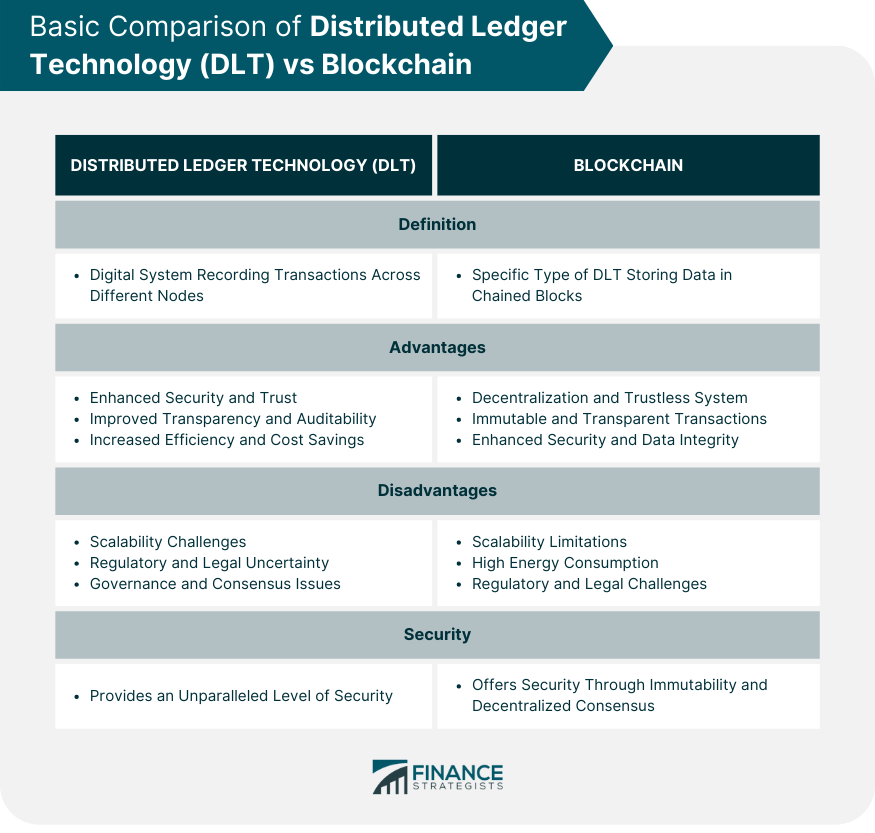

Distributed Ledger Technology (DLT) is a decentralized digital system that records and verifies transactions across multiple participants or nodes in a network. DLT enables secure, transparent, and tamper-resistant record-keeping, providing a foundation for various applications beyond just cryptocurrencies. It allows for simultaneous access, validation, and record updating in an immutable and decentralized manner across a network spread across multiple entities or locations. Blockchain technology is a type of DLT and was initially designed as a public ledger for Bitcoin transactions, its potential uses have since expanded far beyond cryptocurrencies. Blockchain's unique structure offers a secure, transparent, and decentralized way of recording and verifying transactions. While the terms DLT and blockchain are often used interchangeably, it is important to understand that all blockchains are DLTs, but not all DLTs are blockchains. The primary differentiating factor lies in the way the data is structured and stored in these systems. DLTs provide an unparalleled level of security compared to traditional data management systems. Given that the same data is stored across multiple nodes, it becomes incredibly difficult for malicious actors to alter information or carry out fraudulent activities. Each transaction is verified by these nodes before being added to the ledger, further strengthening the system's security. The decentralized nature of DLT also fosters a greater degree of trust among participants. As there is no central authority that can be compromised, users can trust that their transactions will be executed as intended. Furthermore, the transparency and immutability of DLT provide a trustworthy system where users can verify transactions independently, enhancing confidence in the system. DLT provides an enhanced level of transparency due to the shared and synchronized nature of the ledgers. All transactions are visible to the participants in the network, ensuring transparency and accountability. In addition, the immutability of transactions recorded on a distributed ledger provides a strong audit trail, making it easier to trace and verify historical data. This feature is especially valuable in industries like finance and supply chain, where transparency is crucial for trust and regulatory compliance. It enables stakeholders to track transactions or assets in real-time, reducing the possibility of discrepancies, misunderstandings, and fraud. The distributed nature of DLT eliminates the need for intermediaries, thus reducing operational costs and increasing efficiency. Transactions are processed and verified by consensus among network participants, leading to quicker settlements and fewer errors. Furthermore, by automating processes through smart contracts, DLT can streamline complex processes, enhancing efficiency, and reducing the need for manual intervention. Moreover, the reduction of intermediaries leads to significant cost savings, as fees usually associated with intermediation are avoided. This can be a game-changer for industries such as finance, where transaction costs can significantly impact profitability. The need for every node in the network to process every transaction and maintain a copy of the entire ledger can result in significant resource and storage requirements. This makes the system slower and less efficient as the number of participants or transactions increases. The consensus mechanisms used in DLTs can also contribute to scalability issues. These mechanisms, which are crucial for maintaining the integrity of the network, often require significant computational power and can slow down transaction processing time. Given that DLT is a relatively new technology, there is still a great deal of regulatory and legal uncertainty surrounding its use. Various jurisdictions are still figuring out how to regulate and classify DLT-based applications. This uncertainty can deter businesses and organizations from adopting the technology, as the potential legal implications and regulatory changes may pose a risk. This challenge extends to issues such as data privacy, cross-border transactions, and legal liability, which are yet to be fully addressed by existing legislation. Until there is clearer regulatory guidance, this uncertainty may continue to hinder broader adoption of DLT. Governance in DLT refers to the decision-making process related to changes in the network or protocol. In a decentralized system, reaching a consensus on these changes can be challenging, and disagreements can lead to splits, or "forks," in the network. For example, if network participants disagree on a proposed change, they may choose to continue operating under different versions of the protocol, resulting in a fork. This can cause disruptions in the network and can even lead to significant fluctuations in the value of a DLT-based asset. The decentralization inherent in blockchain technology eliminates the need for a central authority or intermediary. Instead, multiple participants maintain the ledger, and a consensus mechanism ensures that all copies of the ledger are consistent. This decentralization allows for a trustless system, in which parties do not need to trust each other but only the system itself. In this system, even if one node is compromised, the integrity of the entire network is not endangered, thanks to the consensus mechanism. Moreover, without the need for a third-party intermediary, transactions can be faster and cheaper, making the system more efficient overall. Blockchain's immutable nature provides an unalterable record of transactions, providing a high degree of security and trust in the data. Once a block has been added to the chain, the information it contains cannot be changed, making the system highly secure against fraud and manipulation. This immutability, combined with the transparency of the blockchain, ensures that every transaction is publicly verifiable, making the system very secure and reliable. In addition to its security benefits, blockchain's transparency can also enhance accountability and trust among network participants. This is particularly useful in industries like finance and supply chain management, where traceability and transparency are key requirements. As transactions are verified by network participants and then encrypted and linked to the preceding transaction, it becomes extremely difficult for anyone to alter or delete existing transactions. This inherent security makes blockchain technology suitable for a variety of applications beyond cryptocurrencies. For example, it can be used in healthcare to secure patient records, in supply chain management to track goods from origin to consumer, and in finance to execute and verify transactions. Blockchain technology faces significant scalability challenges. As the number of transactions on a blockchain increases, so does the size of the blockchain. This requires significant storage and computational resources, which can slow down transaction speeds and increase costs, making the system less efficient. In addition, the consensus mechanisms used in blockchains, such as proof-of-work, are resource-intensive and can further limit the scalability of the system. Although several solutions have been proposed to address these challenges, such as sharding or layer-2 solutions, they have yet to be proven at scale. One of the main criticisms of blockchain, particularly those using proof-of-work consensus mechanisms like Bitcoin, is their high energy consumption. The process of mining, where powerful computers compete to solve complex mathematical problems to add a new block to the chain, requires a significant amount of electricity. This has led to concerns about the environmental impact of blockchain technology, particularly in regions where the electricity used for mining is produced using fossil fuels. These environmental concerns may pose a barrier to the wider adoption of blockchain technology, particularly for organizations with sustainability goals. Due to its decentralized and global nature, it can be difficult to apply existing legal and regulatory frameworks to blockchain technology. This can lead to uncertainty and risks for businesses and users. In addition, blockchain's anonymity and lack of regulation make it a potential vehicle for illicit activities, such as money laundering or illegal trading. This has led some countries to ban or restrict the use of blockchain technology, further complicating the regulatory landscape. DLT and blockchain technologies both use consensus mechanisms to validate transactions and maintain the integrity of the system. However, the specific consensus mechanisms used can vary. Blockchain, for example, commonly uses proof-of-work or proof-of-stake mechanisms, which require participants to show evidence of computational work or ownership stake. In contrast, other DLTs may use different consensus mechanisms that are better suited to their specific applications. For example, some may use voting-based systems or rely on a selected group of trusted validators. These differences in consensus mechanisms can have significant implications for the system's scalability, security, and decentralization. Blockchain's scalability is often limited by its consensus mechanisms and the linear structure of its data, which requires every transaction to be added to the chain. This can lead to slower transaction speeds and higher resource requirements as the size of the blockchain increases. In contrast, some DLTs may have a more scalable structure, such as a directed acyclic graph (DAG), which allows for parallel transactions and potentially faster transaction speeds. However, these systems may also face their own scalability challenges, such as maintaining the integrity and security of the network as the number of participants grows. Both DLT and blockchain offer high levels of security due to their decentralized and transparent nature. However, the level of privacy provided can vary. In a public blockchain, all transactions are visible to all network participants, which may not be desirable for certain applications. In contrast, some DLTs can provide more privacy by allowing for private transactions or restricting who can participate in the network. However, this can also result in a trade-off with decentralization and transparency. DLT and blockchain are poised to revolutionize the financial services sector. They can provide faster and more secure transactions, reduce the need for intermediaries, and improve transparency and traceability. Applications range from cryptocurrencies and payment systems to smart contracts and decentralized finance (DeFi) platforms. For example, blockchain can streamline cross-border payments by eliminating the need for correspondent banking. DLT, on the other hand, can enhance the efficiency and transparency of securities settlement and trading. DLT and blockchain can also improve supply chain management by providing real-time, immutable records of goods as they move through the supply chain. This can increase transparency, improve traceability, and reduce fraud and counterfeiting. For instance, a blockchain-based system can provide a secure and verifiable record of a product's journey from origin to consumer. This can reassure consumers about the authenticity and quality of their purchases, and help businesses comply with regulations and standards. DLT and blockchain have significant potential in the healthcare sector. They can secure patient data, improve interoperability, and streamline administrative processes. For example, a blockchain-based system can provide a secure and tamper-proof record of a patient's medical history, which can be shared among healthcare providers to improve care coordination. DLT, meanwhile, can be used to track and verify the distribution of pharmaceuticals, reducing the risk of counterfeit medicines entering the supply chain. DLT and blockchain are transformative technologies that have the potential to disrupt many traditional industries. While they share common features such as decentralization, transparency, and security, they also have distinct characteristics and applications. DLT provides a flexible and potentially more scalable alternative to traditional databases, while blockchain's immutability and consensus mechanisms make it ideal for secure and transparent transactions. Despite their advantages, both technologies face significant challenges, including scalability issues, high energy consumption, and regulatory uncertainty. However, ongoing technological advances and regulatory developments may help to address these challenges and facilitate the wider adoption of DLT and blockchain. The choice between DLT and blockchain will largely depend on the specific requirements of the application. For applications that require high levels of transparency and security, such as cryptocurrencies or supply chain traceability, blockchain may be the better choice. On the other hand, for applications that require greater scalability or privacy, other types of DLT may be more suitable.Overview of DLT and Blockchain

Advantages of a DLT

Enhanced Security and Trust

Improved Transparency and Auditability

Increased Efficiency and Cost Savings

Disadvantages of DLT

Scalability Challenges

Regulatory and Legal Uncertainty

Governance and Consensus Issues

Advantages of Blockchain

Decentralization and Trustless System

Immutable and Transparent Transactions

Enhanced Security and Data Integrity

Disadvantages of Blockchain

Scalability Limitations

Energy Consumption

Regulatory and Legal Challenges

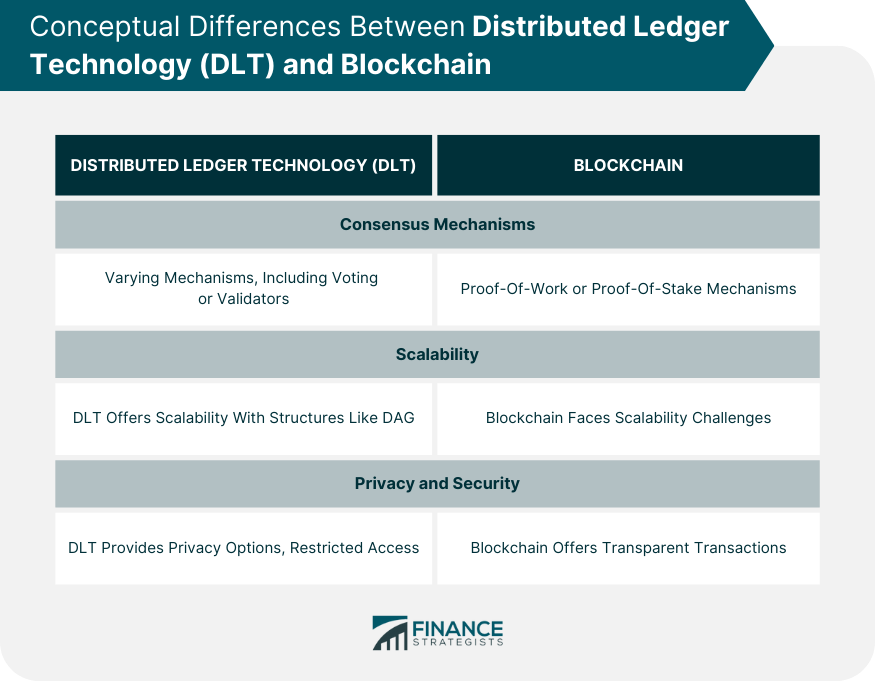

Conceptual Differences Between DLT and Blockchain

Consensus Mechanisms

Scalability

Privacy and Security

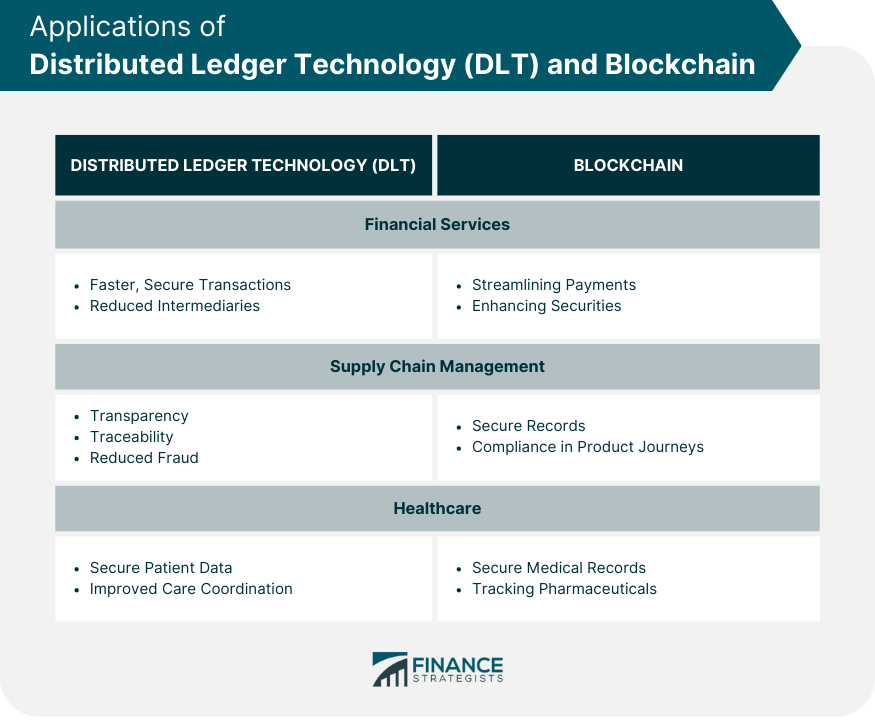

Applications of DLT and Blockchain

Financial Services

Supply Chain Management

Healthcare

Conclusion

DLT vs Blockchain FAQs

DLT and blockchain are often used interchangeably, but they are not exactly the same. DLT is a broader category of technologies that distribute data, assets, and transactions across a decentralized network. Blockchain is a type of DLT that stores data in a linear chain of blocks. All blockchains are DLTs, but not all DLTs are blockchains.

Yes, both DLT and blockchain offer high levels of security. They use cryptographic algorithms to secure data and transactions, and their decentralized nature reduces the risk of single points of failure. However, they are not immune to all types of attacks, and their security largely depends on the specific design and implementation of the system.

DLT and blockchain have many potential use cases across different industries. In the financial services sector, they can be used for cryptocurrencies, payment systems, and securities trading. In supply chain management, they can provide traceability and transparency. In healthcare, they can secure patient data and streamline administrative processes.

DLT and blockchain face several challenges, including scalability issues, high energy consumption, and regulatory uncertainty. Scalability is a particular challenge for blockchain, as the size of the blockchain increases with the number of transactions. Regulatory uncertainty also poses a risk, as the legal and regulatory frameworks for DLT and blockchain are still evolving.

While it is difficult to predict the future with certainty, DLT and blockchain are expected to play a significant role in the digital transformation of various sectors. As these technologies continue to evolve, they are likely to provide new opportunities for innovation and efficiency. However, their widespread adoption will depend on overcoming the existing challenges and proving their value in real-world applications.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.