Eurobonds, a widely-used financial instrument in the global capital markets, are debt securities issued by governments, corporations, or financial institutions in a currency different from that of the issuer's home country. The purpose of Eurobonds is to provide a means for issuers to raise capital in the international markets, diversify their funding sources, and access a broader investor base. The inception of Eurobonds dates back to the 1960s when Italian motorway network operator Autostrade issued the first Eurodollar bond. Eurobonds are denominated in a currency other than the issuer's domestic currency, allowing issuers to tap into international capital markets and attract foreign investors. While the term "Eurobond" might imply that these bonds are denominated in euros, they can be issued in various currencies, such as the US dollar, British pound, or Japanese yen. A key feature of Eurobonds is that they are issued and traded outside the issuer's home country. This allows issuers to circumvent certain domestic regulations and potentially benefit from more favorable borrowing conditions in international markets. There are several types of Eurobonds, catering to the different needs of issuers and investors: Fixed-rate Eurobonds pay a predetermined interest rate, or coupon, throughout the life of the bond. Floating-rate Eurobonds have variable interest rates that are periodically adjusted based on a reference rate, such as LIBOR or Euribor. Zero-coupon Eurobonds do not pay periodic interest; instead, they are issued at a discount to their face value and redeemed at par upon maturity. Dual-currency Eurobonds pay interest in one currency and principal in another, offering investors exposure to multiple currencies. Equity-linked Eurobonds, such as convertible or exchangeable bonds, give investors the option to convert their bonds into shares of the issuing company under specific conditions. Eurobonds typically have medium to long-term maturities, ranging from five to 30 years. Some Eurobonds may also include embedded options, such as put or call provisions, giving issuers or bondholders the right to redeem the bonds before their maturity date. Eurobonds can be issued by various entities, including: 1. Governments: Sovereign nations may issue Eurobonds to finance budget deficits or refinance existing debt. 2. Supranational organizations: Entities such as the World Bank and the European Investment Bank issue Eurobonds to fund development projects and support member countries. 3. Corporations: Companies may issue Eurobonds to raise capital for expansion, acquisitions, or debt refinancing. 4. Financial institutions: Banks and other financial institutions may issue Eurobonds to meet regulatory capital requirements or fund their lending activities. Investors in Eurobonds include: 1. Institutional investors: Pension funds, insurance companies, and asset managers invest in Eurobonds as part of their diversified fixed-income portfolios. 2. Retail investors: Individual investors may also invest in Eurobonds, either directly or through investment vehicles such as mutual funds and exchange-traded funds (ETFs). Intermediaries play a crucial role in the Eurobond market: 1. Underwriters: Investment banks and financial institutions underwrite Eurobond issuances, helping issuers structure, price, and sell their bonds. 2. Eurobond market makers: Market makers facilitate trading in the secondary market by providing liquidity and maintaining bid-ask spreads for Eurobonds. Issuers and investors can both benefit from Eurobonds in various ways: By issuing Eurobonds, issuers can diversify their funding sources, reducing reliance on domestic capital markets and decreasing their vulnerability to local economic fluctuations. Eurobonds allow issuers to tap into global capital markets and attract a broader range of investors, potentially leading to increased demand and more favorable pricing for their bonds. Issuing Eurobonds may result in lower borrowing costs for issuers if the interest rates in international markets are more attractive than those available domestically. Eurobonds offer issuers flexibility in determining the currency, interest rate structure, maturity, and redemption options, allowing them to tailor the bond terms to their specific financing needs and risk profiles. Investing in Eurobonds carries certain risks, including: Investors in Eurobonds face the risk of currency fluctuations, as changes in exchange rates can affect the value of their investments and the income they receive. Interest rate movements can impact the market value of Eurobonds, especially those with fixed interest rates. Risk of rising interest rates may lead to a decline in bond prices, while falling rates may result in price appreciation. Credit risk happens when Investors face the risk that the issuer may default on its interest or principal payments, which can lead to a loss of investment and potential legal complications. Some Eurobonds may be less liquid than domestic bonds, making it more challenging for investors to buy or sell them in the secondary market without affecting their prices. Investing in Eurobonds may expose investors to legal and regulatory risks, as different jurisdictions have varying rules governing the issuance and trading of these securities. The Eurobond issuance process typically involves the following steps: Issuers select underwriters, often investment banks or financial institutions, to assist them in structuring, pricing, and marketing their Eurobonds. Issuers, in collaboration with their underwriters, prepare offering documents that provide information about the bond's terms, the issuer's financial condition, and the risks associated with the investment. Underwriters and issuers conduct marketing activities, such as roadshows, to gauge investor interest and gather feedback on the proposed bond terms. Based on investor demand and prevailing market conditions, underwriters and issuers determine the final pricing and allocate the bonds to investors. After the allocation process, the bonds are settled and listed on an exchange or trading platform, allowing investors to trade them in the secondary market. Investors should consider several factors when investing in Eurobonds, including: 1. Credit quality: Assess the issuer's creditworthiness and the potential risk of default. 2. Currency exposure: Consider the impact of currency fluctuations on the investment's value and income. 3. Interest rate environment: Evaluate the potential effects of interest rate changes on bond prices. 4. Time horizon: Match the bond's maturity with the investor's investment horizon and liquidity needs. Investors can gain exposure to Eurobonds through various investment vehicles: 1. Direct investment: Investors can purchase Eurobonds directly from issuers or in the secondary market. 2. Mutual funds: Eurobond mutual funds pool investors' assets and invest in a diversified portfolio of Eurobonds, providing professional management and risk diversification. 3. Exchange-traded funds (ETFs): Eurobond ETFs track specific indices or market segments and trade on exchanges like stocks, offering investors liquidity and ease of trading. Eurobonds are subject to international regulations, such as the rules set by the International Capital Market Association (ICMA), which aims to promote fair and efficient functioning of the global bond markets. Issuers and investors must also comply with the local regulations of the jurisdictions in which the Eurobonds are issued and traded, as these may vary significantly across countries. The taxation of Eurobonds depends on the specific tax laws of the issuer's and investor's jurisdictions. Issuers may be subject to withholding taxes on interest payments, while investors may be taxed on their interest income or capital gains from the bonds. The first Eurobond was issued in 1963 by Autostrade, an Italian motorway network operator, which raised $15 million in US dollars to fund its expansion plans. This landmark issuance marked the beginning of the Eurobond market, which has since grown into a significant segment of the global capital markets. In recent years, several notable Eurobond issuances have taken place, including: 1. Apple Inc.'s multi-currency Eurobond issuance in 2015, raising over $2 billion in various currencies, including euros, Swiss francs, and British pounds. 2. Argentina's $16.5 billion Eurobond issuance in 2016, marking its return to international capital markets after a 15-year hiatus due to a sovereign debt default. 3. The African Development Bank's issuance of the first "pandemic response" Eurobond in 2020, raising $3 billion to support African countries in combating the COVID-19 pandemic. Eurobonds have emerged as an essential component of the global financial landscape, serving as a valuable source of international capital for issuers and presenting opportunities for diversification and foreign market exposure for investors. It is crucial for issuers and investors to remain informed and adapt their strategies to harness the potential of Eurobonds effectively while managing the inherent risks and challenges associated with this financial instrument. The future of Eurobonds is likely to be shaped by several factors, including global economic shifts, technological innovations, and an evolving regulatory environment. Additionally, the growing focus on sustainability and environmental, social, and governance (ESG) factors may lead to the expansion of sustainable and green bonds. By staying abreast of these developments and adjusting their financing and investment strategies accordingly, issuers and investors can continue to benefit from the opportunities offered by Eurobonds in the ever-changing global financial landscape.What Is a Eurobond?

Characteristics of Eurobonds

Currency Denomination

Issuance Outside the Domestic Market

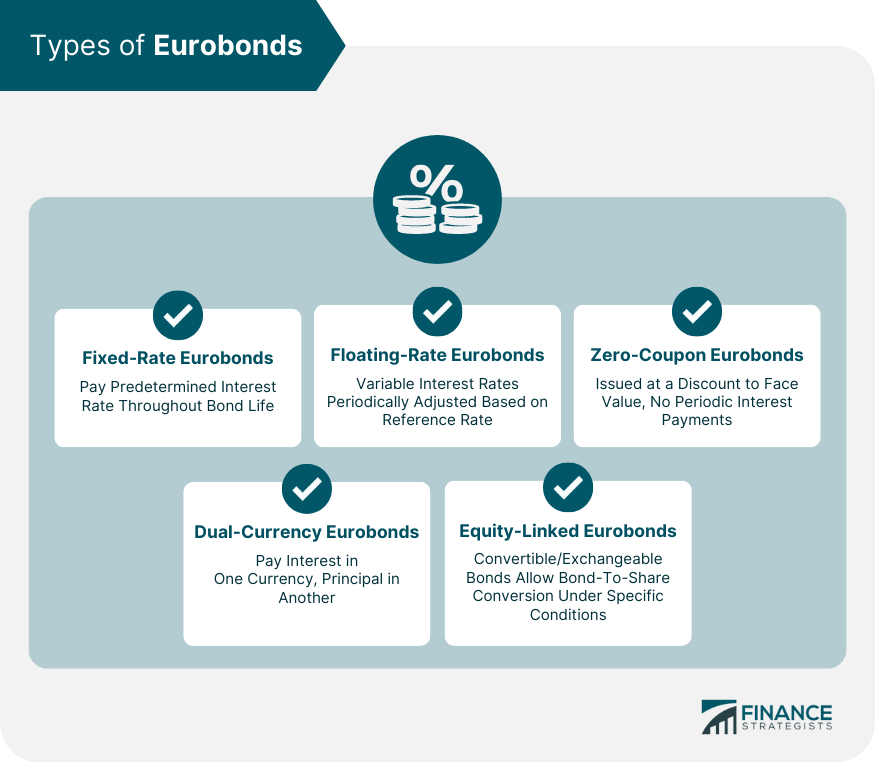

Types of Eurobonds

Fixed-Rate Eurobonds

Floating-Rate Eurobonds

Zero-Coupon Eurobonds

Dual-Currency Eurobonds

Equity-Linked Eurobonds

Maturity and Redemption Options

Eurobond Market Participants

Issuers

Investors

Intermediaries

Benefits of Eurobonds

Diversification of Funding Sources

Access to International Capital Markets

Potentially Lower Borrowing Costs

Flexibility in Issuance Terms

Risks Associated With Eurobonds

Exchange Rate Risk

Interest Rate Risk

Credit Risk

Liquidity Risk

Legal and Regulatory Risk

Eurobond Issuance Process

Appointment of Underwriters

Preparation of Offering Documents

Marketing and Roadshows

Pricing and Allocation

Settlement and Listing

Investing in Eurobonds

Factors to Consider When Investing in Eurobonds

Eurobond Investment Vehicles

Regulatory Framework and Taxation of Eurobonds

International Regulations

Local Regulations in Various Jurisdictions

Tax Implications for Issuers and Investors

Notable Eurobond Issuances and Case Studies

Historical Eurobond Issuances

Recent and Innovative Eurobond Examples

Conclusion

Eurobond FAQs

A Eurobond is a bond issued outside the country of the currency in which it is denominated. It is issued in a currency other than the currency of the country where it is issued.

Eurobonds are different from other bonds because they are issued outside the country of the currency in which they are denominated. They are also not subject to the laws and regulations of the country where they are issued.

Eurobonds are usually issued by large corporations, financial institutions, and governments.

Investing in Eurobonds provides investors with access to international capital markets and allows for diversification of their investment portfolios. Eurobonds also typically offer higher yields than domestic bonds due to the increased risk associated with investing in foreign currency.

Investing in Eurobonds carries certain risks such as exchange rate risk, political risk, and credit risk. Exchange rate risk arises due to fluctuations in exchange rates between the currency of the investor and the currency in which the Eurobond is denominated. Political risk refers to the possibility of changes in government policies that may impact the value of the Eurobond. Credit risk is the possibility that the issuer may default on their payments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.