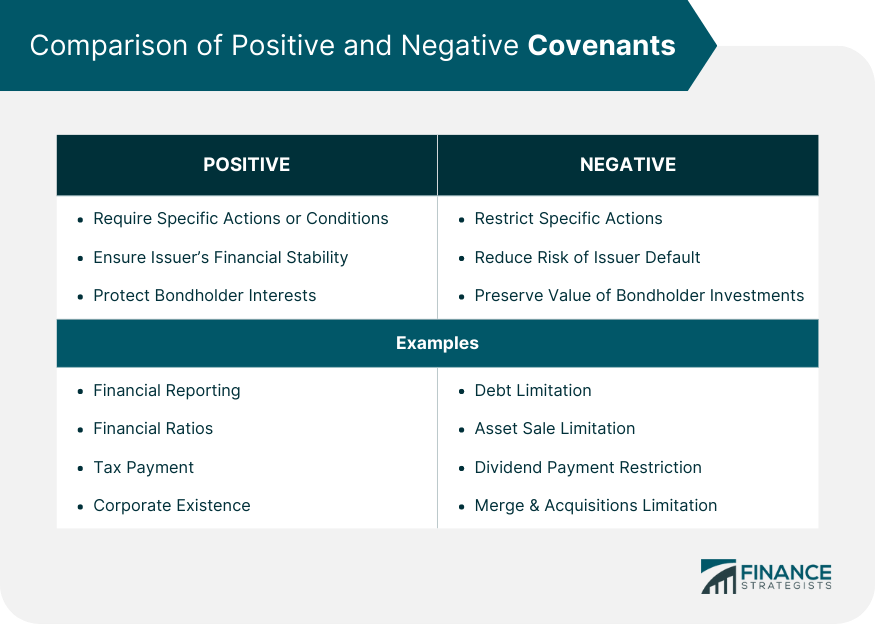

Bond covenants are legally binding clauses within bond agreements that dictate the terms and conditions between bond issuers and bondholders. They serve to protect the interests of bondholders by imposing obligations and restrictions on the issuer. Bond covenants play a crucial role in fixed-income investments by reducing the risk of default and enhancing bondholder protection. They help maintain the issuer's creditworthiness, ensuring that investors receive timely interest payments and principal repayment at maturity. There are two main types of bond covenants: positive and negative covenants. Positive covenants require the issuer to take specific actions, while negative covenants restrict the issuer from engaging in certain activities. Positive covenants are provisions that require the bond issuer to perform specific actions or maintain certain conditions. They ensure that the issuer remains financially stable, reducing the risk of default and safeguarding bondholder interests. Issuers are often required to provide regular financial statements to bondholders, ensuring transparency and enabling investors to monitor the issuer's financial health. Timely and accurate financial reporting helps bondholders assess the issuer's ability to meet its debt obligations. Bond issuers may be required to maintain specific financial ratios, such as debt-to-equity or interest coverage ratios. These ratios serve as indicators of the issuer's financial stability, reducing the risk of default and protecting bondholder interests. Positive covenants may require issuers to stay current on all tax payments and other financial obligations. Timely payment of taxes and other liabilities demonstrates the issuer's commitment to meeting its financial responsibilities, further reducing the risk of default. Some bond covenants require issuers to maintain their corporate existence and remain in good standing with regulatory authorities. This ensures the issuer's ongoing operations and ability to meet its debt obligations, providing added security for bondholders. Negative covenants are restrictions placed on bond issuers, prohibiting them from engaging in specific actions that could negatively impact their creditworthiness. These covenants protect bondholders by reducing the likelihood of issuer default and preserving the value of their investments. Issuers may be restricted from taking on additional debt beyond a specified threshold. This limitation protects bondholders by preventing the issuer from becoming overleveraged, which could result in financial instability and increased default risk. Negative covenants may prohibit or limit the sale of assets or the granting of liens on the issuer's property. These restrictions ensure that the issuer's asset base remains intact, maintaining its creditworthiness and ability to meet its debt obligations. Bond covenants may restrict the issuer's ability to pay dividends on its equity shares. This ensures that the issuer retains sufficient cash flow to meet its debt obligations, further reducing the risk of default for bondholders. Some bond covenants limit the issuer's ability to engage in mergers, acquisitions, or other corporate actions that could impact its financial stability. These restrictions protect bondholders by preserving the issuer's creditworthiness and capacity to meet its debt obligations. Bond covenants are governed by securities regulations, which vary by jurisdiction. These regulations provide a legal framework for the issuance, trading, and enforcement of bond covenants, ensuring transparency and accountability in fixed-income markets. Bond trustees and bondholders play a crucial role in enforcing bond covenants. Trustees act on behalf of bondholders to monitor the issuer's compliance with covenants, while bondholders can enforce their rights through legal action if the issuer breaches any covenant terms. In cases of bond covenant violations, bondholders have several legal remedies available. These may include accelerating the repayment of the bond, seeking damages, or forcing the issuer to rectify the violation through a court order. The credit rating of the bond issuer significantly influences the negotiation of bond covenants. Higher-rated issuers may have more flexibility in negotiating covenant terms, while lower-rated issuers may face stricter covenant requirements to protect bondholder interests. Prevailing market conditions can impact bond covenant negotiations. In a market with low interest rates and high demand for bonds, issuers may be able to negotiate more favorable covenant terms, while in a less favorable market, bondholders may demand stricter covenants. The maturity and structure of the bond influence the negotiation of bond covenants. Longer-term bonds may require stricter covenants to protect bondholders over an extended period, while short-term bonds may have more lenient covenant terms. Successful bond covenant negotiation requires balancing the interests of issuers and bondholders. Issuers seek to minimize restrictions on their operations, while bondholders want robust covenants to protect their investment and minimize the risk of default. Issuers are responsible for ongoing monitoring of their compliance with bond covenants. Regular monitoring ensures that issuers remain in compliance with their covenants, reducing the risk of default and maintaining their creditworthiness. Credit rating agencies play a vital role in assessing bond covenant compliance. They evaluate the issuer's financial health and adherence to covenant terms, which helps investors gauge the credit risk associated with the issuer's bonds. A breach of bond covenants may result in default and the acceleration of bond repayment. This means the issuer must repay the bond's principal immediately, potentially causing financial strain and further credit deterioration. In some cases, bondholders may agree to restructure or renegotiate covenants following a breach. This can provide the issuer with more favorable terms, allowing them to address the breach and avoid default. Legal disputes and potential litigation may arise if a bond covenant breach cannot be resolved through negotiation or restructuring. In such cases, bondholders may seek to enforce their rights through the courts, which can be a lengthy and costly process for both parties. Bond covenants are crucial components of bond agreements that protect the interests of bondholders and reduce the risk of default. Positive covenants require issuers to take specific actions, such as providing financial reports and maintaining certain financial ratios, to ensure their financial stability. Negative covenants restrict issuers from engaging in actions that could negatively impact their creditworthiness, such as incurring additional debt or selling assets. The negotiation of bond covenants is influenced by factors such as the issuer's credit rating, market conditions, and the maturity and structure of the bond. Ongoing monitoring of covenant compliance is essential, and credit rating agencies play a role in assessing compliance. Breaches of covenants can lead to default, restructuring, or legal disputes. Overall, bond covenants play a vital role in maintaining the integrity of the bond market and protecting the interests of bondholders.What Are Bond Covenants?

Positive Covenants

Overview of Positive Covenants

Common Examples of Positive Covenants

Financial Reporting Requirements

Maintenance of Specific Financial Ratios

Payment of Taxes and Other Obligations

Preservation of Corporate Existence

Negative Covenants

Overview of Negative Covenants

Common Examples of Negative Covenants

Restrictions on Additional Debt

Limitations on Asset Sales or Liens

Dividend Payment Restrictions

Mergers and Acquisitions Limitations

Legal and Regulatory Framework for Bond Covenants

Securities Regulations Governing Bond Covenants

Role of Bond Trustees and Bondholders in Enforcing Covenants

Legal Remedies for Bond Covenant Violations

Bond Covenant Negotiation

Factors Influencing Bond Covenant Negotiation

Credit Rating of the Issuer

Market Conditions

Maturity and Structure of the Bond

Balancing Interests of Issuers and Bondholders

Monitoring and Compliance

Ongoing Monitoring of Covenant Compliance by Issuers

Role of Credit Rating Agencies in Assessing Covenant Compliance

Consequences of Covenant Breaches

Default and Acceleration of Bond Repayment

Restructuring or Renegotiation of Covenants

Legal Disputes and Potential Litigation

Final Thoughts

Bond Covenants FAQs

A bond covenant is a legally binding clause in a bond agreement that dictates the terms and conditions between the bond issuer and bondholders. It is important because it helps protect bondholders' interests by imposing obligations and restrictions on the issuer, reducing the risk of default and preserving the value of the investment.

The two main types of bond covenants are positive and negative covenants. Positive covenants require the bond issuer to take specific actions or maintain certain conditions, while negative covenants restrict the issuer from engaging in particular activities that could harm their creditworthiness.

Bond covenants help protect bondholders by ensuring that issuers maintain their financial stability and adhere to specific terms and conditions. For issuers, bond covenants may restrict their operational flexibility, but they also help maintain their creditworthiness and access to capital markets by demonstrating their commitment to meeting obligations.

Bond covenant breaches can be addressed and resolved through various means, such as default and acceleration of bond repayment, restructuring or renegotiation of covenants, or legal disputes and potential litigation. The chosen method often depends on the severity of the breach and the willingness of both parties to negotiate a mutually acceptable solution.

Credit rating agencies play a vital role in assessing bond covenant compliance by evaluating the issuer's financial health and adherence to covenant terms. This assessment helps investors gauge the credit risk associated with the issuer's bonds and make informed investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.