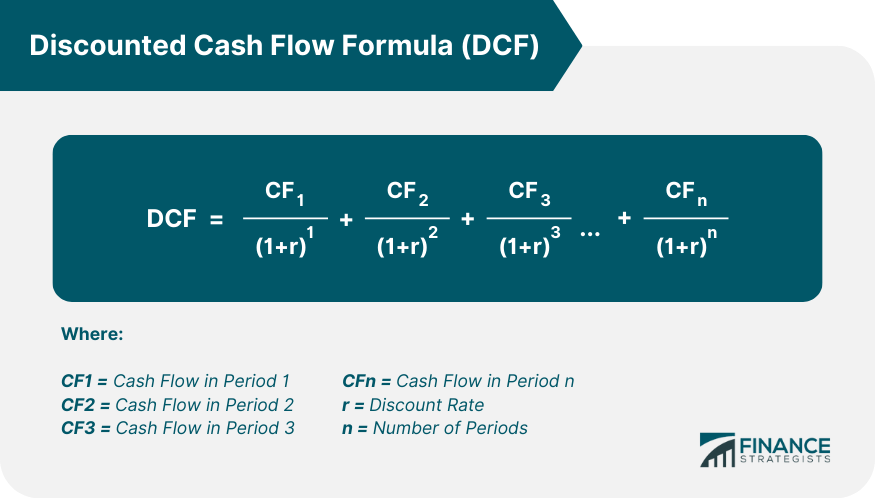

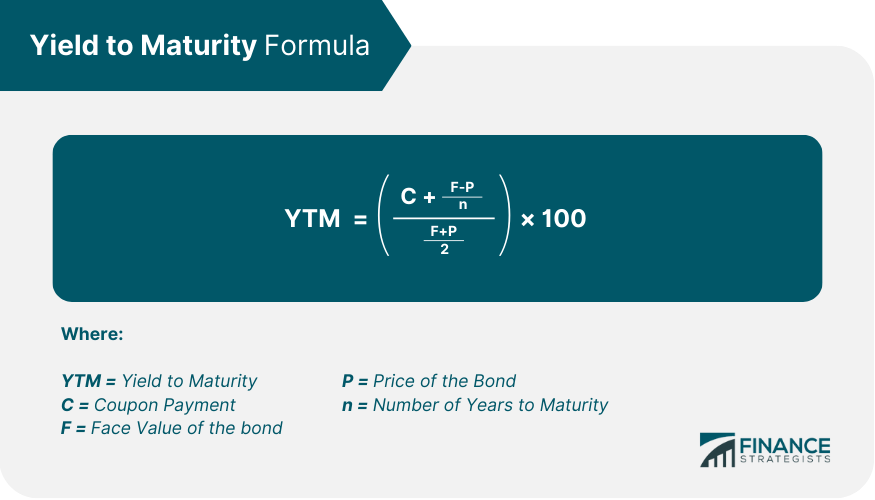

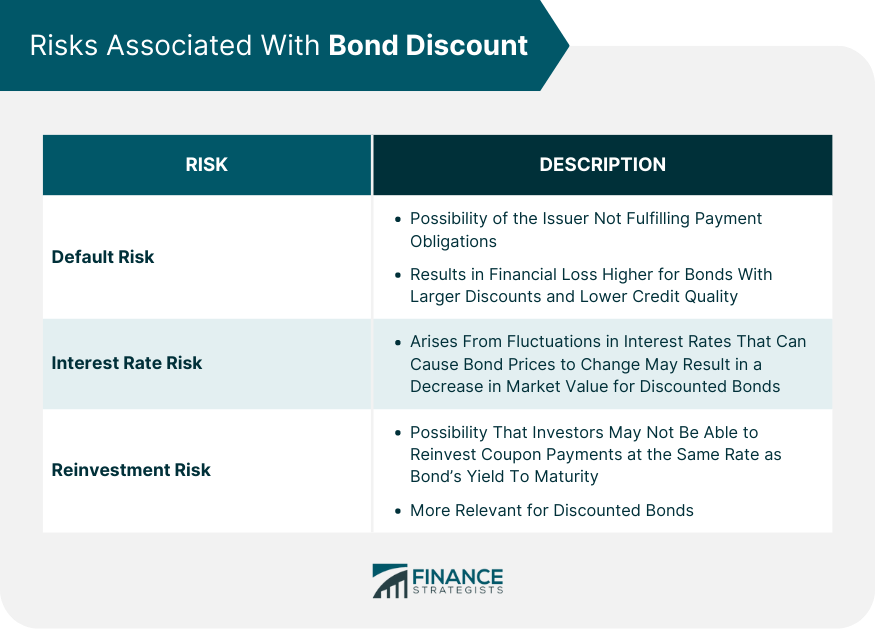

A bond discount refers to the difference between the face value of a bond and its current market price when the bond is trading below its face value. This occurs when the bond's coupon rate is lower than prevailing market interest rates. Understanding bond discount is essential for investors as it helps them evaluate potential returns on investment and make informed decisions. By grasping the concept, investors can assess the risks and rewards associated with discounted bonds. When interest rates rise, bond prices fall, leading to an increase in bond discount. This is because investors seek higher yields to compensate for the opportunity cost of investing in bonds with lower coupon rates. Conversely, when interest rates decline, bond prices rise, and the bond discount decreases. This is because existing bonds with higher coupon rates become more attractive to investors in comparison to newly issued bonds. A lower credit rating indicates a higher risk of default, which often leads to a larger bond discount. Investors demand higher yields to compensate for the increased risk associated with investing in bonds with lower credit ratings. A higher credit rating signifies lower default risk, typically resulting in a smaller bond discount. Investors are willing to accept lower yields on bonds with higher credit ratings due to their perceived stability and lower risk. Bonds with longer times to maturity tend to have larger discounts because they are exposed to interest rate risk and credit risk for extended periods. Investors demand higher yields to compensate for these risks. Bonds with shorter times to maturity generally have smaller discounts, as they are less exposed to interest rate and credit risk. Consequently, investors require lower yields to invest in these bonds. During periods of economic uncertainty, bond discounts may increase as investors seek safer investments and demand higher yields to compensate for the perceived risks associated with bonds. Increased market demand for bonds can lead to higher bond prices and reduced bond discounts. Factors such as changes in monetary policy, economic outlook, and investor sentiment can influence market demand for bonds. The discounted cash flow approach calculates the bond discount by determining the present value of the bond's future cash flows. This includes both coupon payments and the principal repayment at maturity. The discount rate used in the discounted cash flow approach is the required rate of return for an investor. It reflects the prevailing market interest rates and the bond's credit risk, adjusting the present value of future cash flows accordingly. Yield to maturity is the total return expected from a bond if it is held until maturity. It accounts for both the coupon payments and any capital gain or loss resulting from the bond discount. The YTM formula considers the bond's current market price, face value, coupon rate, and time to maturity to calculate the bond's yield. This method provides a comprehensive measure of the bond's return, considering both income and capital gains. Let's consider a bond with a face value of $1,000, a coupon payment of $50, a price of $950, and a maturity of 5 years. Using the formula above, we can calculate the YTM as equivalent to 6.15%. Therefore, the Yield to Maturity for this bond is approximately 6.15%. This indicates the expected rate of return if the bond is held until maturity, considering the coupon payments and the purchase price. Providing examples and practice problems can help investors better understand the calculation of bond discounts using the discounted cash flow and YTM methods. Purchasing bonds at a discount often results in a higher yield to maturity. This is because the bond's yield incorporates both the coupon payments and the capital gain achieved when the bond is redeemed at its face value. When bond prices increase, and the bond discount narrows, investors holding discounted bonds can realize capital gains. This occurs when the bond is sold in the secondary market at a higher price than its initial purchase price. Default risk refers to the possibility that the bond issuer may not fulfill its payment obligations, resulting in financial loss for bondholders. Bonds with larger discounts typically have higher default risks due to lower credit quality. Interest rate risk arises from fluctuations in interest rates that can cause bond prices to change. When interest rates rise, bond prices fall, leading to a potential decrease in the market value of discounted bonds. Reinvestment risk refers to the possibility that investors may be unable to reinvest coupon payments at the same rate as the bond's yield to maturity. This risk is particularly relevant for discounted bonds, as their yields may be higher than prevailing market rates. Diversification involves investing in bonds from various sectors and credit qualities to reduce risk. By spreading investments across a range of bonds, investors can mitigate the impact of sector-specific risks and credit events. Laddering maturities involves investing in bonds with different maturity dates to manage interest rates and reinvestment risk. This strategy provides a steady stream of income and allows investors to take advantage of changing interest rates over time. Active portfolio management entails regularly monitoring bond investments and making adjustments based on market conditions and individual bond performance. By actively managing their portfolios, investors can respond to changes in interest rates, credit quality, and market demand, optimizing their bond investments. Bond funds are managed investment products that invest in a diversified portfolio of bonds. By investing in bond funds, investors can gain exposure to a broad range of discounted bonds without needing to actively manage individual bond holdings. Understanding bond discounts is crucial for investors as it allows them to evaluate potential returns and make informed investment decisions. Factors such as interest rates, credit quality, time to maturity, and market conditions affect bond discounts. Rising interest rates generally lead to larger bond discounts, while falling interest rates reduce the discount. Lower credit ratings and longer time to maturity also contribute to larger discounts. Calculating bond discounts can be done using the discounted cash flow approach or the yield-to-maturity (YTM) method. Investing in discounted bonds offers a higher yield to maturity and potential for capital gains, but it also comes with risks such as default risk, interest rate risk, and reinvestment risk. Strategies for investing in discounted bonds include diversification, laddering maturities, active portfolio management, and investing in bond funds. By employing these strategies, investors can effectively manage the risks and maximize the potential rewards of discounted bonds.What Is a Bond Discount?

Factors Affecting Bond Discount

Interest Rates

Rising Interest Rates

Falling Interest Rates

Credit Quality

Lower Credit Rating

Higher Credit Rating

Time to Maturity

Longer Time to Maturity

Shorter Time to Maturity

Market Conditions

Economic Uncertainty

Market Demand

Calculating Bond Discount

Discounted Cash Flow Approach

Present Value of Future Cash Flows

Discounted Cash Flow Formula

Calculation of Discount Rate

Yield to Maturity (YTM) Method

Understanding YTM

Formula for Calculating YTM

Examples and Practice Problems

Effects of Bond Discount on Investors

Benefits of Purchasing Bonds at a Discount

Higher Yield to Maturity

Potential for Capital Gains

Risks Associated With Bond Discount

Default Risk

Interest Rate Risk

Reinvestment Risk

Strategies for Investing in Discounted Bonds

Diversification Across Bond Sectors

Laddering Maturities

Active Portfolio Management

Investing in Bond Funds

Final Thoughts

Bond Discount FAQs

A bond discount refers to the difference between the face value of a bond and its current market price when the bond is trading below its face value. Understanding bond discount is important for investors as it helps them evaluate potential returns on investment and make informed decisions when investing in discounted bonds.

Interest rates have a significant impact on bond discount. When interest rates rise, bond prices typically fall, leading to an increase in bond discount. Conversely, when interest rates decline, bond prices rise, and bond discounts decrease. This relationship occurs because investors seek higher yields to compensate for the opportunity cost of investing in bonds with lower coupon rates.

The benefits of investing in discounted bonds include higher yield to maturity and potential for capital gains. However, there are risks associated with bond discount, such as default risk, interest rate risk, and reinvestment risk. Investors need to carefully consider these factors when investing in discounted bonds.

Strategies for managing risks and maximizing returns when investing in discounted bonds include diversification across bond sectors, laddering maturities, active portfolio management, and investing in bond funds. These strategies can help investors navigate the complexities of the bond market and make sound investment decisions.

The YTM method considers the bond's current market price, face value, coupon rate, and time to maturity to calculate the bond's yield. Yield to maturity accounts for both the coupon payments and any capital gain or loss resulting from the bond discount, providing a comprehensive measure of the bond's return.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.