A bond quote represents the last price at which a bond is traded. It is typically expressed as a percentage of the bond's par value and converted to a point scale. The par value of a bond is usually set at 100, representing 100% of the bond's face value, which is often $1,000. For instance, if a corporate bond is quoted at 99, it means that the bond is trading at 99% of its face value. In this scenario, the cost to buy each bond would be $990. This calculation is derived by multiplying the bond's face value ($1,000) by the quoted percentage (99%). Bond quotes are essential for investors as they provide information on the current market value of bonds, helping them make informed investment decisions. By understanding bond quotes, investors can assess the risk, return, and potential opportunities in the bond market. Various factors influence bond quotes, including interest rates, credit quality, time to maturity, market liquidity, economic conditions, and supply and demand. These factors can impact a bond's yield and price, affecting its overall attractiveness to investors. The clean price is the bond quote excluding any accrued interest. It represents the price an investor would pay to buy a bond without considering the interest earned since the last coupon payment. The dirty price is the bond quote, including any accrued interest. It represents the total cost an investor would pay to buy a bond, considering the interest earned since the last coupon payment. Yield-to-maturity is the total return an investor would receive if they held a bond until its maturity date. It factors in the bond's coupon payments, capital gains or losses, and the time value of money, providing a comprehensive measure of a bond's performance. The current yield is the annual interest payment divided by the bond's market price. It reflects the income an investor can expect to receive from a bond as a percentage of its current market price and is used to compare bonds with different prices and maturities. Financial news websites provide real-time bond quotes and market data for various types of bonds. They are a valuable resource for investors seeking up-to-date information on bond prices, yields, and market trends. Brokerage platforms offer bond quotes and trading services to their clients. These platforms provide investors with access to a wide range of bonds, allowing them to compare quotes, analyze performance, and execute trades. Financial institutions, such as banks and investment firms, provide bond quotes to their clients as part of their services. They may also offer research and analysis on the bond market, helping investors make informed decisions about their bond investments. Bond rating agencies evaluate the credit quality of bonds and publish bond quotes based on their assessments. Their ratings can impact bond prices and yields, making them an essential source of information for investors seeking to understand the risk and return profile of specific bonds. Interest rates play a crucial role in determining bond quotes, as they influence the cost of borrowing and the attractiveness of fixed-income investments. The Federal Reserve's monetary policy decisions can impact interest rates, which in turn affect bond quotes. For example, when the Fed raises interest rates, bond prices typically fall, and vice versa. Market expectations about future interest rate changes can also impact bond quotes. If investors expect rates to rise, they may demand higher yields, leading to lower bond prices. Credit quality is a key factor that affects bond quotes, as it reflects the likelihood of a bond issuer defaulting on its obligations. Bond rating agencies assess the credit quality of bond issuers and assign ratings that influence bond quotes. Higher-rated bonds generally have lower yields, reflecting their lower risk compared to lower-rated bonds. Credit risk refers to the risk that a bond issuer may default on its interest or principal payments. Bonds with higher credit risk typically have higher yields to compensate investors for the increased risk. The time remaining until a bond's maturity date affects its quote, as bonds with longer maturities are generally more sensitive to interest rate changes and carry greater risks. Market liquidity, or the ease with which bonds can be bought and sold, can influence bond quotes. Bonds with low liquidity may have wider bid-ask spreads, leading to less favorable quotes for investors. Economic conditions can affect bond quotes by influencing interest rates, inflation expectations, and overall market sentiment. A strong economy may lead to higher interest rates, while a weak economy may result in lower rates. Supply and demand dynamics in the bond market can impact bond quotes. When the demand for bonds outstrips supply, bond prices typically rise, and vice versa. Comparing bond quotes allows investors to identify opportunities and make informed decisions. By analyzing different bonds' quotes, investors can assess their relative value and attractiveness. Investors can assess the value of a bond by comparing its quote to its intrinsic value, which is based on factors such as interest rates, credit quality, and time to maturity. Yield and duration are important metrics for interpreting bond quotes, as they provide insights into a bond's income potential and interest rate sensitivity, helping investors manage their risk and return profiles. Interpreting bond quotes involves evaluating the risk and return trade-offs of different bonds. Investors must weigh the potential returns against the risks, such as credit risk and interest rate risk, associated with each bond. The primary market is where new bonds are issued and sold to investors, providing an opportunity to invest in bonds at their initial offering prices. The initial issuance is when a bond is first sold to investors, typically through an underwriting process involving financial institutions and investment banks. The auction process is a method through which government bonds are issued in the primary market. Investors submit bids for the bonds, and the final bond prices are determined based on the submitted bids. The secondary market is where previously issued bonds are traded among investors, providing liquidity and facilitating price discovery. Over-the-counter trading is the most common method for trading bonds in the secondary market. Investors buy and sell bonds through a network of dealers who quote bond prices and facilitate transactions. Exchange-traded bonds are bonds that are listed and traded on a stock exchange, similar to stocks. These bonds offer greater transparency and ease of trading compared to the over-the-counter market. Bond quotes play a vital role in the investment decision-making process. They provide information on the current market value of bonds, allowing investors to assess risk, return, and potential opportunities. Various factors influence bond quotes, including interest rates, credit quality, time to maturity, market liquidity, economic conditions, and supply and demand. Investors should consider these factors to evaluate a bond's attractiveness. Understanding different types of bond quotes, such as clean price, dirty price, yield-to-maturity, and current yield, helps in interpreting bond values and comparing different bonds. Reliable sources of bond quotes include financial news websites, brokerage platforms, financial institutions, and bond rating agencies. Interpreting bond quotes involves comparing quotes, assessing bond value, analyzing yield and duration, and evaluating risk and return. Trading bonds can be done in the primary market through initial issuance or in the secondary market through over-the-counter trading or exchange-traded bonds. By understanding bond quotes and their interpretation, investors can make well-informed decisions in the bond market.What Is a Bond Quote?

Types of Bond Quotes

Clean Price

Dirty Price

Yield-To-Maturity (YTM)

Current Yield

Sources of Bond Quotes

Financial News Websites

Brokerage Platforms

Financial Institutions

Bond Rating Agencies

Factors Affecting Bond Quotes

Interest Rates

Federal Reserve Policy

Market Expectations

Credit Quality

Bond Rating Agencies

Credit Risk

Time to Maturity

Market Liquidity

Economic Conditions

Supply and Demand

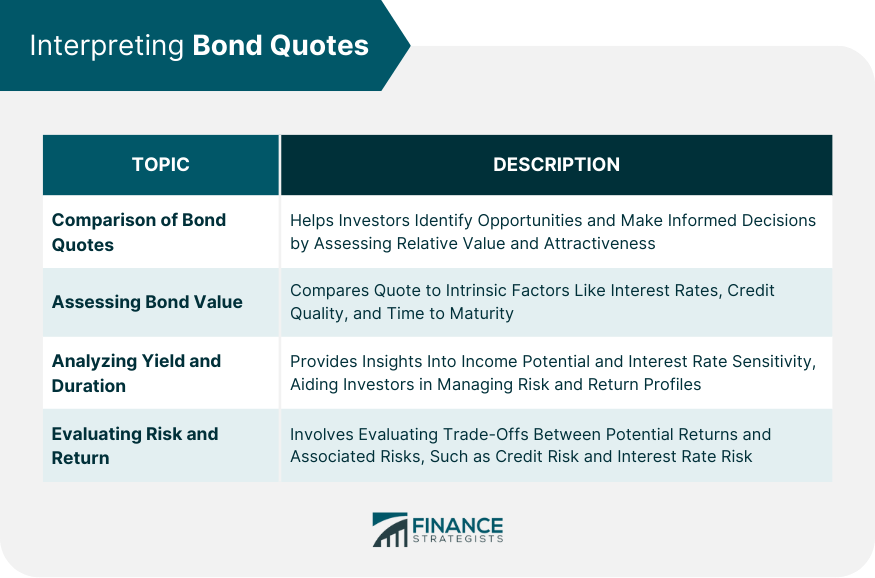

Interpreting Bond Quotes

Comparison of Bond Quotes

Assessing Bond Value

Analyzing Yield and Duration

Evaluating Risk and Return

Trading Bonds

Primary Market

Initial Issuance

Auction Process

Secondary Market

Over-The-Counter (OTC) Trading

Exchange-Traded Bonds

Final Thoughts

Bond Quotes FAQs

A bond quote is the current price at which a bond can be bought or sold in the market, expressed as a percentage of the bond's par value. It is important for investors because it provides information on the market value, risk, and return potential of bonds, helping them make informed investment decisions.

Interest rates have a significant impact on bond quotes, as they influence the cost of borrowing and the attractiveness of fixed-income investments. When interest rates rise, bond prices typically fall, resulting in lower bond quotes and vice versa.

Investors can find bond quotes from various sources, including financial news websites, brokerage platforms, financial institutions, and bond rating agencies. These sources provide up-to-date information on bond prices, yields, and market trends.

Investors can use bond quotes to assess the risk and return potential of different bonds by comparing their prices, yields, credit quality, and other factors. By interpreting bond quotes, investors can weigh the potential returns against the risks associated with each bond and make informed investment decisions.

In the primary market, new bonds are issued and sold to investors at their initial offering prices, while in the secondary market, previously issued bonds are traded among investors. Bond quotes play a role in both markets, as they provide information on the current market value of bonds, helping investors identify opportunities and determine the appropriate prices for buying or selling bonds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.