Blockchain is a digital, decentralized ledger that records transactions across multiple computers so that any involved record cannot be altered retroactively, without the alteration of all subsequent blocks. This technology was originally devised for the digital currency, Bitcoin, but its potential reaches far beyond cryptocurrency. Digital ownership refers to the possession of a digital asset, whether it's a document, piece of music, ebook, or digital collectible. The concept also encompasses the rights and responsibilities that come with possessing such assets. Traditionally, digital ownership has been mediated and tracked by centralized platforms or entities. However, the advent of blockchain technology has provided a new paradigm for establishing, tracking, and verifying digital ownership without the need for a central authority. Blockchain technology can be visualized as a chain of blocks, where each block contains data representing a transaction or a record. The information in these blocks is secured through cryptographic principles, making it resistant to modification or tampering. Every time a new transaction occurs, it gets validated by a network of computers, also known as nodes. Once verified, this transaction is added to a new block which is then linked to the chain of existing blocks. This mechanism provides a clear audit trail of all transactions and establishes an immutable record, making blockchain an ideal tool for maintaining digital ownership records. Digital ownership in the blockchain era refers to the exclusive rights to a digital asset that is verified and recorded on a blockchain. This asset could be anything from a piece of digital art to a digital token representing real-world assets like real estate. The rights to these assets are represented by digital tokens, which are stored in digital wallets. Through cryptographic signatures, these tokens can be transferred from one wallet to another, with each transfer being recorded on the blockchain. The transparent, immutable nature of blockchain technology ensures the verification of these assets' authenticity and the security of their ownership. Blockchain has emerged as a groundbreaking tool in the realm of real estate. It can be used to represent property rights through digital tokens, thus bringing transparency, security, and efficiency to property transactions. By tokenizing real estate, a property can be divided into numerous smaller units, each represented by a digital token. These tokens can be easily transferred or traded, thus enabling fractional ownership of real estate. Moreover, the transactions involving these tokens are recorded on the blockchain, ensuring a clear, tamper-proof history of ownership. Intellectual property (IP) rights, including patents, trademarks, and copyrights, can also be managed using blockchain technology. Blockchain can provide an immutable record of IP rights, establishing proof of creation, proof of use, and proof of ownership. For instance, musicians can use blockchain to register their music, proving their authorship and ownership. Every time their music is used or purchased, this can be recorded on the blockchain, ensuring transparency and traceability. This could revolutionize the way artists are compensated for their work, enabling direct, peer-to-peer transactions between creators and consumers. In supply chain management, blockchain can provide transparency and traceability, establishing clear digital ownership of goods as they move through the supply chain. Every movement or transfer of goods can be recorded on the blockchain, providing an immutable record of the product's journey from manufacturer to consumer. This could significantly reduce fraud and counterfeiting, as the provenance of goods could be verified on the blockchain. Additionally, this could enable more efficient recalls, as the exact path of a product could be traced back through the supply chain. The digital art and collectibles sector, also known as the non-fungible token (NFT) market, has seen an explosion of growth thanks to blockchain technology. NFTs represent unique digital items or pieces of art on the blockchain, verifying their uniqueness and ownership. Artists can mint their digital creations as NFTs, linking their identity to the work in an unalterable way. This not only provides proof of authenticity but also allows artists to retain ownership rights and receive royalties every time the NFT is resold. This has democratized access to the art market, enabling digital artists to sell their work directly to consumers. Blockchain could disrupt traditional models of digital ownership by eliminating the need for trusted third parties. Currently, digital ownership is often managed by centralized entities that maintain ownership records and mediate transactions. By decentralizing this process, blockchain enables peer-to-peer transactions, reducing the cost and complexity associated with intermediaries. This not only increases efficiency but also enhances security and transparency, as every transaction is recorded on the blockchain and visible to all network participants. By tokenizing assets, blockchain could democratize access to various forms of digital ownership. Real estate, fine art, and other traditionally illiquid and high-value assets can be divided into smaller, more affordable units represented by tokens. This fractional ownership allows a broader range of individuals to invest in and benefit from these assets. Additionally, the global accessibility of blockchain networks enables cross-border transactions, broadening the potential investor base. Blockchain’s immutable and transparent nature makes it a powerful tool against fraud and counterfeiting in the realm of digital ownership. The provenance of digital assets can be traced back through the blockchain, verifying their authenticity. Moreover, the cryptographic security of blockchain networks ensures that transactions cannot be tampered with, reducing the risk of fraud. This could have a significant impact on sectors like supply chain management and digital art, where fraud and counterfeiting are prevalent issues. As the size of the blockchain grows and the number of transactions increases, the resources required to maintain and process the blockchain also increase. This could result in slower transaction times and higher costs, limiting the feasibility of blockchain for managing digital ownership on a large scale. While solutions such as layer-2 protocols and sharding are being developed to address this issue, scalability remains a significant obstacle. Blockchain networks, particularly those that use proof-of-work consensus mechanisms, can be energy-intensive. The process of mining – validating transactions and adding new blocks to the blockchain – requires substantial computational power and electricity. This high energy consumption presents not only a financial challenge but also an environmental concern. As society moves towards more sustainable practices, the energy-intensive nature of some blockchain networks could become increasingly problematic. The legal and regulatory landscape for blockchain and digital ownership is still developing. Different jurisdictions have different rules and regulations, creating uncertainty and complexity for businesses using blockchain technology. Furthermore, the lack of standardization in the blockchain space could hinder interoperability – the ability for different blockchain networks to interact and share information. Standardization and interoperability are crucial for the widespread adoption of blockchain for digital ownership. Blockchain technology can provide an immutable, decentralized ledger for recording transactions, and can establish clear, tamper-proof records of digital ownership. This technology can be applied across a wide range of sectors, from real estate to digital art, disrupting traditional models of ownership and democratizing access to digital assets. It could provide a more secure, transparent, and efficient way of managing digital assets, eliminating the need for intermediaries and enabling peer-to-peer transactions. While there are challenges to overcome, such as scalability issues, high energy consumption, and regulatory uncertainties, the future of blockchain and digital ownership looks promising. As the technology matures and solutions to these challenges are developed, we can expect to see an increasing adoption of blockchain for managing digital ownership.Overview of Blockchain and Digital Ownership

What Is Blockchain Technology?

What Is Digital Ownership?

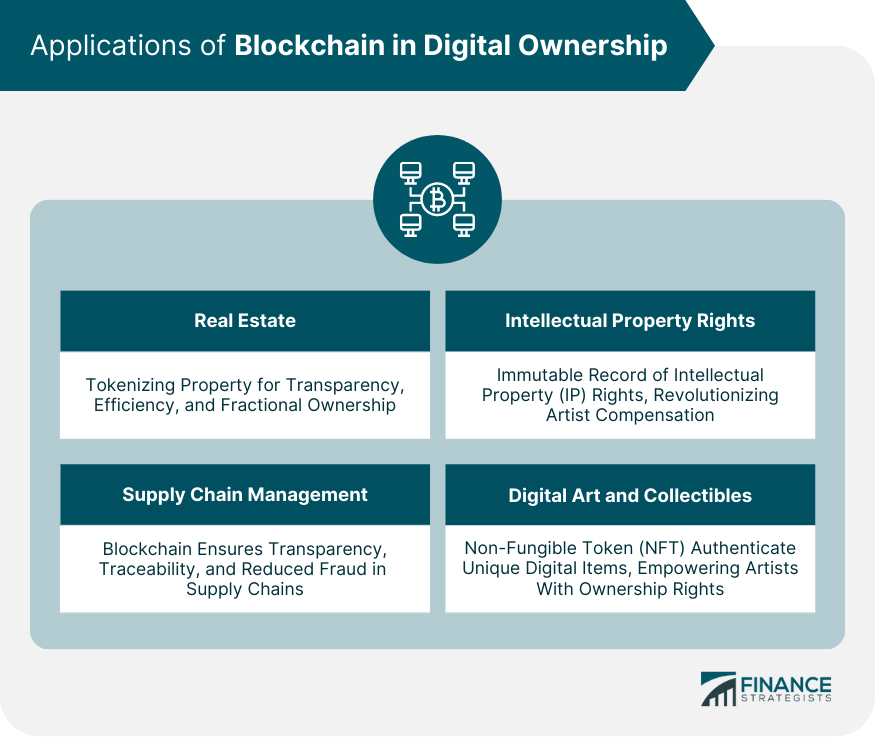

Applications of Blockchain in Digital Ownership

Real Estate

Intellectual Property Rights

Supply Chain Management

Digital Art and Collectibles

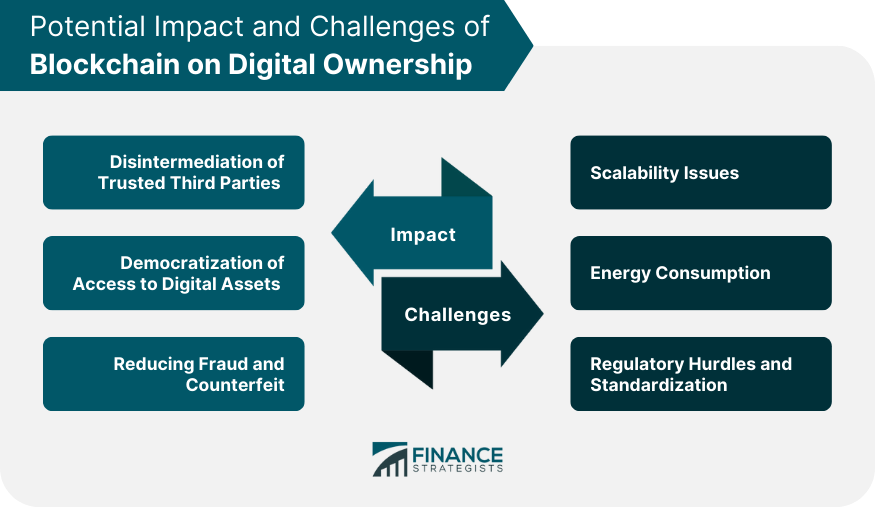

Potential Impact of Blockchain on Digital Ownership

Disintermediation of Trusted Third Parties

Democratization of Access to Digital Assets

Reducing Fraud and Counterfeit

Challenges of Blockchain on Digital Ownership

Scalability Issues

Energy Consumption

Regulatory Hurdles and Standardization

Conclusion

Blockchain and Digital Ownership FAQs

Blockchain is a digital, decentralized ledger that records transactions across multiple computers. The information on a blockchain is secured through cryptography, making it resistant to modification or tampering.

Digital ownership refers to the possession of a digital asset, such as a document, a piece of digital art, or a digital token representing real-world assets like real estate. Digital ownership also encompasses the rights and responsibilities associated with possessing such assets.

Blockchain technology can provide a clear, immutable record of digital ownership. When a digital asset is transferred or a transaction is made, this can be recorded on the blockchain, ensuring transparency and security.

Blockchain can be applied to digital ownership in a variety of sectors, including real estate, intellectual property rights, supply chain management, and digital art and collectibles. For instance, it can enable the tokenization of assets, providing a secure and efficient way of managing and transferring ownership.

Blockchain could disrupt traditional models of digital ownership by eliminating the need for trusted third parties and democratizing access to digital assets. Moreover, the transparent, immutable nature of blockchain could reduce fraud and counterfeiting.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.