Blockchain Asset Management is an innovative approach to managing digital assets using blockchain technology. It leverages the key features of blockchain such as decentralization, immutability, transparency, and security to create a highly efficient and reliable system for managing assets. These assets can range from cryptocurrencies to tokenized securities and other forms of digital rights or property. The main purpose of blockchain asset management is to enhance trust, transparency, and efficiency in the management of digital assets. Given the rise of the digital economy and the increasing relevance of digital assets, blockchain asset management offers a transformative solution to traditional asset management methods, paving the way for a new era of digital finance. At the heart of blockchain asset management is distributed ledger technology (DLT), where the asset ledger is held and updated by all participants, not just a centralized authority. his decentralized approach ensures that everyone has access to the same information simultaneously, increasing transparency and trust. Blockchain technology plays a critical role in record-keeping and verification. Each transaction involving a digital asset is recorded on the blockchain and timestamped, forming an immutable record that is nearly impossible to alter or delete. This ensures integrity and authenticity, greatly reducing the chances of fraudulent activities. Blockchain asset management enhances transparency as each transaction is recorded on a public or semi-public ledger, making it available for verification by all network participants. This fosters trust among parties, which is crucial in financial transactions. Blockchain technology eliminates the need for intermediaries, thus reducing costs associated with their services. The automation of processes through smart contracts enhances efficiency and further reduces costs. The immutable and tamper-evident nature of blockchain records, combined with cryptographic security measures, greatly reduce the risk of fraud and unauthorized activities, thereby improving the security of asset management. Blockchain technology enables anyone with an internet connection to participate in digital asset management. This democratization of finance has the potential to enhance financial inclusion, particularly in regions with limited access to traditional banking services. Despite its potential, blockchain technology is not without its challenges. The most notable is the issue of scalability, as existing blockchain networks often struggle to handle large volumes of transactions efficiently. The significant energy usage associated with some types of blockchain, notably Bitcoin, also poses challenges. The decentralized and international nature of blockchain technology presents significant regulatory and legal challenges. These include issues related to taxation, anti-money laundering rules, and the recognition of digital assets and smart contracts under various jurisdictions. Digital assets managed on the blockchain, such as cryptocurrencies, can be highly volatile. This introduces economic and market risks, particularly for investors who may not fully understand the intricacies of these new types of assets. Blockchain asset management systems are built on a peer-to-peer (P2P) network where all participants hold a copy of the entire blockchain. This architecture underpins the decentralization of the system, ensuring that no single entity has exclusive control over the asset records. Cryptography is used to secure transactions and control the creation of new units in a blockchain asset management system. It protects the identity of the participants and ensures the integrity of the transactions, providing a high level of security for digital assets. Mining, in the context of blockchain, is the process of validating new transactions and recording them on the global ledger. Miners solve complex mathematical problems, and their solutions are used to validate transactions and create new blocks on the blockchain. This system serves as the basis for consensus and trust in the blockchain network. Blockchain asset management has its origins in the creation of Bitcoin and the underlying blockchain technology. Early applications were limited to managing Bitcoin and other cryptocurrencies, but the potential for broader use in asset management was quickly recognized. The technology is now being applied in various industries and sectors, from finance to supply chain, real estate, and even art and music. With the rise of decentralized finance (DeFi), tokenization, and non-fungible tokens (NFTs), blockchain is reshaping the way we manage and interact with assets in the digital realm. The future of blockchain asset management looks promising. It's expected to evolve with technological advancements and the ever-increasing acceptance of digital assets. The potential for blockchain to revolutionize asset management by driving more secure, transparent, and efficient operations is being recognized by an increasing number of institutions and individuals alike. Blockchain Asset Management is transforming the way we interact with digital assets. Harnessing blockchain's decentralized, immutable, and transparent nature, it provides a robust, secure, and efficient approach to handling digital assets, offering benefits like enhanced transparency, reduced costs, improved security, and increased accessibility. Despite certain challenges including scalability, regulatory issues, and market volatility, continuous innovations suggest a bright future for this technology in asset management. As blockchain technology matures and digital assets become increasingly integral to our economy, blockchain asset management could potentially reshape traditional financial paradigms. This transformation, however, calls for awareness and effective management of associated risks, reinforcing the importance of adaptability in the face of technological change.What Is Blockchain Asset Management?

How Blockchain Asset Management Works

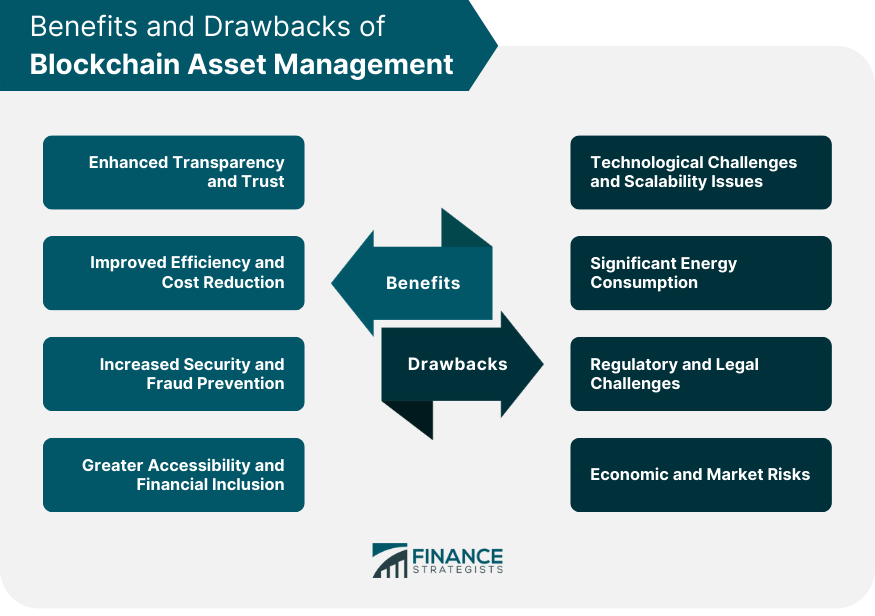

Benefits of Blockchain Asset Management

Transparency and Trust

Efficiency and Cost Reduction

Security and Fraud Prevention

Accessibility and Financial Inclusion

Drawbacks of Blockchain Asset Management

Technological Challenges and Scalability Issues

Regulatory and Legal Challenges

Economic and Market Risks

Architecture of Blockchain Asset Management Systems

Peer-To-Peer Network

Cryptography and Security Measures

Blockchain Mining and Validation

Evolution of Blockchain Asset Management

Origins and Early Applications

Current Trends and Developments

Future Prospects and Predictions

Conclusion

Blockchain Asset Management FAQs

Blockchain Asset Management refers to the use of blockchain technology to manage and optimize digital assets. This can include cryptocurrencies, tokenized securities, and other forms of digital rights or property.

Blockchain Asset Management leverages the features of blockchain technology, such as decentralized ledgers, transparency, immutability, and smart contracts. It records every transaction involving a digital asset on the blockchain, providing a secure, transparent, and efficient system for managing these assets.

The benefits of Blockchain Asset Management include increased transparency and trust, improved efficiency and cost reduction, enhanced security and fraud prevention, and greater accessibility and financial inclusion.

The challenges of Blockchain Asset Management include technological issues such as scalability and energy consumption, regulatory and legal uncertainties, and the economic and market risks associated with the volatility of digital assets.

The future of Blockchain Asset Management is promising, with potential innovations addressing current challenges and driving wider adoption. However, it also presents risks, including regulatory changes, technological uncertainties, and market volatility. The ability to effectively manage these risks will be crucial for those participating in blockchain asset management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.