In a recession, investors often turn to bonds, particularly government bonds, as safer investments. The shift from stocks to bonds can increase bond prices, reduce portfolio volatility, and provide a predictable income. However, drawbacks include lower yield potential, default risks, and interest rate risks. Different bonds have varying advantages and risks. Government bonds are safest, corporate bonds offer higher yields but carry more risk, municipal bonds provide tax advantages and relative safety, and high-yield bonds have the highest yields and risks. Factors to consider when investing in bonds during a recession include risk tolerance, recession duration, economic outlook, and the bond issuer's financial health. Bonds typically have a fixed interest rate, known as the coupon rate, which is based on the creditworthiness of the issuer and prevailing market interest rates at the time of issuance. The bond's price fluctuates based on market conditions, such as changes in interest rates or the issuer's financial health. As interest rates decrease, the value of existing bonds (with their higher coupon payments) increases, and vice versa. The economy moves in a cyclical pattern known as the business cycle, which includes periods of expansion and contraction (recession). During expansions, the economy grows in terms of jobs, income, production, and sales. Conversely, during a recession, these indicators contract. Understanding the business cycle is essential because different investments perform better at different stages of the cycle. Bonds, particularly government bonds, are often seen as safer investments during recessions. When the economy is in a downturn, investors may shift their portfolios towards bonds as a "flight to safety" to protect their capital. This shift increases the demand for bonds, raising their price but reducing their yield. During a recession, investors tend to follow the "flight to safety" strategy, moving their capital from riskier assets like stocks to safer ones like bonds. This is due to the expectation that companies may perform poorly during a recession, affecting stock prices, while bonds, especially those issued by governments, offer fixed interest payments and are backed by the full faith and credit of the government. In response to recessions, central banks often implement monetary policies such as reducing interest rates to stimulate the economy. Lower interest rates make borrowing cheaper, encouraging spending and investment. This policy tends to increase bond prices, as newly issued bonds have lower coupon rates, making existing bonds more attractive. Bonds also serve as a crucial tool for portfolio diversification. Holding bonds alongside other assets like stocks can reduce portfolio risk because bonds and stocks often move in opposite directions. During a recession, the value of bonds might increase as interest rates fall, offsetting potential losses from stocks. Government bonds are considered the safest type of bond, as they are backed by the full faith and credit of the issuing government. They are an attractive option during a recession due to their safety and reliability. Corporate bonds can offer higher yields than government bonds, compensating for the higher risk. During a recession, it's particularly important to focus on bonds issued by financially strong companies that are likely to withstand economic downturns. Municipal bonds, issued by state and local governments, can also be an attractive option. They offer tax advantages and while they may not provide as high yields as corporate bonds, they tend to be safer. High-yield bonds, also known as junk bonds, offer the highest yields but also come with the highest risk. These can be risky during a recession, as the issuing companies may face financial difficulties. The best type of bond for you during a recession depends on your risk tolerance, investment goals, and the specific conditions of the recession. Understanding your own risk tolerance is crucial when investing in bonds during a recession. More risk-averse investors may prefer safer options like government bonds, while risk-tolerant investors may be willing to take on more risk for higher potential returns. The length of the recession can also affect bond performance. A short-lived recession may have a different impact on bonds than a longer, more drawn-out recession. The broader economic outlook can influence bond performance. Understanding future economic trends and central bank policies can help in making more informed investment decisions. It's essential to evaluate the financial health of the bond issuer, especially when considering corporate bonds. Stronger companies are more likely to meet their debt obligations even during a recession. As investors seek safer assets during a recession, the demand for bonds typically increases. This increased demand can drive up the price of existing bonds, especially those with higher interest rates compared to new bonds being issued. Bonds are generally less volatile than stocks. Adding bonds to a portfolio can reduce overall volatility, providing a cushion against the steep declines in stock prices that often occur during a recession. Bonds offer regular interest payments, providing a steady income stream that can be especially valuable during a recession when other income sources may be unstable. While bonds are generally safer than stocks, they also offer lower potential returns. The interest rate of bonds is usually lower than the potential returns from stocks, particularly over the long term. During a recession, the risk of bond issuers defaulting on their debt payments can increase, especially for corporate bonds. If a company's revenues decline due to a weak economy, it may struggle to meet its debt obligations. While falling interest rates during a recession can increase the price of existing bonds, they can also lead to reinvestment risk. When a bond matures, the investor may have to reinvest the principal in new bonds that offer lower yields. Some investors might find opportunities in the stock market during a recession. Companies with solid financials and a robust business model may be undervalued during a downturn, offering the potential for high returns as the economy recovers. Real estate can also offer opportunities during a recession. Property prices might drop, providing opportunities to buy at lower prices. Gold and other precious metals often serve as a hedge against economic uncertainty. During a recession, these assets can help protect a portfolio's value. Holding cash or cash equivalents during a recession provides liquidity and flexibility, allowing investors to quickly take advantage of investment opportunities as they arise. Different investment strategies are suitable for different investors, depending on their risk tolerance, investment goals, and the specifics of the recession. It's important to have a diversified portfolio and make investment decisions that align with your individual circumstances. Investing during a recession presents unique challenges and opportunities, with bonds often playing a critical role as a relatively safe haven in a stormy market. From a theoretical perspective, bonds serve as a diversification tool and can offer increased value, reduced portfolio volatility, and a regular income stream during a recession. However, they're not without risks, including lower yield potential, risk of default, and interest rate risks. The best types of bonds to consider during a recession depend on your risk tolerance, the duration of the recession, the economic outlook, and the bond issuer's financial health. Moreover, it's worth exploring alternative investment strategies such as investing in stocks, real estate, gold, and precious metals or holding cash and cash equivalents. Navigating the complex landscape of investing during a recession can be challenging. If you're unsure of the best approach for your specific circumstances, consider seeking professional guidance from wealth management services.Are Bonds Good During a Recession?

Understanding the Relationship Between Bonds and Recessions

How Bonds Work

Business Cycle: Expansion and Recession

Correlation Between Bonds and Recessions

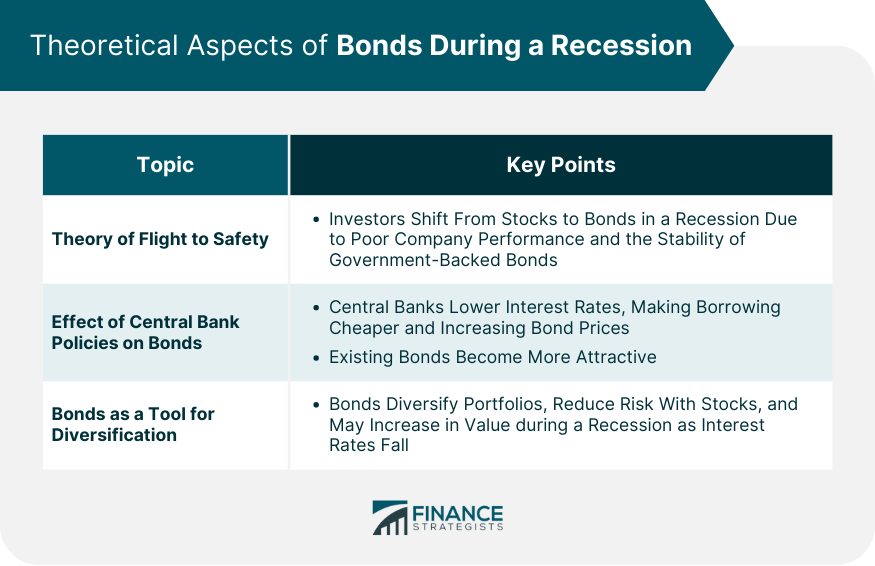

Theoretical Aspects of Bonds During a Recession

Theory of Flight to Safety

Effect of Central Bank Policies on Bonds During Recessions

Bonds as a Tool for Diversification

Types of Bonds to Consider During a Recession

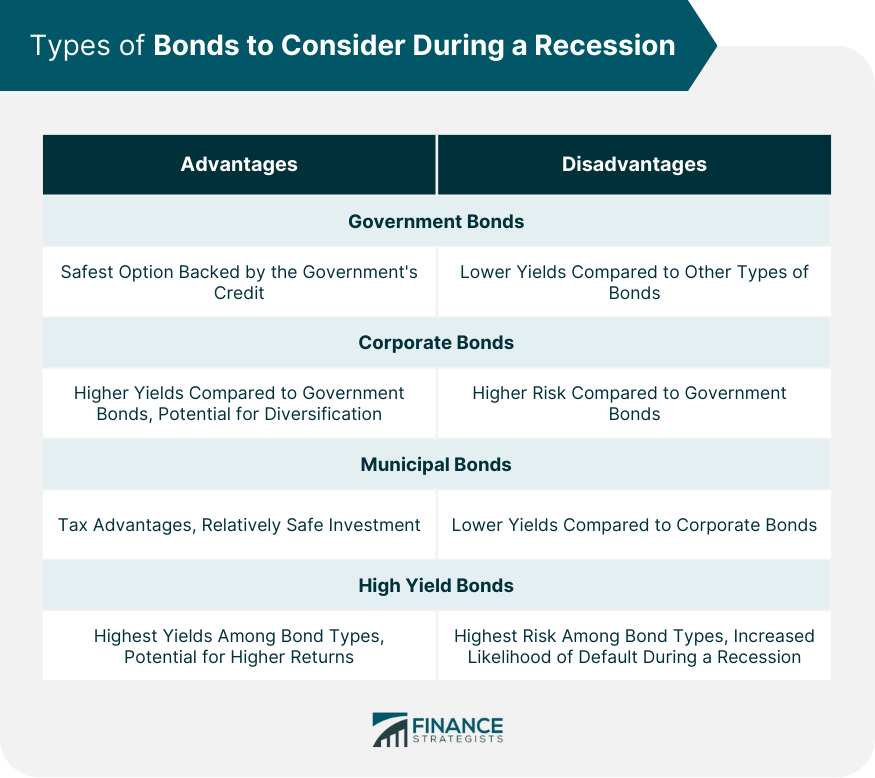

Government Bonds

Corporate Bonds

Municipal Bonds

High-Yield Bonds

Comparison and Suitability

Factors to Consider When Investing in Bonds During a Recession

Investor's Risk Tolerance

Duration of the Recession

Economic Outlook and Predictions

Financial Health of the Bond Issuer

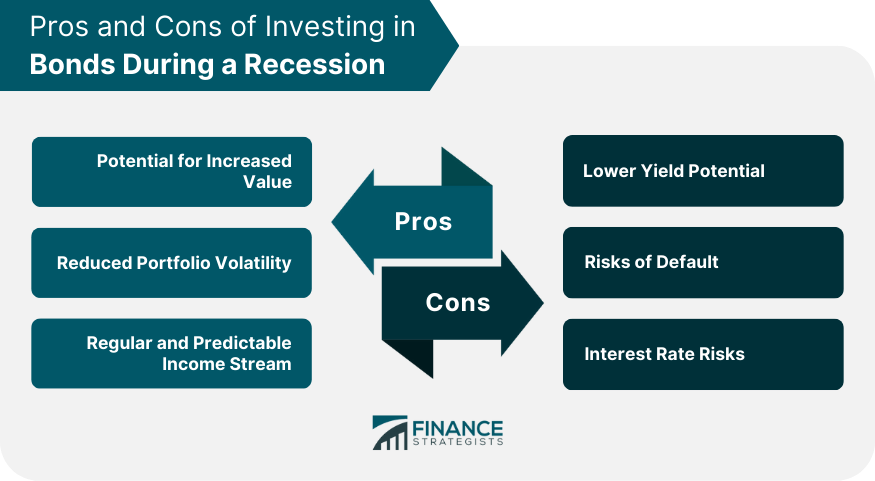

Pros of Investing in Bonds During a Recession

Potential for Increased Value

Reduced Portfolio Volatility

Regular and Predictable Income Stream

Cons of Investing in Bonds During a Recession

Lower Yield Potential

Risks of Default

Interest Rate Risks

Alternative Investment Strategies During a Recession

Investing in Stocks

Real Estate Investment

Gold and Precious Metals

Cash and Cash Equivalents

Comparison and Suitability

Bottom Line

Are Bonds Good During a Recession? FAQs

Yes, bonds are generally considered a good investment during a recession due to their relative stability and predictable income stream. However, the suitability of bonds depends on various factors, including the investor's risk tolerance and the specifics of the recession.

Bonds, particularly government bonds, are often seen as safer investments during a recession due to their regular interest payments and the fact that they are less volatile compared to other assets like stocks.

Yes, while bonds are generally safer, there are risks involved. These include interest rate risk, reinvestment risk, and the risk of the bond issuer defaulting on their debt obligations.

Government bonds are typically the safest option during a recession. However, corporate and municipal bonds can also be considered, depending on the investor's risk tolerance and the financial health of the bond issuer.

Bonds are typically seen as safer during a recession, offering more stability and less volatility. However, some stocks might be undervalued during a downturn and can offer higher potential returns as the economy recovers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.