In financial parlance, the term "at par" represents equality between the face value or par value of a security and its market price. This suggests that the market value of the security is neither less nor more than its face value. This concept is crucial to bond and stock investors and issuers as it influences financial decisions, returns, and the overall health of a portfolio. The term "par" has Latin roots, originating from the word "par," meaning equal. This equality extends to the realm of finance, where it signifies the equilibrium between a security's face value and market price. Traditionally, the term was printed on the face of physical securities, which gave rise to the concept of face value or par value. Several financial terms orbit around the concept of "at par." These include: 1. "Below Par": A term used when the market value of a security is less than its face value. 2. "Above Par": This signifies that the market value of a security exceeds its face value. 3. "Par Value": The nominal or face value of a bond, share of stock, or coupon as indicated on the bond or stock certificate itself. 4. "Market Value": This is the price at which a security is currently trading in the market. Par value, also known as face value or nominal value, is the value of a bond, share, or other financial instrument as stated by the issuer. For bonds, it is the amount paid to the bondholder at maturity, and for shares, it's the minimum price at which a share can be issued. Although it seems like a simple concept, understanding the par value is crucial for any investor. Par value serves as a significant reference point for the pricing of financial instruments. In the context of bonds, par value is the amount that will be returned to investors upon maturity. For equities, par value sets the minimum issuance price to maintain the capital structure of a company. Understanding the par value of financial instruments can assist investors in calculating their potential returns and evaluating their investment risks. While par value is the face value of a financial instrument, market value is the price at which the instrument is traded in the market. Market value is influenced by various factors, including interest rates, inflation, political stability, and market demand. Conversely, par value remains constant unless there's a corporate action like a stock split. Bonds are issued with a fixed par value—typically in denominations of $1,000 or $100—and a fixed interest rate. The bond's market price can fluctuate based on interest rates, credit ratings, and other factors. However, a bond is said to be trading "at par" when its market price equals its face value. Various elements can influence whether a bond trades at par. These include interest rates, the issuer's creditworthiness, and the time remaining until maturity. If prevailing interest rates rise above the bond's coupon rate, the bond will likely trade below par. If they drop below the coupon rate, the bond will likely trade above par. The relationship between par value and maturity date for bonds is direct and straightforward. At the bond's maturity date, the issuer returns the bond's par value to the bondholder, regardless of the price at which the bondholder purchased the bond. Preferred stocks also have a par value, which is used to calculate dividends. While common stocks can be issued without a par value, preferred stocks almost always carry a par value. The primary reason is that the dividends paid to preferred shareholders are a percentage of the par value. When the market price of the preferred stock equals its par value, it is said to be trading at par. Preferred shareholders receive dividends before common shareholders. The dividend rate is typically a percentage of the par value. For example, if a preferred stock has a par value of $100 and a dividend rate of 5%, the shareholder would receive $5 in dividends annually. Apart from bonds and preferred stocks, other debt instruments such as debentures, notes payable, mortgages and bank loans also carry a par value. The interest on these debt instruments is usually a percentage of the par value. Like bonds and preferred stocks, these instruments are said to be trading at par when their market price equals their face value. When a security is trading "at par," it means the market price is identical to its face value. For instance, a bond with a par value of $1000, trading at $1000, is trading at par. A security trades "above par" or "at a premium" when its market price is higher than the face value. If our hypothetical $1000 bond is trading at $1050, it is trading above par. Conversely, a security trades "below par" or "at a discount" when its market price is less than the face value. If our $1000 bond is trading at $950, it is trading below par. The main factors that influence whether a security trades at, above, or below par include interest rates, the creditworthiness of the issuer, and the time left until the security matures. Interest rates have an inverse relationship with bond prices. When interest rates rise, bond prices fall (below par), and when interest rates decrease, bond prices rise (above par). This is because as interest rates increase, new bonds come to market paying higher coupon rates, making the older, lower-yielding bonds less attractive. Issuer creditworthiness can also impact the trading price. If the issuer's credit rating decreases, the perceived risk increases, causing the bond to trade below par. Conversely, an improved credit rating can cause the bond to trade above par. Finally, as a bond nears its maturity date, its market price tends to gravitate toward its par value, regardless of whether it was previously trading above or below par. For investors, a bond trading above par could mean that its coupon rate is higher than current market interest rates. It might be a good buy if they believe rates will remain low. However, the bond is more expensive than the return at maturity. A bond trading below par is cheaper than its face value. It may suggest a potential bargain if the investor believes the issuer's creditworthiness will improve or if they predict a rise in interest rates. However, it does indicate that the bond carries a higher risk. The relationship between interest rates and the trading of bonds at par is inverse. When prevailing market interest rates rise above the bond's coupon rate, the bond price will generally fall below par, since investors can buy new bonds that pay a higher interest rate. Conversely, when market interest rates fall below the coupon rate, the bond's price will generally rise above par, as it pays a higher interest rate than new bonds being issued. Prevailing interest rates heavily impact the prices of bonds and other debt securities. As interest rates rise, bond prices fall, causing them to trade below par. When interest rates decrease, bond prices increase, resulting in bonds trading above par. This phenomenon is essential for investors to understand, as interest rate movements can significantly affect their investment portfolios. While interest rate fluctuations significantly affect a bond's market value, they do not impact the par value. The par value of a bond remains constant and is the amount returned to the bondholder at maturity. However, the market value fluctuates with changes in interest rates. If interest rates rise, the market value decreases, and if they fall, the market value increases. The role of credit ratings in at par trading is crucial. Credit ratings serve as evaluations of an issuer's creditworthiness, assessing their likelihood to repay debt. These ratings, assigned by reputable agencies like Standard & Poor's, Moody's, and Fitch Ratings, carry significant weight in the financial markets. Investors closely consider credit ratings as they impact the price of bonds and whether they trade at, above, or below par. Bonds from issuers with higher credit ratings tend to trade at or above par, indicating lower risk. Conversely, bonds with lower credit ratings often trade below par, indicating higher risk. Therefore, credit ratings play a fundamental role in determining the trading dynamics of bonds and guiding investment decisions. The financial concept of "At Par" signifies the situation where a security's market price equals its face value. This fundamental principle plays a pivotal role in how various financial instruments, such as bonds, preferred stocks, and other debt securities, are traded in the market. The impact of interest rates is particularly noteworthy, given its inverse relationship with bond prices. An increase in interest rates generally leads to bonds trading below par, while a decrease can result in bonds trading above par. The role of credit ratings is crucial in whether securities trade at, above, or below par. Investors must consider these factors, along with the issuer's creditworthiness and time to maturity, when determining an investment strategy. Understanding the concept of 'At Par' is crucial for novice and experienced investors. For further assistance in navigating the intricacies of finance, consider seeking professional wealth management services to help optimize your investment decisions.What Is At Par?

Key Terms Related to At Par

Understanding Par Value

Importance of Par Value in Financial Instruments

Difference Between Par Value and Market Value

Financial Instruments Traded At Par

Bonds

How Bonds Are Traded at Par

Factors Influencing Bonds Trading At Par

Relationship Between Par Value and Maturity Date for Bonds

Preferred Stocks

Trading of Preferred Stocks At Par

Dividends and Par Value for Preferred Stocks

Other Debt Instruments

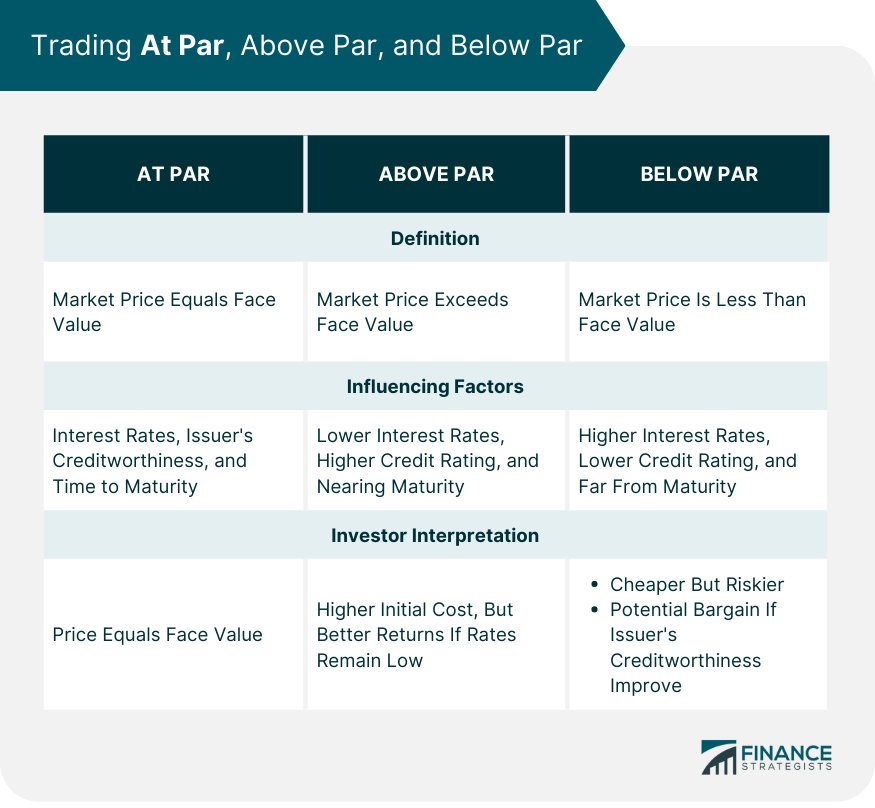

Trading At Par, Above Par, and Below Par

Factors Leading to a Security Trading At, Above, or Below Par

How to Interpret when a Security is Trading At Par, Above Par, and Below Par

Impact of Interest Rates on At Par Trading

Explanation of the Relationship Between Interest Rates and At Par Trading

Impact of Prevailing Interest Rates on Bonds and Other Securities Trading At Par

How Interest Rate Fluctuations Affect the Market Value and Par Value

Role of Credit Ratings in At Par Trading

Final Thoughts

At Par FAQs

When a bond is trading 'At Par,' it means the bond's market price is equal to its face value.

The concept of 'At Par' plays a significant role in the trading of financial instruments. If security is trading 'At Par,' it indicates that the market price is equal to its face value.

Several factors can cause a bond to trade 'At Par,' including interest rates equivalent to the bond's coupon rate, a stable credit rating of the issuer, and the bond is close to its maturity date.

Trading 'At Par' means the security's market price equals its face value. 'Above Par' indicates the market price is higher than the face value, while 'Below Par' means the market price is lower than the face value.

Interest rates have an inverse relationship with bond prices. When interest rates rise, bonds often trade below par. Conversely, when interest rates fall, bonds usually trade above par.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.