A Fixed Rate Bond is a type of debt instrument that pays a fixed interest rate to the investor over a specified period. It represents a loan made by the investor to a corporation, government, or municipality, serving the purpose of funding various projects or operational needs. This financial instrument has a profound impact on investors, offering them a predictable and regular income stream, thus adding stability to their investment portfolio. Fixed rate bonds lies within the broader sphere of investment strategies and portfolio management. Understanding fixed rate bonds is crucial for investors as it allows them to diversify their portfolios, balance risk and reward, and plan for long-term financial goals. It's a fundamental tool in the financial landscape, crucial for both individual and institutional investors. To understand the importance and advantages of fixed rate bonds, it is vital to grasp how they work. A fixed rate bond includes several key elements - face value, interest rate, and maturity date. A fixed rate bond includes several key elements - face value, interest rate, and maturity date Face Value - Amount that the bondholder will receive when the bond matures. Interest Rate - Percentage of the face value that the issuer will pay to the bondholder annually. Maturity Date - The date when the issuer returns the face value to the bondholder. Returns from fixed rate bonds are straightforward to calculate. If a bond has a face value of $1,000, a 5% annual interest rate, and a maturity date in ten years, the bondholder will receive $50 (5% of $1,000) each year for ten years. At the end of the ten-year period, the bondholder will receive the $1,000 face value, netting a total return of $1,500. Corporations issue these bonds to finance operations, expansions, or acquisitions. They typically offer higher interest rates compared to other bonds due to the increased risk associated with corporate solvency. Government or treasury bonds are issued by national governments. They are generally considered low-risk as they are backed by the full faith and credit of the government. Municipal bonds are issued by local government bodies or municipalities. They can finance local projects like schools or infrastructure. Some municipal bonds offer tax-free interest, making them appealing to investors in high tax brackets. Predictability and Stability: Fixed rate bonds offer a reliable and predictable income stream, as they pay a fixed interest rate until maturity. Risk Management: Compared to equities, fixed rate bonds tend to be lower risk. While the issuer could default, the likelihood is generally low, especially with government bonds. Income Generation: Since fixed rate bonds pay regular interest, they can provide a steady income stream, which can be particularly beneficial for retired individuals or those looking for consistent income. Interest Rate Risk: The primary risk of fixed rate bonds is interest rate risk. When interest rates rise, the price of existing bonds falls. Inflation Risk: Inflation risk is another concern. If inflation rates exceed the interest rate of the bond, the real return on investment will be negative. Limited Capital Appreciation: Unlike stocks, fixed rate bonds offer limited potential for capital appreciation. The return is limited to the fixed interest rate set at the time of purchase. Fixed rate bonds provide an excellent means of portfolio diversification. Investing in fixed rate bonds can help spread risk across different asset types and protect against the volatility of riskier assets like stocks. Fixed rate bonds can balance the risk and reward in a portfolio. The predictable returns and lower risk relative to other investments like equities can offer a stable income stream, providing a cushion against losses in other parts of the portfolio. Fixed rate bonds can be a reliable source of income due to their fixed interest payments. For retired individuals or those seeking stable income, these bonds are a valuable portfolio addition. Fixed rate bonds are influenced by various economic factors, such as inflation, interest rates, and economic growth. For example, if the economy is growing rapidly and inflation is rising, interest rates might increase, reducing the attractiveness of existing fixed rate bonds. Interest rates have a particularly noteworthy influence on fixed rate bonds. When interest rates rise, the price of existing bonds falls. Conversely, if interest rates fall, the price of existing bonds rises. This inverse relationship is essential to understand for bond market investing. General market conditions can also impact the performance of fixed rate bonds. For example, during times of economic uncertainty, investors often gravitate towards safer assets, increasing the demand and price of fixed rate bonds. Interest earned from corporate fixed rate bonds is typically subject to both federal and state income taxes. However, interest from municipal bonds is often tax-exempt at the federal level, and in some cases, at the state level too, if the investor lives in the state where the bond was issued. One strategy to manage tax liability involves investing in tax-exempt municipal bonds or tax-advantaged bond funds. Another strategy is to hold bonds in a tax-deferred account, like an Individual Retirement Account (IRA), where taxes on interest aren't due until withdrawal. Fixed rate bonds can be purchased through several channels, including brokerage firms, online trading platforms, and sometimes directly from the issuer. When evaluating a fixed rate bond, look at the bond's credit rating, maturity date, and interest rate. A credit rating can indicate the issuer's creditworthiness, the maturity date can show when you'll get your principal back, and the interest rate can determine your annual return. To buy a bond, you place an order with your broker, specifying the bond you want and the amount you want to spend. When it's time to sell, you can sell your bonds on the secondary market through your broker. Fixed rate bonds, as debt instruments, play a pivotal role in global finance. They offer investors a secure and predictable income source, making them suitable for conservative investment strategies. Their broad types - corporate, government, and municipal - each provide distinct advantages to match diverse financial goals. While they present some risks, such as interest rate and inflation risk, their stability often outweighs the potential drawbacks. The value of fixed rate bonds in portfolio management, providing income generation, diversification, and balance, cannot be overstated. Economic factors and market conditions do influence these bonds, and understanding their impact is crucial. Furthermore, tax considerations and investment strategies should be an integral part of fixed rate bond investing. Overall, fixed rate bonds, with their blend of security and stable returns, are a vital tool in financial planning and portfolio management.Fixed Rate Bonds Overview

Mechanics of Fixed Rate Bonds

Calculating Returns

Types of Fixed Rate Bonds

Corporate Fixed Rate Bonds

Government/Treasury Fixed Rate Bonds

Municipal Fixed Rate Bonds

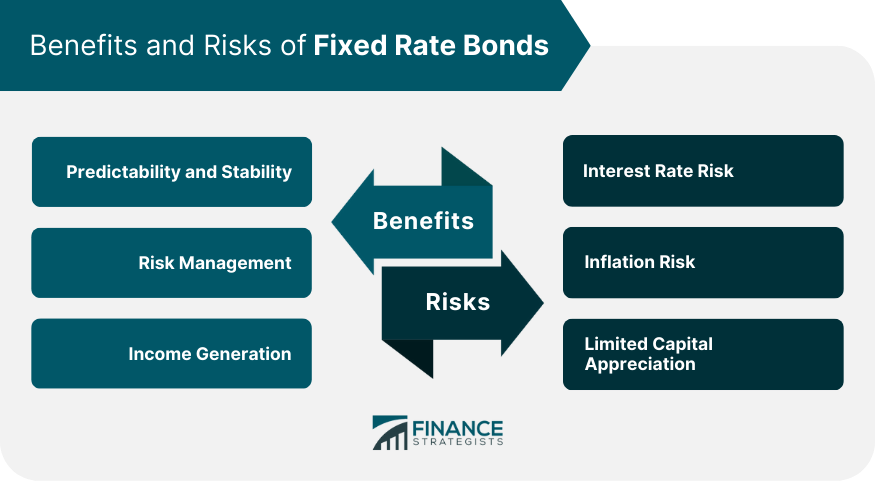

Benefits and Risks of Fixed Rate Bonds

Benefits

Risks

Role of Fixed Rate Bonds in Portfolio Management

Diversification Through Fixed Rate Bonds

Balancing Risk and Reward

Impact on Income Generation and Portfolio Stability

Market Influences on Fixed Rate Bonds

Economic Factors

Interest Rates and Fixed Rate Bonds

Market Conditions

Tax Considerations for Fixed Rate Bonds

Understanding Tax Implications

Managing Tax Liability

How to Invest in Fixed Rate Bonds

Channels for Purchasing

Evaluating Fixed Rate Bonds

Buying and Selling Process

Conclusion

Fixed Rate Bonds FAQs

Fixed rate bonds are a type of debt instrument where an investor lends money to an entity such as a corporation, government, or municipality. The borrower pays a fixed interest rate to the investor over a specified period.

The different types of fixed rate bonds include corporate fixed rate bonds, government or treasury fixed rate bonds, and municipal fixed rate bonds. Each is issued by a different entity for various purposes.

The benefits of investing in fixed rate bonds include predictable and stable returns, lower risk compared to equities, and the ability to generate regular income.

The risks associated with fixed rate bonds include interest rate risk (bond prices fall as interest rates rise), limited capital appreciation due to fixed interest payments, and inflation risk (the fixed returns might be worth less if inflation rises significantly).

Fixed rate bonds contribute to portfolio diversification by providing a different risk profile compared to equities. They offer stable and predictable income, which can balance the volatility of riskier assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.