Industrial Revenue Bonds (IRBs) are tax-exempt debt securities issued by state or local governments to finance the construction or acquisition of facilities for private companies. The proceeds from the bond sale are used to finance projects that provide economic benefits to the community, such as job creation or increased tax revenue. Industrial Revenue Bonds play a crucial role in supporting economic development and growth. They provide a cost-effective financing option for private companies, enabling them to invest in projects that might otherwise be financially unfeasible. As a result, these bonds help stimulate job creation, increase tax revenues, and improve the overall quality of life in communities where projects are developed. IRBs also allow state and local governments to address pressing social, environmental, or economic issues without directly using taxpayer dollars. By attracting private investment to fund projects that align with public policy objectives, communities can address important challenges and priorities without straining public budgets. Industrial revenue bonds are issued on behalf of the private company, which is responsible for repaying the debt. The government agency acts as a conduit issuer, meaning it does not assume any financial responsibility for the bonds. Instead, the borrowing company guarantees the bond's repayment, and the interest and principal are paid by the company's revenue. The primary purpose of Industrial Revenue Bonds is to promote economic growth and development within a community or region. By providing lower-cost financing to private companies, IRBs help attract businesses, spur investment, and create jobs, which in turn can enhance local economic growth. Additionally, IRBs can be used to finance projects that address specific public policy objectives, such as environmental protection, energy efficiency, or the development of key industries. Industrial Revenue bonds can be used to construct, expand, or modernize facilities that produce goods or provide manufacturing-related services. By financing manufacturing facilities, IRBs contribute to job creation, increased productivity, and economic growth in the regions where they are located. IRBs can also be used to fund the construction or improvement of research and development (R&D) facilities. These projects can include laboratories, testing centers, or other facilities dedicated to the advancement of knowledge, technology, or innovation. By financing R&D facilities, IRBs support the growth of new industries and the development of cutting-edge technologies that can drive future economic growth. Energy-related projects, such as power plants, renewable energy facilities, or energy infrastructure, can also be financed using Industrial Revenue Bonds. These projects help communities meet their energy needs and can contribute to a more sustainable and reliable energy supply. IRBs can be particularly useful in financing renewable energy projects, which often require significant upfront capital investments. IRBs can be used to finance pollution control facilities or projects aimed at reducing the environmental impact of industrial operations. This can include investments in technologies or processes that mitigate air, water, or soil pollution, or that promote waste reduction and recycling. By financing pollution control projects, IRBs contribute to environmental protection and improved public health. Recycling facilities, which process and repurpose waste materials, can be financed using Industrial Revenue Bonds. These projects help communities reduce waste, conserve natural resources, and promote environmental sustainability. IRBs can make it more cost-effective for companies to invest in recycling facilities, supporting the development of a circular economy. Industrial parks serve as specialized zones dedicated to housing manufacturing, distribution, and other industrial activities. They offer a range of amenities and infrastructure tailored to support businesses, such as transportation links, utilities, and access to skilled labor. Industrial revenue bonds provide a financing avenue for the development and expansion of these parks, fostering economic growth and job creation in the region. By financing various types of infrastructure projects, such as transportation, utilities, or telecommunications systems, industrial revenue bonds can enhance the overall competitiveness of a region and improve the quality of life for residents. Investing in infrastructure creates a more attractive environment for businesses, fostering long-term economic development. The interest earned on these bonds is generally exempt from federal income tax and, in many cases, state and local taxes as well. This tax exemption allows investors to accept a lower interest rate on IRBs compared to taxable bonds, which in turn reduces the borrowing costs for the private company. As a result of their tax-exempt status, IRBs typically offer lower interest rates than traditional loans or corporate bonds. This reduced cost of borrowing can make it more financially viable for companies to invest in projects that benefit the community, such as job creation or environmental improvements. IRBs often come with flexible repayment terms, allowing companies to structure their debt in a way that best suits their needs and financial capabilities. This can include features such as longer maturity dates, interest-only periods, or customized repayment schedules. These flexible terms can help companies manage their cash flow more effectively and reduce the risk of default. Industrial Revenue Bonds provide companies with access to capital that might otherwise be unavailable or too costly through traditional financing options. By leveraging the creditworthiness of the government issuer, businesses can obtain financing for projects that may be considered too risky or unattractive by conventional lenders. Like any investment, Industrial Revenue Bonds are subject to market risks. Changes in interest rates, inflation, or economic conditions can impact the value of the bonds and the company's ability to repay the debt. Investors must carefully consider these risks when investing in IRBs and should consult with a financial advisor to determine if these investments are suitable for their portfolio. Credit risk refers to the possibility that the borrowing company will be unable to make timely payments on the principal and interest owed on the bonds. Since the bonds are backed solely by the revenue generated by the financed project, investors assume the risk of default if the company fails to meet its financial obligations. To mitigate credit risk, investors should carefully evaluate the creditworthiness of the company and the viability of the project being financed. IRBs may also be subject to political risks, such as changes in tax laws or regulatory policies that could affect the tax-exempt status of the bonds or the profitability of the project. Investors should be aware of these risks and consider the potential impact of political developments on their investment. The process of issuing Industrial Revenue Bonds involves several steps, including identifying a suitable project, selecting an issuer (typically a state or local government agency), obtaining necessary approvals, and structuring the bond issue. The issuer works closely with the borrowing company and other professionals, such as underwriters, bond counsel, and financial advisors, to ensure a successful bond issuance. The issuer, usually a state or local government agency, serves as a conduit for the bond issuance, facilitating the borrowing process for the private company. While the issuer does not assume financial responsibility for the bonds, it plays a critical role in ensuring that the bond issuance complies with all legal and regulatory requirements. The issuer also helps coordinate the various parties involved in the bond issuance and may have an ongoing role in monitoring the project's progress and compliance with the bond terms. The underwriter, typically an investment bank or financial institution, is responsible for purchasing the bonds from the issuer and reselling them to investors. The underwriter works closely with the issuer and the borrowing company to structure the bond issue, including setting the interest rate, maturity date, and other terms. The underwriter also plays a crucial role in marketing the bonds to potential investors and ensuring a successful bond sale. The bond counsel is a legal expert who specializes in municipal finance and tax law. The bond counsel advises the issuer and the borrowing company on the legal aspects of the bond issuance, including compliance with federal tax laws and securities regulations. The bond counsel also provides an opinion on the tax-exempt status of the bonds, which is a critical factor for investors. Industrial Revenue Bonds (IRBs) are a valuable financing tool for private companies, enabling them to access capital at lower costs to fund projects that contribute to economic growth and development. By offering tax-exempt status, lower interest rates, and flexible repayment terms, IRBs help support job creation, increased tax revenue, and improved quality of life in the communities where projects are developed. The issuance of IRBs involves a complex process with several key players, including the issuer, underwriter, and bond counsel. By understanding the roles and responsibilities of each party, companies and investors can better navigate the IRB issuance process and leverage this financing tool to support economic development and growth.What Are Industrial Revenue Bonds (IRBs)?

How Do Industrial Revenue Bonds (IRBs) Work?

Types of Projects That Qualify for IRBs

Manufacturing Facilities

Research and Development Facilities

Energy Facilities

Pollution Control Facilities

Recycling Facilities

Industrial Parks

Infrastructure Projects

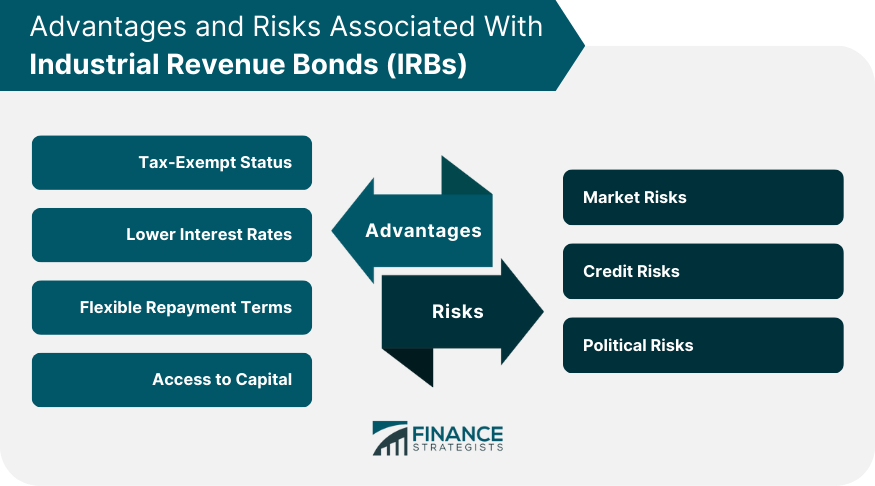

Advantages of IRBs

Tax-Exempt Status

Lower Interest Rates

Flexible Repayment Terms

Access to Capital

Risks Associated With IRBs

Market Risks

Credit Risks

Political Risks

Issuance of IRBs

Process of Issuing IRBs

Role of the Issuer

Role of the Underwriter

Role of the Bond Counsel

Final Thoughts

Industrial Revenue Bonds (IRBs) FAQs

IRBs are tax-exempt bonds issued by state or local governments on behalf of a private company to finance capital expenditures.

IRBs offer tax-exempt status, lower interest rates, flexible repayment terms, and access to capital for businesses to fund their capital expenditures.

Businesses that meet certain criteria, such as job creation or retention, and engage in qualified projects, such as manufacturing or infrastructure development, are eligible for IRBs.

IRBs are subject to market, credit, and political risks that can affect their value and yield, including changes in interest rates, credit ratings, and government regulations.

IRBs are typically issued through a bond issuance process that involves an issuer, an underwriter, and a bond counsel. The proceeds from the bond sale are then used to finance the qualified project.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.