Bonds vs Stocks: Overview

Investment portfolios fundamentally contain bonds and stocks. Bonds are loans investors provide to entities like corporations or governments who repay with interest, representing debt.

Conversely, stocks symbolize ownership, where investors, becoming shareholders by purchasing stocks, can partake in company profits and potentially influence governance.

Both the bond and stock markets are vital for the global financial ecosystem. They give entities necessary capital for operations, expansion, or innovation while providing investors with wealth growth opportunities.

The bond market sees governments and corporations issuing bonds to gather capital.

The stock market is a platform for buying, selling, and trading public company shares, facilitating capital raise for various business needs.

What Is a Bond?

At its simplest, a bond is a loan. The issuer of the bond is the borrower, and the investor is the lender.

The issuer promises to repay the principal amount of the loan on a specific date, known as the maturity date. In addition, the issuer pays the investor a fixed interest rate over the life of the bond.

Types of Bonds

There are several types of bonds. Government bonds, issued by national governments, are often seen as safe investments as they are backed by the government's ability to tax its citizens.

Corporate bonds are issued by companies and typically offer higher interest rates due to their higher risk.

Municipal bonds, issued by local governments, often have tax advantages for investors.

Risk Associated With Bonds

While generally considered safer than stocks, bonds do carry risk. The primary risk is the default risk, where the bond issuer may fail to make interest payments or repay the principal. There's also the interest rate risk, where changes in interest rates can affect the value of a bond.

What Is a Stock?

A stock represents a share in the ownership of a company. As a shareholder, an investor has a claim on part of the company's assets and earnings. Stocks are also known as equities or shares.

Types of Stocks

There are two main types of stocks: common and preferred.

Common stockholders have voting rights in the company and may receive dividends, a portion of the company's profits. Preferred stockholders have a higher claim on dividends and assets but usually don't have voting rights.

Risk Associated With Stocks

Investing in stocks carries a higher risk compared to bonds. The main risk is market risk, where the price of a stock can fluctuate significantly due to various factors, such as economic conditions or company performance.

There's also the company-specific risk, where issues within the company can impact its stock price.

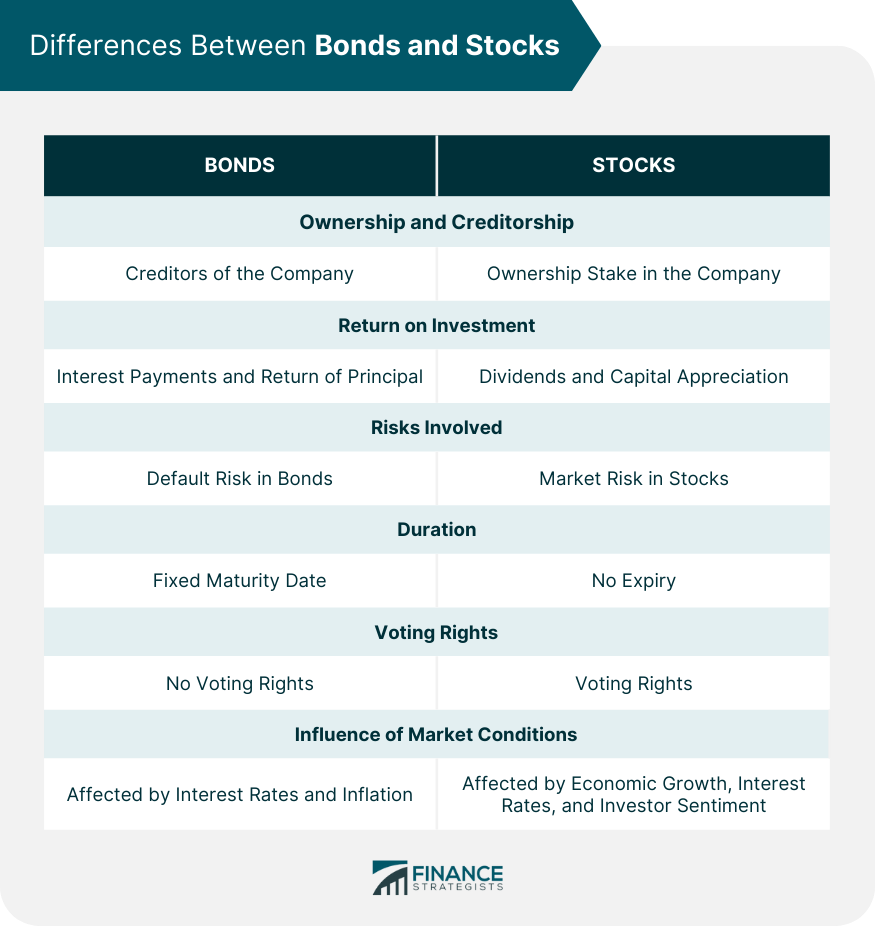

Differences Between Bonds and Stocks

Ownership and Creditorship

When an investor purchases a bond, they essentially become a creditor of the company. The company owes them the debt they've invested, along with the agreed-upon interest.

Purchasing a stock implies buying an ownership stake in the company. The investor becomes a shareholder and owns a part of the company.

Return on Investment

Investors in bonds earn returns through interest payments made by the bond issuer. At the maturity date, they receive the principal amount invested.

Investors in stocks earn returns through dividends and capital appreciation. Dividends are a share of the company's profits distributed to shareholders. Capital appreciation occurs when the price of a stock increases over the investor's purchasing price.

Risks Involved

Bonds carry the risk of the issuer defaulting on their payment obligations, either on the periodic interest or the principal at maturity.

The main risk in stock investing is market risk, where the stock price fluctuates due to factors like economic conditions or changes in investor sentiment.

Duration

Bonds have a fixed maturity date when the principal amount invested is supposed to be returned to the investor.

Unlike bonds, stocks do not have a maturity date. An investor can hold onto a stock as long as the company is in operation.

Voting Rights

Bondholders are creditors of the company and do not have any voting rights within the company.

Stockholders, particularly those who own common stocks, typically have voting rights in the company.

Influence of Market Conditions

Interest rates and inflation are two market conditions that significantly influence bond prices. When interest rates rise, bond prices typically fall.

Similarly, higher inflation can erode the purchasing power of the fixed interest payments that bonds offer.

Market conditions like economic growth, interest rates, and investor sentiment can significantly impact stock prices.

Generally, strong economic growth and positive investor sentiment drive stock prices up, while economic downturns and negative sentiment can drive prices down.

Factors to Consider When Choosing Between Bonds and Stocks

When it comes to choosing between bonds and stocks, factors like investment objectives, risk tolerance, and time horizon must be considered.

A well-diversified portfolio often contains a mix of both, offering a balance between risk and return. Ultimately, the choice between bonds and stocks should be an informed decision based on comprehensive knowledge, sound advice, and individual investment goals.

Investment Objectives

An investor's specific objectives play a crucial role in choosing between bonds and stocks. If the objective is steady income and preservation of capital, bonds might be the preferred choice. If the objective is long-term growth, stocks may be more suitable.

Risk Tolerance

Risk tolerance is another factor to consider. Bonds are generally considered less risky than stocks, making them suitable for risk-averse investors. Meanwhile, stocks might be appropriate for those willing to take on more risk for potentially higher returns.

Time Horizon

An investor's time horizon can significantly influence the choice between bonds and stocks. Generally, the longer the time horizon, the more risk an investor can afford to take, favoring stocks. Shorter time horizons may necessitate the safety of bonds.

Financial Situation

An investor's financial situation is crucial in this decision. Those with financial stability and discretionary funds might be more inclined to invest in stocks. Conversely, those seeking stable returns might favor bonds.

The Bottom Line

Understanding the key differences between bonds and stocks is essential for investors to make informed investment decisions.

Bonds offer stability, lower risk, and steady income through interest payments, while stocks carry higher risk but offer potential for higher returns and ownership in a company.

When deciding between bonds and stocks, investors must consider factors such as investment objectives, risk tolerance, time horizon, and financial situation.

A well-diversified portfolio includes a mix of both assets to achieve a balance between risk and return. The choice between bonds and stocks should be based on comprehensive knowledge, sound advice, and individual investment goals.

To navigate the complexities of investing and create a tailored investment strategy that aligns with your financial goals, it is recommended to seek the assistance of a professional wealth management service.

A wealth management advisor can provide personalized portfolio management and ongoing monitoring to help you make well-informed investment decisions.

Difference Between Bonds and Stocks FAQs

In a bond investment, you're essentially a creditor to the issuing entity, while investing in stocks grants you partial ownership of the company.

Bonds provide a steady return through interest payments, while stocks offer potentially higher returns through dividends and capital appreciation.

If you have a lower risk tolerance, bonds may be a more suitable investment as they are generally less risky than stocks.

Market conditions, such as interest rates and inflation, can affect the price of bonds and stocks differently.

Both assets play crucial roles in diversification. Stocks offer growth potential, while bonds can provide income and stability, leading to a balanced portfolio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.