Gifting a bond refers to the act of transferring ownership of a bond from one individual to another as a gift. It involves giving someone the rights to receive interest payments and the principal amount upon maturity of the bond. Bonds are fixed income securities that represent a loan made by an investor to a borrower, typically a corporation or government entity. Bonds are an effective tool for raising capital and are an integral part of the global financial market. The borrower, or issuer, promises to pay the investor, or bondholder, a predetermined interest rate, known as the coupon, over a specified period. Upon maturity, the issuer repays the bond's face value to the bondholder. Gifting bonds can be a thoughtful gesture and a strategic wealth management tool, allowing individuals to share financial benefits and opportunities with their loved ones. Choosing the right bond to gift requires careful research. You'll want to familiarize yourself with different bond types, their characteristics, and how they align with the recipient's financial goals and risk tolerance. For instance, a risk-averse recipient may appreciate a government bond for its safety and stability, while a recipient seeking higher returns might prefer a corporate bond. Evaluating the risk and return factors of different bonds is a critical part of the selection process. These factors include the bond's yield, maturity date, credit rating, and the issuer's financial stability. A bond's yield indicates the return you can expect, while its credit rating reflects the issuer's ability to meet its financial obligations. Choosing a suitable bond also involves considering the recipient's financial goals. For instance, if the recipient is saving for a long-term goal like retirement, you might opt for a bond with a longer maturity. Conversely, if the recipient needs funds in the near future, a short-term bond may be more appropriate. It's also helpful to consider the recipient's other investments to ensure the gift complements their overall portfolio. The first step in gifting bonds is determining the gift amount. This decision should take into account your financial situation, the recipient's needs, and any potential tax implications. Keep in mind that while gifting can be a meaningful way to support a loved one's financial goals, it's essential not to compromise your own financial security. Next, you'll need to select a bond issuer. This decision should be based on the issuer's financial health, credit rating, and the interest rate they offer. It may also depend on the bond type you're considering. For instance, if you're planning to gift a government bond, you'll likely choose from issuers like the U.S. Treasury or a foreign government. Once you've selected an issuer, the next step is purchasing the bonds. This can typically be done through a brokerage account or directly from the issuer. Be sure to keep all documentation related to the purchase, as you'll need it for the gifting process and potentially for tax purposes. After purchasing the bonds, you'll need to decide whether to hold them in your account or transfer ownership to the recipient immediately. Holding the bonds allows you to control when the recipient gains access to them, which can be useful if the recipient is a minor or if you want the bonds to be a surprise. If you choose to transfer ownership immediately, you'll need to follow the specific steps required by the issuer or brokerage. One of the primary benefits of gifting bonds is the potential for stable income. Bonds typically provide regular interest payments, which can help the recipient meet their financial goals or supplement their income. For younger recipients, these payments can be a valuable lesson in managing money and understanding investments. Gifting bonds can also contribute to the diversification of the recipient's investment portfolio. Diversification, or spreading investments across various asset types and sectors, can help reduce risk and potentially enhance returns. Bonds can provide a counterbalance to more volatile investments like stocks, helping to smooth out portfolio returns over time. While they do carry risk – including the risk that the issuer could default on its obligations – many types of bonds are considered relatively safe investments. As such, gifting bonds can offer the recipient some degree of capital preservation, particularly if you choose highly rated bonds from reputable issuers. Depending on the type of bond and the recipient's circumstances, gifting bonds can offer tax advantages. For example, the interest from certain municipal bonds is often exempt from federal income tax and sometimes from state and local taxes. Additionally, the gift itself may qualify for the annual gift tax exclusion, potentially reducing your taxable estate. Lastly, gifting bonds can be a powerful tool for promoting financial literacy. For younger recipients, receiving and managing bonds can offer practical experience in investing and personal finance. They can learn about concepts like interest rates, credit ratings, and market dynamics, setting the stage for informed financial decision-making in the future. While bonds can provide stable income and capital preservation, they are not without risk. Bond prices can fluctuate based on various factors, including changes in interest rates, inflation, and the issuer's creditworthiness. If the recipient needs to sell the bond before maturity, they may receive less than the original purchase price. Bonds can also pose liquidity considerations. While many bonds are readily tradable in the secondary market, some may be more difficult to sell, particularly if the issuer's credit rating has declined or market conditions are unfavorable. These factors can limit the recipient's ability to access the bond's value if they need funds before the bond matures. Gifting bonds also entails legal and regulatory considerations. These may include gift tax rules, ownership transfer restrictions, and regulations related to gifting securities to minors. It's crucial to understand these rules and seek professional advice if needed to ensure the gifting process is compliant and effective. When gifting bonds, it's essential to understand the applicable gift tax regulations. In general, gifts above a certain value may be subject to federal gift tax, which typically falls on the giver. Given the complexity of gift tax rules and the potential tax implications of gifting bonds, it can be beneficial to consult with a tax advisor. A tax advisor can provide personalized advice based on your circumstances and help you understand how to gift bonds in a tax-efficient manner. The annual gift tax exclusion is a key tool for tax-efficient gifting. This rule allows you to give a certain amount each year to as many people as you wish without triggering the gift tax. In 2024, the annual exclusion amount is set at $18,000, which means that individuals can give up to this amount as a gift without incurring gift tax. For married couples, the total annual exclusion gifts allowed is $36,000. This exclusion applies to gifts given to children, grandchildren, or any other individuals. Gifting bonds refers to the act of transferring ownership of a bond from one individual to another as a gift. It involves giving someone the rights to receive interest payments and the principal amount upon maturity of the bond. When gifting bonds, it is important to select the appropriate bond type that aligns with the recipient's financial goals and preferences. The process involves purchasing the bonds and transferring ownership to the intended recipient. Effective communication is essential to provide the recipient with the necessary instructions and documentation. The benefits of gifting bonds extend to both parties involved. For the giver, gifting bonds allows for strategic wealth management, diversification of investment portfolios, and potential tax advantages. It can also serve as an opportunity to promote financial literacy and education. On the recipient's side, gifting bonds provides the potential for stable income, preservation of capital, and the opportunity to achieve financial goals. Additionally, it fosters financial responsibility and serves as a valuable asset for future needs.What Is Bond Gifting?

Identifying Suitable Bonds for Gifting

Researching Different Bond Options

Evaluating Risk and Return Factors

Considering the Recipient's Financial Goals

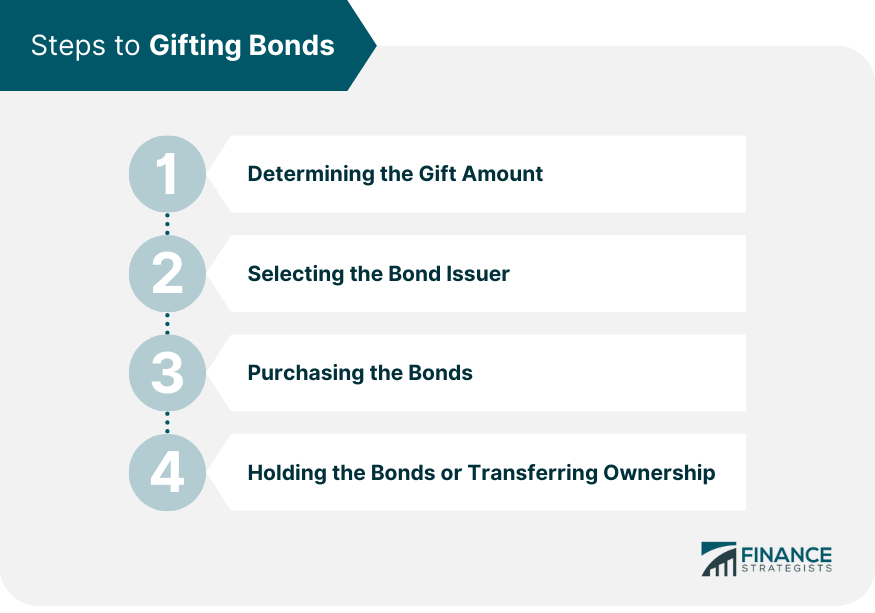

Steps to Gifting Bonds

Determining the Gift Amount

Selecting the Bond Issuer

Purchasing the Bonds

Holding the Bonds or Transferring Ownership

Benefits of Gifting Bonds

Potential for Stable Income

Diversification of Investment Portfolio

Preservation of Capital

Tax Advantages

Education and Financial Literacy Opportunities

Risks and Limitations of Gifting Bonds

Bond Market Fluctuations

Liquidity Considerations

Legal and Regulatory Restrictions

Tax Considerations

Gift Tax Regulations

Consultation With a Tax Advisor

Utilizing Annual Gift Tax Exclusion

Conclusion

How to Gift Bonds? FAQs

Bond gifting refers to the act of giving bonds as a gift to another person. It involves transferring the ownership of a bond from one individual to another, typically with the intention of providing financial benefits or opportunities to the recipient.

Gifting bonds involves purchasing a bond and then transferring ownership to another person. This can be a way to contribute to a loved one's financial future, offering them a stable income source and potential capital preservation.

Identifying suitable bonds for gifting involves researching different bond options, evaluating risk and return factors, and considering the recipient's financial goals. It's essential to choose a bond that aligns with the recipient's risk tolerance and financial objectives.

Gifting bonds can provide stable income, portfolio diversification, capital preservation, tax advantages, and financial literacy opportunities for the recipient.

The risks of gifting bonds include bond market fluctuations, liquidity considerations, and legal and regulatory restrictions. It's crucial to understand these risks and take appropriate steps to manage them.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.