A blockchain payment system is a decentralized digital infrastructure that leverages blockchain technology to facilitate secure and direct transactions without the need for intermediaries. It enables individuals to transact with each other directly, utilizing consensus algorithms to verify and record transactions on a distributed ledger. By leveraging cryptographic techniques, blockchain payment systems ensure the integrity, confidentiality, and authenticity of transactions, offering enhanced security and transparency compared to traditional payment methods. These systems typically use digital tokens or cryptocurrencies, like Bitcoin or Ethereum, as a means of exchange. Furthermore, the immutability of blockchain records provides an audit trail, making it nearly impossible to alter or forge transaction histories, thereby reducing the risk of fraud. Blockchain payment systems employ consensus algorithms to verify and record transactions. Through methods like proof of work or proof of stake, participants in the network collaborate to validate the authenticity of transactions and add them to the blockchain, ensuring immutability and transparency. The backbone of blockchain payment systems is a decentralized ledger distributed across a network of computers called nodes. This distributed nature ensures that transaction records are stored in multiple locations, enhancing security and resilience and preventing a single point of failure. To ensure the security of transactions, blockchain payment systems utilize advanced cryptographic techniques. Public-private key encryption, digital signatures, and hash functions safeguard the integrity, confidentiality, and authenticity of each transaction, making it extremely difficult for unauthorized manipulation. Blockchain payment systems offer a plethora of advantages over traditional payment methods, disrupting the financial landscape in several ways. Blockchain's cryptographic nature provides robust security, making it highly resistant to tampering and fraud. Transactions recorded on the blockchain are transparent and immutable, offering a high level of trust and integrity. Every transaction recorded on the blockchain is visible to all participants, creating a transparent ecosystem. This transparency fosters trust, accountability, and efficient auditing, as transactions can be traced back to their origin. Traditional payment systems often involve intermediaries, leading to additional fees and delays. In contrast, blockchain payment systems eliminate intermediaries, resulting in direct peer-to-peer transactions and significantly reducing costs. By removing intermediaries and utilizing smart contracts, blockchain payment systems enable near-instantaneous settlement of transactions. This automation eliminates manual reconciliation processes, reducing administrative overhead and enhancing overall efficiency. Blockchain payment systems transcend geographical boundaries, providing a global infrastructure for seamless cross-border transactions. With reduced fees and transactional friction, individuals and businesses can conduct international payments easily and affordably. While blockchain payment systems offer substantial benefits, several challenges need to be addressed for widespread adoption and scalability. As blockchain networks grow in size and usage, scalability becomes a critical concern. Traditional blockchains face limitations in terms of transaction throughput, causing potential congestion and delays. Solutions such as sharding, layer-two protocols, and optimized consensus algorithms are being explored to enhance scalability. Certain blockchain networks employ energy-intensive consensus mechanisms, raising concerns about their environmental impact. Research and development efforts are focused on developing more energy-efficient consensus algorithms and promoting the use of renewable energy sources to mitigate these concerns. The nascent nature of blockchain technology has resulted in regulatory uncertainties and legal challenges. The establishment of clear and comprehensive regulatory frameworks addressing areas such as data privacy, identity verification, and compliance is crucial for the wider adoption and acceptance of blockchain payment systems. Blockchain payment systems must provide user-friendly interfaces and seamless experiences to drive widespread adoption. Simplifying complex processes like key management, wallet interfaces, and transaction execution is vital to encourage individuals and businesses to embrace blockchain-based payment solutions. Blockchain payment systems are making tangible impacts across various industries, transforming traditional processes and opening up new possibilities. Cryptocurrencies, such as Bitcoin and Ethereum, have gained significant traction as digital payment methods. They enable secure, decentralized, and borderless transactions, allowing individuals to send and receive digital assets without intermediaries or geographical limitations. Blockchain payment systems offer enhanced transparency and traceability in supply chain management. By recording every step of a product's journey on the blockchain, stakeholders can verify authenticity, reduce counterfeiting, streamline logistics, and build trust among participants. Blockchain payment systems simplify cross-border transactions and remittances. With reduced fees, faster settlement times, and enhanced security, individuals can send money internationally more efficiently, bypassing traditional intermediaries and their associated delays. Blockchain payment systems facilitate micropayments and peer-to-peer transactions with minimal fees. This enables new business models and opportunities, such as content monetization, where users can directly support creators with small, instantaneous payments. Blockchain payment systems are decentralized structures employing blockchain technology to facilitate secure, direct transactions devoid of intermediaries. These systems ensure transaction integrity and confidentiality, providing advantages such as increased security, enhanced transparency, reduced transaction costs, and improved efficiency. While the transformative potential of blockchain payment systems is evident, they also pose challenges relating to scalability, energy consumption, regulatory uncertainties, and user adoption. Practical applications span various industries, including digital payments, supply chain management, remittances, and micropayments. As you navigate the future of financial transactions, understanding and leveraging the power of blockchain payment systems could be paramount. If you're looking to capitalize on this revolution and manage your wealth effectively, now is the time to seek professional wealth management services. Harness the power of blockchain to secure your transactions and explore new investment opportunities.What Is a Blockchain Payment System?

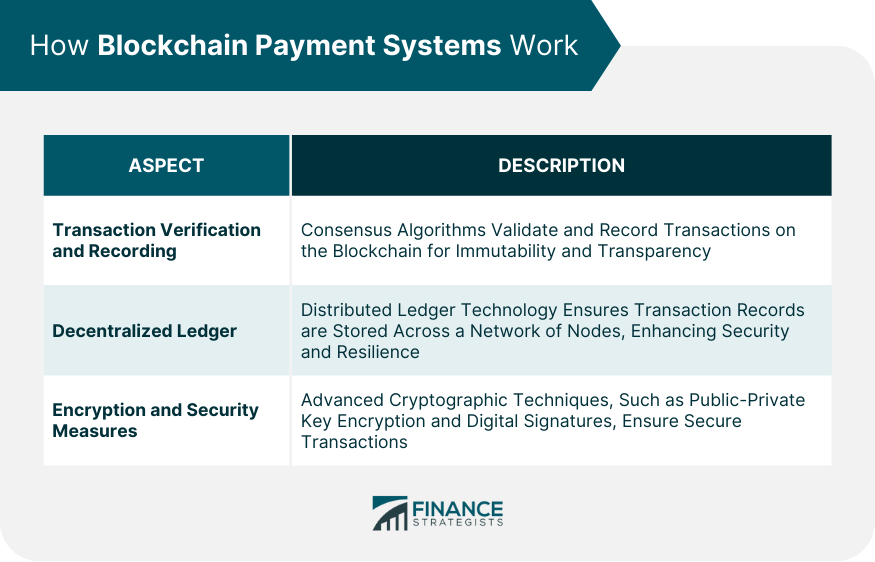

How Blockchain Payment Systems Work

Transaction Verification and Recording

Decentralized Ledger

Encryption and Security Measures

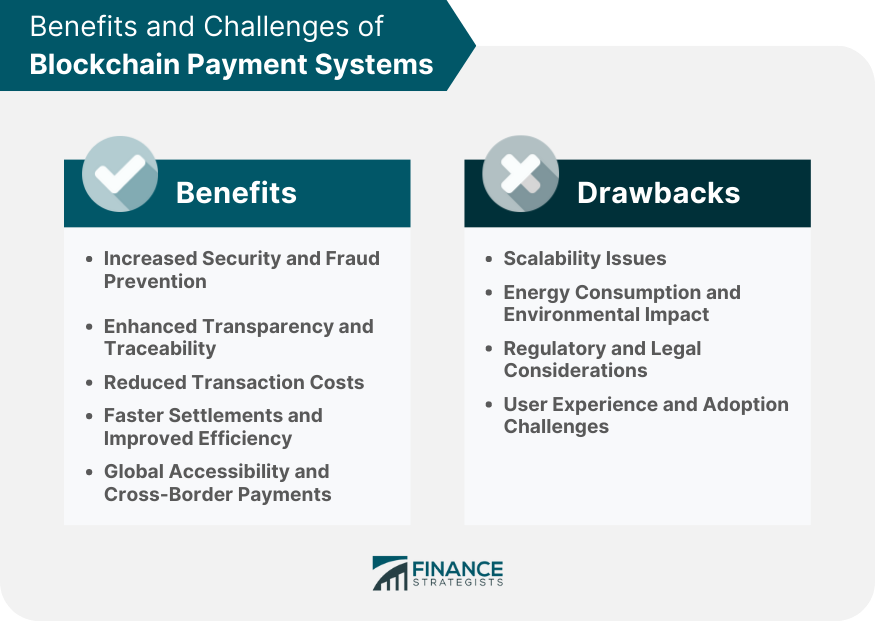

Benefits of Blockchain Payment Systems

Increased Security and Fraud Prevention

Enhanced Transparency and Traceability

Reduced Transaction Costs

Faster Settlements and Improved Efficiency

Global Accessibility and Cross-Border Payments

Challenges in Blockchain Payment Systems

Scalability Issues

Energy Consumption and Environmental Impact

Regulatory and Legal Considerations

User Experience and Adoption Challenges

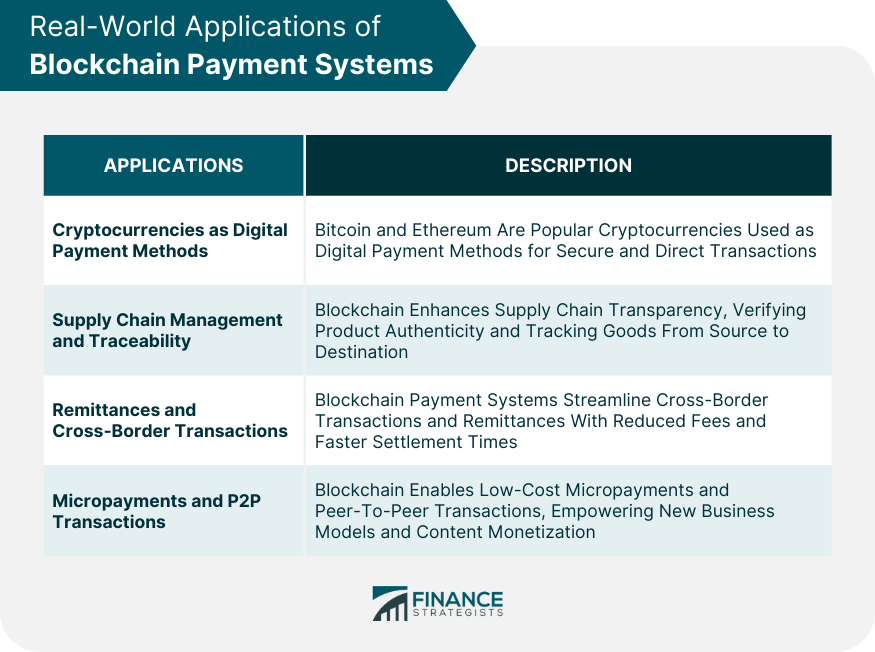

Real-World Applications of Blockchain Payment Systems

Cryptocurrencies as Digital Payment Methods

Supply Chain Management and Traceability

Remittances and Cross-Border Transactions

Micropayments and P2P Transactions

Final Thoughts

Blockchain Payment System FAQs

A blockchain payment system is a decentralized platform that enables secure and direct transactions using blockchain technology.

Blockchain payment systems use consensus algorithms to verify transactions and store them on a decentralized ledger, ensuring transparency and security.

Blockchain payment systems offer increased security, transparency, reduced costs, faster settlements, and global accessibility for cross-border payments.

Scalability, energy consumption, regulatory considerations, and user adoption are challenges that blockchain payment systems need to overcome.

Blockchain payment systems are used for cryptocurrencies, supply chain management, cross-border transactions, and facilitating micropayments and peer-to-peer transactions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.