A bond rating is an assessment of the creditworthiness of a bond issuer. The rating indicates the likelihood of default or the issuer's ability to meet its financial obligations. Higher bond ratings indicate lower risk, while lower ratings imply higher risk for investors. Bond ratings serve as a useful tool for investors to gauge the credit risk associated with a particular bond issue. They help investors make informed decisions about which bonds to invest in based on their risk tolerance and investment objectives. Additionally, bond ratings influence the interest rates and pricing of bonds in the market. Credit rating agencies play a crucial role in evaluating and assigning ratings to bonds. These agencies analyze the financial health and creditworthiness of bond issuers, taking into account various factors such as debt levels, cash flow, and profitability. Their assessments help shape investor perceptions and market dynamics. Investment grade bonds are considered relatively safe investments with a low risk of default. They are typically issued by financially stable entities such as governments and large corporations. These bonds are further classified into high-grade and medium-grade bonds. High-grade bonds are the highest quality investment grade bonds, carrying the lowest risk of default. These bonds are issued by entities with a strong financial position, making them an attractive option for conservative investors seeking steady income and capital preservation. Medium-grade bonds are investment grade bonds with slightly higher risk compared to high-grade bonds. While still considered relatively safe, these bonds offer higher yields to compensate for the increased level of risk. They are suitable for investors looking for a balance between risk and return. Non-investment grade bonds, also known as speculative or high-yield bonds, carry a higher risk of default. They are issued by entities with weaker financial health or those facing economic challenges. These bonds are further classified into lower medium-grade and low-grade bonds. Lower medium-grade bonds are non-investment grade bonds with moderate credit risk. These bonds offer higher yields to compensate for their increased risk compared to investment grade bonds. They are suitable for investors with a higher risk tolerance, seeking potentially higher returns. Low-grade bonds are the riskiest non-investment grade bonds, with a high likelihood of default. They are issued by entities with weak financial positions or facing significant challenges. These bonds offer the highest yields among bond categories but are suitable only for investors with a high risk tolerance and a speculative investment approach. Standard & Poor's (S&P) is a leading global credit rating agency known for its extensive coverage of bond issuers and credit analysis. S&P assigns bond ratings based on its assessment of the issuer's creditworthiness, providing investors with valuable insights into the risks associated with a particular bond. Moody's Investors Service is another prominent credit rating agency that evaluates the creditworthiness of bond issuers. Like S&P, Moody's assigns ratings based on a thorough analysis of the issuer's financial health, economic conditions, and other relevant factors, helping investors make informed decisions. Fitch Ratings is a globally recognized credit rating agency that provides independent assessments of bond issuers' creditworthiness. Its bond ratings serve as a valuable source of information for investors, helping them evaluate the risks associated with a bond and make better investment choices. The financial health of a bond issuer plays a crucial role in determining its bond rating. Credit rating agencies analyze various aspects of an issuer's financial health, such as debt levels, cash flow, and profitability, to assign a rating that reflects its creditworthiness. Debt levels are a key indicator of an issuer's financial stability. High debt levels can make it difficult for an issuer to meet its financial obligations, increasing the risk of default. Rating agencies assess the debt level relative to the issuer's assets, income, and overall financial position. Cash flow is an important measure of an issuer's ability to generate funds to meet its debt obligations. Rating agencies evaluate the consistency and stability of an issuer's cash flow to determine its creditworthiness. Strong and consistent cash flow can lead to higher bond ratings. Profitability is another important factor in assessing an issuer's financial health. Higher profitability can enhance an issuer's ability to service its debt and meet financial obligations. Rating agencies consider an issuer's profitability in the context of its industry and historical performance. Economic conditions, including industry trends and market conditions, influence bond ratings by affecting the financial prospects of issuers. Rating agencies consider industry trends to understand the long-term prospects and risks associated with a particular bond issuer. An issuer operating in a growing and stable industry is more likely to have a higher bond rating than one in a declining or volatile industry. Market conditions, such as interest rates, economic growth, and inflation, can impact an issuer's financial performance and credit risk. Rating agencies take these factors into account when evaluating the creditworthiness of bond issuers, as they can affect their ability to meet financial obligations. The political and regulatory environment can significantly impact an issuer's financial stability and credit risk. Rating agencies consider factors such as political stability, government policies, and regulatory changes when assessing bond ratings, as they can influence the issuer's operating environment and financial prospects. Strong management and corporate governance practices can enhance an issuer's creditworthiness and contribute to higher bond ratings. Rating agencies evaluate the competency of management, strategic planning, and the effectiveness of corporate governance structures to assess an issuer's ability to navigate financial challenges and meet its obligations. Bond ratings are an essential tool for investors to assess the credit risk associated with a bond issue. Higher-rated bonds typically have lower default risk, while lower-rated bonds carry higher risk. Investors can use bond ratings to align their investments with their risk tolerance and objectives. Bond ratings play a crucial role in investment decision-making by providing a standardized measure of credit risk. Investors can use these ratings to compare different bonds and make informed decisions about which bonds to include in their portfolios based on their risk-return preferences. Incorporating bonds with varying credit ratings into an investment portfolio can help investors achieve diversification and manage risk. A well-diversified portfolio can include a mix of high-grade, medium-grade, and non-investment grade bonds, allowing investors to balance risk and return while minimizing exposure to any single issuer or sector. Bond ratings have a direct impact on the yield and pricing of bonds in the market. Higher-rated bonds generally offer lower yields, as they carry lower risk, while lower-rated bonds offer higher yields to compensate for the increased risk. Investors can use bond ratings to identify suitable investment opportunities based on their desired risk-return profile. Bond rating downgrades and upgrades occur when credit rating agencies reassess an issuer's creditworthiness due to changes in its financial position, economic conditions, or other relevant factors. Downgrades typically result from deteriorating financial health, while upgrades reflect improved financial performance or reduced risk factors. Market reactions to bond rating changes can be significant, as investors adjust their expectations of credit risk. Downgrades often lead to declines in bond prices and higher yields, while upgrades can result in higher bond prices and lower yields. These market reactions can impact the cost of capital for issuers and the returns for investors. Bond rating changes can have considerable implications for both issuers and investors. For issuers, downgrades can increase borrowing costs and make it more challenging to raise capital, while upgrades can lower financing costs. For investors, rating changes can affect the value of their bond holdings and influence their investment decisions. Conflicts of interest in rating agencies have been a major point of criticism. Since issuers often pay rating agencies for their services, there is a potential conflict of interest that could influence the agencies' assessments and lead to inflated ratings or a lack of objectivity. The accuracy and timeliness of bond ratings have also been questioned, as rating agencies may not always accurately predict default risk or respond promptly to changing circumstances. This issue can result in investors making decisions based on outdated or inaccurate information, potentially leading to financial losses. Bond rating agencies have faced criticism for their role in financial crises, such as the 2008 financial crisis, where they were accused of assigning overly optimistic ratings to mortgage-backed securities. These inflated ratings contributed to the buildup of risk in the financial system and exacerbated the crisis when the underlying assets deteriorated. Peer-to-peer rating systems involve market participants providing their assessments of bond issuers' creditworthiness, creating a more decentralized and potentially unbiased source of information. This approach can complement traditional rating agency assessments and offer investors additional insights into credit risk. Machine learning and artificial intelligence (AI) can be used to develop bond rating models that analyze vast amounts of data to predict credit risk. These models can potentially provide more accurate and timely assessments of bond issuers' creditworthiness, aiding investors in their decision-making process. Decentralized and blockchain-based rating platforms can offer a transparent and tamper-proof alternative to traditional bond ratings. These platforms can leverage the collective wisdom of the market, reduce the influence of conflicts of interest, and enhance the credibility of bond ratings. Bond ratings are crucial for investors as they assess the creditworthiness of bond issuers and help guide investment decisions. Investment grade bonds are considered safer, while non-investment grade bonds carry higher risk. Major credit rating agencies such as Standard & Poor's, Moody's, and Fitch play a significant role in assigning ratings based on factors like financial health, economic conditions, and management quality. Bond rating changes impact market reactions, issuer financing costs, and investor returns. However, there are criticisms regarding conflicts of interest, accuracy, and inflated ratings within the industry. Alternative approaches, including peer-to-peer rating systems, machine learning and AI-based models, and decentralized blockchain platforms, offer potential solutions. Understanding bond ratings and their implications is essential for investors to make informed decisions in the bond market.What Is Bond Rating?

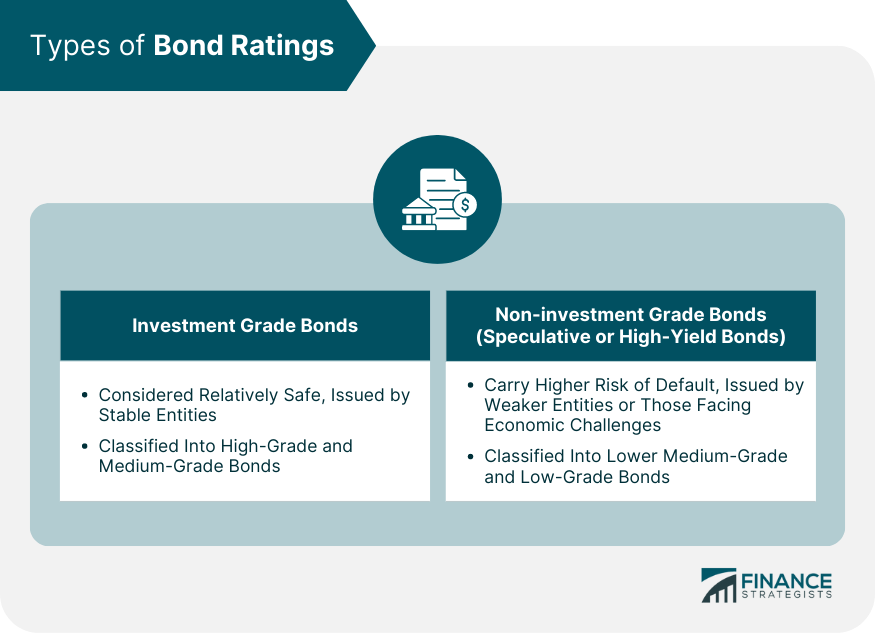

Types of Bond Ratings

Investment Grade Bonds

High-Grade Bonds

Medium-Grade Bonds

Non-Investment Grade Bonds (Speculative or High-Yield Bonds)

Lower Medium-Grade Bonds

Low-Grade Bonds

Major Credit Rating Agencies

Standard & Poor's (S&P)

Moody's Investors Service

Fitch Ratings

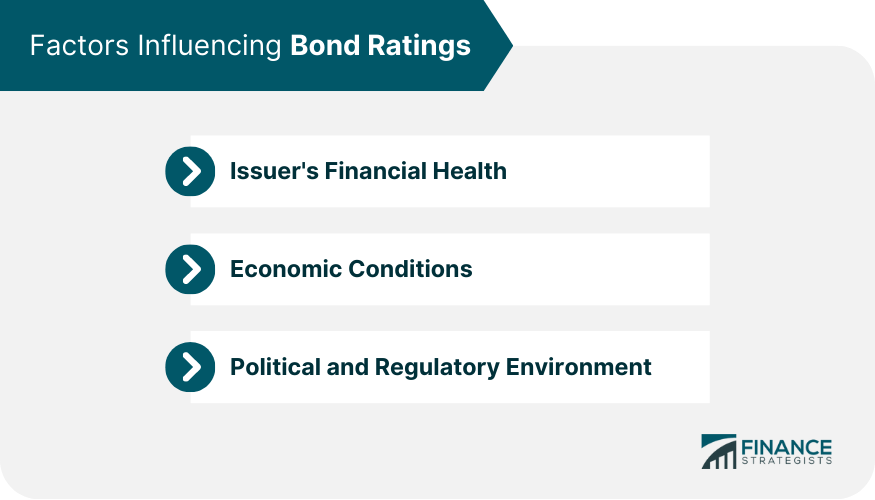

Factors Influencing Bond Ratings

Issuer's Financial Health

Debt Level

Cash Flow

Profitability

Economic Conditions

Industry Trends

Market Conditions

Political and Regulatory Environment

Management and Corporate Governance

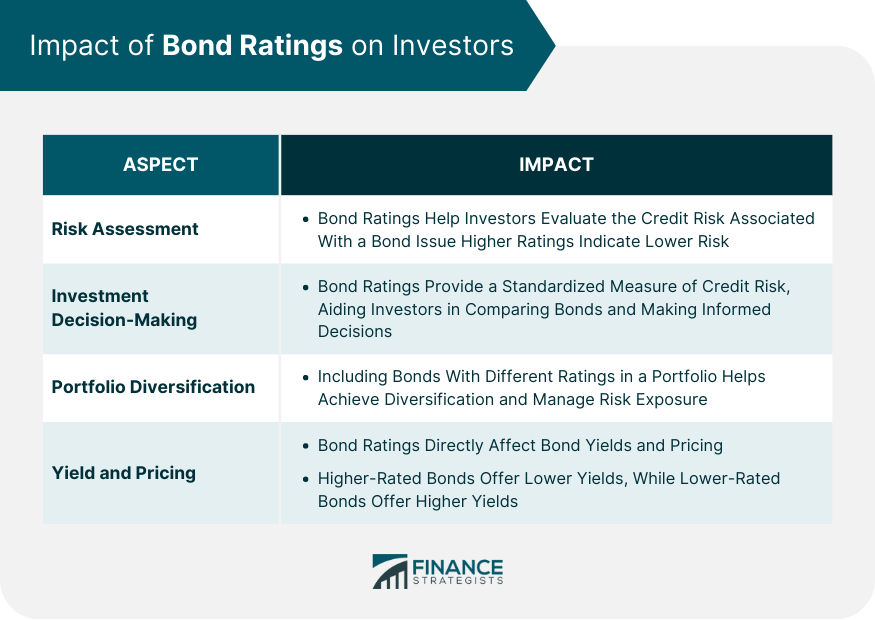

Impact of Bond Ratings on Investors

Risk Assessment

Investment Decision-Making

Portfolio Diversification

Yield and Pricing of Bonds

Bond Rating Downgrades and Upgrades

Causes of Downgrades and Upgrades

Market Reactions to Rating Changes

Impact on Issuers and Investors

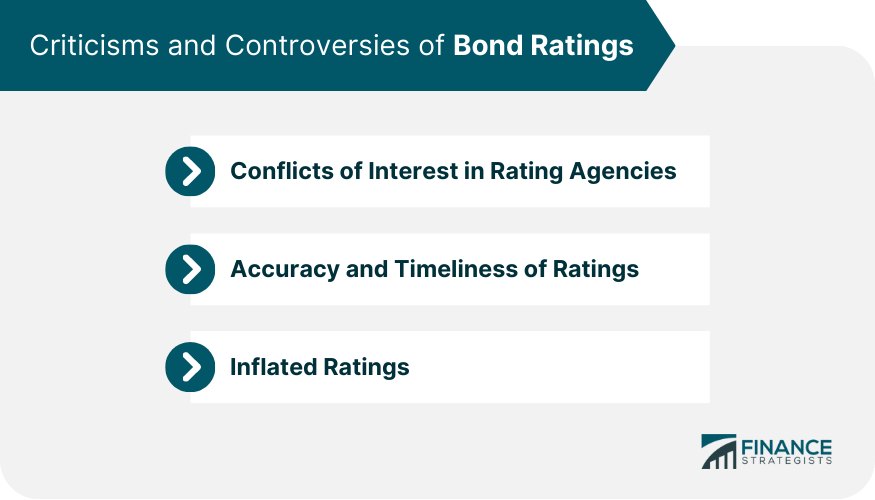

Criticisms and Controversies of Bond Ratings

Conflicts of Interest in Rating Agencies

Accuracy and Timeliness of Ratings

Inflated Ratings

Alternative Approaches to Bond Ratings

Peer-To-Peer Rating Systems

Machine Learning and AI-Based Rating Models

Decentralized and Blockchain-Based Rating Platforms

Final Thoughts

Bond Rating FAQs

A bond rating is an assessment of the creditworthiness of a bond issuer, indicating the likelihood of default or the issuer's ability to meet its financial obligations. Bond ratings are important for investors because they help gauge the credit risk associated with a particular bond issue, allowing them to make informed investment decisions based on their risk tolerance and objectives.

Credit rating agencies, such as Standard & Poor's, Moody's, and Fitch Ratings, analyze various factors, including an issuer's financial health, economic conditions, political and regulatory environment, and management and corporate governance, to determine the creditworthiness of a bond issuer. Based on their analysis, they assign a bond rating that reflects the issuer's ability to meet its financial obligations.

Investment grade bonds are considered relatively safe investments with low risk of default, typically issued by financially stable entities. They have higher bond ratings and are further classified into high-grade and medium-grade bonds. Non-investment grade bonds, also known as speculative or high-yield bonds, carry a higher risk of default and have lower bond ratings. They are further classified into lower medium-grade and low-grade bonds.

Bond rating downgrades and upgrades can have significant implications for the bond market and bondholders. Downgrades can lead to declines in bond prices and higher yields, while upgrades can result in higher bond prices and lower yields. These rating changes can impact the cost of capital for issuers and the returns for investors, affecting the value of bond holdings and influencing investment decisions.

Alternative approaches to bond ratings include peer-to-peer rating systems, machine learning and AI-based rating models, and decentralized and blockchain-based rating platforms. These approaches can complement traditional bond ratings by providing more decentralized, unbiased, transparent, and potentially accurate assessments of bond issuers' creditworthiness, addressing concerns related to conflicts of interest, accuracy, and timeliness in the traditional bond rating process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.