Development Impact Bonds (DIBs) are a type of performance-based financing mechanism that brings together private investors, service providers, and outcome funders to achieve specific social or environmental outcomes. Investors provide upfront capital to service providers, who then implement interventions to achieve predefined outcomes. If the interventions are successful, outcome funders repay the investors with a return on investment based on the achieved outcomes. DIBs aim to address social and environmental challenges by incentivizing innovation and improving the efficiency of development programs. They also help attract private sector investment in social outcomes and promote a focus on results, ensuring that funds are allocated to interventions that have a demonstrable impact. Investors provide the upfront capital required to implement the interventions. They typically include private investors, foundations, or other entities interested in achieving social or environmental impact while potentially earning a financial return. Service providers are responsible for implementing the interventions aimed at achieving the predefined outcomes. They can be non-profit organizations, private companies, or public agencies with expertise in relevant social or environmental issues. Outcome funders commit to repaying the investors if the interventions successfully achieve the predefined outcomes. They are typically government agencies or philanthropic organizations interested in promoting innovative and effective solutions to social or environmental challenges. Intermediaries are crucial in designing, structuring, and managing DIBs. They help to identify stakeholders, facilitate negotiations, and provide technical assistance throughout the implementation process. Below is the process of how to setup DIBs: The first step in setting up a DIB is identifying a specific social or environmental issue requiring intervention. This should be a pressing challenge with measurable outcomes that can be linked to the interventions. Next, the relevant stakeholders need to be identified and brought together. This includes investors, service providers, outcome funders, and intermediaries. Stakeholders need to agree on the outcome metrics and targets that will be used to measure the success of the interventions. These metrics should be clear, achievable, and linked to the social or environmental issue being addressed. Lastly, the payment structure must be agreed upon, including how much the outcome funders will pay for each achieved outcome and the potential return on investment for the investors. DIBs offer several benefits, including aligning stakeholder incentives, promoting innovation, and enhancing efficiency in development programs. By linking payments to successful outcomes, DIBs ensure that all stakeholders have a shared interest in achieving the desired impact. This helps to align incentives and encourages collaboration between investors, service providers, and outcome funders. DIBs incentivize service providers to innovate and adapt their interventions as needed to achieve the best results. This flexibility allows them to learn from their experiences and improve their strategies over time, ultimately leading to more effective solutions to social and environmental challenges. By focusing on outcomes, DIBs encourage greater accountability and transparency in development programs. This results-based approach helps ensure that funds are allocated to the most effective interventions and enables stakeholders to learn from and build on successful models. DIBs attract private sector investment by offering investors the opportunity to earn a financial return while contributing to positive social or environmental impact. This helps to mobilize additional resources for development programs and encourages cross-sector collaboration. Despite their potential benefits, DIBs face several challenges that must be addressed to ensure successful implementation. DIBs involve multiple stakeholders, complex contractual arrangements, and rigorous outcome measurement processes. This complexity can be a barrier to entry for some organizations and may require significant time and resources to manage effectively. Measuring the success of interventions can be challenging, particularly when dealing with complex social or environmental issues. Selecting appropriate outcome metrics and establishing reliable measurement systems is crucial for determining whether a DIB has achieved its objectives. Investors in DIBs face the risk that interventions may not achieve the desired outcomes, potentially leading to a loss of capital. Balancing this risk with the potential for financial returns and social impact is a key challenge for structuring DIBs in a way that attracts investment. Service providers may require additional capacity and resources to implement interventions effectively and meet DIBs' rigorous outcome measurement requirements. Building this capacity is essential for ensuring the success of DIBs and scaling their impact. DIBs hold significant potential for addressing social and environmental challenges, but their future success depends on several factors. DIBs can be applied to a wide range of social and environmental issues, including education, healthcare, employment, climate change, and more. Identifying new areas for growth and expansion is crucial for scaling the impact of DIBs. DIBs must be scaled and integrated into mainstream development finance to fully realize their potential. This may require building capacity among stakeholders, developing standardized processes and tools, and fostering a supportive policy environment. As more DIBs are implemented, learning from their experiences and identifying best practices for designing, structuring, and managing these innovative financing mechanisms is essential. The development community can leverage DIBs to drive greater impact and address pressing social and environmental challenges by sharing lessons learned and building on successful models. Development Impact Bonds offer a promising approach to addressing pressing social and environmental challenges by leveraging private sector investment and focusing on results. By aligning stakeholder incentives, promoting innovation, and enhancing the efficiency of development programs, DIBs have the potential to drive significant positive impact across various sectors. However, they also present challenges in terms of design, implementation, and measuring success. If you are considering investing in Development Impact Bonds or exploring opportunities to implement them in your organization or community, we recommend seeking the help of an expert in wealth management. These experts can help you navigate the complexities of DIBs and ensure a successful outcome for all stakeholders involved.What Are Development Impact Bonds (DIBs)?

Purpose and Goals of DIBs

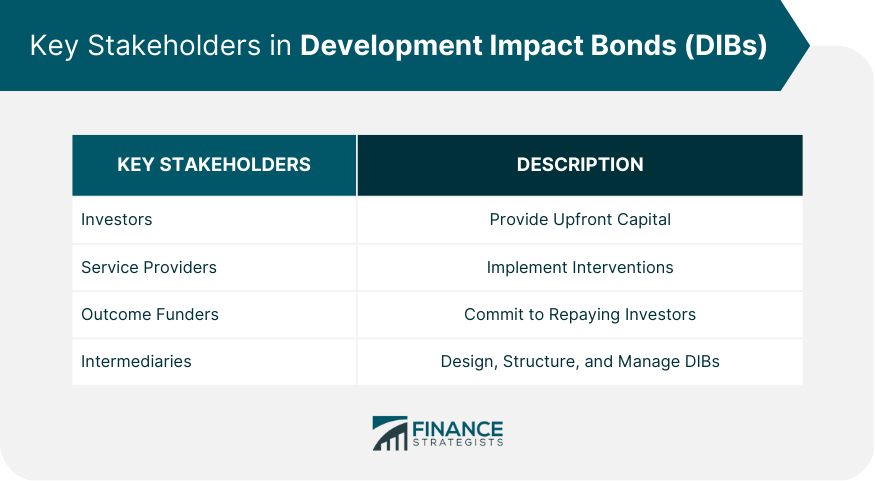

Key Stakeholders in DIBs

1. Investors

2. Service Providers

3. Outcome Funders

4. Intermediaries

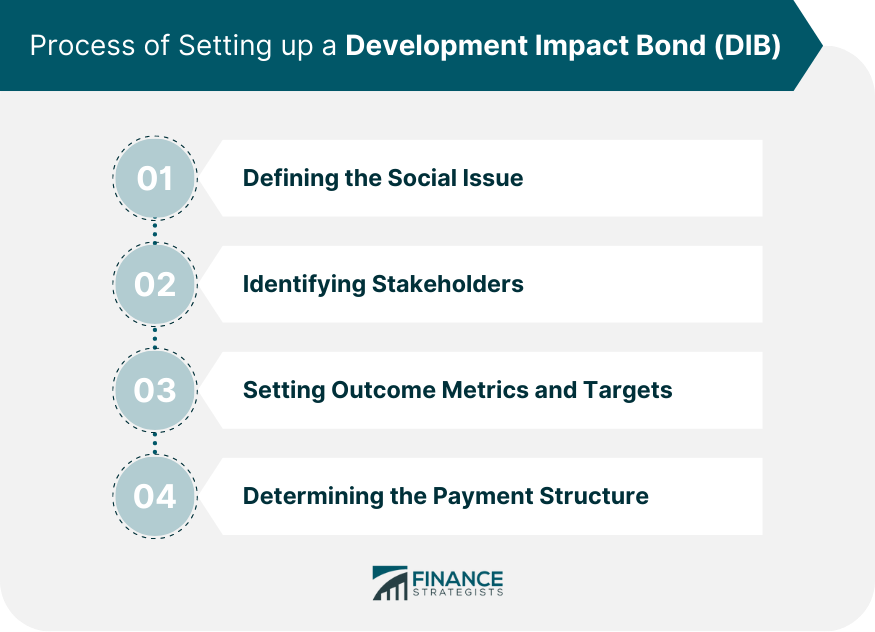

Process of Setting up a DIB

Step 1: Defining the Social Issue

Step 2: Identifying Stakeholders

Step 3: Setting Outcome Metrics and Targets

Step 4. Determining the Payment Structure

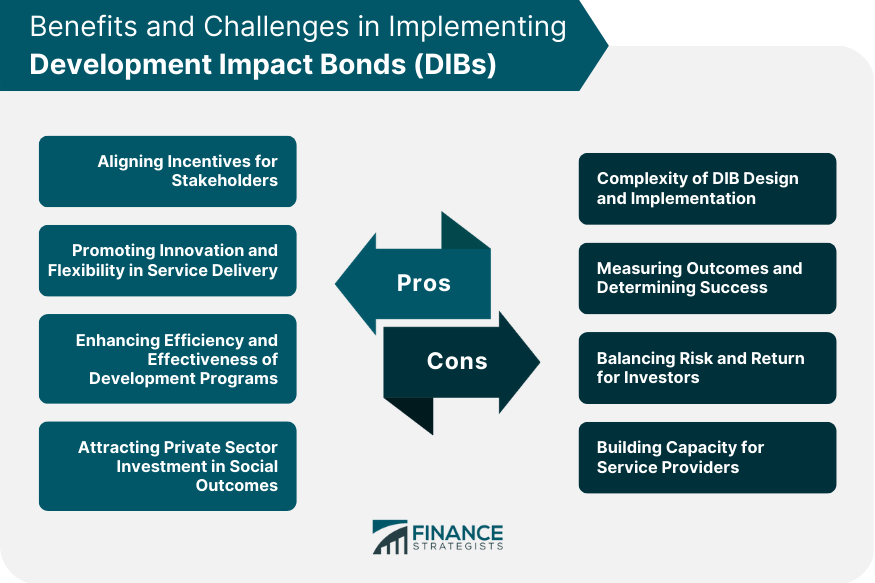

Benefits of Development Impact Bonds (DIBs)

Aligning Incentives for Stakeholders

Promoting Innovation and Flexibility in Service Delivery

Enhancing Efficiency and Effectiveness of Development Programs

Attracting Private Sector Investment in Social Outcomes

Challenges in Implementing Development Impact Bonds (DIBs)

Complexity of DIB Design and Implementation

Measuring Outcomes and Determining Success

Balancing Risk and Return for Investors

Building Capacity for Service Providers

The Future of Development Impact Bonds (DIBs)

Potential Areas for Growth and Expansion

Strategies for Scaling and Mainstreaming DIBs

Lessons Learned and Best Practices for Successful DIB Implementation

Final Thoughts

Development Impact Bonds (DIBs) FAQs

Development Impact Bonds (DIBs) are an innovative financing mechanism that links private sector investment to the achievement of specific social or environmental outcomes. They involve investors, service providers, and outcome funders working together to implement interventions, with investors being repaid based on the success of these interventions.

DIBs work by having private investors provide upfront capital to service providers, who then implement interventions aimed at achieving predefined social or environmental outcomes. If the interventions are successful, outcome funders repay the investors with a return on investment based on the achieved outcomes.

Benefits of DIBs include aligning incentives for stakeholders, promoting innovation and flexibility in service delivery, enhancing the efficiency and effectiveness of development programs, and attracting private sector investment in social outcomes.

Challenges in implementing DIBs include the complexity of DIB design and implementation, measuring outcomes and determining success, balancing risk and return for investors, and building capacity for service providers.

Yes, DIBs can be applied to a wide range of social and environmental issues, such as education, healthcare, employment, climate change, and more. Their versatility allows them to address pressing challenges and drive positive impact across different sectors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.