A blockchain unconfirmed transaction refers to a transaction that has been submitted to the network but has not yet been included in the blockchain. When a transaction is made, it first enters the pool of unconfirmed transactions, often known as the mempool. From here, miners pick transactions, verify them, and include them in the next block of transactions. Until that happens, the transaction remains unconfirmed and technically is not finalized. Unconfirmed transactions are a critical aspect of blockchain technology, reflecting the inherent nature of decentralization, where transactions require network consensus for validation. They exist as an inevitable part of the transaction validation and block creation process. An unconfirmed transaction on the blockchain signifies that the transaction has not yet been validated by the network. These transactions exist in a liminal state; they have been broadcasted to the network but have not yet been incorporated into a block by miners. This state of unconfirmed transactions is a fundamental element of blockchains, particularly those operating under proof-of-work consensus models like Bitcoin. The characteristic highlights the decentralized nature of blockchain, where each transaction must achieve consensus validation to be added to the public ledger. Although an unconfirmed transaction is not yet added to the blockchain, it is visible to nodes in the network in the transaction pool, also known as the mempool. From here, transactions are selected to be added to the next block. While in the mempool, a transaction is essentially in a pending state. During this phase, it's publicly visible, providing transparency, a key attribute of blockchain technology. However, the transaction is not yet final and can still be altered or dropped, depending on several factors, such as transaction fees and network congestion. Unconfirmed transactions carry a risk of double-spending. Double-spending is a potential flaw in digital cash schemes, where a user can spend the same money more than once. Since unconfirmed transactions aren't yet validated and included in a block, there's a window of opportunity for malicious actors to try and double spend. Blockchain protocols implement various measures, like requiring multiple confirmations for a transaction, to minimize this risk, but the possibility remains as long as a transaction is unconfirmed. A number of factors can lead to transactions remaining unconfirmed in the blockchain. These include issues like network congestion, transaction fees, and confirmation policies. Blockchain networks have a finite capacity for handling transactions. When transaction volume spikes, it can lead to a backlog of unconfirmed transactions in the mempool. This is often the case during periods of high market activity, where increased transaction volume overwhelms the network's ability to confirm transactions in a timely manner. Network congestion and high transaction volumes highlight a current limitation of blockchains: scalability. As blockchain networks grow and attract more users, efficiently managing transaction volume will continue to be a significant challenge to ensure quick confirmations. Miners are incentivized to confirm transactions by the potential of earning transaction fees. When users submit a transaction, they can choose to include a fee that goes to the miner who confirms the transaction. If the fee is too low, miners may deprioritize the transaction in favor of others with higher fees. The setting of transaction fees is a balancing act for users. Higher fees can ensure quick confirmations but can also make transactions expensive. Conversely, lower fees can save money but may result in long confirmation times or even the transaction being ignored. The issue of transaction prioritization further complicates the landscape of unconfirmed transactions. Miners typically prioritize transactions offering higher fees. Therefore, a transaction with a lower fee might be left unconfirmed during periods of high activity, even if it was submitted before others with higher fees. This can create situations where transactions remain unconfirmed for extended periods. It also introduces elements of economic competition into the transaction confirmation process, which can impact the affordability and accessibility of blockchain networks. Different blockchain networks have different policies for confirming transactions. Some networks require multiple confirmations before a transaction is considered valid. This can increase security by reducing the risk of double-spending and other fraudulent activities, but it also increases the time a transaction spends in the unconfirmed state. Confirmation policies are an essential aspect of how blockchain networks manage security and risk. However, they can also impact transaction efficiency and speed, particularly for networks with high transaction volumes or high requirements for multiple confirmations. Unconfirmed transactions, while an integral part of blockchain operation, bring with them certain risks. As mentioned earlier, unconfirmed transactions can potentially be double-spent. This represents a serious risk, as it undermines the integrity of the digital currency. The risk of double-spending is the reason many merchants and services wait for at least one confirmation before considering a transaction as valid. While blockchain protocols use various measures to prevent double-spending, such as requiring multiple confirmations for a transaction, the risk remains while the transaction is unconfirmed. This is a particular concern for transactions of larger amounts, where the potential gains for a successful double-spend are higher. Unconfirmed transactions are vulnerable to various forms of attack and manipulation, such as transaction malleability, where an attacker changes the unique ID of a transaction before it's confirmed. These security vulnerabilities can potentially be exploited by malicious actors to disrupt blockchain operations or to commit fraud. They represent a serious challenge that needs to be effectively managed to maintain the trust and integrity of the blockchain network. The scalability of a blockchain, or its capacity to handle increasing volumes of transactions, has a direct impact on the confirmation of transactions. As transaction volumes grow, the capacity of a blockchain network to process and confirm transactions efficiently is tested. Networks that struggle with scalability can experience backlogs of unconfirmed transactions, particularly during periods of high activity. This can lead to increased confirmation times and heightened risk of issues associated with unconfirmed transactions, such as double-spending and security vulnerabilities. While unconfirmed transactions present challenges, there are several potential solutions that can help manage these issues. One straightforward way to get a transaction confirmed quicker is to increase the transaction fee. As miners prioritize transactions with higher fees, paying more can make your transaction more attractive for confirmation. While this method can speed up confirmation times, it may also lead to an arms race of ever-increasing fees, making transactions prohibitively expensive for some users. Therefore, it's a solution with potential drawbacks and should be used judiciously. Some blockchain networks allow for transaction replacement mechanisms, such as Bitcoin's Replace-by-Fee (RBF) feature. This allows users to essentially "bump" an unconfirmed transaction by replacing it with a new one with a higher fee, increasing its chances of being confirmed. While this can be a useful feature, it's not without controversy. Critics argue that it enables "fee sniping," where users can outbid other transactions to get their own confirmed quicker. This can potentially lead to an unhealthy competitive environment and exacerbate the problems of high transaction fees. Off-chain solutions and Layer 2 protocols offer a promising way to deal with unconfirmed transactions. These solutions process transactions off the main blockchain, only committing the final state to the main chain. This reduces the load on the network and can result in faster confirmation times. Examples of these solutions include Bitcoin's Lightning Network and Ethereum's Plasma. They introduce a new layer to the blockchain network where transactions can be confirmed faster and at lower costs. However, these solutions come with their own complexities and potential security considerations, and their effectiveness relies on widespread adoption and use. Improving consensus algorithms may provide another path to tackling unconfirmed transactions. Consensus algorithms like Proof of Stake (PoS) or Delegated Proof of Stake (DPoS) offer faster transaction confirmation times compared to traditional Proof of Work (PoW) algorithms. These consensus algorithms prioritize energy efficiency and speed over computational power, enabling quicker transaction confirmations. However, these methods are also not without their own issues, including concerns over centralization and security. Unconfirmed transactions are a fundamental aspect of blockchain technology, reflecting the process of network consensus validation before a transaction is added to the public ledger. They exist as transactions that have not yet received network validation and inclusion in the blockchain. Unconfirmed transactions exhibit characteristics such as lack of confirmation on the blockchain, pending status in the mempool, and vulnerability to double-spending. Factors affecting the confirmation status include network congestion, transaction fees, confirmation policies, scalability limitations, and transaction prioritization. Risks associated with unconfirmed transactions encompass double-spending implications, security vulnerabilities, and scalability impact on confirmation. Addressing these challenges requires solutions such as higher transaction fees, transaction replacement mechanisms, off-chain solutions, layer 2 protocols, and improved consensus algorithms. These approaches aim to expedite confirmation, enhance security, and mitigate scalability issues. However, each solution has its own considerations and trade-offs.What Are Blockchain Unconfirmed Transactions?

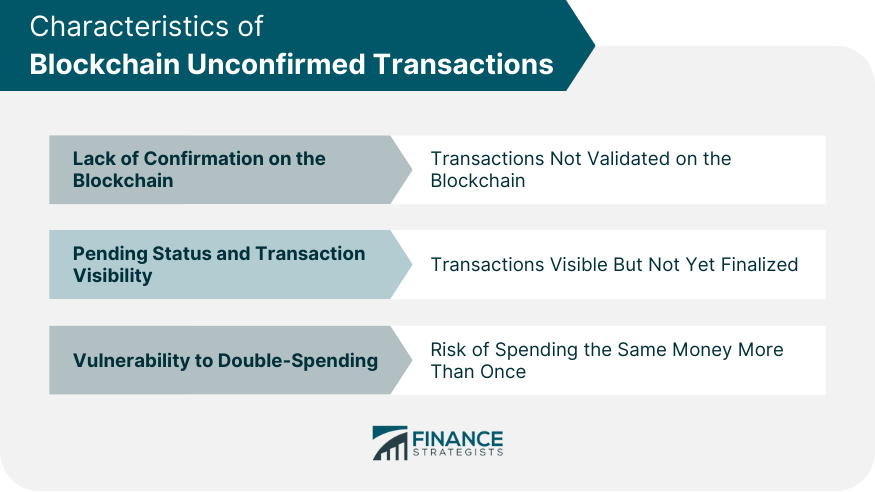

Characteristics of Blockchain Unconfirmed Transactions

Lack of Confirmation on the Blockchain

Pending Status and Transaction Visibility

Vulnerability to Double-Spending

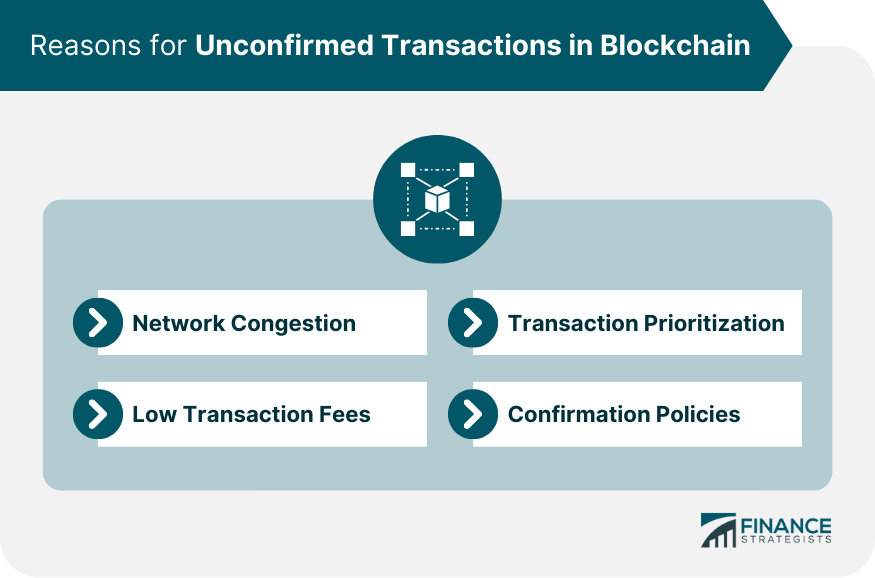

Reasons for Unconfirmed Transactions in Blockchain

Network Congestion and High Transaction Volume

Low Transaction Fees

Transaction Prioritization

Confirmation Policies

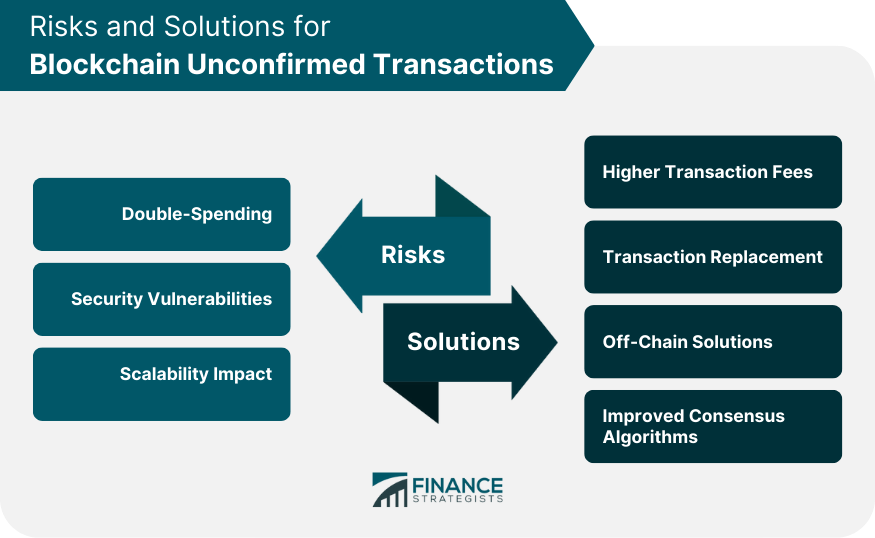

Risks of Blockchain Unconfirmed Transactions

Double-Spending Implications

Security Vulnerabilities

Scalability Impact on Confirmation

Solutions for Blockchain Unconfirmed Transactions

Higher Transaction Fees

Transaction Replacement Mechanisms

Off-Chain Solutions and Layer 2 Protocols

Improved Consensus Algorithms

Conclusion

Blockchain Unconfirmed Transaction FAQs

An unconfirmed transaction in the blockchain refers to a transaction that has been submitted to the network but has not yet been included in the blockchain. It remains in the mempool (pool of unconfirmed transactions) until a miner picks it up, validates it, and includes it in the next block.

Unconfirmed transactions happen due to factors such as network congestion, low transaction fees, transaction prioritization, and certain confirmation policies. In periods of high network activity, the transaction volume may exceed the network's capacity to promptly confirm all transactions.

Yes, unconfirmed transactions do pose some risks in the blockchain. These include the potential for double-spending, where the same digital currency can be spent twice, and various security vulnerabilities until the transaction is confirmed and added to a block.

Confirmation time can be sped up by increasing the transaction fee, which incentivizes miners to prioritize your transaction for validation. Additionally, some blockchains offer transaction replacement mechanisms and off-chain solutions to expedite the process.

Solutions for dealing with unconfirmed transactions include increasing transaction fees, using transaction replacement mechanisms, implementing off-chain solutions and Layer 2 protocols, and adopting improved consensus algorithms. These measures can help to manage unconfirmed transactions, making the blockchain more efficient and secure.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.