A bullet bond is a type of debt instrument that pays interest over its entire duration and returns the principal on its maturity date. It is a common type of bond structure. The term "bullet" comes from the fact that the entire principal is "due at once" at the end, similar to a bullet being fired all at once. So, if a company issues a 10-year bullet bond with a face value of $1,000, it will make regular coupon or interest payments over the 10 years, and then, at the end of year 10, it will return the full $1,000 principal to the bondholder. Bullet bonds are the antithesis of "amortizing" bonds, where the principal is paid down over the life of the bond. These are the most common form of corporate and government bonds. Bullet bonds are straightforward, predictable, and easier for investors to understand, which can make them a popular choice. Every bullet bond is characterized by a specific maturity date, which is the date when the bond issuer is obligated to repay the principal amount in full to the bondholders. This date is established when the bond is initially issued and can range widely from a few years to several decades. The maturity date is an important aspect for investors, as it informs the duration for which their capital will be tied up and the period over which they can expect to receive interest payments. It also has implications for the yield and price sensitivity of the bond to changes in market interest rates. Bondholders receive interest payments at regular intervals - usually semi-annually or annually - for the entire term of the bond. These interest payments, also known as coupons, are derived from a predetermined fixed interest rate that was set at the time of issuance. The regularity and predictability of these payments can make bullet bonds appealing to investors seeking a consistent income stream. Unlike some other types of bonds, bullet bonds do not repay principal incrementally over the life of the bond. Instead, the full face value of the bond is repaid to the bondholder in one lump sum at the end of the bond's term, i.e., at maturity. This means that the bondholder's initial investment is returned all at once rather than gradually. This feature can be beneficial for investors who require a large amount of money at a future date, such as for a major purchase or retirement. The interest rate determined at the bond's issuance will remain unchanged for the entire life of the bond. This fixed rate provides certainty and predictability for the investor, as it guarantees a known income stream regardless of fluctuations in market interest rates. However, this can be a disadvantage if market rates rise significantly above the bond's fixed rate, as the investor will be receiving a lower return compared to what they could potentially earn from other investments. These are issued by corporations seeking to raise capital for various purposes, such as expanding operations, refinancing existing debt, or funding new projects. Corporate bullet bonds typically have higher yields than government bonds due to the higher risk associated with them. Governments issue bullet bonds to finance public expenditures, such as infrastructure development or debt refinancing. These bonds usually have lower yields, as they are considered safer investments. These hybrid securities allow the bondholder to convert the bond into a predetermined number of the issuer's common shares. Convertible bullet bonds offer potential upside from the issuer's stock price while providing regular interest income. These bonds are backed by a pool of mortgages, providing the bondholder with interest payments from the mortgage payments. Mortgage-backed bullet bonds can offer higher yields compared to other bullet bonds due to the underlying collateral. It makes financial planning easier for individuals and institutions alike. For example, retirees who need a consistent income stream to cover living expenses often find the predictable cash flows from bullet bonds desirable. Similarly, institutional investors, such as pension funds and insurance companies, may use bullet bonds to match their known liabilities in the future. The terms of a bullet bond are relatively easy to understand: there's a fixed interest rate, a clear schedule of interest payments, and a defined date for the repayment of principal. This simplicity helps investors understand the exact cash flows they will receive, barring a default by the issuer, making bullet bonds one of the more accessible and comprehensible financial instruments for both seasoned investors and novices. Bullet bonds can be especially attractive to investors in search of a reliable return on their investments, such as retirees or those who are more risk-averse. Given the fixed nature of the interest rate on most bullet bonds, these payments remain consistent over the life of the bond, barring a default by the issuer. Assuming the issuer does not default, bullet bonds offer a strong assurance of principal preservation, as the entire principal amount is repaid at maturity. This makes bullet bonds an attractive option for conservative investors who prioritize the return of their original investment over chasing higher, but riskier, returns. If the market interest rates increase after an investor has purchased a bullet bond, the fixed interest rate of the bond becomes less attractive. New bonds will be issued with higher interest rates, which makes the existing bond less competitive. If the bondholder needs to sell before maturity in a higher interest rate environment, they may have to sell at a lower price. Conversely, the bond's price increases if interest rates fall, but that only benefits the bondholder if they intend to sell the bond before maturity. Although bullet bonds eliminate reinvestment risk during their term due to their non-amortizing nature, they do introduce reinvestment risk at maturity. When a bullet bond matures, the investor is faced with reinvesting the principal in a potentially different interest rate environment. If market rates have fallen, they may not be able to achieve the same level of returns when reinvesting the principal. This is the risk that the issuer might face financial challenges that prevent them from making the scheduled interest payments or returning the principal at maturity. This risk can vary significantly depending on the creditworthiness of the issuer. For instance, government bonds are usually considered low risk, while corporate bonds can range from high to low risk depending on the company's financial stability. Not all bullet bonds are easy to buy or sell without impacting their price. While bonds from governments and large corporations tend to be more liquid, those issued by smaller entities may not have as many buyers or sellers, making them less liquid. If an investor needs to sell such a bond before its maturity, they may not be able to do so without selling at a discount, resulting in a potential loss. Holding a bullet bond to maturity could result in an opportunity cost for investors if other investments are providing higher returns. This is particularly relevant in an environment where interest rates are rising and new bonds are being issued at these higher rates. The fixed interest rate of the bullet bond might start to look less attractive compared to potential returns elsewhere. However, selling the bond before maturity to pursue higher returns could lead to losses if market interest rates have increased, making the opportunity cost a notable risk. For example, in the United States, Treasury bonds can be purchased directly from the U.S. government through the Treasury Direct website. This can be a good way to invest in bullet bonds if you plan to hold the bond until maturity, as it allows you to avoid broker fees. These institutions act as intermediaries between the buyers and sellers of bonds. Buying through a broker or bank can offer you a wider selection of bonds from different issuers. However, keep in mind that brokers typically charge fees for their services. This means that even after the initial issuance, you can still invest in bullet bonds by buying them from other investors. The price you'll pay for a bond on the secondary market may be more or less than its face value, depending on various factors such as changes in interest rates and the issuer's creditworthiness. These funds pool money from many investors to purchase a diversified portfolio of bonds. By investing in a bond fund or ETF, you get exposure to a wide range of bonds without having to buy each one individually. Note, however, that fees are associated with these funds, and unlike individual bonds where the principal is returned at maturity, the return of principal is not guaranteed in bond funds or ETFs. These bonds do not make periodic interest payments. Instead, they're issued at a discount to their face value and at maturity, the investor receives the face value of the bond. Zero-coupon bonds can be an attractive alternative for investors who do not need regular income but seek a guaranteed return at a future point in time. Unlike bullet bonds, amortizing bonds repay parts of the principal over the bond's life in addition to the interest payments. This can reduce the risk of having to reinvest a large sum of money all at once when the bond matures. These bonds have interest payments that are tied to a reference interest rate, such as the London Interbank Offered Rate (LIBOR) or the Federal Funds rate, and can adjust at predetermined intervals. They can be a good alternative to bullet bonds when interest rates are expected to rise, as the interest payments on these bonds will increase with the rates. These bonds, such as Treasury Inflation-Protected Securities (TIPS) in the U.S., offer investors protection against inflation, as both the principal and interest payments are adjusted for inflation. This is a unique feature not provided by traditional bullet bonds. These are corporate bonds that give the bondholder the option to convert the bond into a predetermined number of shares of the issuing company. Convertible bonds combine the features of bonds and stocks, offering the potential for capital appreciation if the company's stock price rises. Callable bonds allow the issuer to repay the bond before its maturity date, while puttable bonds allow the bondholder to sell the bond back to the issuer before maturity. These features provide flexibility to either the issuer or the bondholder, but they introduce additional risks and considerations for the investor. For those looking for potentially higher returns and are willing to take on more risk, investing in equities or equity-focused mutual funds could be an alternative. While these investments do not provide the fixed interest payments of bonds, they offer the potential for capital appreciation and, in some cases, dividend income. Bullet bonds offer fixed maturity dates, regular interest payments, and a lump sum principal repayment at maturity, providing clarity and understanding of cash flows. They are particularly appealing to those who value predictability, simplicity, consistent income generation, and preservation of principal. However, bullet bonds are not without drawbacks. Investors face interest rate, reinvestment, credit, and liquidity risks. Additionally, holding a bullet bond to maturity may incur opportunity costs if higher returns are available elsewhere. To access bullet bonds, investors can directly purchase them from the issuer, utilize brokerages and banks, explore the secondary market, or consider bond funds and ETFs. Each option has its own benefits and considerations, such as fees and the guarantee of principal repayment. Alternatively, investors can explore other bonds, such as zero-coupon bonds, amortizing bonds, floating-rate bonds, inflation-linked bonds, convertible bonds, and callable/puttable bonds, each offering unique features and benefits. The choice between bullet bonds and alternatives depends on an investor's financial goals, risk tolerance, and market expectations. A thorough evaluation of different bond types and market conditions is essential when making investment decisions. Seeking the help of a professional financial advisor can be advantageous.What Is a Bullet Bond?

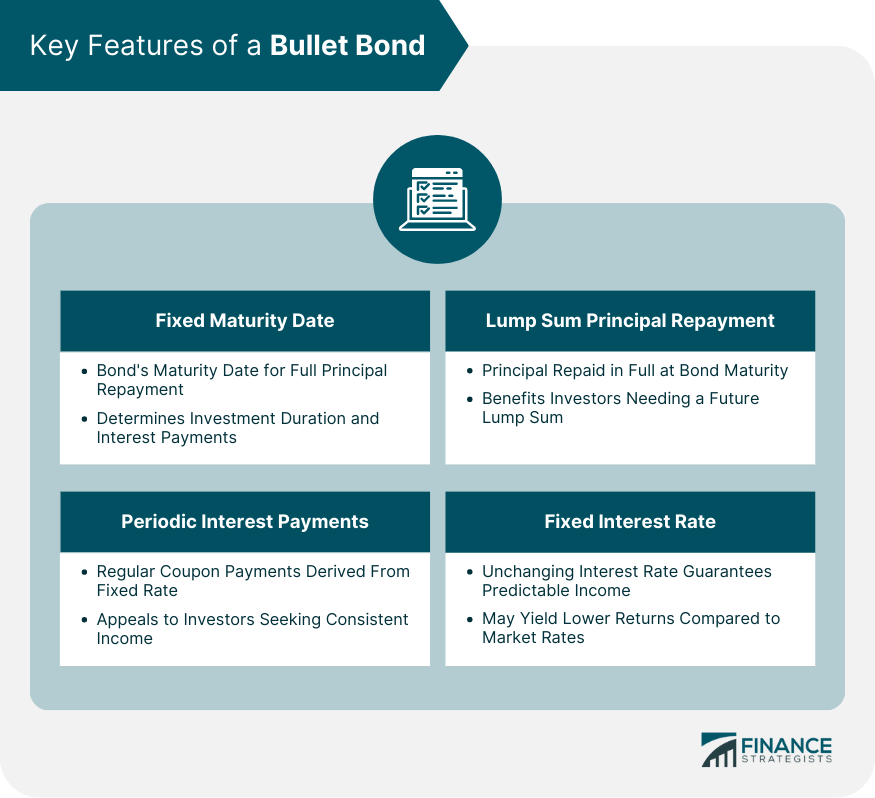

Key Features of a Bullet Bond

Fixed Maturity Date

Periodic Interest Payments

Lump Sum Principal Repayment

Fixed Interest Rate

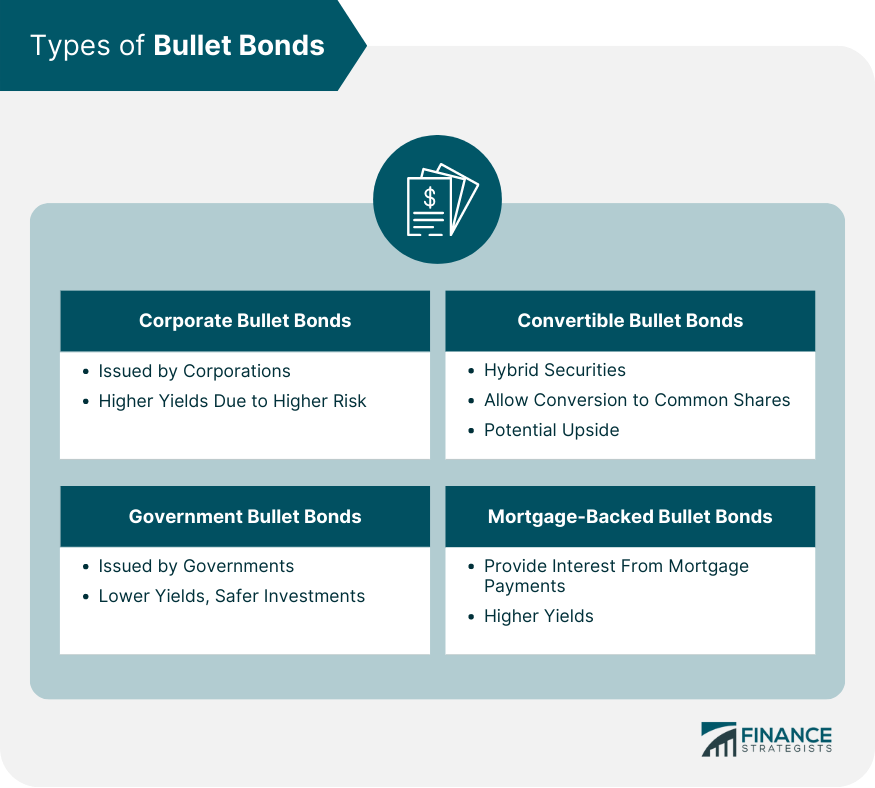

Types of Bullet Bonds

Corporate Bullet Bonds

Government Bullet Bonds

Convertible Bullet Bonds

Mortgage-Backed Bullet Bonds

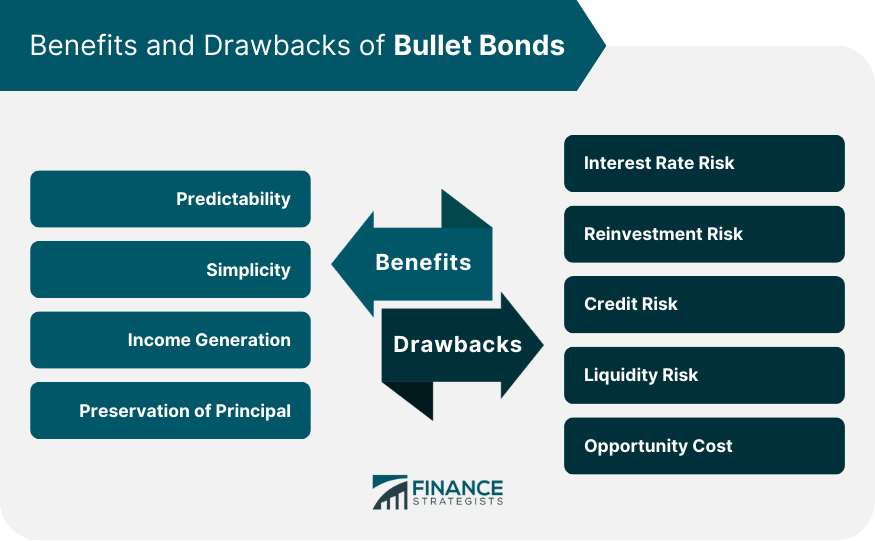

Benefits of Bullet Bonds

Predictability

Simplicity

Income Generation

Preservation of Principal

Drawbacks of Bullet Bonds

Interest Rate Risk

Reinvestment Risk

Credit Risk

Liquidity Risk

Opportunity Cost

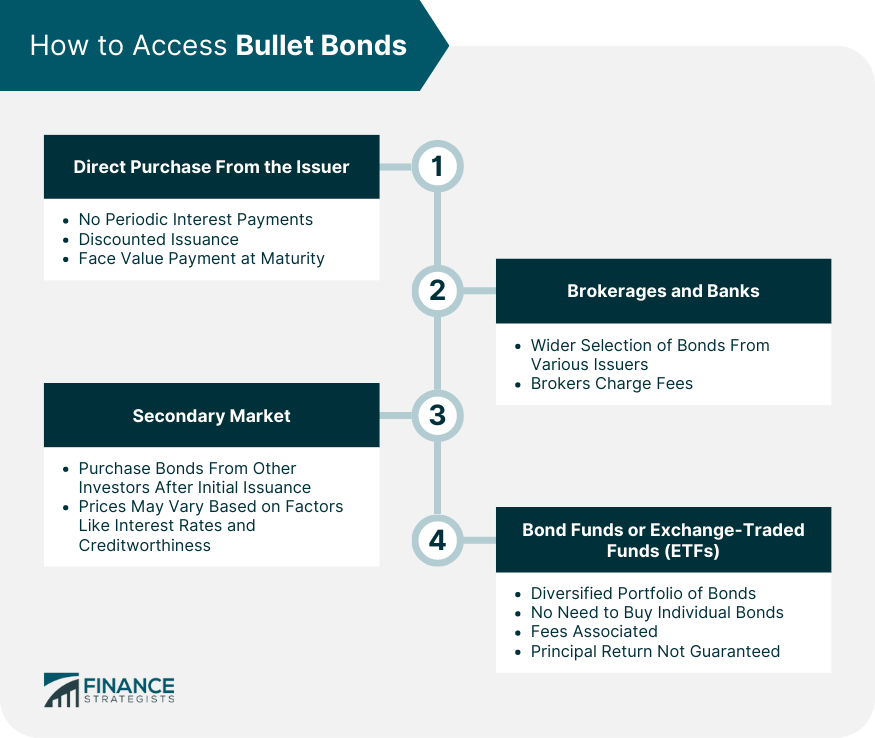

How to Access Bullet Bonds

Direct Purchase From the Issuer

Brokerages and Banks

Secondary Market

Bond Funds or Exchange-Traded Funds (ETFs)

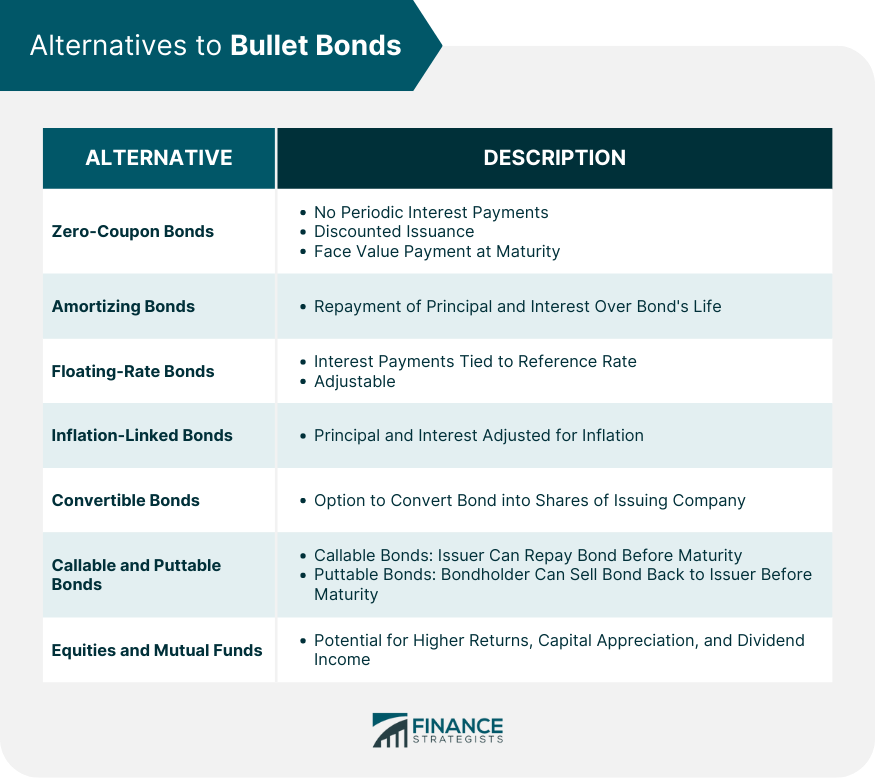

Alternatives to Bullet Bonds

Zero-Coupon Bonds

Amortizing Bonds

Floating-Rate Bonds

Inflation-Linked Bonds

Convertible Bonds

Callable and Puttable Bonds

Equities and Mutual Funds

Conclusion

Bullet Bond FAQs

A bullet bond is a type of debt security with a fixed maturity date. The issuer must repay the entire principal amount in a single lump sum payment at maturity. Interest payments are typically made periodically throughout the bond's life.

Unlike an amortizing bond, where the principal is gradually repaid over the bond's life through a series of installment payments, a bullet bond requires the issuer to repay the entire principal amount in one lump sum at maturity. Interest payments are made periodically in both cases.

Key features of a bullet bond include a fixed maturity date, periodic interest payments (usually semi-annually or annually), and a single lump sum repayment of the principal amount at maturity. Bullet bonds typically have a fixed interest rate.

Advantages of investing in a bullet bond include predictable cash flows from periodic interest payments, the potential for capital preservation due to the repayment of the full principal amount at maturity, and the ability to plan for future cash needs based on the bond's fixed maturity date.

Risks associated with investing in a bullet bond include interest rate risk (changes in market interest rates can affect the bond's price), credit risk (the risk that the issuer may default on interest or principal payments), and reinvestment risk (the risk that interest payments may need to be reinvested at lower rates).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.