A fiduciary bond functions as a type of insurance that offers protection to heirs, beneficiaries, and creditors from fraudulent or dishonest actions committed by a fiduciary. Courts often require this bond when an individual has a fiduciary responsibility towards another party. Generally, a fiduciary is someone who is responsible for safeguarding the interests of another party and may include financial professionals, trustees, guardians, or other parties with control over the assets or property of an individual. A fiduciary bond is commonly required when a fiduciary is appointed to manage the assets of an individual, which may happen when an individual cannot manage their assets independently, and the fiduciary is responsible for managing them. Have questions about Fiduciary Bonds? Click here. A fiduciary bond involves three parties: the court, the fiduciary, and the surety or bond company. When a court mandates a fiduciary bond, the fiduciary must obtain and post the bond. Once the bond is posted, the surety company is obligated to pay a set amount to the court if the fiduciary fails to fulfill their obligations in any way. Such failures include fraud, embezzlement, or theft from the funds of the estate. With a fiduciary bond in place, the damage done to the estate is limited because the surety company will cover the funds taken, even if the acts were caused by negligence or carelessness. The bond is typically set at the value of the assets (excluding real property) under the control of a fiduciary. A certain Jane Doe is appointed as the legal guardian for the child of her sister, who inherited a large sum of money. Jane may need to obtain a fiduciary bond to ensure the assets of the child are properly managed. This bond will help guarantee that Jane fulfills her fiduciary obligations and does not engage in fraudulent or dishonest behavior, such as embezzlement of the funds of the child. If someone believes that Jane is not fulfilling her role as a fiduciary, they can make a claim against her. The surety company that issued the bond will investigate the claim and, if it is found to be valid, will cover any losses incurred by the estate of the child. The company will then pursue Jane for reimbursement of the funds paid out. If Jane resigns from her role as the legal guardian, she must find a suitable replacement and get approval from the court to do so. Until she finds a replacement and gets approval, she remains accountable for the duties and responsibilities of the fiduciary, and the bond remains in effect to protect the assets of the child. Several types of fiduciary bonds are available, each designed to meet the needs of different types of fiduciaries. The most common types of fiduciary bonds include: This type of bond is often required when someone is appointed as a personal representative or executor of an estate. It financially protects heirs, beneficiaries, and creditors if the personal representative fails to fulfill their legal duties and obligations. The bond helps ensure that the estate affairs are handled responsibly and ethically and comply with state and federal laws. This bond is required when an executor is appointed to administer a will. It guarantees that the executor will manage the estate properly and fulfill their legal obligations, such as distributing assets to the beneficiaries according to the provisions of the will. The bond also protects the beneficiaries financially if the executor embezzles or mismanages estate assets. This bond is required when a court appoints a guardian to care for a minor or incapacitated adult. It provides financial protection to the ward and their estate by ensuring that the guardian upholds their legal duties and obligations. If the guardian fails to fulfill their responsibilities, the bond covers any losses incurred by the ward or their estate. This bond is required when someone is appointed as a trustee of a trust. It provides financial protection to the trust beneficiaries, ensures that the trustee manages the trust assets properly, and complies with the trust provisions and state and federal laws. The bond covers losses incurred by the beneficiaries if the trustee breaches their legal duties or obligations. This bond is required when someone is appointed as an administrator of an estate where there is no will. It guarantees that the administrator will distribute the estate assets according to state and federal laws and in compliance with the court orders. The bond covers any losses the estate or its creditors incur if the administrator breaches their legal duties or obligations. This bond is required when someone is appointed as a conservator of a person who is unable to manage their financial affairs. It ensures that the conservator handles the financial matters of the ward appropriately and in compliance with state and federal laws. The bond covers losses incurred by the ward if the conservator breaches their legal duties or obligations. The cost of a fiduciary bond varies depending on the size of the estate and the level of coverage required. Typically, the court requires that the bond covers any non-real property assets that the fiduciary will be in control of. The average premium for a fiduciary bond is usually a few percentage points of the total amount being covered. For example, if the premium is 1% of the total bond amount, a $30,000 bond would cost $300. However, this is just an example, and rates may vary depending on the state and the specific circumstances of the case. The most accurate estimate can be obtained by contacting reputable bond companies in the state where the fiduciary bond is required. It is important to note that the bond cost is an ongoing expense that the fiduciary must pay as long as they act in its fiduciary capacity. Fiduciaries have varying duties and obligations depending on their types, such as an executor who manages the property of a decedant or a trustee who directs audits and determines claimants. On the other hand, guardians and conservators may be more responsible for caring for an incapacitated individual or minor. Fiduciaries are held to a high standard of care and must exhibit high loyalty in fulfilling their roles. It is worth noting that those who handle funds or provide financial advice are also considered fiduciaries. If they work for a company, the company is required to obtain a fidelity bond, which is different from a fiduciary bond. The requirement for fiduciary bonds varies from state to state, with many states mandating bonds for probate proceedings where a fiduciary role is assigned, such as executor, administrator, trustee, and guardian. In some states, bonds are required when an individual dies without a will or when a will does not waive the bond requirement. In other states, the probate court may have the discretion to impose bonds. In cases where the honesty or loyalty of a fiduciary is in question, other parties such as beneficiaries or creditors, may request the imposition of a bond instead of challenging the appointment of the fiduciary. This provides financial protection and assurance to the creditors or beneficiaries. A fiduciary bond is an important protection mechanism for beneficiaries of an estate or trust in the event of fraudulent or dishonest actions committed by a fiduciary. Different types of fiduciary bonds are available to cater to the needs of different types of fiduciaries. Although the cost of obtaining a fiduciary bond can be high, it is a necessary expense to safeguard the beneficiaries against financial loss. For anyone appointed as a fiduciary, it is crucial to have a clear understanding of their roles and obligations and take appropriate measures to protect the beneficiaries. Obtaining a fiduciary bond is a vital step in fulfilling the duties of a fiduciary and ensuring that the beneficiaries are protected. In case of any doubts or questions related to fiduciary bonds or fiduciary obligations, it is advisable to seek guidance from a qualified attorney or a wealth management professional.What Is a Fiduciary Bond?

How Fiduciary Bonds Work

Example of a Fiduciary Bond

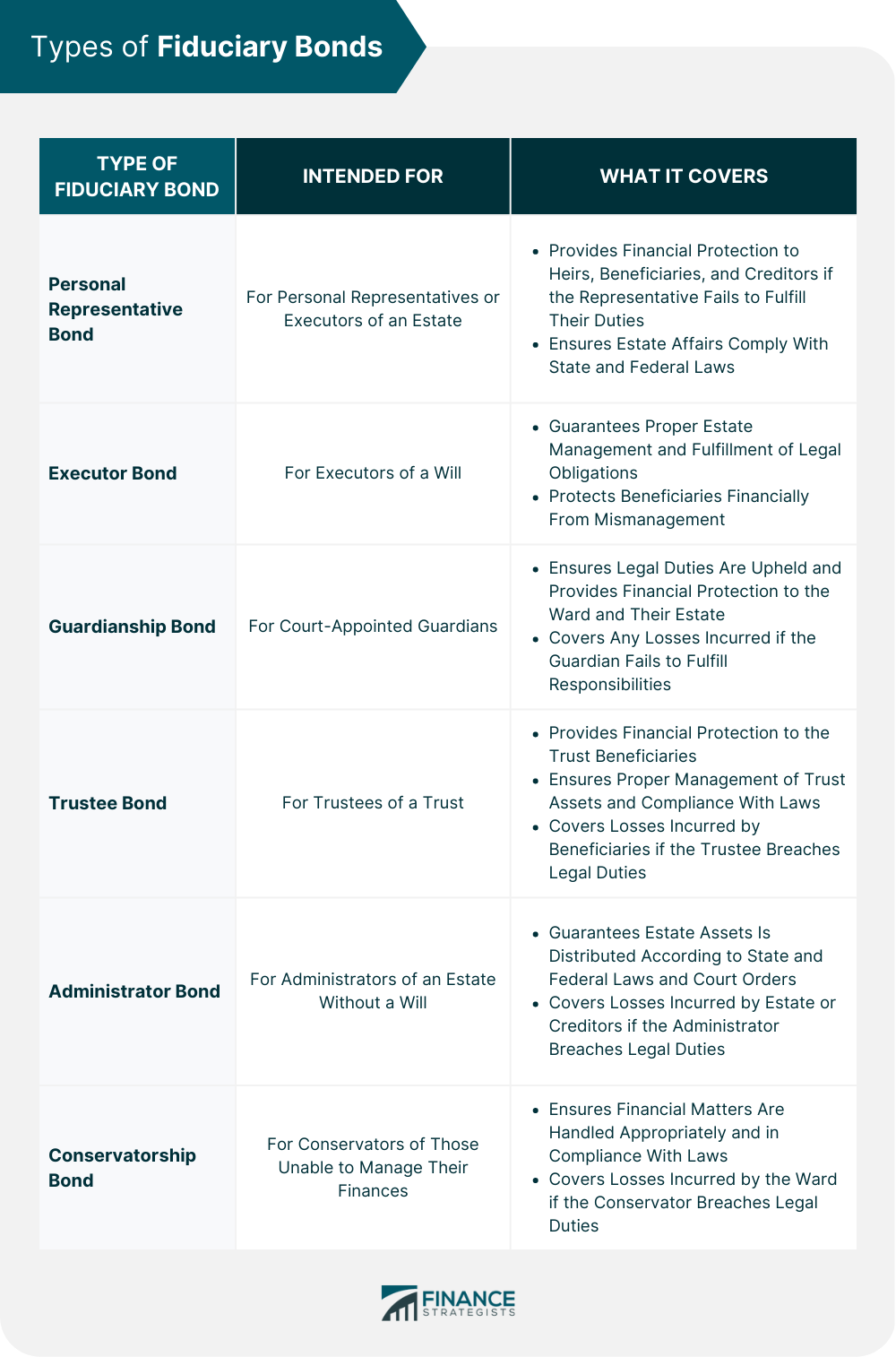

Types of Fiduciary Bonds

Personal Representative Bond

Executor Bond

Guardianship Bond

Trustee Bond

Administrator Bond

Conservatorship Bond

Cost of Fiduciary Bonds

Roles and Duties of a Fiduciary

When Do You Need a Fiduciary Bond?

Final Thoughts

Fiduciary Bond FAQs

A fiduciary bond serves as an insurance policy that safeguards heirs, beneficiaries, and creditors from fraudulent or deceitful behavior committed by a fiduciary. Typically, courts mandate this bond when an individual assumes a fiduciary role toward someone else.

Fiduciary bonds are typically required when a fiduciary is appointed to manage the affairs of another person or entity. This includes personal representatives of estates, trustees of trusts, guardians of minors or incapacitated adults, and conservators of incapacitated adults.

A fiduciary bond works by providing financial protection to individuals or entities who have been harmed by the fraudulent or dishonest actions of a fiduciary. The harmed party can claim the fiduciary bond if a fiduciary violates their duties or obligations. If the claim is found to be valid, the surety company that issued the bond will pay out the claim up to the limit of the bond. The bond issuer then seeks to recover the amount paid from the fiduciary.

Several types of fiduciary bonds are available, each designed to meet the needs of different types of fiduciaries. The most common types of fiduciary bonds include personal representative, executor, guardianship, trustee, administrator, and conservatorship bonds.

Fiduciary bond cost varies by estate size and coverage needed. The bond should cover non-real property assets. The average premium is a few percentage points of the total amount covered.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.