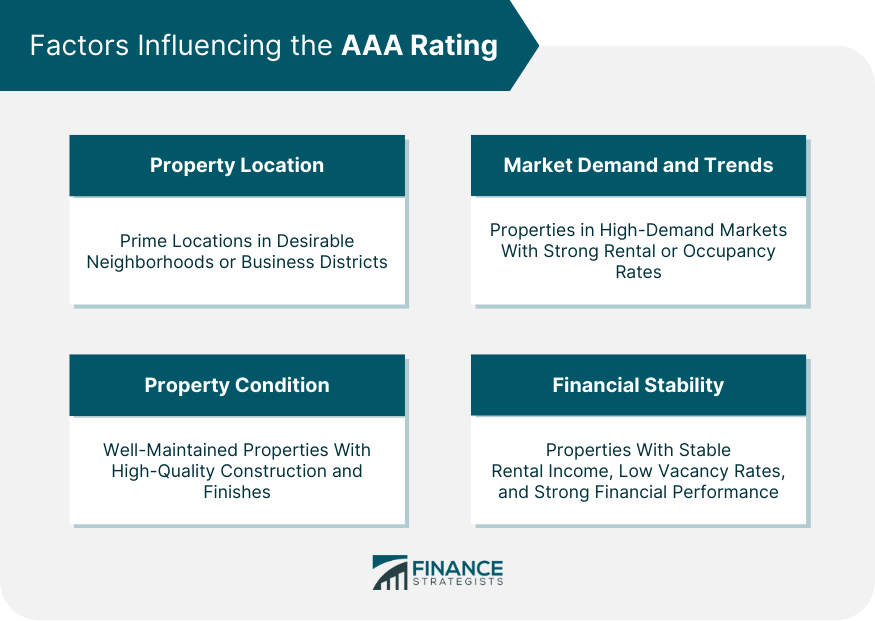

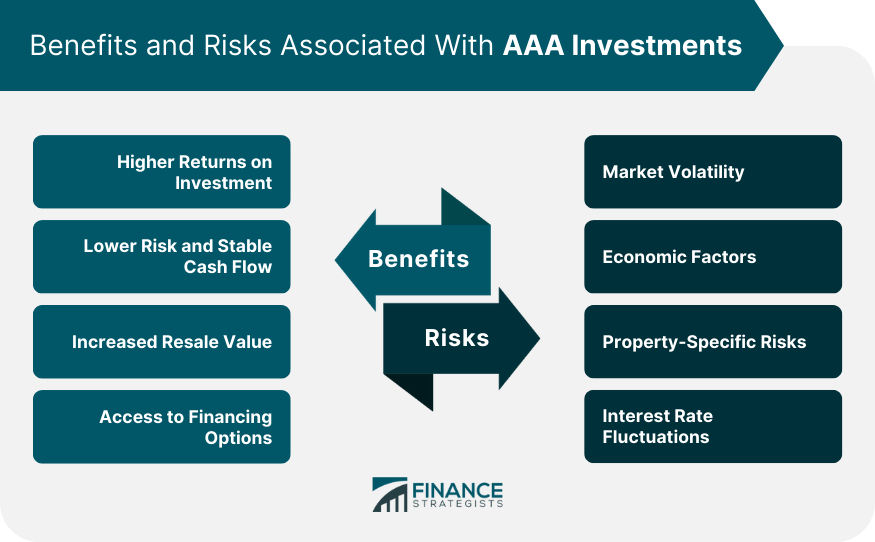

AAA in real estate investment refers to the highest rating given to properties based on their quality, location, financial stability, and market demand. AAA-rated properties are considered prime investments and represent the highest level of quality and desirability in the real estate market. The AAA rating signifies that a property has met stringent criteria and is deemed to have exceptional attributes that make it a top-tier investment. Investors often seek AAA-rated properties as they offer the potential for higher returns, lower risk, and increased market value compared to properties with lower ratings. To achieve a AAA rating, properties are evaluated based on various factors, including location, condition, market demand, financial stability, and overall investment potential. The rating is typically assigned by independent rating agencies or institutions that specialize in assessing real estate investments. AAA ratings for properties are influenced by several key factors that contribute to their desirability and investment appeal. Prime locations in desirable neighborhoods or central business districts often command higher ratings due to their proximity to amenities, transportation hubs, employment centers, and quality of life factors. The condition and quality of a property are essential considerations for its rating. AAA-rated properties are typically well-maintained, structurally sound, and exhibit high-quality construction and finishes. Properties with modern infrastructure, energy-efficient features, and advanced technology may also receive higher ratings. The level of market demand and current trends in the real estate industry impact a property's rating. Properties located in markets with high demand, strong rental or occupancy rates, and positive growth potential are more likely to achieve AAA ratings. The financial stability and performance of a property, including its income generation, cash flow, and overall financial health, are critical factors in determining its rating. Properties with stable and consistent rental income, low vacancy rates, and strong financial projections are more likely to receive AAA ratings. Investing in AAA properties offers several advantages that make them attractive to investors. AAA-rated properties have the potential to deliver higher returns on investment due to their desirability and market demand. These properties often command premium rental rates and have the potential for appreciation, resulting in increased cash flow and capital gains for investors. Their prime locations, strong market demand, and high-quality attributes provide stability and reduce the risk of prolonged vacancies or fluctuating rental income. This stability ensures a consistent and reliable cash flow for investors. AAA-rated properties tend to have higher resale values compared to properties with lower ratings. Their desirable locations, superior quality, and market appeal make them sought-after assets in the real estate market. This increased demand can lead to greater appreciation in property value and the potential for higher profits upon resale. Investing in AAA-rated properties can provide investors with easier access to financing options. Lenders view these properties as lower-risk investments, making it more likely for investors to secure favorable loan terms, higher loan amounts, and lower interest rates. While AAA investments offer several benefits, it is important to be aware of the potential risks and challenges. AAA-rated properties are still subject to market volatility. Economic downturns, changes in supply and demand, and shifts in market conditions can impact property values and rental income, potentially affecting investment returns. The overall economic climate can influence the performance of AAA investments. Factors such as interest rates, inflation, and unemployment rates can impact property values, rental rates, and cash flow. Each property carries its own unique risks that investors must consider. These may include unforeseen maintenance or repair costs, tenant turnover, lease defaults, or changes in local regulations that affect property operations. Fluctuations in interest rates can impact the affordability of financing and the cost of debt for investors. Rising interest rates can increase borrowing costs, potentially affecting cash flow and investment returns. To identify AAA investment opportunities, investors can employ several strategies. Thorough research and analysis of real estate markets, including studying market trends, rental rates, vacancy rates, and economic indicators, can help identify areas with potential AAA properties. Collaborating with real estate professionals, such as brokers, agents, and investment advisors, can provide valuable insights and access to off-market or pre-market AAA investment opportunities. Building a network of industry connections, including fellow investors, developers, and professionals in the real estate sector, can provide access to information, off-market deals, and potential partnerships that can lead to AAA investments. This includes conducting property inspections, reviewing financial statements, analyzing market data, and assessing the overall investment potential and risks associated with the property. AAA refers to the highest rating given to properties in real estate investment. It signifies properties that meet stringent criteria and are considered prime investments due to their quality, desirability, and investment potential. Several factors influence the AAA rating of properties. The location plays a crucial role, with prime locations in desirable neighborhoods or central business districts commanding higher ratings. Investing in AAA-rated properties offers several benefits to investors. These properties have the potential to deliver higher returns, provide lower risk and stable cash flow, and an increased resale value. Considering AAA properties is important for real estate investors seeking stable and potentially lucrative investments. These properties offer a level of security and reliability that can mitigate risks and enhance returns.What Is AAA?

Factors Influencing the AAA Rating

Property Location

Property Condition

Market Demand and Trends

Financial Stability

Benefits of Investing in AAA Properties

Higher Returns on Investment

Lower Risk and Stable Cash Flow

Increased Resale Value

Access to Financing Options

Risks Associated With AAA Investments

Market Volatility

Economic Factors

Property-Specific Risks

Interest Rate Fluctuations

Strategies for Identifying AAA Investment Opportunities

Research and Analysis

Working With Real Estate Professionals

Networking and Industry Connections

Due Diligence and Risk Assessment

Final Thoughts

AAA FAQs

AAA stands for the highest rating given to properties based on their quality, desirability, and investment potential.

AAA ratings are typically assigned by independent rating agencies or institutions specializing in real estate investment assessments. They evaluate properties based on various criteria, including location, condition, market demand, and financial stability.

While AAA-rated properties are considered low-risk investments, they are still subject to market volatility, economic factors, and property-specific risks. Investors should conduct thorough due diligence to assess the potential risks associated with each property.

AAA-rated properties have the potential to deliver higher returns due to their desirability, stable cash flow, and market demand. However, returns are influenced by various factors and are not guaranteed.

Investors can find AAA investment opportunities by conducting research and analysis, working with real estate professionals, networking within the industry, and performing due diligence to identify properties that meet the criteria for AAA ratings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.