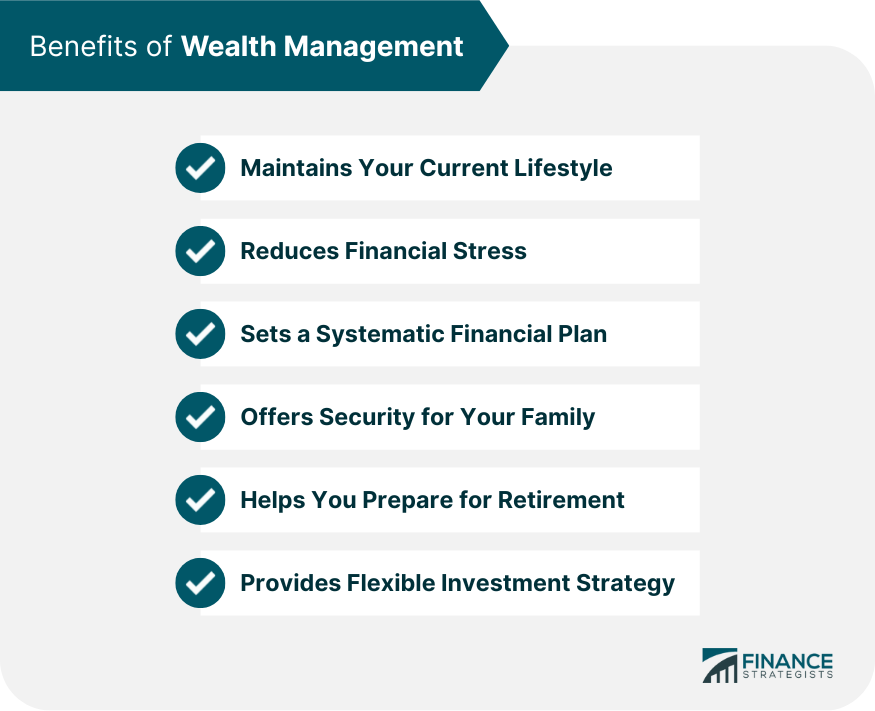

Wealth management is a high-end investment advisory service that offers holistic and comprehensive financial planning and management services to affluent clients. It is an integral part of achieving, growing, and preserving financial success. The objective of wealth management is to maximize wealth, ensure the financial security, and preserve assets for future generations. This involves managing investments, taxes, estate planning, insurance, cash flow, and retirement planning. Wealth management is facilitated by wealth managers who are highly-trained professionals specializing in wealth preservation. They develop a solid wealth management strategy, which is essential for a handful of reasons. Wealth managers employ a variety of strategies and help you understand your financial situation. They guide you to make good decisions to ensure that you are not spending more than you need to and that their investments are meeting your financial goals. With effective wealth management, you can enjoy your current lifestyle without worrying about having insufficient funds for retirement or depleting assets in the future. Wealth managers help you increase and stabilize your income streams and preserve capital for long-term financial security. The world of finance is constantly changing, and wealth managers are well-versed in the latest shifts that could affect your finances. Wealth management will enable you to continue living the life you want now while also preparing for the future. As you start to build wealth, managing your finances can become overwhelming and stressful. Wealth management services help reduce financial stress by providing more clarity on your goals and how to achieve them. Your wealth manager will identify any potential risks or opportunities within the investing and planning process that may affect your long-term objectives. They also provide guidance on a variety of complicated topics that require financial expertise, including taxes, retirement planning, insurance coverage, investments, and estate planning. By having an experienced professional helping to steer you in the right direction with sound advice and actionable steps based on your individual needs, you will be able to manage your finances without worrying about making the wrong decisions. A systematic financial plan includes setting saving goals, investments, and spending habits. Wealth managers will help you review your current financial situation and create a practical plan for meeting your financial objectives. They draw up a comprehensive strategy that factors in all aspects of the investment process, such as taxes, insurance, cash flow management, estate planning, and retirement planning. Wealth management also helps identify any threats involved with investing or any missed opportunities to grow wealth. You can rest assured that your finances are secure in the present and future. Your wealth manager will provide guidance on how best to proceed with investments to reach long-term goals while staying within budget. Wealth management is not just about growing your wealth - it also provides security for your family and future generations. Your wealth manager can develop a plan to protect current assets while creating a legacy of financial security. Your wealth manager will suggest the best ways to use trusts, insurance, savings accounts, investments, and retirement plans to provide long-term stability for you and your family. In addition to preserving assets, they will help develop strategies that can pass on wealth to multiple generations without having to worry about taxation, lawsuits, or other potential risks. Retirement planning can be one of the most important aspects of wealth management. Your wealth manager will help you figure out how to generate a steady income stream and plan for medical expenses in retirement. They offer guidance on investment options, such as 401(k)s, Individual Retirement Accounts (IRAs), mutual funds, annuities, and other investments that are designed to provide secure retirement income. Your wealth manager can also create a plan to help reach your specific financial goals over time by monitoring progress, evaluating risks, and suggesting changes as needed. With the help of professional wealth management services, you can enjoy financial security and peace of mind during retirement. Wealth managers design comprehensive plans tailored to your goals and needs. Such plans involve a mix of investments such as stocks, bonds, exchange-traded funds (ETFs), mutual funds, and more. Wealth managers are able to provide an adaptable approach when it comes to investing. Depending on your financial situation, risk tolerance level, and risk capacity, advisors may recommend different types of investments to reach desired financial outcomes. Your wealth manager will explore all available options and develop a plan that takes into account current market conditions, liquidity needs, tax liabilities, and any other unique circumstances. They provide advice on how best to diversify investments while minimizing risks. They also review financial strategies periodically in order to make sure the portfolio is performing well. With professional guidance, you can make smarter decisions with your investments and reach your financial objectives faster. Wealth management is a comprehensive strategy for managing your finances. It covers investment selection and portfolio management, as well as retirement planning, tax legislation, estate planning, and legacy planning. Professional wealth management services develop strategies that have the potential to maintain your current lifestyle and reduce financial stress by providing more clarity on goals and helping make informed decisions about investing and saving. They can help you create a systematic plan to grow your assets, reduce taxes, protect your assets, and generate wealth for generations to come. With proper wealth management, your family’s investments are in good hands and they will be financially secure for years. You can also prepare for retirement with confidence and you can achieve financial stability over time even after retirement. You can make sound decisions with your investments if you have someone knowledgeable about financial matters and access to up-to-date market data. This enables you to build wealth with greater ease. Hence, investing in wealth management services is one of the best ways to ensure long-term financial security for yourself and your family.1. Maintains Your Current Lifestyle

2. Reduces Financial Stress

3. Sets a Systematic Financial Plan

4. Offers Security for Your Family

5. Helps You Prepare for Retirement

6. Provides Flexible Investment Strategy

The Bottom Line

Benefits of Wealth Management FAQs

Wealth management is a holistic and comprehensive strategy for managing, growing, and preserving your finances. It involves everything from investment selection and portfolio management to retirement planning, tax legislation, estate planning, and legacy planning. This service is usually provided by an experienced wealth manager for wealthy clients.

Wealth management is crucial because it helps you make informed decisions about your finances, plan for retirement, and protect and grow your assets. With the guidance of a professional wealth manager, you can avoid costly mistakes, maximize returns on investments, and diversify your portfolio to manage risks. Wealth management can help you achieve financial security both now and in the future.

Private banks or investment firms will most likely charge an annual headline management fee, as a percentage of total assets under management. This is normally approximately 1% to 3% every year.

Wealth management is a service designed for individuals with significant financial assets. It is best suited to those who want a tailored approach to their finances, as well as access to advice and the latest market insights on a long-term basis. Wealth management services are suitable for those who want to meet their financial goals, manage their finances, grow wealth and preserve it.

Using wealth management services can help you lower risk levels in your portfolio. A professional wealth manager will analyze market trends and help create a diversified portfolio that spreads the risk across many different assets. This reduces the chance of experiencing large losses due to market volatility while still providing opportunities for capital growth.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.