Savings bonds represent one of the safest investment avenues for people in the United States. They are debt securities issued by the Department of the Treasury to help pay for the U.S. government's borrowing needs. Essentially, purchasing a savings bond means loaning money to the U.S. government. In return, the government promises to pay back the principal (the initial amount invested), plus interest, over a specified period. These bonds are non-transferable, meaning they cannot be bought or sold in secondary markets. However, they can be gifted or inherited, making them an effective way to transfer wealth across generations. Savings bonds serve multiple purposes for both the government and the investor. For the government, they facilitate the financing of its operations. Currently, there are two types of U.S. savings bonds, namely Series EE and Series I. Each bond has a specific maturity date, which is the date when the bond is supposed to be cashed in. The maturity date of a bond is determined by the bond series and when it was issued. For example, Series EE bonds have an initial maturity period of 20 years, but they continue to earn interest for another 10 years, reaching final maturity after 30 years. The decision to cash in savings bonds is typically influenced by factors such as: The bond’s current value and interest rate. The bond’s maturity date. The investor's financial needs and goals. The tax implications of cashing in the bond. Cashing in savings bonds before they mature can have consequences. If a bond is cashed in within the first five years, there is a penalty of the last three months' interest. Moreover, the deferred interest becomes taxable income in the year the bond is cashed in, potentially increasing the bond owner's tax liability. The U.S. Department of the Treasury's Savings Bond Calculator is an essential tool for savings bond owners. This online tool allows bond owners to find the current value of their bonds, the interest earned, and other bond-related information. To determine the current value of your savings bonds using the Treasury's Savings Bond Calculator, follow these steps: 1. Gather your bond information. You'll need the bond serial number, denomination, and issue date. 2. Visit the Savings Bond Calculator on the TreasuryDirect website. 3. Enter the bond information and click 'Calculate'. 4. The calculator will display the current value of the bond, the interest earned, and the next accrual date. Understanding the resulting data is essential. The 'Current Value' represents how much the bond is worth now. The 'Interest Earned' is the total interest the bond has accrued since the issue date. The 'Next Accrual Date' indicates when the bond will next accrue interest. Remember, the decision to cash in your savings bond should be based on a thorough understanding of its current value, your financial situation, and the tax implications. Therefore, it is advisable to consult with a financial advisor before making a decision. The first step in cashing in your paper savings bonds involves some preparation. Gather the paper bonds that you wish to cash and bring them along with your identification. The identification could be a driver's license, a passport, or any other government-issued ID. Ensure your identification is valid and up-to-date to avoid any hiccups during the process. The next step in the process involves signing each of the bonds you wish to cash. This step is crucial because it verifies that you are the rightful owner of the bonds. Make sure to sign each bond in the presence of a bank officer. This allows the officer to verify your signature against the one on your identification. Once you've signed your bonds, the bank officer will verify your identity. This process is important as it provides the bank with assurance that you are indeed the rightful owner of the bonds. The officer will compare the signature on the bonds with the one on your identification. They will also ensure that the names match. If everything checks out, the officer will proceed with the transaction. After successful verification, the bank officer will process the transaction. They will calculate the cash value of the bonds based on the current rates and the period for which the bonds have been held. It's worth noting that savings bonds earn interest for up to 30 years. The officer will then initiate the transaction. Finally, you will receive the cash value of your bonds. The bank can offer you a direct deposit into your bank account or issue a check. Direct deposit might be the quickest way to access your funds, especially if you're cashing the bonds at your regular bank. If you opt for a check, you can cash it immediately or deposit it into your account. The first step to cashing in your electronic savings bonds is to access your TreasuryDirect account. This is where you manage all your electronic bonds, including purchasing new bonds, viewing your bond inventory, and redeeming your bonds when the time comes. You can log in with your unique account credentials, typically your account number and password. After you've logged in, you'll be directed to your account dashboard. This screen shows you an overview of your account, including your total holdings. Here, you can select the specific bond or bonds you wish to cash in. To do this, find the list or summary of your bonds and choose the one(s) you want to redeem. Be sure to check the details of each bond before proceeding, including the current value and the interest accrued. Once you have selected the bond(s) you wish to redeem, you can follow the on-screen prompts to complete the transaction. These prompts will guide you through the redemption process and confirm your decision to redeem the bond(s). At this stage, you'll also need to confirm the bank account details where the redeemed bond funds will be deposited. Make sure this information is accurate to prevent any issues with the transaction. After completing the redemption process, the funds from the redeemed bonds will be deposited into the linked bank account within one to two business days. Keep in mind that this timeline may vary depending on your bank's processing times and any potential holidays. The amount you receive will be the face value of the bond plus any accrued interest. Be aware that cashing in bonds before they reach maturity may result in lower returns, as some bonds do not reach their full value until they have fully matured. Interest earned from savings bonds is subject to federal income tax. However, it's typically not taxed until the bond is redeemed or reaches final maturity. State and local income taxes, on the other hand, do not apply to savings bonds interest. Several strategies can help minimize or delay tax payments when cashing in savings bonds: Education Exclusion: The interest earned on Series EE and Series I bonds may be excluded from federal income tax if the bond owner pays qualified higher education expenses in the same year the bonds are redeemed. Deferring Redemption: If possible, delaying the redemption of bonds until a year when you expect to be in a lower tax bracket can reduce the tax burden. Spreading Redemption Over Several Years: By cashing in bonds over several years, you can spread out the interest income, potentially keeping your taxable income lower in any single year. Some bonds stop earning interest after a certain period. For instance, Series EE bonds stop earning interest after 30 years. Once a bond has stopped earning interest, it's usually best to cash it in, as it no longer serves as a productive investment. The U.S. Department of the Treasury provides a process for replacing or cashing in lost, stolen, or damaged savings bonds. You can complete FS Form 1048 (Claim for Lost, Stolen, or Destroyed United States Savings Bonds) and submit it to the Bureau of the Fiscal Service for assistance. If the owner of a savings bond passes away, the bond can be cashed in by the surviving owner listed on the bond, the beneficiary named on a POD (Payable on Death) registration, or by a legal representative of the deceased owner's estate. The process varies based on the bond's registration and requires specific documentation, such as a copy of the death certificate. It's recommended to seek legal advice when navigating this process. Cashing in savings bonds requires careful consideration of various factors, including the bond's maturity date, current value, and the investor's financial goals. To determine the current value of savings bonds, bond owners can utilize the U.S. Department of Treasury's Savings Bond Calculator. When cashing in paper savings bonds at a bank or electronically, proper preparation is necessary. Special considerations arise when cashing in bonds that have stopped earning interest, dealing with lost or damaged bonds or handling bonds of deceased owners. Proper documentation and legal advice may be required in these situations. Overall, cashing in savings bonds should be approached with careful planning and consideration of personal financial circumstances. Seeking guidance from a financial advisor can help ensure a smooth and informed decision-making process.Overview of Savings Bonds

Understanding When to Cash in Savings Bonds

Understanding Bond Maturity

Factors Influencing the Decision to Cash in Savings Bonds

Consequences of Cashing in Early

Identifying the Current Value of Your Savings Bonds

Introduction to the U.S. Department of Treasury's Savings Bond Calculator

Steps to Determine the Current Value of Your Bonds

Interpretation of the Resulting Data

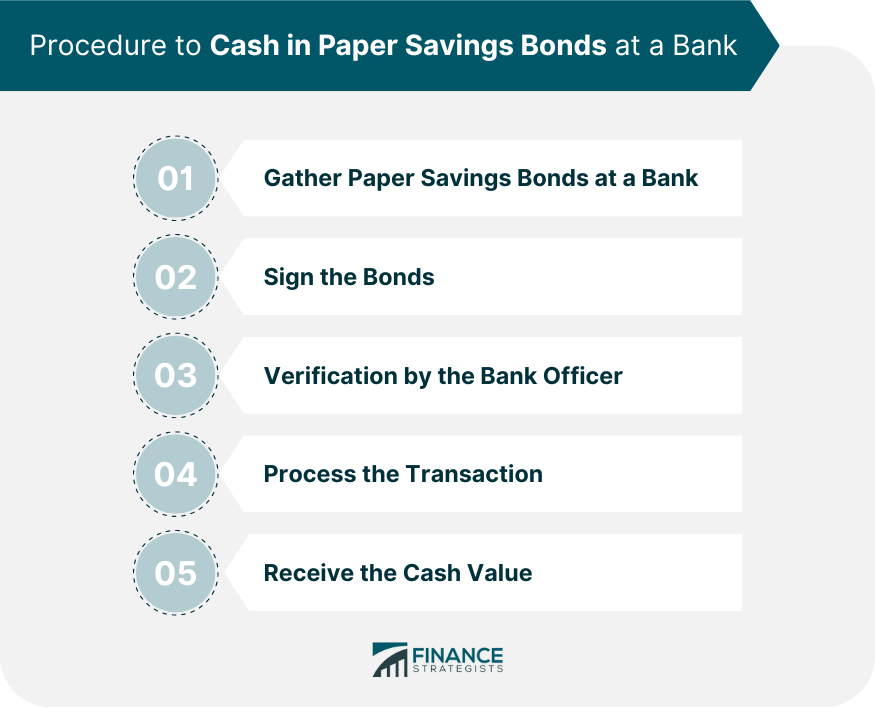

Procedure to Cash in Paper Savings Bonds at a Bank

Gather Paper Savings Bonds at a Bank

Signing the Bonds

Verification by the Bank Officer

Processing the Transaction

Receiving the Cash Value

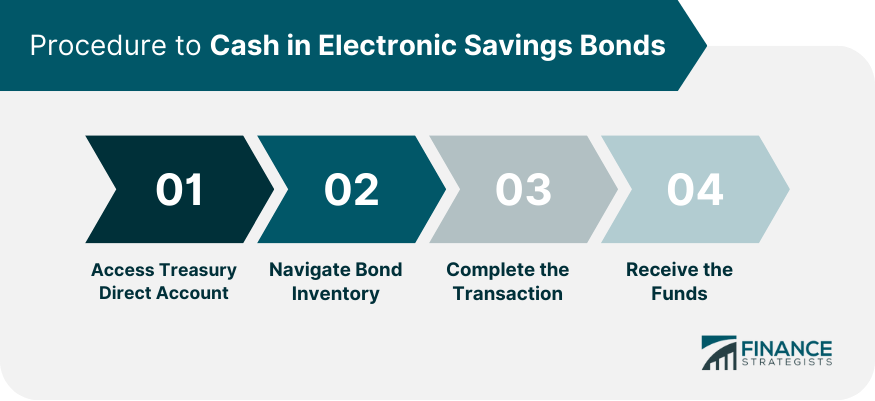

Procedure to Cash in Electronic Savings Bonds

Accessing Your TreasuryDirect Account

Navigating to Your Bond Inventory

Completing the Transaction

Receiving the Funds

Tax Implications When Cashing in Savings Bonds

Strategies to Minimize or Delay Tax Payments

Special Considerations When Cashing in Savings Bonds

Cashing in Bonds That Have Stopped Earning Interest

Cashing in Lost, Stolen, or Damaged Bonds

Cashing in Bonds for Deceased Bond Owners

Bottom Line

How to Cash in Savings Bonds FAQs

Most financial institutions, like banks and credit unions, allow you to cash paper savings bonds. Simply take the bond and valid identification to your bank, sign the bond in front of a bank officer, and receive the funds.

Electronic savings bonds can be cashed in through your TreasuryDirect account. Log into your account, select the bond(s) you wish to redeem, and follow the prompts. The funds will be deposited into your linked bank account within one to two business days.

Yes, you can cash in your savings bonds at any time after a minimum holding period of one year. However, if you cash them in within the first five years, there's a penalty of the last three months' interest.

The interest earned from savings bonds is subject to federal income tax but is usually tax-deferred until the bond is redeemed or reaches final maturity. State and local income taxes do not apply to savings bonds interest.

If you've lost your paper savings bond, you can request a replacement or payment from the U.S. Department of the Treasury by submitting Form PD F 1048.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.