Analysis in Wealth Management

Role of Cost-Efficiency in Wealth Management Strategy

Methods for Minimizing Asset Management Costs

Negotiating Fees With Asset Managers

Using Low-Cost Investment Vehicles Like Index Funds and ETFs

Utilizing Tax-Efficient Investing Strategies

Monitoring and Controlling Transaction Costs

Bottom Line

Understanding Asset Management Cost FAQs

Asset management costs are expenses incurred while managing an investment portfolio, including direct costs like management, transaction, and performance fees and indirect costs like operating expenses and taxes.

Higher asset management costs reduce the net return on your investment. The accumulated cost can significantly affect wealth growth due to compounding over time.

Asset management costs play a key role in shaping overall wealth management strategy. It involves evaluating cost-benefit dynamics and aiming for cost-efficient investments to maximize returns.

Minimizing asset management costs can involve negotiating fees with asset managers, investing in low-cost vehicles like index funds and ETFs, adopting tax-efficient strategies, and controlling transaction costs.

A cost-efficient wealth management strategy aims to maximize returns for a given level of risk while minimizing costs. It involves selecting low-cost investment vehicles, diversifying the portfolio, and managing taxes effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.