A hospital revenue bond is a type of municipal bond issued by hospitals, healthcare facilities, or other healthcare-related entities to raise capital for construction, renovation, or expansion projects. These bonds are backed by the revenue generated from the healthcare facility's operations, such as patient fees and other income sources. Hospital revenue bonds can be an attractive investment option for investors looking to diversify their portfolio with relatively low-risk investments while supporting the improvement and expansion of healthcare facilities. They typically offer competitive yields and can be either tax-exempt or taxable, depending on the specific bond issuance. Moreover, hospital revenue bonds can also offer investors the opportunity to support the growth and development of healthcare facilities and services in their communities. By investing in these bonds, investors contribute to improving the quality of healthcare and infrastructure, which can have a positive impact on the community's overall wellbeing. General obligation bonds are a type of municipal bond backed by the full faith and credit of the issuing municipality. In the case of hospital revenue bonds, this means that the issuer pledges to use its taxing power or other general revenues to meet its debt obligations. These bonds typically have lower yields than revenue bonds but are considered more secure due to the issuer's commitment to repay the bondholders. Revenue bonds, as their name suggests, are bonds backed by the revenue generated by a specific project or facility. For hospital revenue bonds, this means the income generated from the healthcare facility's operations, such as patient fees and other income sources, is used to repay bondholders. As a result, revenue bonds are generally considered to be riskier than general obligation bonds, as their repayment depends on the success of the project or facility they finance. However, they typically offer higher yields to compensate for this increased risk. Tax-exempt bonds are a type of municipal bond that provides investors with interest payments that are exempt from federal income taxes, and in some cases, state and local taxes as well. Hospital revenue bonds can be issued as tax-exempt bonds if they meet certain criteria set by the Internal Revenue Service (IRS), such as financing projects for public purposes or benefiting the general public. This tax advantage can make tax-exempt hospital revenue bonds an attractive option for investors, particularly those in higher tax brackets. In contrast to tax-exempt bonds, taxable bonds are municipal bonds whose interest payments are subject to federal, state, and local income taxes. Hospital revenue bonds may be issued as taxable bonds if they do not meet the criteria for tax-exempt status, or if the issuing entity chooses to issue them as taxable bonds for other reasons. Although taxable bonds offer lower after-tax returns than tax-exempt bonds, they may still be a worthwhile investment option for investors seeking diversification and a stable source of income, particularly when compared to other fixed-income investments. Hospital revenue bonds generally offer higher yields compared to other types of municipal bonds, such as general obligation bonds. This higher yield can result in a greater return on investment for investors, particularly when considering the potential tax advantages associated with some hospital revenue bond issuances. One of the key advantages of investing in hospital revenue bonds is their potential tax-exempt status. As mentioned earlier, some hospital revenue bonds may qualify for tax-exempt status, meaning that the interest payments received by investors are exempt from federal income taxes, and possibly state and local taxes as well. This tax advantage can result in a higher after-tax return for investors, particularly those in higher tax brackets. Hospital revenue bonds are typically considered a low-risk investment due to their backing by a stable revenue source, such as patient fees and other income generated by healthcare facilities. Additionally, healthcare is a fundamental need for any community, which contributes to the stability of hospital revenue bonds as an investment. Investing in hospital revenue bonds provides a secure and consistent source of income for investors in the form of interest payments. This stable income can be an attractive feature for investors seeking reliable cash flow, particularly during periods of economic uncertainty or market volatility. Credit risk refers to the possibility that the issuer of a hospital revenue bond may default on its interest payments or be unable to repay the principal at maturity. While hospital revenue bonds are generally considered low-risk investments, it is essential for investors to evaluate the creditworthiness of the issuer and the bond's rating to understand the potential credit risk associated with the investment. Interest rate risk is the risk that changes in prevailing interest rates may negatively impact the market value of a bond. When interest rates rise, bond prices typically fall, which can result in a decline in the market value of existing bonds, including hospital revenue bonds. Investors should be aware of this risk and consider the potential impact of changing interest rates on their bond investments. Market risk, also known as systematic risk, refers to the risk of losses in an investment due to factors that affect the overall performance of the financial markets. While hospital revenue bonds are typically considered a stable investment, they are not immune to market risk. Economic conditions, changes in government policies, and other external factors can impact the performance of hospital revenue bonds, potentially resulting in losses for investors. Liquidity risk is the risk that an investor may not be able to sell a bond quickly or at a favorable price when they need to liquidate their investment. Hospital revenue bonds, like other municipal bonds, may have limited secondary market liquidity, which can make it more challenging for investors to sell their bonds at a desirable price. Investors should consider this risk and assess their need for liquidity before investing in hospital revenue bonds. Before investing in hospital revenue bonds, it is crucial to evaluate the creditworthiness of the issuer. This can be done by reviewing the issuer's financial statements, understanding the performance of the healthcare facility, and considering factors such as the facility's location, management team, and market competition. Credit rating agencies, such as Standard & Poor's, Moody's, and Fitch, assign ratings to bonds based on their evaluation of the issuer's creditworthiness and ability to meet its debt obligations. Investors should review these ratings before investing in hospital revenue bonds to gain a better understanding of the potential credit risk associated with the investment. Investors should consider prevailing interest rates and their potential impact on the market value of the bonds. When interest rates are low, hospital revenue bonds may offer more attractive yields compared to other fixed-income investments, while rising interest rates may negatively impact bond prices and make them less appealing. Understanding the current market conditions and the overall economic environment is crucial when investing in hospital revenue bonds. Factors such as economic growth, inflation, and government policies can impact the performance of these bonds, and investors should be aware of these factors when making investment decisions. Hospital revenue bonds can be an attractive investment option for investors seeking a stable, long-term investment that offers competitive yields and potential tax advantages. These bonds can play a crucial role in wealth management by providing a fixed-income investment option that helps diversify a portfolio and manage risk. There are various types of hospital revenue bonds, such as general obligation bonds, revenue bonds, tax-exempt bonds, and taxable bonds, each with its unique characteristics and benefits. However, like any investment, there are risks associated with investing in hospital revenue bonds, including credit risk, interest rate risk, market risk, and liquidity risk. To make informed decisions when investing in hospital revenue bonds, investors should consider factors such as the creditworthiness of the issuer, bond ratings, interest rates, and market conditions. By carefully evaluating these factors and understanding the potential risks and benefits, investors can make well-informed decisions and potentially reap the rewards of investing in hospital revenue bonds.What Is a Hospital Revenue Bond?

Types of Hospital Revenue Bonds

General Obligation Bonds

Revenue Bonds

Tax-Exempt Bonds

Taxable Bonds

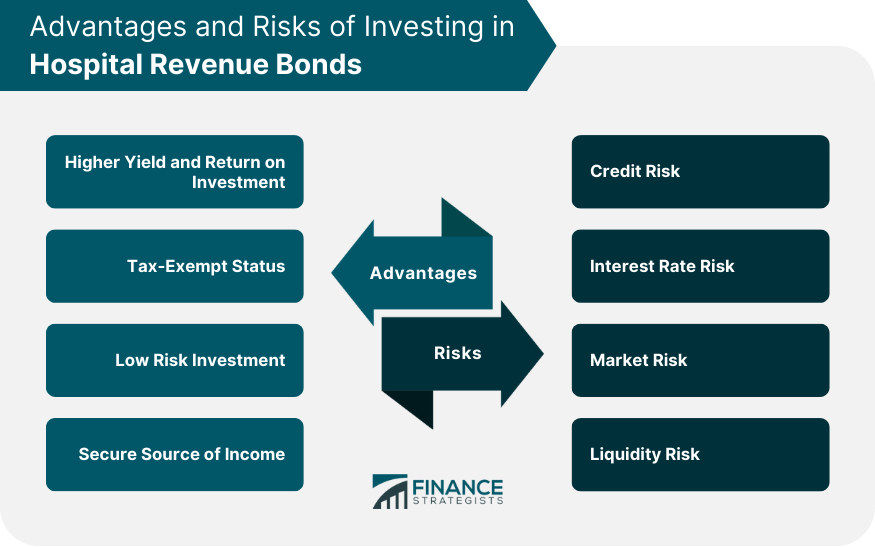

Advantages of Investing in Hospital Revenue Bonds

Higher Yield and Return on Investment

Tax-Exempt Status

Low Risk Investment

Secure Source of Income

Risks of Investing in Hospital Revenue Bonds

Credit Risk

Interest Rate Risk

Market Risk

Liquidity Risk

Factors to Consider When Investing in Hospital Revenue Bonds

Creditworthiness of the Issuer

Bond Ratings

Interest Rates

Market Conditions

Final Thoughts

Hospital Revenue Bond FAQs

Hospital Revenue Bond is a type of municipal bond used to finance healthcare projects by hospitals and medical centers.

Hospital Revenue Bonds offer a higher yield, tax-exempt status, low risk investment, and secure source of income.

The risks include credit risk, interest rate risk, market risk, and liquidity risk.

You can look at bond ratings, financial statements, and the issuer's ability to repay the bond principal and interest.

Factors to consider include creditworthiness of the issuer, bond ratings, interest rates, market conditions, and the purpose of the bond issuance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.