Build America Bonds are municipal bonds created under the American Recovery and Reinvestment Act of 2009. They were designed to support funding for state and local government capital projects, such as infrastructure improvements. Unlike traditional municipal bonds, which are typically tax-exempt, the interest earned on BABs is taxable. However, the federal government provides a subsidy to make these bonds more attractive to investors and affordable for issuers. This subsidy can take one of two forms: a direct payment to the bond issuer equivalent to 35% of the interest cost or a tax credit for the bondholder. The BABs program was temporary, and the authority to issue new BABs expired on December 31, 2010. However, BABs that were issued before this date continue to trade on the secondary market. Tax Credit Build America Bonds (TC-BABs) provide bondholders with federal tax credits in lieu of traditional interest payments. The tax credit, typically equal to 35% of the interest paid on the bond, lowers the effective interest rate for investors and reduces the borrowing costs for issuers. This structure appeals to both tax-exempt and taxable investors, as the tax credit can offset other tax liabilities and effectively increase the bond's after-tax yield. Direct Payment Build America Bonds (DP-BABs) differ from TC-BABs in providing a direct cash subsidy to the bond issuer instead of a tax credit to the bondholder. The federal government covers a portion of the interest cost, generally 35%, which reduces the issuer's net interest expense. This structure allows issuers to offer higher interest rates on their bonds, attracting more investors, including those who may not benefit from tax credits, such as pension funds and foreign investors. While interest earned on traditional municipal bonds is typically exempt from federal income taxes, BABs are taxable instruments. This distinction makes BABs more attractive to a broader range of investors, including those who do not benefit from tax-exempt investments. Both BABs and traditional municipal bonds carry credit risk, but the specific risk profile of each bond depends on the issuer's creditworthiness. Investors must carefully evaluate the credit quality and potential default risk associated with each bond, regardless of its structure. The market for traditional municipal bonds is significantly larger and more established than the market for BABs, which existed relatively short. As a result, traditional municipal bonds may offer greater liquidity and market depth compared to BABs. BABs attracted a more diverse investor base than traditional municipal bonds due to their taxable status. By offering a new asset class with potentially higher yields, BABs drew interest from pension funds, insurance companies, and foreign investors who may have yet to find traditional tax-exempt municipal bonds as appealing. One of the primary goals of Build America Bonds was to spur infrastructure development and create jobs in the aftermath of the 2008 financial crisis. By offering a lower-cost financing alternative to traditional municipal bonds, BABs incentivized state and local governments to undertake infrastructure projects that might have otherwise been delayed or canceled due to budget constraints. BABs enabled state and local governments to issue debt at lower interest rates than they would have through traditional tax-exempt bonds. The federal subsidy offered through BABs effectively lowered borrowing costs, allowing governments to fund more projects with the same debt or reduce their overall debt burden. This asset class attracted a wide range of investors, including pension funds, insurance companies, and foreign investors, who previously needed to improve their ability to invest in traditional tax-exempt municipal bonds due to tax considerations. By making it more financially attractive for private entities to participate in public infrastructure projects, BABs encouraged public-private partnerships. These collaborations bring private-sector efficiency and innovation to public projects, potentially improving outcomes and reducing costs. Infrastructure projects funded by BABs had the added benefit of creating jobs, especially in the construction and engineering sectors. By financing new projects during an economic downturn, BABs reduced unemployment and spurred economic growth. The federal subsidies associated with BABs represent a significant cost to the federal government. Critics argue that these subsidies could strain the federal budget and contribute to long-term fiscal challenges, especially if the program were to be expanded or reintroduced in the future. Some critics argue that their long-term fiscal implications outweigh the short-term benefits of BABs. By encouraging state and local governments to take on additional debt, BABs could contribute to unsustainable borrowing practices and ultimately strain municipal budgets. There is a concern that some state and local governments may misuse BABs funding for purposes other than infrastructure development. Ensuring proper oversight and accountability is crucial in preventing potential abuse of the program and ensuring that the funds are used effectively and efficiently. Investors must carefully evaluate the credit quality of individual issuers to understand their risk exposure. Furthermore, although the federal government provides subsidies for interest payments, it does not guarantee the principal, exposing investors to potential losses. BABs can be traded in the secondary market, where investors buy and sell existing bonds. The secondary market offers investors the opportunity to buy BABs at potentially discounted prices or to sell their holdings when they need to rebalance their portfolios or access cash. However, investors should know that secondary market trading may involve higher transaction costs and potentially lower liquidity than the primary market. Agencies typically provide credit ratings for bond issuers, which can be a useful starting point for evaluating risk. Additionally, investors should examine the issuer's financial health, the project being financed, and the overall economic environment. The bond's yield should be considered in the context of its risk profile and compared to other investment opportunities with similar risk characteristics. While BABs are taxable investments, the specific tax implications for each investor will depend on their circumstances, such as their tax bracket and any other tax liabilities. Investors should consult with a tax professional to understand the potential tax implications of investing in BABs and to optimize their investment strategy accordingly. Build America Bonds emerged as an innovative financial instrument during the 2008 financial crisis, providing much-needed funding for infrastructure projects and stimulating economic recovery. With two distinct types—Tax Credit BABs and Direct Payment BABs—the program offered various advantages, such as lower borrowing costs for state and local governments, diversification for investors, and job creation. Despite some criticisms, including concerns about the federal government's cost burden and potential misuse of funds, BABs significantly impacted the municipal bond market and contributed to economic growth. As the United States continues to confront infrastructure challenges, revisiting the concept of BABs and exploring potential improvements could be beneficial. Investors should consider the risk profile, yield, and tax implications when evaluating BABs as an investment opportunity. Overall, understanding the intricacies of BABs is crucial for investors and policymakers to make informed decisions about this financial instrument's potential role in addressing the nation's infrastructure needs.What Are Build America Bonds (BABs)?

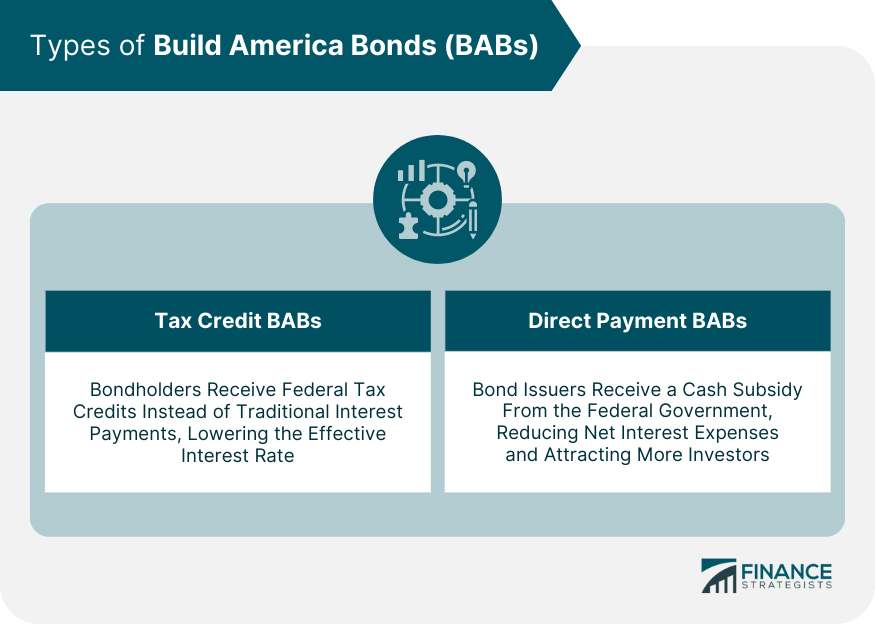

Types of Build America Bonds

Tax Credit BABs

Direct Payment BABs

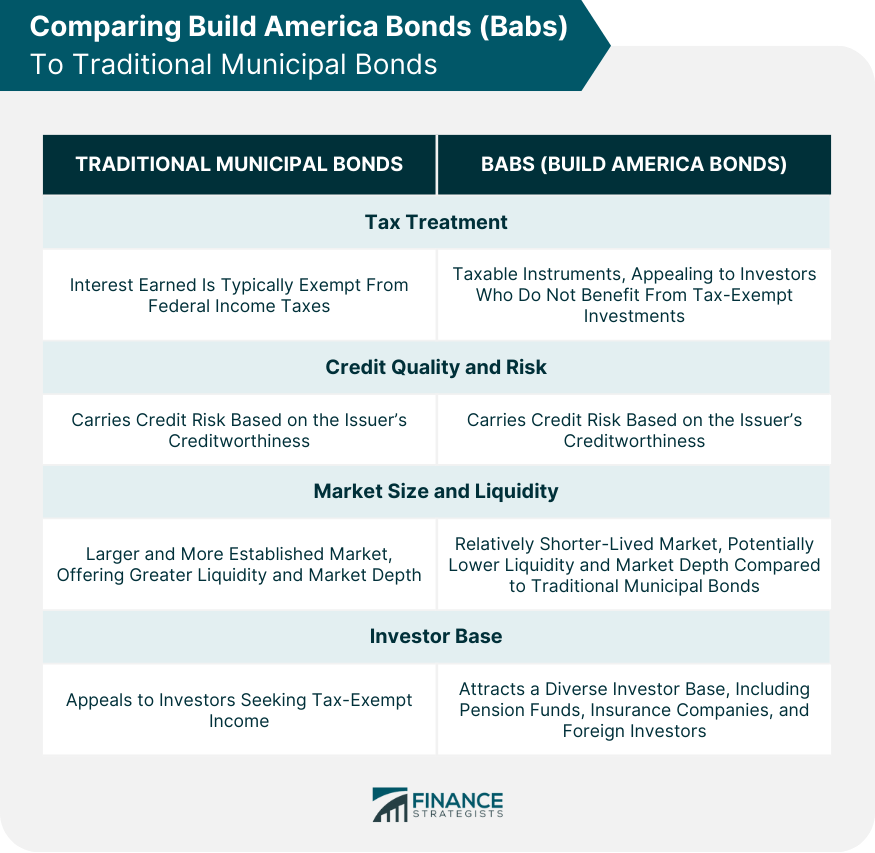

Comparing BABs to Traditional Municipal Bonds

Tax Treatment

Credit Quality and Risk

Market Size and Liquidity

Investor Base

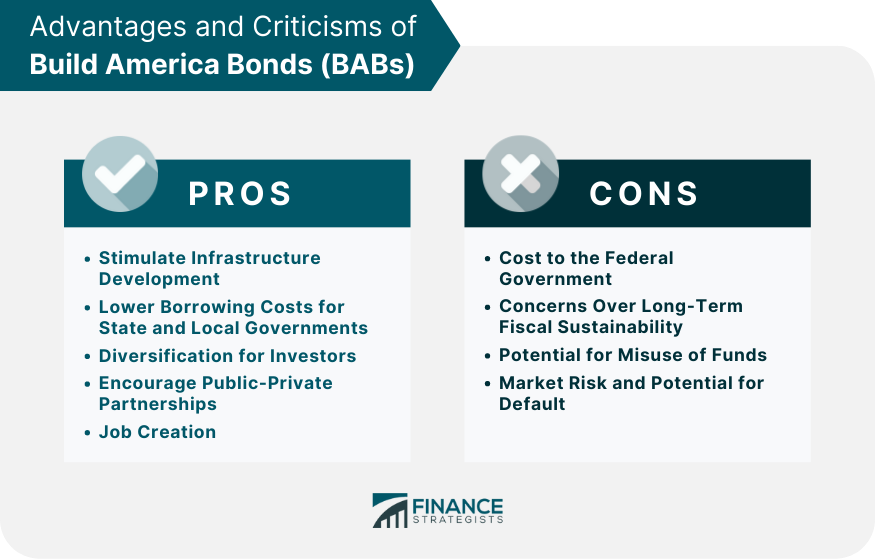

Advantages of Build America Bonds

Stimulating Infrastructure Development

Lower Borrowing Costs for State and Local Governments

Diversification for Investors

Encouraging Public-Private Partnerships

Job Creation

Criticisms and Limitations of BABs

Cost to the Federal Government

Concerns Over Long-Term Fiscal Sustainability

Potential for Misuse of Funds

Market Risk and Potential for Default

Investing in Build America Bonds

Secondary Market Trading

Evaluating Credit Risk and Yield

Tax Implications for Investors

Conclusion

Build America Bonds (BABs) FAQs

Build America Bonds (BABs) are a type of municipal bond that was introduced by the U.S. government in 2009 as part of the American Recovery and Reinvestment Act. Unlike traditional municipal bonds, which are typically tax-exempt, the interest on BABs is taxable. However, the federal government subsidizes the issuer or the bondholder to offset this tax liability.

When a state or local government issues a Build America Bond, they agree to pay the bondholders a certain amount of interest over a specified period of time. The interest on these bonds is taxable, but the federal government provides a subsidy to offset this tax liability. The subsidy can either be a direct payment to the issuer, reducing the cost of borrowing, or a tax credit to the bondholder, reducing their tax liability.

The purpose of Build America Bonds (BABs) is to reduce the cost of borrowing for state and local governments and to stimulate the economy by encouraging infrastructure investment. By providing a federal subsidy, the government makes it more attractive for these entities to issue bonds and fund projects, which can lead to job creation and economic growth.

The main difference between Build America Bonds (BABs) and traditional municipal bonds is the tax treatment of the interest. Interest on traditional municipal bonds is generally exempt from federal income taxes, while interest on BABs is taxable. However, the federal government subsidizes the issuer or the bondholder to offset this tax liability.

The Build America Bonds (BABs) program was a temporary measure introduced as part of the American Recovery and Reinvestment Act of 2009. The authority to issue new BABs expired on December 31, 2010. However, BABs that were issued before this date continue to trade on the secondary market.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.