Corporate bonds are debt securities issued by companies to raise capital for various purposes, such as funding operations or financing large projects. Investors who purchase these bonds essentially lend money to the issuer, who in turn pays periodic interest and repays the principal upon maturity. Corporate bonds allow companies to access funding at potentially lower costs than equity financing while providing investors with a source of regular income. There are various types of issuers in the corporate bond market, including financial institutions, industrial corporations, and utilities. These issuers may have different credit ratings, financial profiles, and industry exposures, which can affect the risks and returns associated with their bonds. Investors can diversify their bond portfolios by selecting bonds from a wide range of issuers. Corporate bonds play a vital role in financing various business activities, such as mergers and acquisitions, capital investments, and working capital requirements. By issuing bonds, companies can access funds from a diverse pool of investors, potentially at lower costs than bank loans or equity issuance. This helps companies grow, create jobs, and contribute to economic growth. Understanding the key features of corporate bonds is crucial for investors seeking to make informed decisions and build well-diversified portfolios. In this section, we will examine the par value, coupon rate, and maturity date of corporate bonds, as well as discuss the different types and credit ratings. The par value or face value, of a corporate bond is the amount the issuer promises to repay upon maturity. The coupon rate represents the annual interest payment, usually expressed as a percentage of the par value. The maturity date is when the bond's principal is due to be repaid. These features determine the cash flows investors can expect to receive from a bond and are critical in assessing its value and risk profile. Credit ratings evaluate the creditworthiness of a corporate bond issuer and provide investors with a useful tool for assessing risk. Rating agencies, such as Standard & Poor's, Moody's, and Fitch, assign ratings based on various factors, including the issuer's financial strength, industry outlook, and economic environment. Higher-rated bonds generally offer lower yields but carry lower credit risk, while lower-rated bonds offer higher yields but carry higher credit risk. There are several types of corporate bonds, each with unique characteristics and risk-return profiles. Secured bonds are backed by specific assets or collateral, while unsecured bonds rely solely on the issuer's creditworthiness. Convertible bonds can be exchanged for a specified number of the issuer's shares, while non-convertible bonds cannot. Callable bonds allow the issuer to redeem the bond before its maturity date, while non-callable bonds do not have this feature. Corporate bonds offer certain benefits, including: Corporate bonds typically pay a fixed rate of interest, providing a reliable source of income for investors. This can be especially useful for those in retirement or those looking to supplement their income. Compared to stocks, corporate bonds are generally considered to be a lower-risk investment. This is because the issuer of the bond, the corporation, is obligated to repay the bond's face value when it matures. Adding corporate bonds to your investment portfolio can help diversify your holdings, reducing your overall risk and potentially increasing your returns. Corporate bonds also come with associated risks such as: This is the risk that the issuing corporation may default on its bond payments or go bankrupt, causing you to lose some or all of your investment. This is the risk that changes in interest rates will affect the market value of your bonds. If interest rates rise, the value of your bonds may decrease. This is the risk that the overall bond market may perform poorly, affecting the value of your bonds. This risk can be exacerbated by economic downturns or other market events. Several strategies can help investors manage risks and optimize their corporate bond investments. Laddering involves purchasing bonds with different maturities, which can help manage interest rate and reinvestment risks. The barbell strategy involves investing in short-term and long-term bonds while avoiding intermediate-term bonds, aiming to balance the risk and return profile. Passive management focuses on buying and holding bonds that track a specific index, while active management seeks to outperform the market by actively selecting individual bonds based on analysis and research. Corporate bonds play an essential role in the broader economy, affecting capital markets, public projects and infrastructure, and interest rates and monetary policy. In this section, we will examine these impacts in greater detail. Corporate bonds represent a significant portion of the capital markets, offering companies an alternative to bank loans and equity financing. This fosters competition and innovation by providing businesses with access to diverse funding sources. Furthermore, the corporate bond market can influence the broader financial market, as changes in credit spreads and default rates can signal shifts in investor sentiment and economic conditions. Some corporate bond issuers, such as utilities and transportation companies, use bond proceeds to finance public projects and infrastructure. This can lead to improvements in essential services and the overall quality of life for communities. By investing in corporate bonds, investors can indirectly support public works projects while potentially earning attractive returns. The corporate bond market can impact interest rates and monetary policy, as central banks and regulators monitor credit spreads and market conditions to gauge economic health. Changes in corporate bond yields can signal shifts in investor risk appetite, inflation expectations, and economic growth prospects. In turn, this information can inform central bank decisions on interest rates and other policy tools. The corporate bond market is subject to various regulations and compliance requirements, both domestically and internationally. In the United States, the SEC regulates the issuance and trading of corporate bonds to protect investors and maintain fair and efficient markets. Issuers must register their bonds with the SEC and provide detailed information about their financial condition and the bond's terms. Additionally, ongoing reporting requirements ensure that investors have access to up-to-date information on the issuer's financial performance and any material developments. FINRA is a self-regulatory organization that oversees broker-dealers and their activities in the corporate bond market. FINRA establishes rules governing the conduct of its members and enforces these rules to protect investors and ensure market integrity. This includes requirements related to disclosure, fair pricing, and best execution practices. The corporate bond market is subject to various international regulations, as issuers and investors increasingly operate across borders. Harmonizing regulations across countries can help promote transparency, investor protection, and market efficiency. International organizations, such as the International Organization of Securities Commissions (IOSCO) and the Financial Stability Board (FSB), work to coordinate regulatory efforts and develop best practices to foster a stable and robust global corporate bond market. The corporate bond market is continuously evolving, driven by technological innovations, environmental, social, and governance (ESG) considerations, and global economic developments. Technological advancements are transforming the corporate bond market, with electronic trading platforms providing increased transparency, efficiency, and access to a broader range of investors. Additionally, blockchain technology and smart contracts have the potential to revolutionize the issuance, trading, and settlement of corporate bonds, reducing costs and increasing market efficiency. ESG factors are playing an increasingly important role in the corporate bond market, as investors and issuers alike recognize the need to address sustainability challenges. Green bonds, social bonds, and sustainability-linked bonds are examples of instruments that incorporate ESG considerations into their structures, attracting investors who seek to align their portfolios with their values and driving demand for ESG-focused corporate bonds. Global economic developments, such as shifts in trade policies, geopolitical tensions, and changes in economic growth patterns, can significantly impact the corporate bond market. Investors must monitor these developments and consider their potential implications for credit risk, interest rates, and market sentiment when making investment decisions. Corporate bonds are an essential component of today's financial landscape, providing companies with the means to finance their operations and growth, while offering investors a source of income and diversification. Understanding the various characteristics, risks, and strategies associated with corporate bond investing is crucial for informed decision-making. As the market continues to evolve, investors and issuers must adapt to new trends and challenges to navigate this complex yet rewarding asset class effectively. If you're considering investing in corporate bonds, working with a professional wealth management service can be a great way to unlock the full potential of your investment. What Are Corporate Bonds?

Characteristics of Corporate Bonds

Par Value, Coupon Rate, and Maturity Date

Credit Ratings

Types of Corporate Bonds

Secured Bonds

Convertible Bonds

Callable Bonds

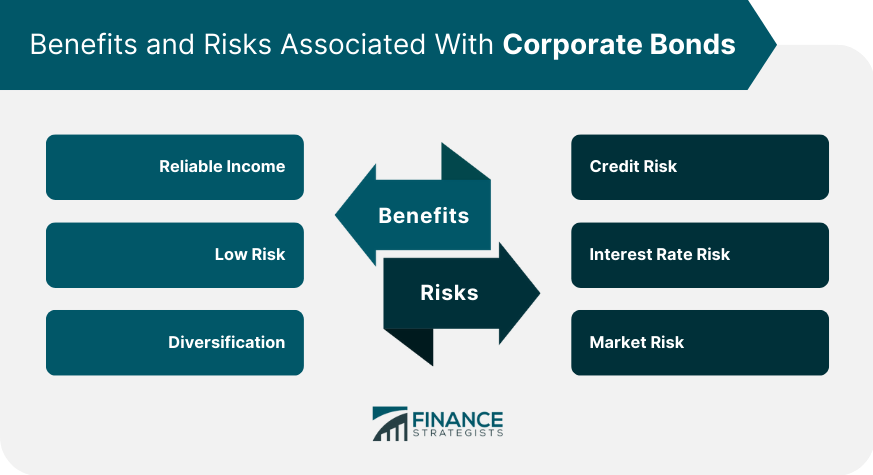

Benefits of Investing in Corporate Bonds

Reliable Income

Low Risk

Diversification

Risks Associated with Corporate Bonds

Credit Risk

Interest Rate Risk

Market Risk

Strategies for Investing in Corporate Bonds

Laddering

Barbell Strategy

Passive Management

The Role of Corporate Bonds in the Economy

Impact on Capital Markets

Financing Public Projects and Infrastructure

Influence on Interest Rates and Monetary Policy

Regulations and Compliance

Securities and Exchange Commission (SEC) Regulations

Financial Industry Regulatory Authority (FINRA)

International Regulatory Framework

Future Trends and Challenges in Corporate Bonds

Technological Innovations

Environmental, Social, and Governance (ESG) Considerations

Global Economic Developments and Their Impact on Corporate Bonds

Conclusion

Corporate Bonds FAQs

Corporate bonds are debt securities issued by corporations to raise capital. They are similar to government bonds, but instead of being issued by a government, they are issued by a corporation.

When an investor buys a corporate bond, they are essentially lending money to the corporation for a set period of time. In return, the corporation agrees to pay the investor a fixed rate of interest for the life of the bond and repay the bond's face value when it matures.

Investing in corporate bonds carries some risk, including credit risk (the risk that the issuing corporation may default on its bond payments or go bankrupt), interest rate risk (the risk that changes in interest rates will affect the market value of your bonds), and market risk (the risk that the overall bond market may perform poorly, affecting the value of your bonds).

Corporate bonds can be a good fit for a variety of investors, including those who are looking for a steady stream of income, those who want to diversify their investment portfolio, and those who are looking for a relatively low-risk investment option.

You can invest in corporate bonds by purchasing individual bonds or through a bond mutual fund or exchange-traded fund (ETF). Before investing, it's important to consider your investment goals, risk tolerance, and other factors, and to seek the advice of a financial advisor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.