Amortizable bond premiums refer to the portion of the premium paid by an investor for purchasing a bond that is deductible over the life of the bond. When an investor buys a bond at a price higher than its face value or par value, the difference between the purchase price and the face value is known as the bond premium. This premium represents an additional cost to the investor but provides a higher yield compared to bonds purchased at face value. To account for the premium paid on a bond, the investor has the option to amortize or spread out the deduction of the premium over the remaining term of the bond. By doing so, the investor can reduce their taxable income each year by deducting a portion of the bond premium as an amortized expense. In the context of wealth management and bond investing, understanding and managing amortizable bond premiums is essential, as they can impact the bond's yield, tax implications, and overall investment strategy. When an investor buys a bond at a price higher than its face value, they are effectively paying a premium for that bond. This premium often arises because the bond's coupon rate (interest rate) is higher than the current market rate, making it more attractive to investors. Bond prices and interest rates share an inverse relationship. When interest rates decrease, bond prices increase, and vice versa. This is because investors are willing to pay more for bonds with higher coupon rates, as they provide a greater return on investment compared to the lower market rates. The yield to maturity is the total return an investor can expect if they hold the bond until it matures. When a bond is purchased at a premium, the YTM will be lower than the coupon rate, as the investor has paid more for the bond than they will receive back at maturity. The constant yield method is the most commonly used method for calculating amortizable bond premiums. This method involves spreading the premium over the bond's remaining life using an effective interest rate. The annual bond premium amortization is calculated by multiplying the bond's adjusted cost basis by its effective interest rate and subtracting the annual interest payment. This is done each year until the bond matures. The updated bond cost basis is calculated by subtracting the annual bond premium amortization from the initial cost basis. This updated cost basis is then used to calculate the amortization for the following year. The straight-line method is a simpler alternative to the constant yield method. This method involves dividing the total bond premium by the number of years until maturity and amortizing the same amount each year. The annual bond premium amortization is calculated by dividing the total bond premium by the number of years until maturity. The updated bond cost basis is calculated by subtracting the annual bond premium amortization from the initial cost basis. Both methods have their advantages and disadvantages. The constant yield method provides a more accurate reflection of the bond's yield, while the straight-line method is simpler and easier to understand. Investors should consider their specific investment objectives and tax situation when choosing the appropriate method. Interest income from bonds is generally subject to federal income tax. However, some bonds, such as municipal bonds, may be exempt from federal and state taxes. Understanding the tax implications of your bond investments is crucial for effective wealth management. The Internal Revenue Service (IRS) allows investors to deduct the annual amortization of bond premiums from their taxable income. This effectively reduces the amount of taxable interest income, leading to potential tax savings. Investors must report bond interest income and bond premium amortization on their annual tax returns. Proper recordkeeping and understanding the reporting requirements are essential to ensure compliance with tax laws. A diversified bond portfolio is essential to managing risk and maximizing returns. Including bonds with varying coupon rates, maturities, and credit ratings can help investors achieve a balanced portfolio that takes advantage of amortizable bond premiums while managing interest rate risk. Investors should consider the tax implications of their bond investments when developing a wealth management strategy. By selecting bonds with favorable tax treatment, such as municipal bonds, and managing bond premium amortization, investors can optimize their portfolios for tax efficiency. Interest rate fluctuations can significantly impact bond prices and returns. Investors should monitor interest rate trends and adjust their bond portfolios accordingly. This may involve reallocating investments towards bonds with lower sensitivity to interest rate changes or utilizing other financial instruments, such as interest rate swaps, to hedge against interest rate risk. Understanding amortizable bond premium is crucial in wealth management, as it significantly influences bond yields, tax implications, and overall investment strategies. By grasping the concept of bonds sold at a premium and the relationship between bond prices and interest rates, investors can better comprehend the bond market. The constant yield and straight-line methods are used to calculate amortizable bond premium, with each method having its advantages and disadvantages. Considering the tax implications of bond income and managing bond premium amortization are vital for tax-efficient investing. Implementing wealth management strategies that involve diversification, tax efficiency, and interest rate risk management can optimize bond portfolios and enhance overall returns. By learning from real-life examples and case studies, investors can develop a comprehensive understanding of amortizable bond premium and its role in successful wealth management strategies.Definition of Amortizable Bond Premiums

How Amortizable Bond Premiums Arise

Bonds Sold at a Premium

Relationship Between Bond Price and Interest Rates

Yield to Maturity (YTM)

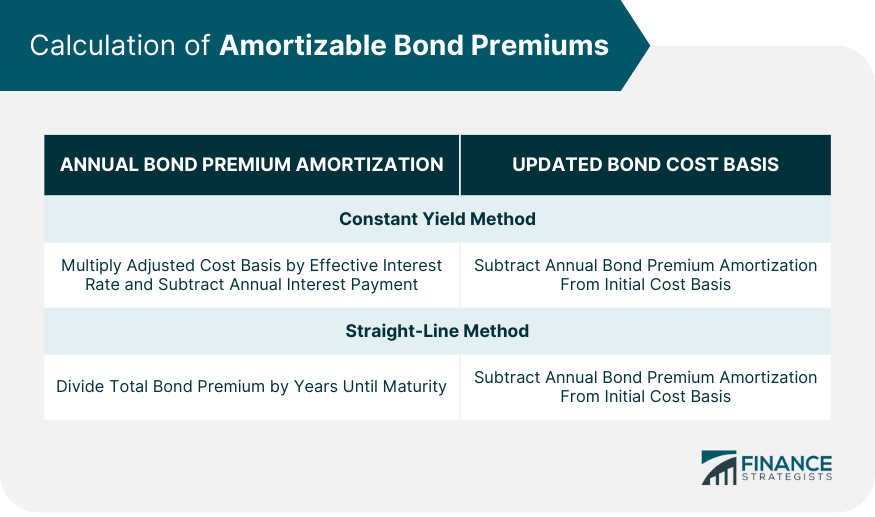

Calculation of Amortizable Bond Premiums

Constant Yield Method

Annual Bond Premium Amortization

Updated Bond Cost Basis

Straight-Line Method

Annual Bond Premium Amortization

Updated Bond Cost Basis

Comparison of Methods and Choosing the Right One

Tax Implications of Amortizable Bond Premiums

Taxation of Bond Income

Amortization as a Deduction

Reporting Requirements on Tax Returns

Wealth Management Strategies Involving Amortizable Bond Premiums

Diversification of Bond Portfolio

Tax-Efficient Investing

Managing Interest Rate Risk

Conclusion

Amortizable Bond Premium FAQs

An amortizable bond premium is the excess amount paid for a bond over its face value when purchased at a higher price. It is important in wealth management because it impacts the bond's yield, tax implications, and overall investment strategy.

To calculate the amortizable bond premium using the constant yield method, multiply the bond's adjusted cost basis by its effective interest rate and subtract the annual interest payment. This process is repeated each year until the bond matures.

To calculate the amortizable bond premium using the straight-line method, divide the total bond premium by the number of years until maturity. The result is the annual bond premium amortization, which remains the same each year.

The Internal Revenue Service (IRS) allows investors to deduct the annual amortization of bond premiums from their taxable income, effectively reducing the amount of taxable interest income. Proper reporting of bond interest income and bond premium amortization is required on annual tax returns.

Investors can incorporate amortizable bond premium management into their wealth management strategies by diversifying their bond portfolios, considering the tax implications of their investments, and managing interest rate risk. This can help optimize bond portfolios, minimize tax liabilities, and achieve better overall returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.