Dollar Duration, or DV01, is a vital concept in finance used to measure the price sensitivity of bonds and fixed-income securities to interest rate changes. It estimates how much the value of a bond will change for a one-basis point shift in rates. Dollar duration helps investors assess the risk in their portfolio when interest rates fluctuate. It is particularly important for institutional investors with large fixed-income holdings. By calculating dollar duration, investors can anticipate gains or losses and adjust their portfolios to optimize returns and reduce risk. Unlike other measures like yield to maturity and current yield, dollar duration provides a more comprehensive understanding of risk by considering the impact of interest rate changes. The fundamental relationship between dollar duration and bond prices lies in their inverse correlation. When interest rates rise, bond prices fall, and vice versa. Dollar Duration quantifies this price change in dollar terms. A high dollar duration implies a greater sensitivity to interest rate changes, indicating higher risk but also higher potential return. Conversely, a lower dollar duration means the bond or portfolio is less sensitive to interest rate fluctuations. As the basic mechanism behind dollar duration is to measure price sensitivity to interest rate changes, a volatile interest rate environment may lead to larger dollar duration values and thus, higher potential risks. Conversely, in a stable interest rate environment, dollar duration values may be lower, suggesting lesser risk. Duration and dollar duration, while related, are distinct concepts. Duration measures the sensitivity of a bond's price to interest rate changes in time units (usually years), whereas dollar duration expresses this sensitivity in dollar terms. In essence, dollar duration is a practical extension of duration, facilitating direct understanding of the potential dollar value change in a bond or portfolio due to interest rate changes. The formula to calculate dollar duration is straightforward: Here: DUR represents the bond's straight duration. The straight duration of a bond measures the weighted average time until the bond's cash flows are received. It is often computed using the Macaulay duration. ∆i signifies the change in interest rates. This is typically a small change for which the Dollar Duration measure is most accurate. i stands for the current interest rate. This is the prevailing market interest rate at which the bond is being priced. P is the price of the bond. To calculate dollar duration, follow these steps: 1. Compute the Duration: Calculate the straight duration of the bond using Macaulay duration, a weighted average of the time until cash flows are received based on their present value as a percentage of the total present value of the bond. 2. Determine the Interest Rate Change: Identify the change in interest rates (∆i). Remember that the Dollar Duration is most accurate for small changes in interest rates. 3. Identify the Current Interest Rate: Determine the current interest rate (i) for the bond. This is the prevailing market interest rate at which the bond is being priced. 4. Note the Bond Price: Note the current market price (P) of the bond. 5. Plug in the Values: Substitute the obtained values into the formula to compute the Dollar Duration. This will yield the expected change in the dollar value of the bond for a 100 basis point change in interest rates. It's important to understand that dollar duration gives an estimate of the price change for a bond given a small change in interest rates. For larger interest rate changes, other measures such as convexity may provide more accurate estimates. Understanding and applying dollar duration can be crucial for managing interest rate risk and optimizing bond portfolios. In portfolio management, dollar duration is a valuable tool for hedging interest rate risk. By understanding the dollar duration of their holdings, portfolio managers can create strategies to offset potential losses from interest rate changes. For instance, if a portfolio has a positive dollar duration (meaning it would lose value if interest rates increase), the manager could offset this risk by investing in financial derivatives with a negative dollar duration. Dollar duration helps quantify potential risks associated with interest rate changes, enabling risk managers to identify and mitigate these risks proactively. By understanding the dollar duration of their holdings, risk managers can design risk mitigation strategies to optimize risk-reward trade-offs. For banks and insurance companies, asset-liability management is a major concern. These institutions need to ensure that the dollar duration of their assets (like loans given out) matches the Dollar Duration of their liabilities (like deposits received) as closely as possible. This matching of dollar duration helps to mitigate the risk of interest rate changes disrupting their financial stability. If there is a mismatch, they can use interest rate swaps or other derivative contracts to adjust the Dollar Duration of their assets or liabilities. Linear approximation presumes that for small changes in interest rates, the price change of a bond or fixed-income security will be proportional. However, for large changes in interest rates, this linear approximation may not hold, and the actual price change may diverge from the one predicted by dollar duration. Another limitation is the implicit assumption that the change in interest rates is uniform across all maturities. This assumption overlooks the possibility of yield curve twists, where interest rates for different maturities change at different rates. Such twists can significantly impact bond prices and hence the actual dollar duration. Dollar duration primarily focuses on quantifying interest rate risk. It may not adequately account for other factors that can impact bond prices. Changes in the credit risk of the bond issuer, alterations in liquidity conditions, or changes in the overall market sentiment are factors that can affect bond prices but may not be fully captured by the dollar duration. The calculation of dollar duration can be mathematically challenging. It requires calculating the duration of a bond, which involves determining the present value of future cash flows, a complex task, especially for bonds with embedded options or other non-standard features. To apply dollar duration effectively in portfolio management or risk management, one needs a robust understanding of financial markets and the potential impacts of various economic factors on interest rates. The interpretation of dollar duration values and the implementation of strategies based on these values require nuanced financial knowledge and expertise. A common misconception about dollar duration is that a higher value is invariably negative, signifying higher risk. However, the reality is more complex. A higher dollar duration does imply a higher sensitivity to interest rate changes, which means higher risk. But it can also mean higher potential returns, as the price change can be either positive or negative, depending on whether interest rates fall or rise. In reality, dollar duration applies to any fixed-income securities, including derivative contracts and mortgage-backed securities. Any investment that yields a series of cash flows over time can have its dollar duration calculated to assess its sensitivity to interest rate changes. Dollar duration quantifies how much a bond's price will change for a small change in interest rates. This sensitivity is particularly important for longer-term bonds, which are more susceptible to interest rate changes. Derivative securities, such as interest rate swaps and options, also have dollar duration. In the case of interest rate swaps, the dollar duration can be used to determine how much the swap's value will change for a small change in the underlying interest rate. For options, the concept of dollar duration can be extended to include the effects of changes in the volatility of the underlying asset. Mortgage-backed securities (MBS) presents a unique challenge for dollar duration due to their prepayment risk. When interest rates fall, homeowners may refinance their mortgages, leading to early return of principal. This risk complicates the calculation of dollar duration for MBS, but it remains an essential tool for managing interest rate risk in these securities. Dollar duration and convexity are two critical concepts in bond pricing and risk management. They help investors understand how changes in interest rates can affect the value of their bond investments. However, they approach this problem from different perspectives, each providing unique insights into the behavior of bond prices. Dollar duration is a measure of a bond's sensitivity to changes in interest rates. It quantifies how much the price of a bond or fixed-income security will change for a small change in interest rates. The higher the dollar duration, the greater the price change for a given interest rate change. Dollar Duration is based on a linear approximation, assuming that bond prices and interest rates have a linear relationship for small changes in interest rates. Convexity, on the other hand, takes the analysis a step further. It measures the rate of change of The higher the dollar duration itself, essentially providing a second-level sensitivity measure. Convexity accounts for the fact that the relationship between bond prices and interest rates is not perfectly linear, but curved. This means that the dollar duration will change as interest rates change, a phenomenon captured by convexity. While dollar duration provides a first-order approximation of the bond price change for small changes in interest rates, it can become less accurate for larger interest rate changes. This is where convexity comes in. By accounting for the curvature in the bond price-yield relationship, convexity provides a more accurate estimate for larger interest rate changes. Both dollar duration and convexity are used by portfolio managers and investors to manage interest rate risk. Dollar duration gives an initial estimate of how much a bond's price will change for a small change in interest rates, which is useful for risk management and pricing. Convexity provides additional information, especially for managing large interest rate changes. It helps investors understand how their risk exposure (as measured by dollar duration) will change as interest rates change. Interest rate changes are the primary driver of dollar duration. A rise in interest rates increases the dollar duration of a bond or portfolio, indicating a higher sensitivity to further changes in rates. Conversely, a fall in interest rates reduces the dollar duration. Inflation indirectly affects dollar duration through its impact on interest rates. Higher inflation typically leads to higher interest rates, which in turn increases the dollar duration of a bond or portfolio. Market volatility can affect the dollar duration through its impact on interest rates and bond prices. During periods of high volatility, interest rates may fluctuate widely, leading to larger changes in dollar duration. Moreover, market volatility can affect the liquidity conditions and credit risk of bonds, which are not captured by dollar duration. Dollar duration, a critical financial concept, quantifies the sensitivity of bond prices or other fixed-income securities to small changes in interest rates. It provides linear estimates of how much the dollar value of a bond or portfolio will change for a one-basis point change in interest rates. The formula for dollar duration is straightforward: Dollar Duration = DUR x (∆i/1+ i) x P. The calculated value aids in risk management, asset liability management, and portfolio optimization, providing valuable insight into potential price changes due to interest rate shifts. However, the linearity assumption of the dollar duration may be less accurate for large interest rate changes, and it may not fully capture other factors impacting bond prices. Applying it requires a sound understanding of financial markets. Consider seeking professional wealth management services to help navigate dollar duration and make the most of your investments.What Is Dollar Duration?

Understanding the Concept of Dollar Duration

Relationship Between Dollar Duration and Bond Prices

Impact of Interest Rates on Dollar Duration

Duration in Relation to Dollar Duration

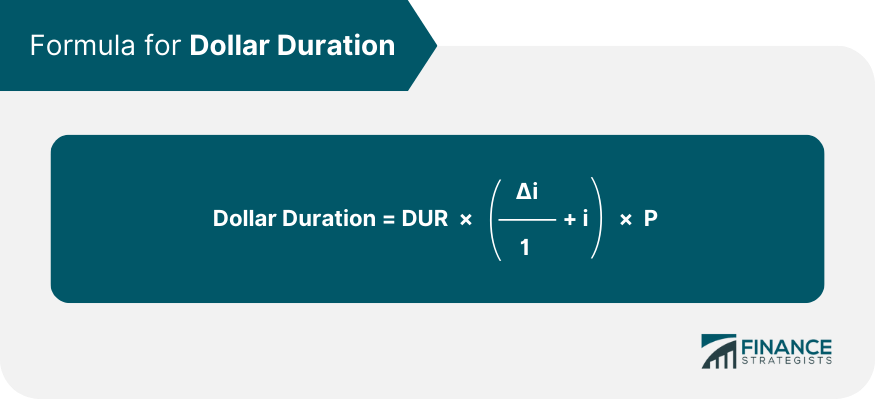

Formula for Dollar Duration

Calculation of Dollar Duration

Applications of Dollar Duration

Use in Portfolio Management

Role in Risk Management

Dollar Duration in Asset Liability Management

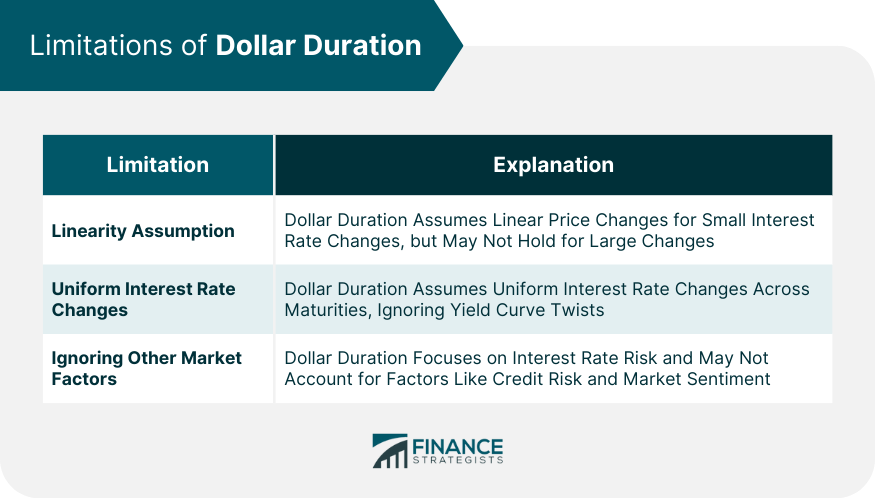

Limitations of Dollar Duration

Linearity Assumption

Uniform Interest Rate Changes

Ignoring Other Market Factors

Challenges in Calculation and Application of Dollar Duration

Mathematical Complexity

Solid Understanding of Financial Markets

Misconceptions About Dollar Duration

Higher Dollar Duration Equals Higher Risk

Applicability Only to Bonds

Dollar Duration in Different Financial Instruments

Dollar Duration of Bonds

Dollar Duration of Derivative Securities

Dollar Duration of Mortgage-Backed Securities

Comparing Dollar Duration and Convexity

Measure of Sensitivity: Dollar Duration

Second-Level Sensitivity: Convexity

Accounting for Non-Linearity

Interpretation and Use

Impact of Economic Factors on Dollar Duration

Effect of Interest Rate Changes on Dollar Duration

Influence of Inflation on Dollar Duration

Impact of Market Volatility on Dollar Duration

Final Thoughts

Dollar Duration FAQs

Dollar duration is a financial metric used to measure the price sensitivity of bonds or other fixed-income securities to changes in interest rates. It quantifies the expected change in the dollar value of a bond for a one-basis point change in interest rates.

Dollar duration is calculated using the formula: Dollar Duration = Duration * (∆i/1+ i) * Price. Here, Duration represents the bond's straight duration, ∆i is the change in interest rates, i stands for the current interest rate, and Price is the current market price of the bond. Essentially, it measures the expected change in the dollar value of a bond for a 100 basis point change in interest rates.

In portfolio management, dollar duration is used to assess the potential risk or exposure of a portfolio to minor shifts in interest rates. This understanding helps in devising strategies to optimize returns and minimize risk.

The main limitations of dollar duration include its assumption of linearity and uniform interest rate changes across all maturities. It may also not account for other factors affecting bond prices, such as changes in credit risk or liquidity conditions.

Yes, dollar duration can apply to any fixed-income securities, including derivative contracts and mortgage-backed securities. Any investment that yields a series of cash flows over time can have its dollar duration calculated.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.