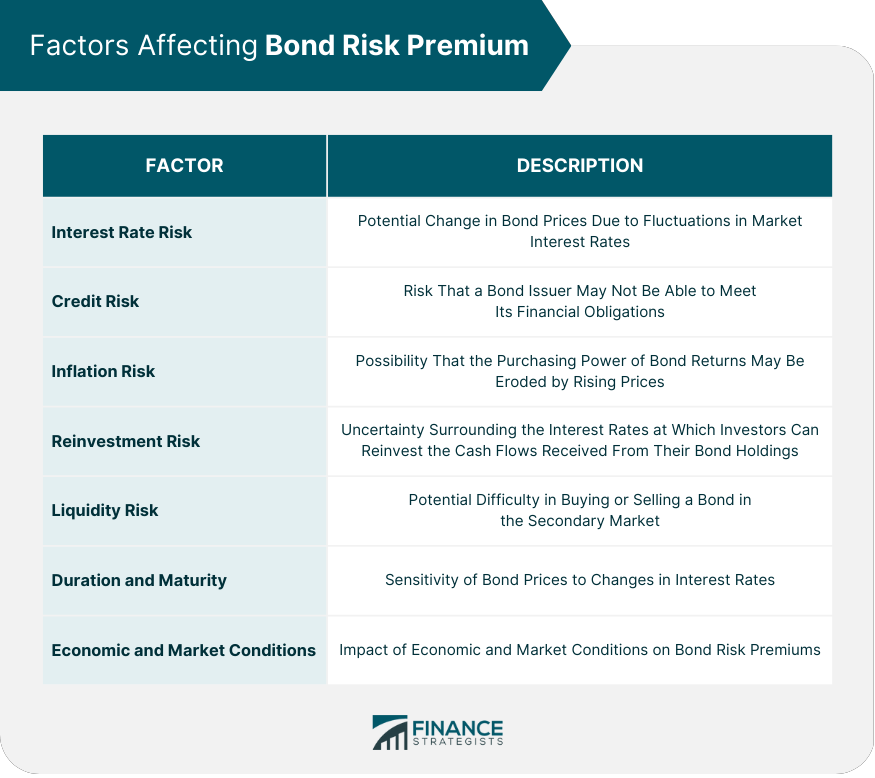

The bond risk premium is the additional return that an investor expects to receive for taking on the risk of holding a bond that has a higher likelihood of default or other credit-related issues compared to a risk-free bond. This additional return compensates the investor for the additional risk they are taking on by investing in the bond. Interest rate risk refers to the potential change in bond prices due to fluctuations in market interest rates. When interest rates rise, bond prices fall, and vice versa. This inverse relationship exposes investors to the risk of potential capital losses if they need to sell a bond before its maturity date. Credit risk is the risk that a bond issuer may not be able to meet its financial obligations, including timely payment of interest and principal. Investors demand a higher yield to compensate for the increased risk associated with issuers with lower creditworthiness. Default risk is the probability that a bond issuer will not be able to make interest and principal payments as scheduled. A higher default risk translates to a higher bond risk premium. Inflation risk is the possibility that the purchasing power of bond returns may be eroded by rising prices. When inflation expectations increase, investors demand a higher yield to compensate for the reduced purchasing power of their fixed-income investments. Reinvestment risk refers to the uncertainty surrounding the interest rates at which investors can reinvest the cash flows received from their bond holdings. If interest rates decline, investors may be forced to reinvest at lower rates, negatively impacting their overall investment returns. Liquidity risk arises from the potential difficulty in buying or selling a bond in the secondary market. Bonds with lower liquidity tend to have wider bid-ask spreads, making it more challenging and costly for investors to trade these bonds. To compensate for this risk, investors demand a higher yield. Duration is a measure of a bond's price sensitivity to changes in interest rates. Bonds with longer durations and maturities are generally more sensitive to interest rate changes, resulting in higher bond risk premiums. Economic and market conditions can significantly impact bond risk premiums. In times of economic uncertainty or financial market stress, investors often demand higher bond risk premiums as compensation for the heightened risks. Yield to maturity (YTM) is the total return an investor can expect from a bond if held to maturity. By comparing the YTM of a bond with that of a risk-free rate (e.g., Treasury bonds), investors can estimate the bond risk premium. Credit spreads are the difference in yield between a corporate bond and a risk-free government bond with the same maturity. A wider credit spread indicates a higher bond risk premium. Bond rating agencies assign credit ratings to bonds based on their assessment of the issuer's creditworthiness. Higher-rated bonds typically have lower bond risk premiums, while lower-rated bonds have higher bond risk premiums. Historical default rates provide insights into the likelihood of an issuer defaulting on its bond payments. Investors can use these rates to estimate the bond risk premium associated with a particular bond or issuer. Understanding bond risk premium is essential for investors looking to diversify their portfolios. By including bonds with varying risk premiums, investors can create a more diversified and balanced portfolio, potentially reducing overall portfolio risk. Incorporating bond risk premium into investment decisions helps investors balance the risk-return trade-off. By assessing the risk premium, investors can gauge whether the potential return from a bond investment justifies the associated risks. Understanding bond risk premiums can also inform investors' decisions regarding active or passive bond management strategies. Active managers attempt to exploit market inefficiencies and mispricing, while passive managers seek to replicate bond index performance. Bond risk premiums can help investors identify potential opportunities in active management or decide if a passive approach is more suitable for their risk tolerance. Duration and immunization strategies help investors manage the interest rate risk associated with their bond portfolios. By matching the duration of assets and liabilities, investors can minimize interest rate risk and the potential impact on bond risk premiums. Macroeconomic factors, such as economic growth, monetary policy, and inflation expectations, can significantly impact bond risk premiums. For instance, during periods of robust economic growth, investors may perceive bonds as less risky, leading to lower bond risk premiums. Investor sentiment also plays a crucial role in determining bond risk premiums. In times of heightened market volatility or uncertainty, investors tend to demand higher bond risk premiums to compensate for the increased risks. During financial crises, investors often seek the safety of high-quality bonds, such as U.S. Treasuries, leading to a "flight to quality." This shift can result in a widening of credit spreads and an increase in bond risk premiums for lower-rated bonds. Risk factors affecting bonds can change over time, making it challenging to accurately assess bond risk premiums. For example, an issuer's creditworthiness may improve or deteriorate, or market conditions may change, leading to a reassessment of the bond risk premium. Credit ratings assigned by bond rating agencies can have limitations. Ratings may not always fully capture an issuer's credit risk or may be slow to incorporate new information. Consequently, relying solely on credit ratings to assess bond risk premiums can be problematic. Measuring credit risk is often subjective, as it requires an evaluation of the issuer's financial health, industry outlook, and other qualitative factors. This subjectivity can make it challenging to accurately estimate bond risk premiums, leading to potential mispricing in the market. In summary, the bond risk premium plays a crucial role in fixed-income investments. Investors and portfolio managers need to have a good understanding of the bond risk premium to make informed investment decisions. By understanding the factors affecting the bond risk premium, such as interest rate risk, credit risk, inflation risk, and market conditions, they can manage portfolio risks, optimize risk-return trade-offs, and improve investment outcomes. Although there are challenges in assessing bond risk premiums, a comprehensive understanding of the bond risk premium and its implications can provide valuable insights to investors and help them achieve their investment goals. Therefore, it is important for investors and portfolio managers to pay close attention to the bond risk premium and manage it effectively.What Is Bond Risk Premium?

The bond risk premium is a critical concept in the world of fixed-income investments. It represents the additional yield investors demand to compensate for the risks associated with holding a bond compared to a risk-free security, such as a U.S. Treasury bond. Factors Affecting Bond Risk Premium

Interest Rate Risk

Credit Risk

Issuer Creditworthiness

Default Risk

Inflation Risk

Reinvestment Risk

Liquidity Risk

Duration and Maturity

Economic and Market Conditions

Estimating Bond Risk Premium

Yield to Maturity Comparison

Credit Spread Analysis

Bond Rating Agencies

Historical Default Rates

The Role of Bond Risk Premium in Portfolio Management

Diversification

Risk-Return Trade-off

Active vs Passive Bond Management Strategies

Duration and Immunization Strategies

Bond Risk Premium in Relation to Market Performance

Macroeconomic Factors

Market Sentiment

Flight to Quality During Financial Crises

Challenges in Assessing Bond Risk Premium

Changing Risk Factors Over Time

Limitations of Credit Ratings

Subjectivity in Measuring Credit Risk

Conclusion

Bond Risk Premium FAQs

The bond risk premium refers to the additional return that an investor demands to hold a bond with a higher level of risk compared to a risk-free bond.

The bond risk premium is calculated by subtracting the yield of a risk-free bond from the yield of a risky bond. The difference represents the additional return demanded by investors for taking on the additional risk.

Several factors can affect the bond risk premium, including the creditworthiness of the issuer, the term of the bond, and prevailing market conditions such as interest rates and inflation.

The bond risk premium is important for investors because it provides insight into the level of risk associated with a particular bond investment. A higher bond risk premium indicates a higher level of risk and potentially higher returns, but also higher potential losses.

Yes, the bond risk premium can change over time in response to changes in market conditions, issuer creditworthiness, and other factors. Investors should regularly monitor the bond risk premium associated with their investments to ensure they align with their risk tolerance and investment goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.