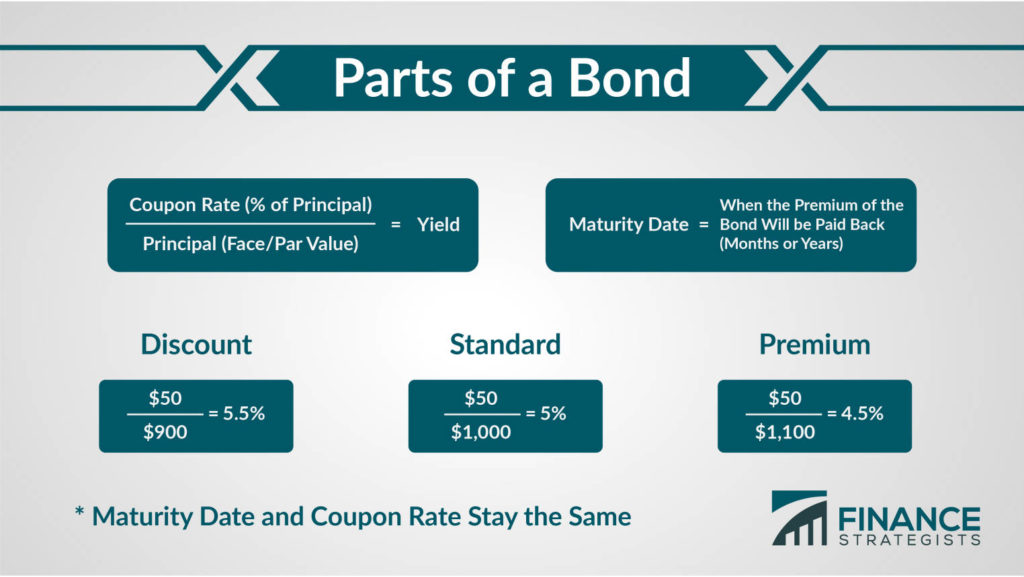

The principal of the bond, also called its face value or par value, refers to the amount of money the issuer agrees to pay the lender at the bond's expiration. The principal of a bond is usually either $100 or $1000, but on the open market, bonds may also trade at a premium or discount on this price. Before discussing more about the principal of a bond, let's first discuss what a bond is. A bond is a certificate of debt issued by a company. They are purchased by an investor, making them small scale loans held by individuals. Bonds are securities, like stocks. However, instead of buying a piece of a company in return for equity ownership, bonds provide their return on investment through interest paid on the principal of the bond. Bonds have three components: the principal, the coupon rate, and the maturity date. These 3 components are used to calculate a bond's yield. The principal of the bond, also called its face value or par value, refers to the amount of money the issuer agrees to pay the lender at the bond's expiration. The principal of a bond is usually either $100 or $1000, but on the open market, bonds may also trade at a premium or discount on this price. The coupon rate is the percentage of the principal paid back to the investor as interest. Whatever the principal is, the coupon rate is a percentage of that value. The bond maturity date is the date on which the principal must be paid back to the bondholder. The bond issuer will make interest payments while holding onto the investor's money, and will also pay back the principal of the bond. Depending on whether the bond was sold at a discount or a premium, the principal of the bond may be slightly higher or lower than the original investment.Principal of a Bond

Bond Definition

How Does a Bond Work?

Principal of a Bond FAQs

The principal of the bond, also called its face value or par value, refers to the amount of money (usually $100 or $1000) the issuer agrees to pay the lender at the bond’s expiration.

Yes, the value of a bond moves inversely to changes in interest rates, so that when rates rise, the value of the bond declines and vice versa.

A bond's principal is held by the issuing company until the bond matures, at which time the issuer repays the prinicipal.

Bonds have three components: the principal, the coupon rate, and the maturity date.

Instead of buying a piece of a company in return for equity ownership, bonds provide their return on investment through interest paid on the principal of the bond.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.