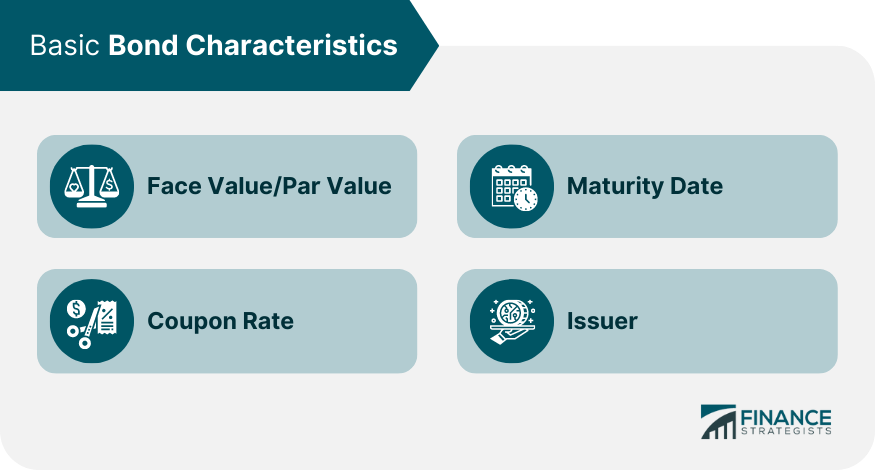

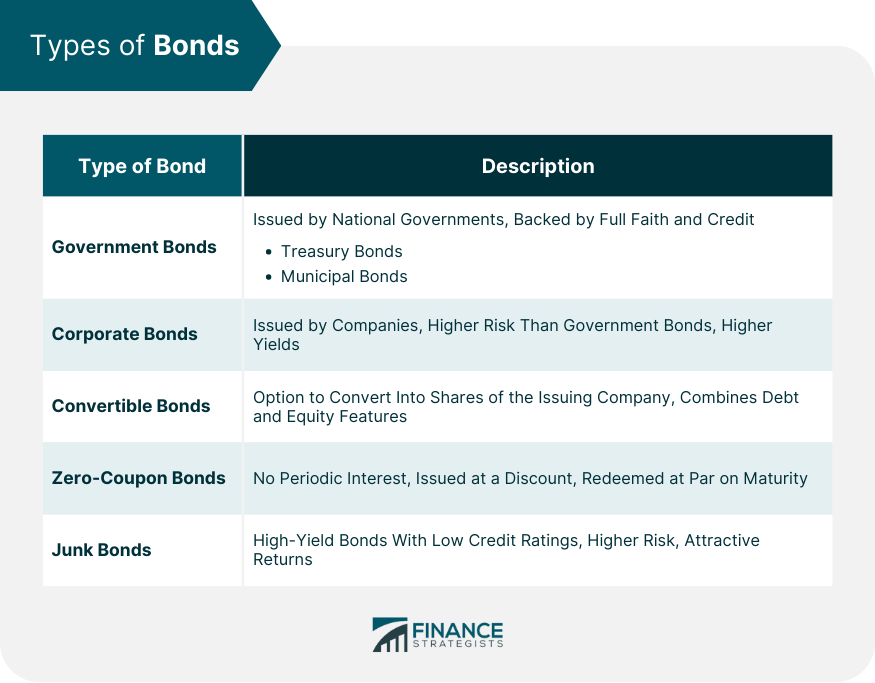

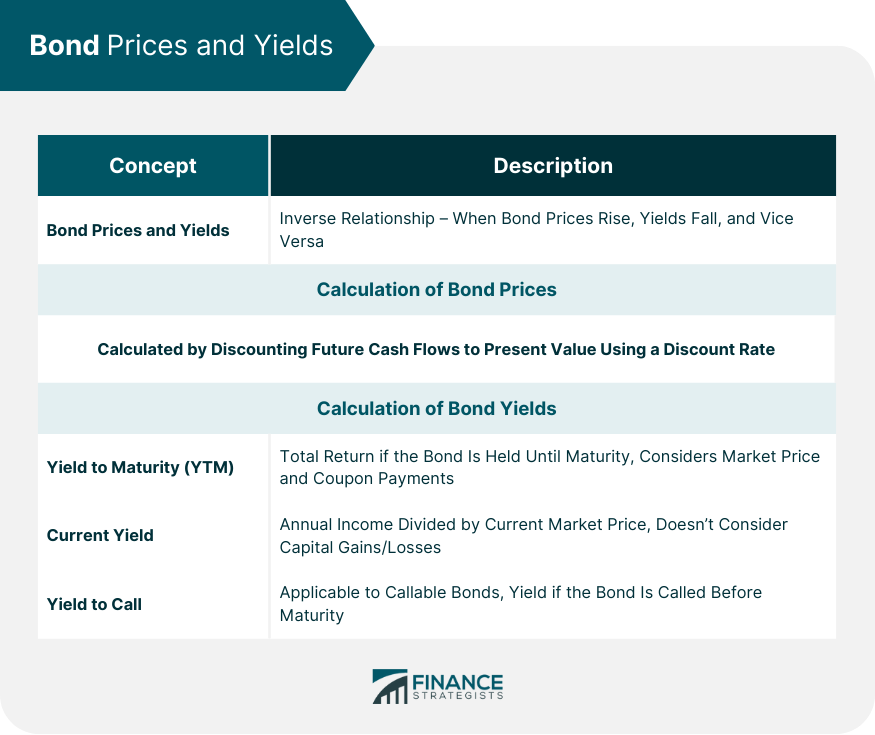

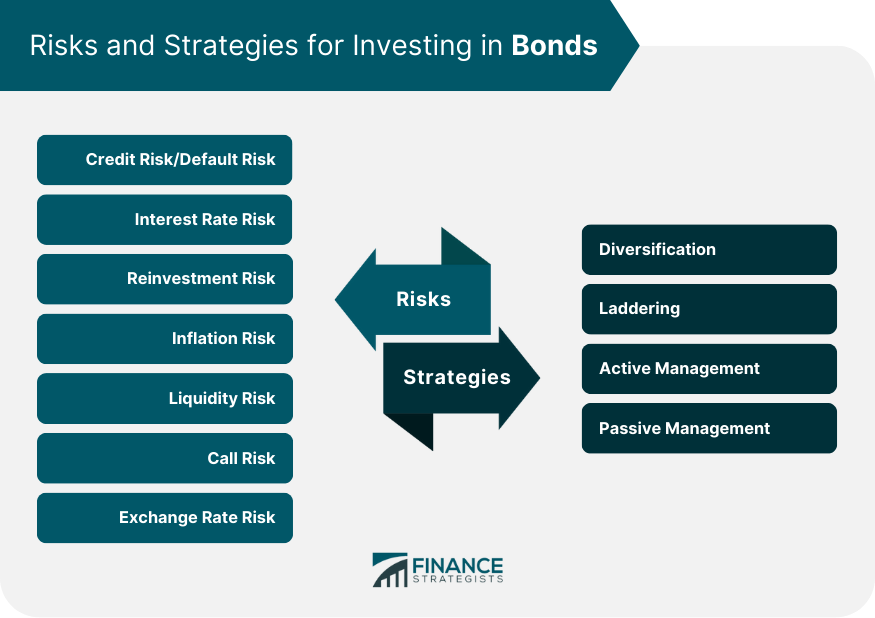

Bonds represent a critical component of the financial markets. They are debt instruments issued by corporations, governments, or municipalities with the purpose of raising capital. An investor purchasing a bond essentially lends money to the issuer. In return, the issuer promises to repay the bond's face value upon maturity and makes regular interest payments, known as coupon payments, until then. There are various types of bonds, each with unique features and risk-return profiles. The characteristics of a bond, such as its face value, coupon rate, maturity date, and the issuer, determine its value and the income it can generate. Investors consider these characteristics when making investment decisions, as they play a significant role in shaping a bond's performance and risk level. Understanding bonds and their characteristics is fundamental for anyone seeking to navigate the bond market effectively. Understanding the essential characteristics of bonds is vital to appreciate their function in an investment portfolio. The face value, or par value, is the amount the bond issuer promises to repay the bondholder upon maturity. Typically, the face value of most bonds is set at $1,000. The coupon rate is the interest that the bond issuer pays the bondholder. It's usually a fixed percentage of the face value. This payment could be semi-annual, quarterly, or annually depending on the bond's terms. The maturity date is when the bond issuer must repay the bond's face value to the bondholder. Maturities can range from one to 30 years, but most bonds typically have a maturity period between 20 and 30 years. The issuer of the bond is the entity that borrows the funds. It could be a government, a municipality, or a corporation. Bonds come in various forms, each serving different purposes and offering different risk-return profiles. Government bonds are issued by national governments. They are considered the safest type of bonds as they are backed by the full faith and credit of the issuing country. Treasury bonds and municipal bonds are examples. Treasury Bonds: These are issued by the U.S. government. They are considered risk-free since the probability of the government defaulting is close to zero. Municipal Bonds: These are issued by states, cities, or other local entities. They are used to finance public projects like schools, highways, and bridges. Corporate bonds are issued by companies to fund operations or finance expansions. They usually offer higher yields than government bonds to compensate for their higher risk. Convertible bonds give the bondholder the option to convert the bond into a specified number of shares of the issuing company. They combine the features of debt and equity. These bonds do not pay periodic interest. Instead, they are issued at a discount to their face value and redeemed at par on maturity. Junk bonds are high-yield bonds issued by entities with low credit ratings. They carry higher risks but offer attractive returns to compensate for the risk. The price of a bond and its yield are inversely related. When bond prices rise, yields fall, and vice versa. Understanding this relationship is crucial to successful bond investing. The price of a bond fluctuates in response to changes in interest rates. When interest rates rise, bond prices fall, and yields increase. Conversely, when interest rates fall, bond prices rise, and yields decrease. Bond prices is calculated by discounting the bond's future cash flows (coupon payments and the face value at maturity) back to the present value using a discount rate. The bond yield is the rate of return an investor gets from holding the bond. There are several ways to calculate the yield, including the current yield and yield to maturity. YTM is the total return an investor will receive if they hold the bond until maturity. It considers both the bond's current market price and its coupon payments. The current yield is the annual income from the bond divided by its current market price. It does not take into account any capital gains or losses if the bond is sold before maturity. Yield to call is applicable to callable bonds. It is the yield earned if the bond is called before its maturity. Bond ratings indicate the creditworthiness of a bond issuer and the likelihood of default. They significantly influence the interest rates and prices of bonds. Bond ratings helps investors assess the credit risk associated with a particular bond. The higher the bond rating, the lower the risk of default. Three main agencies provide bond ratings: Moody's, Standard & Poor's, and Fitch Ratings. 1. Moody's: Moody's uses a lettering system from Aaa (the highest quality) to C (the lowest). 2. Standard & Poor's: Standard & Poor's rating system ranges from AAA (the highest) to D (default). 3. Fitch Ratings: Fitch's rating system mirrors that of S&P, ranging from AAA to D. Ratings are typically divided into two broad categories: investment grade and non-investment grade (or junk). Investment-grade bonds are considered relatively safe, while non-investment-grade bonds carry a higher risk of default. When a bond's rating is upgraded, its price generally rises, and its yield falls. Conversely, when a bond's rating is downgraded, its price usually falls, and its yield rises. Despite being considered safer than equities, bonds are not without risks. Investors need to understand these risks to make informed decisions. Credit Risk/Default Risk: This is the risk that the issuer may fail to make timely interest or principal payments. Interest Rate Risk: This is the risk that changes in interest rates will negatively affect the price of a bond. Reinvestment Risk: This is the risk that the investor may have to reinvest the coupon payments at a lower interest rate. Inflation Risk: This is the risk that the returns from the bond may not keep up with inflation, eroding the purchasing power of the investor's returns. Liquidity Risk: This is the risk that the investor may not be able to sell the bond quickly at a fair price. Call Risk: Applies to callable bonds. It's the risk that the issuer will redeem the bond before its maturity date. Exchange Rate Risk: For bonds denominated in foreign currencies, the exchange rate risk is the risk that changes in exchange rates will affect the value of the bond. There are several strategies that investors can use when investing in bonds, such as diversification, laddering, and active or passive management. Diversification: Involves spreading investments across various types of bonds to reduce risk. Laddering: Involves buying bonds with different maturity dates to balance the risk and return. Active Management: Involves regularly buying and selling bonds to capitalize on market opportunities. Passive Management: Investors buy and hold bonds to maturity. This strategy is generally less risky than active management. Bonds are significant financial instruments that corporations, governments, and municipalities issue to raise capital. They serve as loans, with the issuer being the borrower and the bondholder the lender. The basic characteristics of a bond include its face value, coupon rate, maturity date, and the issuer. These factors determine its profitability and risk level. Various types of bonds exist, each offering different risk-return profiles. These range from relatively safe government and treasury bonds to higher-risk corporate and junk bonds. Understanding these diverse types of bonds and their unique characteristics helps an investor make informed decisions, balancing their risk tolerance and income requirements. Despite their perceived safety, bonds carry certain risks, including credit, interest rate, and inflation risks. Nonetheless, with the right strategies, they remain an essential part of a well-diversified portfolio, providing regular income and capital preservation.Bonds Overview

Basic Bond Characteristics

Face Value/Par Value

Coupon Rate

Maturity Date

Issuer

Types of Bonds

Government Bonds

Corporate Bonds

Convertible Bonds

Zero-Coupon Bonds

Junk Bonds

Bond Prices and Yields

Relationship Between Bond Prices and Yields

Calculation of Bond Prices

Calculation of Bond Yields

Yield to Maturity (YTM)

Current Yield

Yield to Call

Bond Ratings

Importance of Bond Ratings

Major Bond Rating Agencies

Rating Categories

Impact of Ratings on Bond Prices and Yields

Risks Associated With Bonds

Strategies for Investing in Bonds

Conclusion

Bond Characteristics FAQs

The primary bond characteristics that investors should understand are the face value, coupon rate, maturity date, and the issuer. These characteristics determine the bond's value, income potential, risk level, and the repayment promise made by the issuer.

Bond characteristics directly influence bond prices and yields. For instance, bonds with higher coupon rates are generally more valuable and have lower yields than bonds with lower coupon rates. Similarly, bonds issued by entities with high credit ratings (indicating low default risk) usually have lower yields than bonds issued by entities with lower credit ratings.

There are several types of bonds, including government bonds, corporate bonds, convertible bonds, zero-coupon bonds, and junk bonds. Their characteristics differ in terms of their issuer, risk level, interest payment terms, and potential for capital appreciation or conversion to shares.

Bond ratings issued by credit rating agencies like Moody's, Standard & Poor's, and Fitch Ratings reflect the creditworthiness of a bond issuer. They provide an assessment of the issuer's ability to make the scheduled interest payments and repay the face value upon maturity, thus encapsulating crucial bond characteristics and risks.

Understanding bond characteristics can help investors align their investment strategies with their risk tolerance and income needs. For instance, if an investor wants a steady income with low risk, they might choose bonds with high credit ratings and regular coupon payments. If an investor is willing to take on more risk for potential capital appreciation, they might opt for lower-rated or convertible bonds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.