Floating-rate bonds are a unique type of debt instrument that can provide investors with income and protection against rising interest rates. Floating-rate bonds, also known as floaters or adjustable-rate bonds, are debt securities that pay interest at a variable rate. The interest rate on these bonds is periodically reset, typically in line with a benchmark rate, such as LIBOR or the U.S. Federal Funds Rate. As a result, the bond's yield adjusts to changes in market interest rates, providing investors with a degree of protection against interest rate risk. Unlike floating-rate bonds, fixed-rate bonds pay a constant interest rate over their entire term. This means that the yield on fixed-rate bonds remains the same regardless of changes in market interest rates. Floating-rate bonds, on the other hand, offer the potential for higher yields in a rising interest rate environment, as their yields adjust to reflect the prevailing market rates. Investors typically purchase floating-rate bonds to reduce interest rate risk and hedge against inflation. Since the interest payments on floating-rate bonds adjust with market rates, investors can potentially benefit from rising rates, unlike holders of fixed-rate bonds. Additionally, floating-rate bonds can offer lower price volatility and increased income potential during periods of rising interest rates. There are several types of floating-rate bonds, each with its unique features and risk-return profiles. Understanding the differences between these types can help investors choose the most suitable instrument for their investment goals. Floating-to-fixed rate bonds initially pay interest at a floating rate, which then switches to a fixed rate at a predetermined date. This structure can be appealing to investors who anticipate a decline in interest rates, as the bond will lock in a higher fixed rate during the fixed-rate period. Inverse floating-rate bonds have an interest rate that moves inversely to a benchmark interest rate. This means that when the benchmark rate rises, the bond's interest rate falls, and vice versa. These bonds can be attractive to investors who expect interest rates to decline, as they can potentially offer higher yields in a falling rate environment. Step-up callable bonds are a type of floating-rate bond with a predetermined interest rate schedule that increases over time. Issuers can call, or redeem, these bonds at specified dates, typically coinciding with the step-up dates. Investors in step-up callable bonds can benefit from the increasing interest rates over time, but they also face call risk if the issuer decides to redeem the bonds early. Perpetual floating-rate bonds have no maturity date, meaning they pay interest indefinitely. The interest rate on these bonds is periodically reset in line with a benchmark rate. These bonds can be appealing to income-focused investors who desire a steady stream of income, but they also carry higher credit risk and price volatility compared to bonds with a fixed maturity date. The interest rate on floating-rate bonds is typically tied to a benchmark index, and understanding these indexes and the spreads applied to them is crucial for investors. Several benchmark indexes are used to determine the interest rate on floating-rate bonds, including the London Interbank Offered Rate (LIBOR), the Secured Overnight Financing Rate (SOFR), and the Euro Interbank Offered Rate (Euribor). Each index reflects the prevailing market interest rates and serves as a reference for setting the bond's interest rate during the reset periods. The interest rate spread is the difference between the benchmark rate and the floating-rate bond's interest rate. The spread is typically determined by factors such as the creditworthiness of the issuer and the bond's time to maturity. A higher credit rating generally results in a lower spread, while a longer time to maturity can lead to a higher spread. Changes in benchmark rates and spreads can significantly impact the yield of a floating-rate bond. If the benchmark rate increases, the bond's yield will generally rise, providing investors with higher income. Conversely, if the benchmark rate decreases, the bond's yield will generally fall, resulting in lower income for investors. While floating-rate bonds can offer certain benefits, they are not without risks. Investors should carefully consider the various risks associated with these bonds before adding them to their portfolios. Interest rate risk refers to the potential for bond prices to fluctuate due to changes in market interest rates. Although floating-rate bonds are generally less sensitive to interest rate fluctuations compared to fixed-rate bonds, they are still exposed to some degree of interest rate risk, particularly during periods of significant rate changes. Credit risk is the risk that the issuer of a bond may default on its interest payments or fail to repay the principal upon maturity. Floating-rate bonds are subject to credit risk, and bonds issued by entities with lower credit ratings typically carry higher credit risk. Investors should assess the creditworthiness of the bond issuer to mitigate this risk. Liquidity risk is the risk that an investor may not be able to sell a bond quickly or at a favorable price due to a lack of buyers in the market. Some floating-rate bonds, particularly those issued by smaller or less creditworthy entities, may have limited liquidity, making it difficult for investors to exit their positions when needed. Call risk refers to the risk that a bond issuer may redeem a bond before its maturity date. This can happen if interest rates decline, prompting the issuer to refinance its debt at lower rates. Callable floating-rate bonds, such as step-up callable bonds, are exposed to call risk, which can result in a lower yield for investors if the bond is called early. Floating-rate bonds can be a valuable addition to an investment portfolio, but it's essential to understand who they are most suitable for and how to evaluate potential investments. Floating-rate bonds are typically most suitable for investors who seek income and protection against rising interest rates. They can be a good fit for conservative investors who wish to reduce interest rate risk or for those who expect interest rates to rise in the near future. Investing in floating-rate bonds can be done through individual bond purchases or by investing in floating-rate bond funds or exchange-traded funds (ETFs). These funds and ETFs hold a diversified portfolio of floating-rate bonds, providing investors with exposure to a variety of issuers and credit qualities while potentially reducing risk. Before investing in floating-rate bonds, investors should carefully consider factors such as the bond's credit rating, time to maturity, and the benchmark index it is tied to. Additionally, it's essential to assess the issuer's financial health and the bond's liquidity to ensure the investment aligns with the investor's risk tolerance and objectives. Floating-rate bonds can serve various purposes in an investment portfolio, providing benefits such as diversification, inflation protection, and reduced interest rate risk. Including floating-rate bonds in a diversified investment portfolio can help reduce overall portfolio risk by providing exposure to a different asset class. This diversification can lead to more stable portfolio returns, as floating-rate bonds may perform differently than other investments, such as stocks or fixed-rate bonds, during various market conditions. Floating-rate bonds can offer a degree of protection against inflation, as their interest payments typically adjust with market rates. When inflation is high, interest rates often rise, leading to higher yields for floating-rate bond investors. This feature can help preserve the purchasing power of the income generated from these bonds. One of the primary benefits of floating-rate bonds is their ability to reduce interest rate risk within a portfolio. Because the interest payments on these bonds adjust with market rates, they tend to be less sensitive to fluctuations in interest rates compared to fixed-rate bonds. Including floating-rate bonds in a portfolio can help investors manage interest rate risk and maintain more stable income streams during periods of rising rates. Floating-rate bonds can be a valuable addition to an investment portfolio, offering income potential, protection against rising interest rates, and diversification benefits. Understanding the various types, risks, and characteristics of these bonds is crucial for investors who wish to incorporate them into their investment strategies. By carefully evaluating potential investments and considering the role of floating-rate bonds in their portfolios, investors can make more informed decisions and optimize their risk-adjusted returns. Working with a wealth management service can help ensure a comprehensive and informed approach to investing in floating-rate bonds, providing access to expert advice and personalized strategies to meet your investment goals.What Are Floating-Rate Bonds?

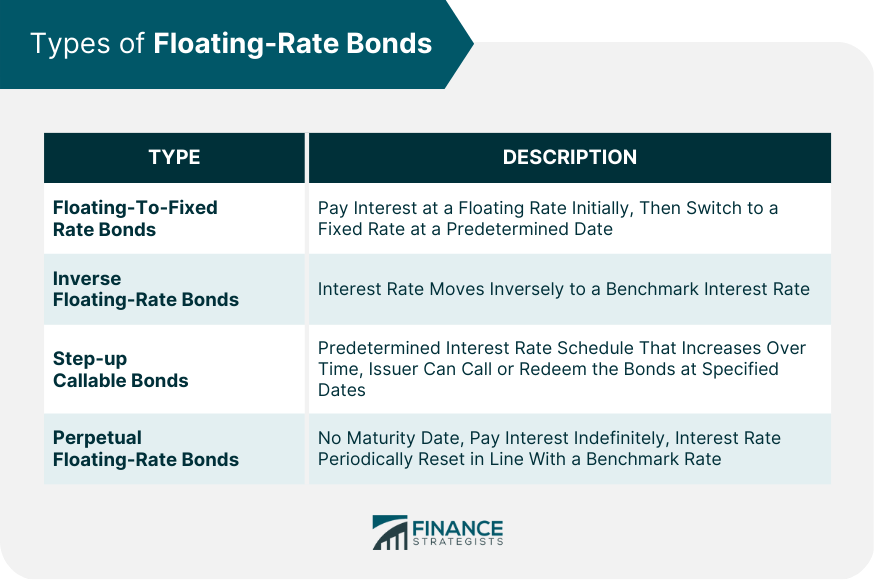

Types of Floating-Rate Bonds

Floating-To-Fixed Rate Bonds

Inverse Floating-Rate Bonds

Step-up Callable Bonds

Perpetual Floating-Rate Bonds

Interest Rate Indexes and Spreads

Commonly Used Indexes

Calculating the Interest Rate Spread

Impact on Bond Yields

Risks Associated with Floating-Rate Bonds

Interest Rate Risk

Credit Risk

Liquidity Risk

Call Risk

Investing in Floating-Rate Bonds

Suitable Investors

Floating-Rate Bond Funds and ETFs

Evaluating Potential Investments

The Role of Floating-Rate Bonds in a Portfolio

Diversification Benefits

Inflation Protection

Reducing Interest Rate Risk

Bottom Line

Floating-Rate Bonds FAQs

Floating-rate bonds are a type of debt security where the interest rate paid on the bond adjusts periodically based on changes in a benchmark interest rate.

Investing in Floating-rate bonds can provide investors with a higher yield compared to fixed-rate bonds in a rising interest rate environment. They also offer greater flexibility and less interest rate risk.

The main risk associated with Floating-rate bonds is credit risk, as there is a possibility that the issuer may default on their debt obligations. There is also the possibility of interest rate risk, if the benchmark rate changes significantly.

Floating-rate bonds can be suitable for investors who are seeking to diversify their fixed income portfolio, or for those who are looking for a higher yield compared to fixed-rate bonds.

There are several types of Floating-rate bonds, including Floating-To-Fixed rate bonds, Inverse Floating-Rate bonds, Step-up Callable bonds, and Perpetual Floating-Rate bonds. Each type has its own unique features and risk-return profile.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.